“In two decades I’ve lost a total of 789 pounds. I should be hanging from a charm bracelet.” ~ Erma Bombeck

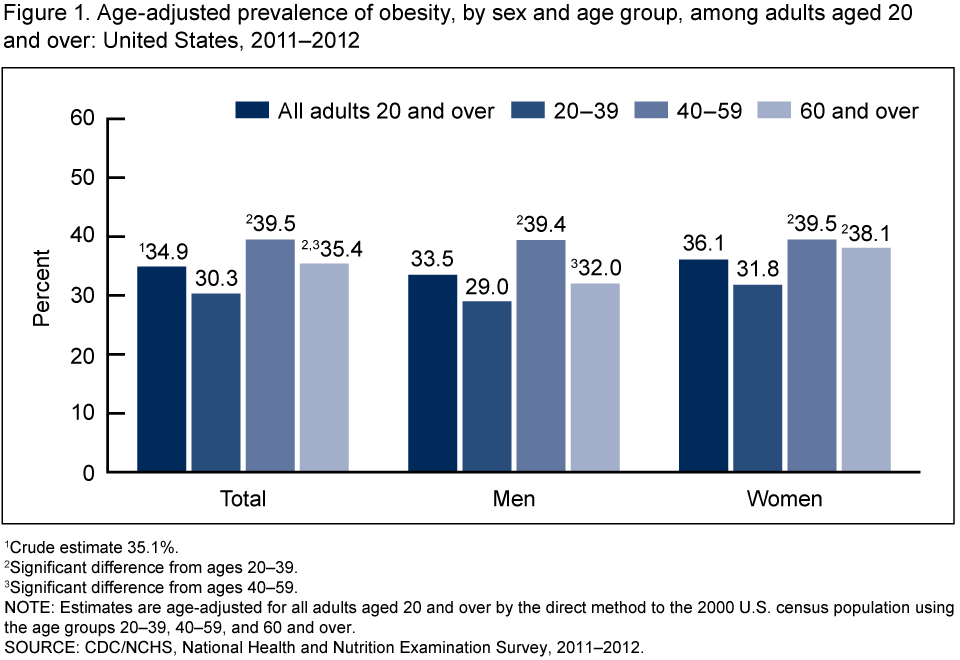

Obesity is a U.S. and global public-health problem. The global obesity rate has nearly doubled since 1980, and the World Health Organization estimates that nearly 1 billion people (adults, adolescents, and children) are obese. Some scientists project that by 2030, one in five women and one in seven men will be categorized as obese. Within the U.S., one in three adults is categorized as obese, and one in six children as well. (Obesity is officially defined as having a Body Mass Index of 30 or higher)

Medical costs for people with obesity in the U.S. tend to be 30% to 40% higher than those for people without obesity – double the percentage attributable to cigarette smoking. Obesity accounts for 20% or more of the $4.5 trillion in annual U.S. healthcare expenditures – approximately $900 billion.

While these statistics might not be common knowledge, the health consequences of obesity are. As a result, multiple sub-industries – specialty food, fitness, and supplements, for example – have arisen to help everyday men and women lose weight and improve their health – though climbing obesity rates suggest limited success.

That appears to have changed in the past year, with those industries having been disrupted by the introduction of a new product: incretin mimetics, or synthetic incretins. (Incretins are a class of hormones produced by the body during the digestive process. Absorbed into the bloodstream, they travel to the brain and other organs, where they activate areas that promote insulin production and the feeling of satiety.)

Arguably the better-known synthesized incretin on the market is semaglutide. Novo Nordisk (NVO) first developed semaglutide as a treatment for Type II diabetes. Clinical trials began in 2016 and the treatment earned FDA approval the next year. Semaglutide is synthesized using recombinant DNA and works to stimulate the part of the brain that normally responds to the incretin GLP-1 (Glucagon-Like Peptide 1). Like GLP-1, semaglutide tells the brain to trigger the production of insulin.

Many patients who began diabetes treatment with semaglutide – branded Ozempic – soon experienced significant weight loss. As it turns out, not only does semaglutide stimulate insulin production, it also works on the part of the brain that promotes the feeling of satiety. Further studies have shown that semaglutide also delays the gastric emptying process, prolonging the time that food stays in the stomach – augmenting this feeling of fullness. Physicians soon began prescribing Ozempic off-label (i.e., for purposes other than for what the FDA approved the treatment) to help patients who had weight problems. Novo-Nordisk took notice and subsequently won approval to offer a version of semaglutide specifically for weight loss, marketed as Wegovy. (The primary difference is in dosage strength, with Wegovy available in slightly stronger doses.)

Eli Lilly (LLY) has also seen similar beneficial effects from a tirzepatide, another synthesized incretin. Marketed as the diabetes treatment Mounjaro, tirzepatide mimics the effects of both GLP-1 and of Glucose-dependent Insulinotropic Polypeptide (GIP). GIP binds to and activates the pancreatic cells that produce insulin. Because of this dual effect, some proponents suggest that tirzepatide could be a more effective treatment for both diabetes and weight loss – though, to date, there have been no head-to-head studies regarding this hypothesis. As with semaglutide, tirzepatide is marketed as a weight-loss drug called Zepbound.

Various studies have found that obese patients – both diabetic and non-diabetic – have successfully lost as much as 30% of their body weight using these treatments. Given the dramatic numbers, and with celebrities like Oprah (Ozempic), Elon Musk (Wegovy), and Charles Barkley (Mounjaro) confirming that they have lost weight while on the treatments, it comes as no surprise that the companies behind these medications – Novo Nordisk and Eli Lilly – have seen demand surge despite warnings that those who slim down on the medications could regain some or even all of the weight if they stop using them.

This does not seem to have dampened their appeal, and neither has the high cost: treatments can run as much as $1,300 a month, and some health insurers have been reluctant to fully cover costs, particularly when the patient has not been diagnosed as diabetic or pre-diabetic. The high demand has forced Novo Nordisk to restrict new sales of semaglutide medications to ensure a steady supply for existing prescriptions. (The company announced that it would spend $6.5 billion in 2024 to ramp up production capacity, and Eli Lilly has announced similar efforts.)

Also unsurprisingly, Novo Nordisk and Eli Lilly have seen their stock prices climb steeply in recent months:

Barclays analysis suggests the market for such drugs has the potential to reach $100 million by 2033. Part of this could be driven by demographics. Millennials are entering into middle age, which means they are entering the age group most strongly correlated with obesity.

Demand could also rise as these medications are approved to treat more conditions. Novo Nordisk recently announced that in a five-year clinical trial involving 17,600 adults, semaglutide appears to have lowered the risk of serious heart problems, such as heart attacks or strokes, by 20% (as compared to a placebo). Other potential uses under investigation include the treatment of kidney conditions, alcoholism, and sleep apnea.

Other implications

If we assume that the so-called ‘skinny shots’ live up to their promise, helping millions of people lose weight and keep it off, this creates obvious growth potential for the companies making these drugs. The implications of having a large segment of the population realizing significant weight loss could also have a positive spillover effect on companies in other sectors.

Medical Aesthetics and Cosmetic Surgery

For example, after significant weight loss – particularly when that weight loss is rapid – many people find themselves with excess skin. This can lead to a more gaunt, wrinkled appearance that some refer to as “Ozempic face,” and loose folds of skin elsewhere on the body – so-called “Wegovy butt” is one example.

It is reasonable to theorize that as Wegovy and Zepbound become more commonly prescribed, many patients will seek out remedies to these changes in their appearance – especially since improved appearance is a common motivator for weight loss. One easy approach might be lotions and moisturizers, which means companies in this segment – think L’Oréal (LRLCY), Estee Lauder (EL), Shiseido (SSDOY), and LVMH (LVMUY) – could see increased sales.

Others might well seek professional assistance from plastic surgeons and medical spas.

Although such businesses are generally too small to be publicly traded, the companies that make some of the equipment and supplies they use are not. Options to address wrinkles from weight loss include:

- Dermal fillers. Dermal fillers are injected under the skin, where their gel-like consistency helps to add volume and smooth out wrinkles. Typically, the effects last from six to 12 months, after which a touch-up or refresher is required. One of the more popular fillers is the Juvéderm line, made by Allergan, a subsidiary of Abbvie (ABBV). Allergan also makes a filler called Perlane, intended for deeper wrinkles.

- Skin tightening. Skin tightening seeks to treat loose and sagging skin by using controlled bursts of energy (laser, ultrasound, radiofrequency, etc.), microneedling, and/or heat to stimulate the production of collagen and elastin for up to three years. One of the more popular skin-tightening devices is Thermage, made by Solta, a subsidiary of Bausch Health (BHC). Other options are the Fraxel system offered by Allergan, the Titan Skin Tightening System made by Cutera (CUTR), and the Morpheus8microneedling system made by InMode (INMD).

- Skin resurfacing. This refers to a family of procedures that remove the top layers of skin to reduce the appearance of wrinkles and improve skin tone. This can be done chemically, via laser, radiofrequency waves, and physical abrasion. For example, InMode’s Fractotal combines radiofrequency and laser energy to resurface and tighten skin. Solta’s Fraxel system, mentioned above, can also be used for skin resurfacing, as can the Pearl Fusion system by Cutera.

- Neurotoxins. Through the carefully controlled use of the neurotoxin that causes botulism, professionals can reduce the appearance of wrinkles by effectively preventing facial muscles from contracting. (Treatment benefits last from three to 12 months.) The most well-known of these treatments is Botox, made by Allergan. Another option is Jeuveau, offered by Evolus (EOLS).

Fitness-related

Although treatments like Wegovy and Zepbound are sometimes depicted by the media as miracle drugs, they are meant to be used in conjunction with a program of regular exercise. As patients lose weight, they will hopefully adopt other elements of a healthy lifestyle that includes regular workout sessions. Some companies that can help include:

With more people slimming down and exercising regularly could potentially mean increased revenues for clothing brands – especially those specializing in fitness apparel. The major players in this space need no introduction:

It is important to note that many of the companies mentioned in this section have significantly underperformed in recent years, and some could even be described as troubled. We mention them only in the spirit of intellectual completeness.

Healthy Foods

A number of food-industry players have speculated on whether the appetite-depressing effects of Wegovy and Zepbound could hurt their bottom lines, yet there is another food-related effect that could have a different impact.

Several studies suggest that obese people have a duller sense of taste. Some scientists hypothesize (based on experiments on mice) that obese people have fewer taste buds, due to their generally higher levels of background inflammation. Regardless of the reason, obese individuals often prefer sweeter, saltier, and fattier foods – potentially resulting in a vicious cycle.

Other studies have found that significant weight loss can cause a person’s sense of taste to recover, change, or intensify, as taste buds become more sensitive to sweet, salty, and fatty flavors. This is borne out by the anecdotal experiences of those who have slimmed down after bariatric surgery and found themselves enjoying healthier food choices more than before.

As Wegovy and Zepbound users adopt a healthier lifestyle, this change in food preferences could produce a slight but meaningful tailwind for companies that focus on healthier foods. This includes:

- Health-focused grocery chains like Amazon’s (AMZN) Whole Foods and Sprout Farmers Market (SFM)

- Producers of fruits and vegetables like Limoneira (LMNR), Dole (DOLE), and Fresh Del Monte Produce (FDP)

- Healthy-eating restaurant chains like Sweetgreen (SG)

Dating Apps

Finally, although improved health is important to everybody, improved appearance is obviously another important motivator. The desire for a better love life contributes to this motivation, and some studies have shown that weight loss and a higher sex drive are correlated. This leads to an offbeat idea: The possibility exists that companies that help people with matters of the heart, such as Match Group (MTCH) (owners of popular services like Match.com, Hinge, Tinder, and OkCupid) and Bumble (BMBL) could benefit as Ozempic/Wegovy and Mounjaro/Zepbound become more widely and effectively used.

In closing, we should note that, as usual, Signal From Noise should be viewed as a source of ideas and a starting point for further research rather than as investment recommendations. While many industry observers believe that such medications could have a paradigm-shifting impact on various industries and on society itself, these treatments have only begun to see broader use.

We also encourage you to explore our full Signal From Noise library, which includes deep dives on topics such as artificial intelligence, our aging power grid, the path to automation, and the Boeing crisis. Other past topics include opportunities associated with “vice” companies and the rise of Generation Z.