“Don’t look for the needle in the haystack. Just buy the haystack!” – John Bogle

Early in 2022, we did an installment of this column called When Volatility Smiles At You, Smile Back in which we discussed the risk revolution ushered in by the insights of Fisher Black, Myron Scholes and Robert Merton. Disruption isn’t always achieved by shiny things; sometimes simple algebra will do. The Black-Scholes model revolutionized investing and made it so “one bad season doesn’t have to ruin the farm.” The risk management revolution Black, Scholes and Merton unleashed was one of the most profound in the history of Wall Street. The only intellectual revolution on Wall Street in the last decades that’s been of equal or greater significance was the move toward passive vehicles that allow investors to insulate themselves from the idiosyncratic risk of single stocks — exchange traded funds (ETFs).

Stock picking is incredibly challenging and highly time intensive. You might pick a great company, and they might even beat earnings estimates just like you thought they would. Still, if this occurs at the wrong time alongside tepid guidance, the company’s stock might plunge in price regardless of the excellent research you did to identify the company’s prospects. Your stock pick might be good, on the other hand, if idiosyncratic factors are responsible for most of the price movement. However, during anomalously high market stress, correlations between stocks can move toward one. In market conditions where macro factors drive price action, how well your company is performing or being managed may have minimal bearing on its price action.

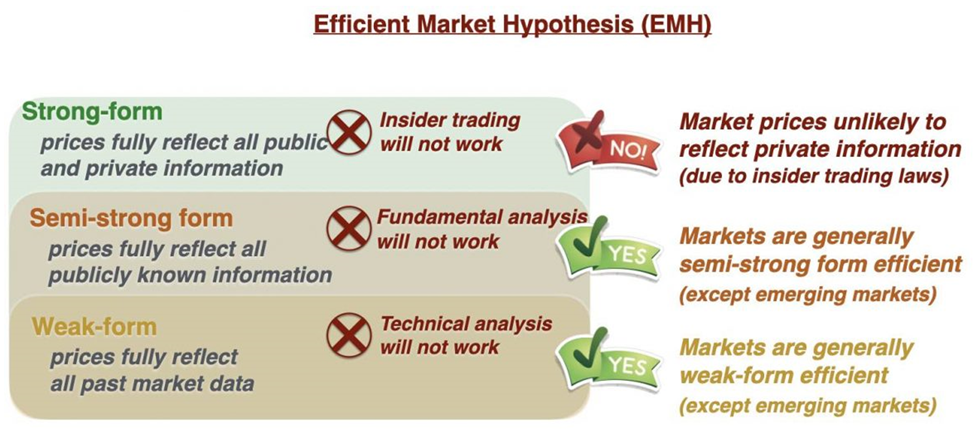

Ok, so everyone knows stock-picking is hard, and if you think it isn’t, you’re probably about to find out that you’re wrong. Many argue that stock-picking is a fool’s errand and that any success, or the illusion thereof, will be fleeting and will normalize over time. Burton Malkiel most famously advanced this concept in his must-read 1973 book, A Random Walk Down Wall Street, that stock prices operate on a random walk – that is, behave randomly.

If stocks truly operated on a random walk, then both technical analysis and fundamental analysis would be essentially useless. Accordingly, investment advisors and research would add little or no value. Taken to its extreme, this would imply that monkeys randomly throwing darts at a list of public companies could pick stocks just as effectively as the most seasoned and revered experts.

This revolutionary concept on Wall Street has created a heated debate between those who advocate between passive and active management. If you think about it, though, the Efficient Market Hypothesis (EMH) is really implying the same thing. The strong version of the EMH posits that stock prices themselves are the best current source of information. If a market is performing at true efficiency, then the price should reflect all public and private information. So instead of thinking of price as an annoyance or something you hate to look at, please do look at it as one of the most vital sources of information you have. We like to say, listen to Professor Price, and CERTAINLY don’t lecture him.

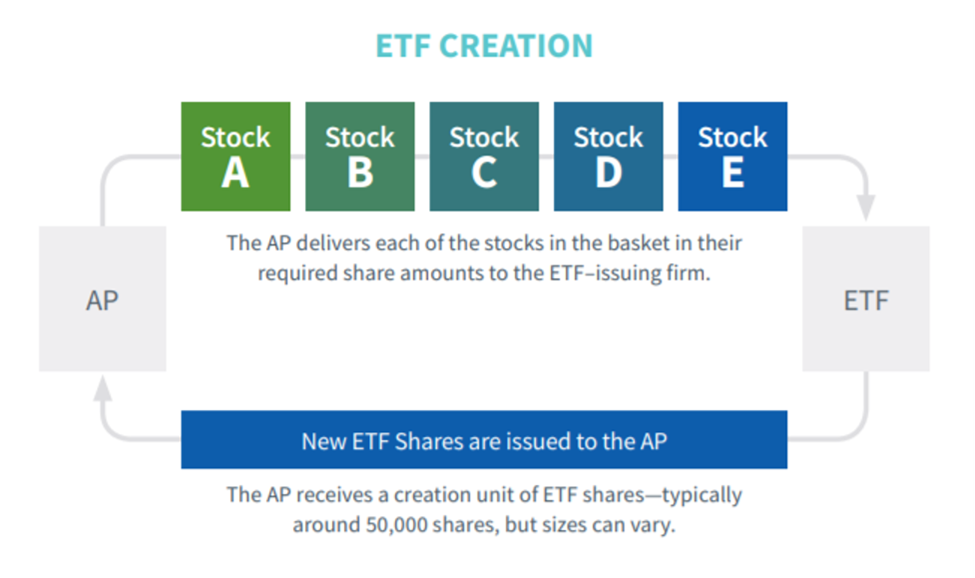

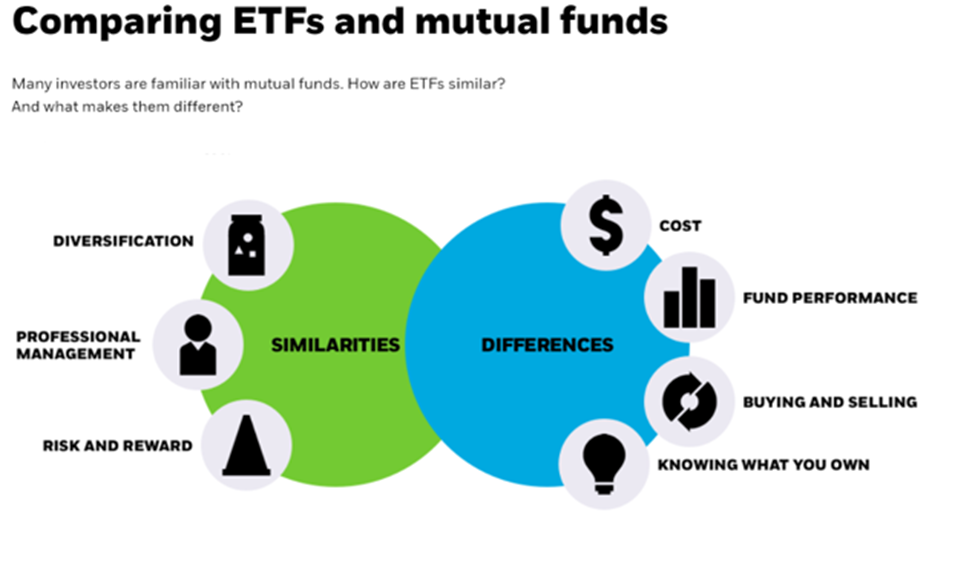

This insight was part of the intellectual fuel that led to the ETF revolution. People can get exposure to a wide variety of factors, industries, or volatility using passive instruments that aim not to outperform an index but rather to mimic the performance of one. This allows people to mimic the markets rather than embarking on the Sisyphean task of trying to beat it consistently. We live in a world that is increasingly defined by Team A vs. Team B thinking. There are severe limitations to thinking along these lines. Just as it is hyperbolic to say Democrats are Communists and Republicans are Fascists (not that it stops people) we think the Active versus Passive debate is more nuanced than meets the eye.

We don’t want to talk ourselves out of the job, but there is something to this theory. We obviously believe research and both fundamental and technical analysis can add value, but we also see the benefit of implementing passive vehicles in your overall investment strategy. Only 17% of active managers beat the market over 10 years. Over 20 years it is a mere 6%.

The Expansion of ETFs Gives Investors Precise Tools They Once Lacked

The ETF universe has massively expanded. You can get direct exposure to different groups of stocks. You can slice and dice them a lot of ways. You can buy an ETF for emerging markets, for agricultural grains, rare earth elements and others. You can do something as simple as getting an equal-weighted index as opposed to one that is weighted by market capitalization. All else being equal, this should give you better exposure to the small-cap premium. One area we’d urge you to avoid is leveraged ETFs or ETFs that are heavily dependent on derivatives or futures to meet their mandate. A lot can go wrong, friends. Always pay attention to the correlation between the price the vehicle is aiming to imitate and what the actual price is. The further away it is from one, the worse the ETF is at fulfilling its objective.

Markets have been particularly volatile recently as they face the most severe bout with inflation since Ronald Reagan was in the White House. Inflation has been made even worse by a raging and resource-intensive ground war on Europe’s eastern flank in a country that is crucial for global food supply. Our team has noticed a lot of soft data pointing to declining inflation, but the headline numbers keep coming in hot. It’s hard to make heads or tails of what’s going on, and single-stock strategies are tough. Did you think a hot CPI would lead to a massive rally today? Yeah, tough markets folks.

Our Head of Quantitative Analysis, Adam Gould, has found that idiosyncratic risk is rising, making for a better stock-picking environment. But effective stock-picking takes a massive investment of time and energy that you may not have. For his part Mr. Gould doesn’t think active management versus passive management is as clear-cut as some. Most active managers would outperform without fees, for example, which douses some water on the Malkiel purists. However, the time you would need to take to select the best active managers has a cost as well. Think of ARK. Often last year’s biggest winners are amongst this year’s greatest losers.

Let’s Explore Some ETFs and How You Can Use Them

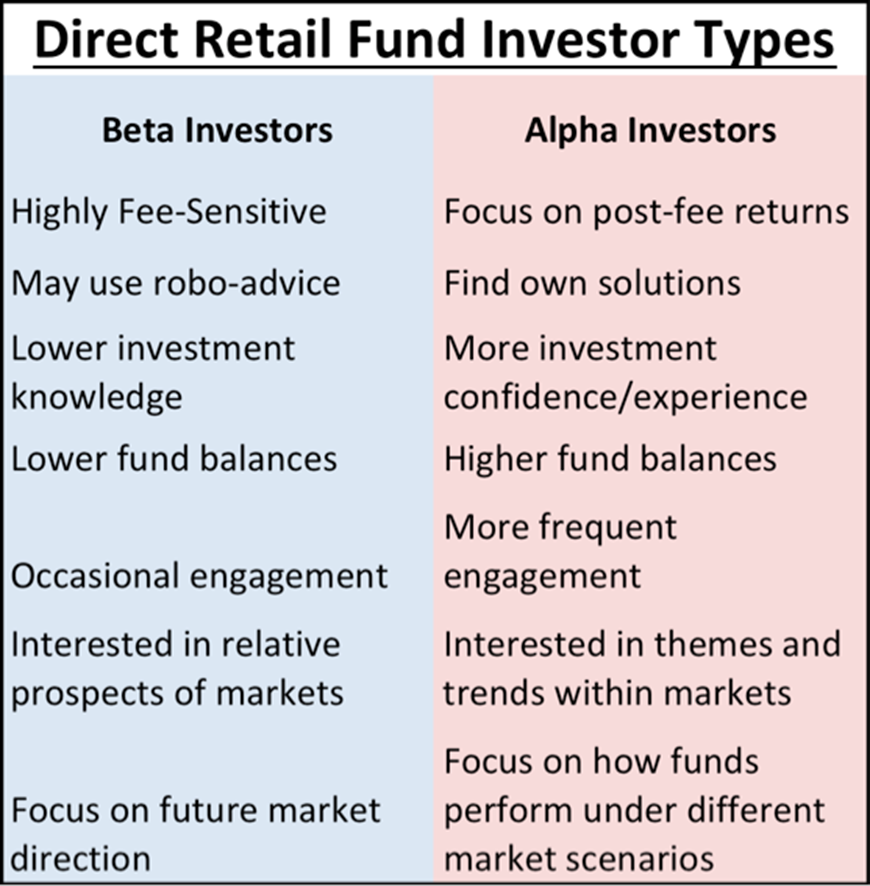

ETFs make markets more efficient and accessible. They empower investors. A couple decades ago buying gold was cumbersome and fraught with risk and scam artists. Now all you have to do is type GLD into your brokerage account and you can get exposure. We want to be specific here—we’re highlighting a few ETFs to show you how they can be used in conjunction with our investment theses, not making direct recommendations at this time. You must ask yourself: Are you an alpha seeker? Or is getting steady returns close to the market (or your chosen ETF) good enough for you? Alpha seekers beware—there’s likely a lot of blood, sweat, tears and gnashing of teeth in your future.

Get Exposure to Factor-based ETFs with Dynamic Stock Holdings: Invesco S&P 500 High Beta ETF (SPHB)

Beta refers to an investment’s relative volatility compared to the market or a specified benchmark. So, a stock with a beta of 1.0 has the same volatility as the overall market. A stock with a 0.8 beta will be 20% less volatile than the overall market. A stock with a beta of 1.2 will be 20% more volatile than the market or benchmark. Both alpha and beta are historical measures. Beta should not be thought of as a static variable that never changes. It very much changes with the drivers and catalysts that affect the market at any time.

Tom Lee made a famous call in the dog days of the pandemic in 2020. He told folks to pile into Epicenter stocks, or those closest to the economic and social consequences of the great pandemic we faced together (congrats on making it through by the way). There were a lot of stocks that met this definition, so we advised that investors could get exposure through the Invesco S&P 500 High Beta ETF. Now at the time, the highest beta stocks were industrials, energy, financials, cruise lines and others that were experiencing full-scale revenue interruptions.

High-beta stocks are positively correlated with the S&P 500’s returns but generally are relatively amplified in terms of returns. High beta does great during bull markets but often underperforms significantly in bear markets. If you looked at a list of what was in this ETF back then, it would be completely different than what is in it now. There was very little Technology in it during the pandemic, for example. Now 40% is Technology.

When you think about it, this makes sense. As tightening has become one of the primary drivers of markets, high-multiple stocks have been adversely affected as interest rates rise. So, these are what’s driving down the index. In our research meeting this morning, our Head of Technical Analysis, Mark Newton, mentioned Tech’s persistent weakness was hiding recent strength in other corners of the market. Exposure to ETFs like this based on a crucial factor can be very helpful. Adam Gould has also suggested that low-volatility and quality could be useful areas to get exposure to, given the uncertainty and increasing relative appeal of debt compared to equity.

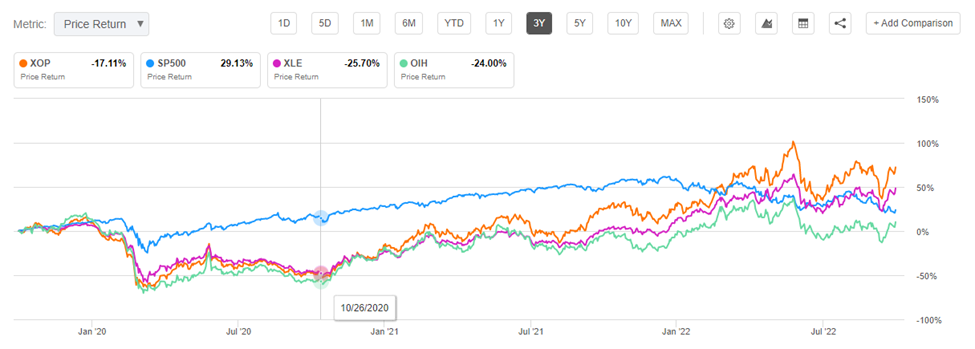

Get Sub-Sector Exposure to Industries or Sub-Industries: Oil & Gas Exploration ETF (XOP)

Another great call by our team was the prescient realization that Energy would be a top-performing sector after years of dismal performance. We are long past the time when Exxon-Mobil was the world’s largest company by market-cap, but the market went way too far in proclaiming the premature death of a massive and important industry. Tom Lee pointed out that secular underinvestment in oil and gas exploration was a major catalyst for the industry to do better. The fundamental imbalance between supply, which is diminishing due to underinvestment, and demand, which is still substantial, remains in place.

So, maybe you think Energy is tapped out after its stellar outperformance over the last period and just want to get exposure to those doing the drilling. Drilling holes in the ground to make money is particularly tricky business. If you’re not a geologist, then other investors are probably going to have the drop on you in analyzing which drillers will do best. They may do an in-depth analysis of their proven reserves that doesn’t make a whole lot of sense to people outside very technical corners of the Energy industry.

However, it’s a common-sense notion that we still need a lot of oil and that alternative energy sources won’t be able to fully replace fossil fuels for quite some time. Rather than doing the additional work to sift through the nitty gritty details of planned exploits of Oil & Gas Exploration companies, you can get exposure to the whole group. This is one way to effectively use ETFs—to achieve alpha through beta. You can even use a type of active-passive “barbell” strategy. You can have your portfolio anchored in passive ETFs with some satellite positions to boost the alpha.

Best of Both Worlds: Active Allocation Using Passive Instruments

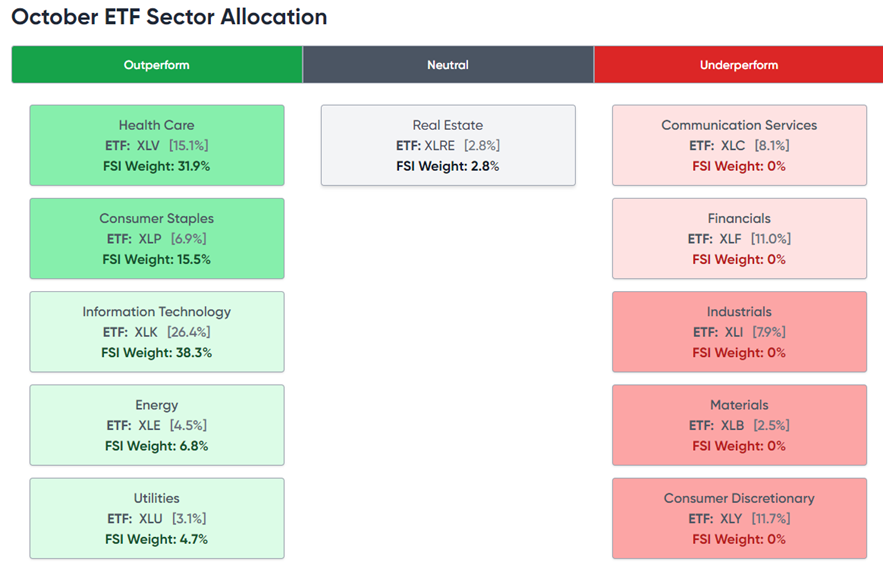

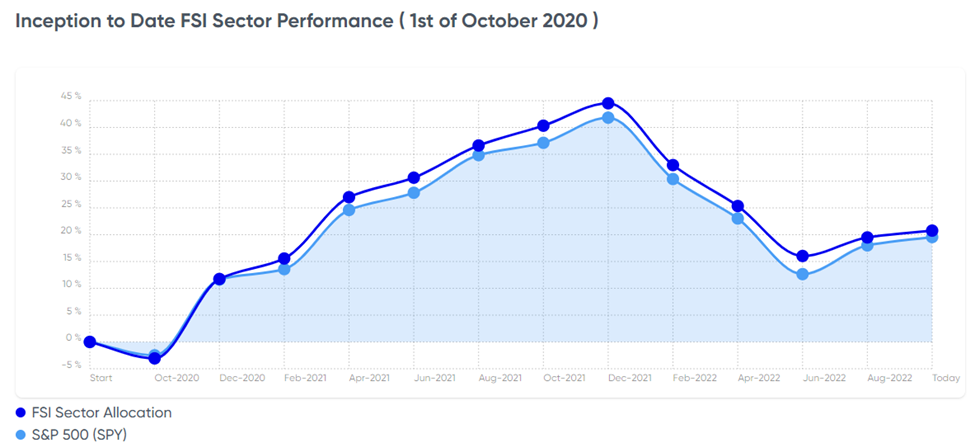

Our Head of Global Portfolio Strategy, Brian Rauscher, is more used to dealing with institutional clients and the buy-side than retail clients. He’s always trying to help investors outperform the benchmark they are tied to, as this is one of the most important considerations for the institutional side. Mr. Rauscher has a fantastic product called Active Sector Allocation. This product is great for risk-averse investors who don’t want to leave the market-driven gains on the table but still want to try their hand at getting a bit more alpha than the average joe. As you can see below, Mr. Rauscher and his team use passive sector-level ETFs to attempt to outperform the S&P 500. The purpose of this product is to get higher than benchmark returns while taking minimal additional risk.

Source: FSInsight.com

The basic concept of Rauscher’s product is: Why own the losers if you don’t have to? He uses his proprietary model to over-allocate to those sectors he expects to outperform and to under-allocate (or zero-weight) sectors he expects to underperform. Now the returns aren’t going to as high as if you’d loaded up into all-Energy at the beginning of 2022, but it will capture some more of that alpha than a straight play on the index would. However incremental outperformance, month-by-month, adds up over time. It also prevents you from coloring too far outside of the lines and experiencing catastrophic losses in your portfolio.

So, when you’re sitting in front of your brokerage account or your institutional trading account and you’re hungry for a new pick to give you an edge—remember that sometimes the road to alpha can be paved with the clever use of beta. ETFs give you access to investments with different profiles that were not available before. We also asked our Head of Cryptocurrency Sean Farrell what he thought the best ETF to gain exposure to cryptocurrencies was. He said BITO (until the SEC finally approves the spot ETF.) Come on Gensler!