“Make friends with the eminent dead.”- Charlie Munger

Investing is incredibly difficult, and the competition is fierce. Most people hope to get rich quickly with little work—of course, they do. Investors sometimes hear about some stock that folks have made money on and buy it blindly, hoping to get in on whatever the gold rush of the day is. Stories of great success in the stock market keep people coming back, but the people who make real money over time tend to focus on a fundamental question: who is running the business I own a stake in? Are they competent? Do they have a good plan? Who has got my money, and what do they plan to do with it? This seems simple, but far too many investors ignore this essential analytical lens.

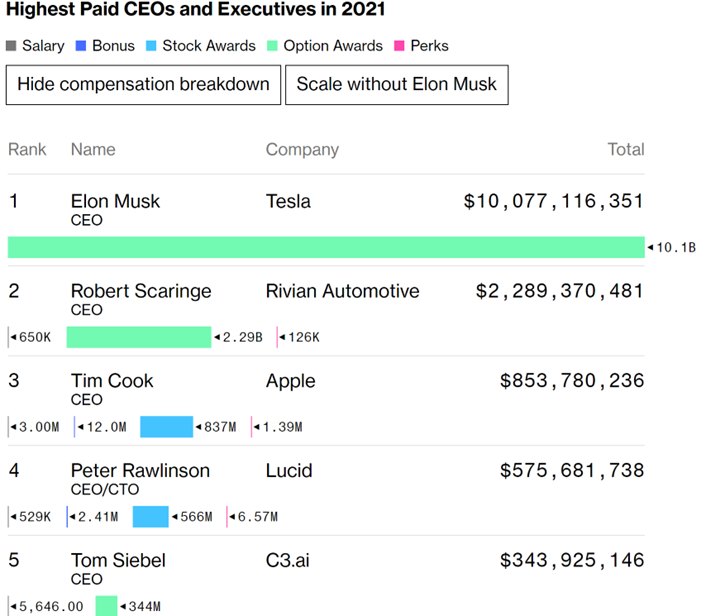

The perennial swinging of the pendulum between fear and greed continues through whatever the issues of our modern time are. Also perennial and above any catalyst of the day is being able to evaluate what management is telling you soundly. So, when you’re feeling fresh and looking at a complicated graph and surmising which securities you think will do best, ask yourself: What do you know about this company and the people that make it up? Too many firms can attract capital with buzzwords and promises. There are a lot of ways to judge CEOs. Who is the highest paid? Who is in the news most? Who isn’t in the news at all but keeps delivering for shareholders? We’ll share some of our team’s favorites and our top three in the S&P 500 right now.

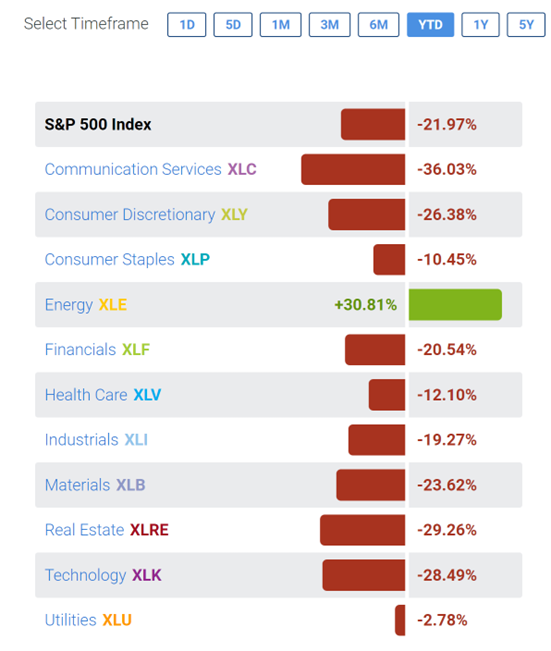

We assure you that you will be a better investor if you understand the organizations in which you own stakes on a fundamentally human level, especially the leadership and their capabilities. We’ll give you a quick example. As climate change has come to the fore, Energy multiples for American companies collapsed, implying their demise was near. The market essentially prematurely announced the death of the Energy sector. People that make money from digging holes in the ground have a remarkable resilience, though, and many of those who thought the sector was dead have recently found it the only safe place to hide.

Now, if you were grounded in the daily coverage and watching graphs and market analysis come by about carbon footprints stuck in the headlines, so to speak, you may have missed a very crucial question you should have asked yourself. Do I want to bet against millions of the most capable people in Texas? Will these millions of people and their leaders who bear responsibility for their financial futures just roll over and die? Think about it.

Does a change in discourse relegate millions’ efforts and hard work undone? Does it make energy less necessary for the operation of the economy? No, it doesn’t. And we didn’t want to bet against Texas, which is part of why Energy was our top-sector pick for 2022. By the way, we’re not dismissing the seriousness of climate change—we’re just giving you an example of how to think about businesses to reflect what they really are: groups of people and leaders trying to do their best to make a living. Please keep it simple, and always remember carefully to evaluate the human element.

If you are here strictly to get stock picks and resistance levels, then you’re missing the larger picture and, frankly, the value of our service. We truly believe that knowledge and thinking differently are at the core of investing success. An agreement on May 17, 1792, under a buttonwood tree near the address of 68 Wall Street, led to the formation of the New York Stock Exchange.

Through all the curveballs and tragedy history has thrown at us since then, the spirit of that agreement and the market it spawned has remained resilient and intact. While technology and progress have changed markets, the function is still the same. You are still buying a stake in a business, and to be successful, you need to understand that business, its prospects, and its people. To be really successful, you have to understand it better than the crowd.

The Past Is Prologue; Compassion is Strength

“A true leader has the confidence to stand alone, the courage to make tough decisions, and the compassion to listen to the needs of others. He does not set out to be a leader but becomes one by the equality of his actions and the integrity of his intent.”- Douglas McArthur

Let’s also remember what a business is at its core: competition for scarce resources. Our predecessors much more often had to conquer, kill and struggle even to achieve subsistence. Competition in the world of business is less acute than the great struggles of our past, but it is no less consequential. The corporation has replaced the state as the primary driver of social and technological change. Still, the insights from the past and management skills during those dark past times often illuminate vital lessons that we can use to evaluate the competitive prowess of firms and their leaders.

We may take for granted that we get to sit in an air-conditioned office to compete for resources. As Colonel Dax, the protagonist in Stanley Kubrick’s Paths of Glory, said to a General lamenting “armchair officers” who are worried about whether a mouse will run up their pants leg, “I don’t know, General. If I had the choice between mice and Mausers, I think I’d take the mice every time.” The brutal lessons from a more violent past provide great insight into the more restrained competition of modern commercial endeavors. Remember, they are both at their core competition over scarce resources.

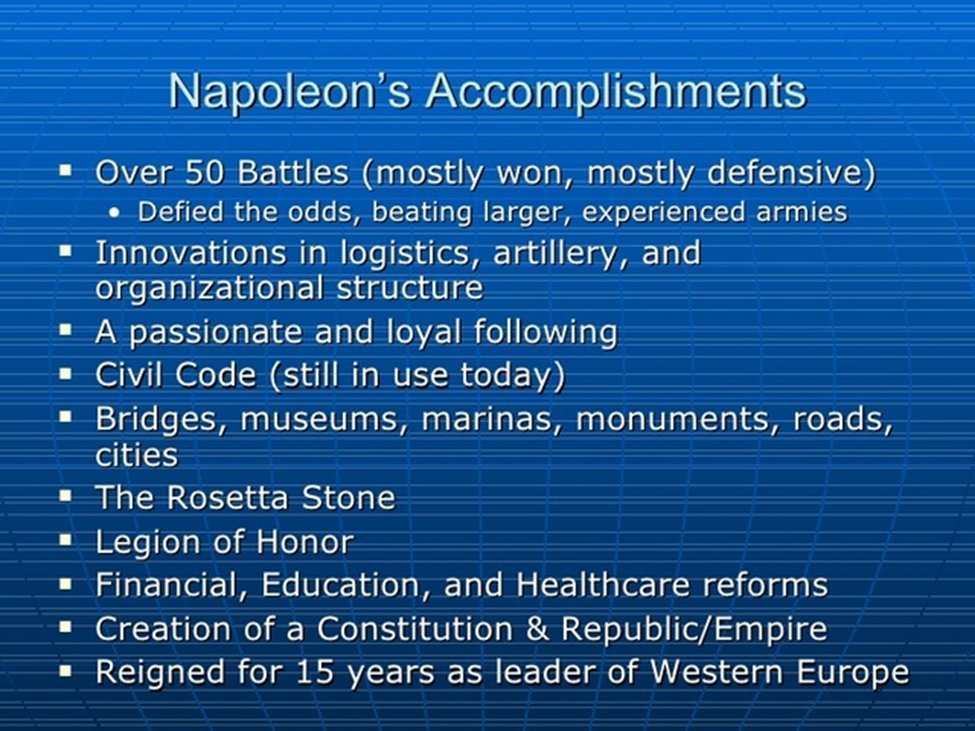

Napoleon Bonaparte was more successful than you. More successful than anyone you know or have met. We know this statement will sadden and shock some on Wall Street. However, for the sake of argument, let’s just agree that Napoleon was a better leader than you. He could well be termed the most disruptive individual in history, using today’s corporate parlance for success. More books have been written about the man than days have passed since his death in 1821. His achievements and victories are grander than any living human being today, and what was required to achieve them—the grit, the intelligence, the confidence, and the vision are quite incomprehensible to us in our pampered modern age.

While he was the most powerful man on Earth and well hated by the establishment, he also paid incredible personal attention to his soldiers, even the lowliest. Indeed, his camaraderie with his soldiers was the lynchpin of his successes. When this crucial camaraderie broke down, that’s when his storied failures began. For the first time, Napoleon’s subordinates, whom he always depended so heavily upon, were not being honest with him. They gave him flowery descriptions of camps where starvation and disease reigned, and that epic relationship he had with his Marshalls failed when he needed it most.

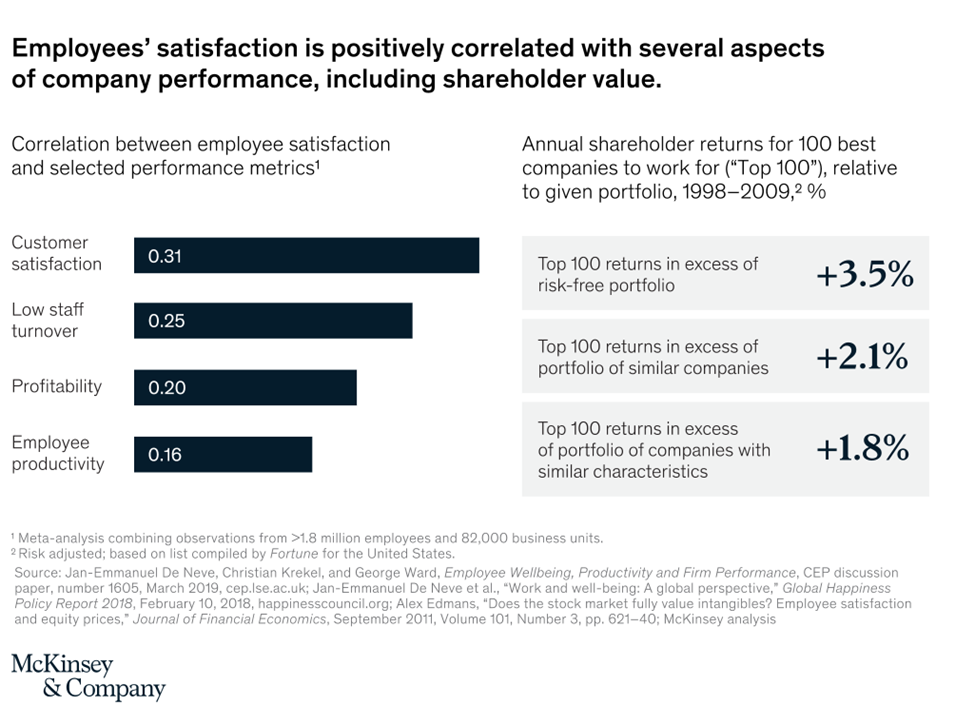

He was a soldier first, and all his other achievements flowed from his martial mastery. Open-mindedness and compassion are qualities often seen in great military leaders. Ulysses S. Grant had a teamster tied to a tree for maltreating a horse once. He recoiled at the sight of blood and was generous with his vanquished foes. Napoleon himself always showed mercy to wounded adversaries. Compassionate leadership raises the cohesiveness of a business as it did for the armies of Grant and Bonaparte. Compassionate leaders have been found to improve collaboration, raise levels of trust and loyalty in the workplace, and are perceived as stronger and having higher competence.

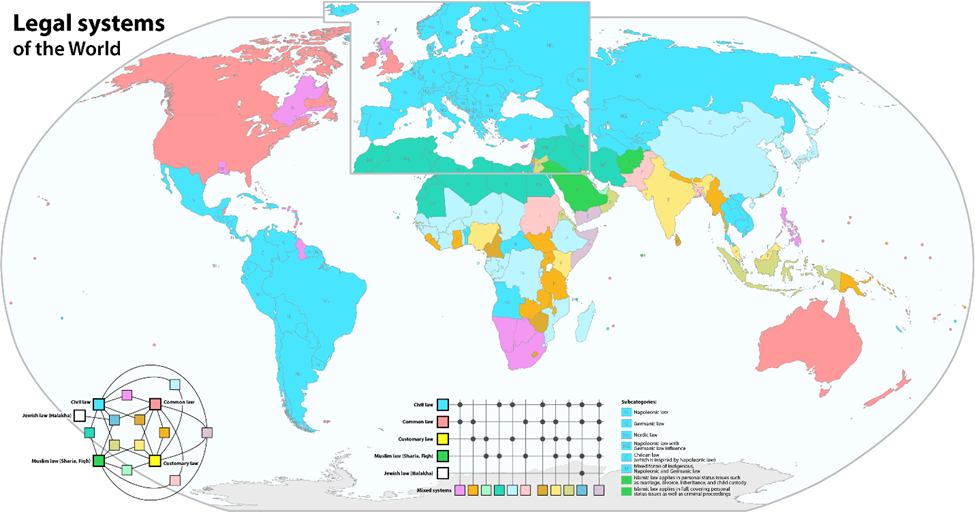

Napoleon was an enigma like many great leaders: a revolutionary and a despot, a micromanager and an incredible visionary, a compassionate man that was nonetheless responsible for untold devastation, death, and suffering. While known as a dictator, he perhaps did more than any single man to exalt the liberal ideas of the late 18th century revolutions in the United States and France worldwide. He introduced the Napoleonic Code, which was the template for civil law based on rationality and common sense. Before the revolutions that laid the foundation for our modern systems, the law was merely some thuggish king’s whim. Rationality took a back seat to brute force for most of human history.

Some of you are glossing over. Maybe you don’t like reading about history. Maybe you don’t like reading about markets and just want picks. You’re sick of the jargon and are feeling confused. That feeling means you’re about to learn something, so keep going. We get it. We have to do this all day, friends, so we understand the exhaustion of being bombarded with complicated content. We also insist that it is necessary never to stop learning and challenge conventions if you want to be a great investor. Indeed the Sapir-Whorf hypothesis seems to confirm this notion. The modern version of this hypothesis suggests that our very thought patterns depend significantly on our grasp of language. It is the thread we must use to produce the tapestry of our thoughts with: more thread means more options. A richer tapestry.

Wall Street has a language all its own, a major hurdle for many people. Unlike our competitors, we don’t use this language to intimidate people—we try to get you to understand it so your thought processes as an investor can evolve and grow. Understanding a few concepts thoroughly will help boost your ability to invest successfully. Correspondingly, having a diverse organization with different native language speakers should all and all be a strength to improve your organization’s collective thinking. We teach people to fish at FS Insight. Learning new words and concepts will help you understand the crowd; if you practice and keep learning, you might even be able to get ahead of them and make some real money.

Learn From the Best, Especially from Their Worst

“When a management with a reputation for brilliance tackles a business with a reputation for bad economics, it is the reputation of the business that remains intact.” -Warren Buffet

“One must never ask fortune more than she can grant.”- Napoleon Bonaparte

So, we’ve established that Napoleon was a masterful leader and achieved victory on a level we can scarcely imagine today. Indeed, in June 1812, he was at the height of his power. After years of uneasy and hard-fought peace with Russia, Czar Alexander I broke the Tilsit Treaty, and Napoleon decided to invade Russia. He didn’t have to, but he thought his honor was impugned. This was one of the worst decisions he ever made and was so consequential that it eroded the benefits of all his prior victories, amazing and awe-inspiring as they were.

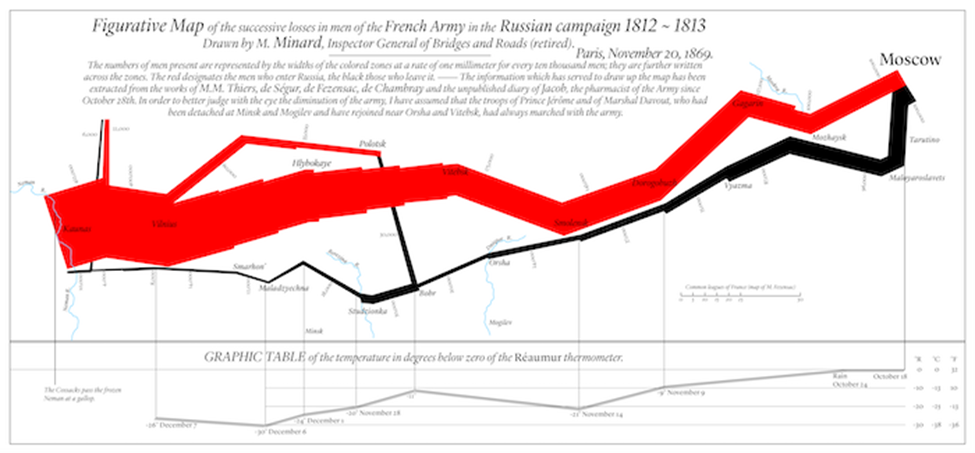

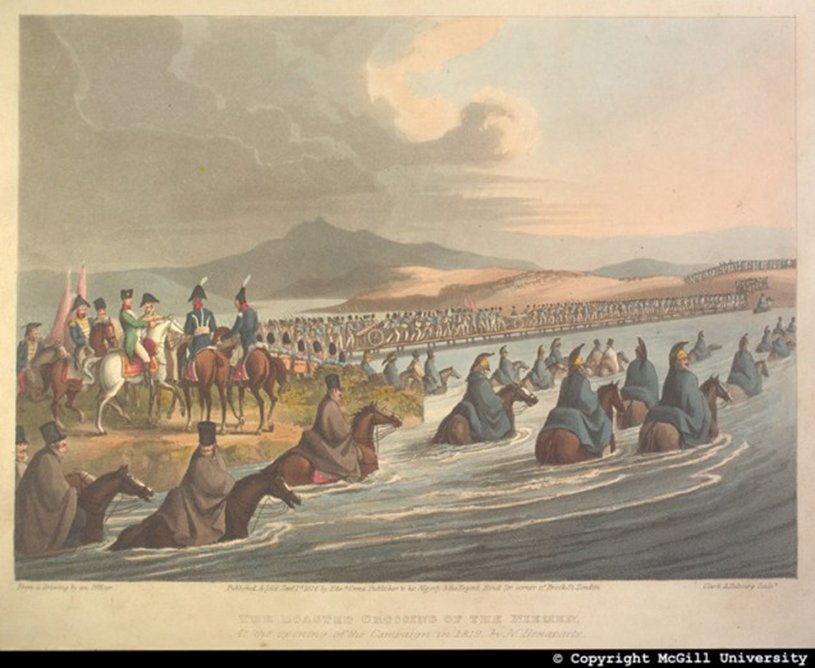

Napoleon’s decision to invade Russia and conquer Moscow was one of the most consequential in history. It also put the multi-national force of more than 600,000 in one of the most unenviable spots of the entire collective human experience. When Napoleon crossed the Niemen River, people were optimistic and confident in victory, much the same way many founders feel when starting a business. The infographic above, produced by civil engineer Charles Minard, is one of the most famous data visualizations in history and started the genre now so crucial for investment analysis.

The width of the red line denoted the size of Napoleon’s army after he crossed the Niemen River, where it is thickest. You can see that he suffered severe losses before the Moscow retreat. Poor administration and operating on a larger scale than he was accustomed to diminished many of Napoleon’s key strengths that brought him victory in his younger years. The army he took to Russia looked much like the ones he defeated in his youth. You can see the black line; on the way back from Moscow through the cold, the forces diminished from the elements and from constant attacks from a pursuing enemy.

The experience of the soldiers retreating was one of the worst in human history. Many starved, many froze to death, and others were beaten to death and tortured by angry Russian peasants in orgies of violence or death marched naked in subzero temperatures. Some of those lucky enough to survive only did so because they practiced cannibalism. Think of the acrimony that can sometimes occur in your own workplace—then think what it would be like if the stakes were as high as they were for the poor men who endured one of the most successful people in history’s greatest failure. About 90% of the men who set out never returned, maybe more.

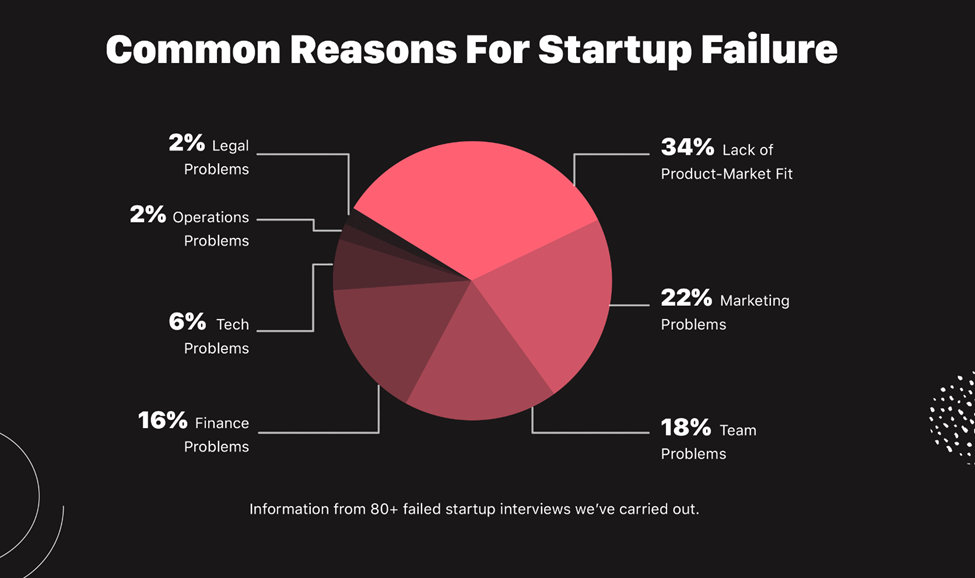

When you look at that map and envision the human suffering, freezing temperatures, death, and wanton violence that led to those lines shrinking to a negligible fraction of what they were when Napoleon first crossed the Niemen—ask yourself if knowing all that you know, would you have gone? The answer is probably an emphatic NO. Next, consider that although numbers are fuzzy and were purposely obfuscated by Napoleon himself, people who start a business face about the same odds as those who crossed the Niemen in 1812.

“Crossing the Rubicon” has become prevalent in our lexicon. We urge you to use “Crossing the Niemen” to describe starting a business and to think about how to begin to assess management teams of stocks you own properly. When you start a business in the United States, your situation is nearly hopeless; like a member of Napoleon’s Grande Armee that crossed the Niemen, you face a 90% chance of failure.

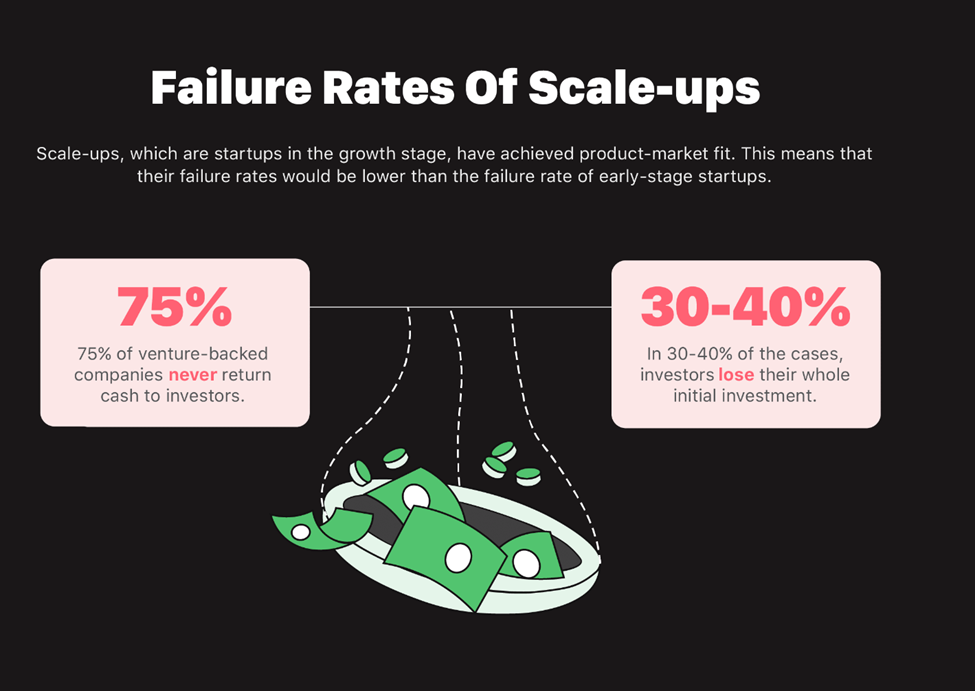

So, when you’re contemplating these questions of wielding authority and how one of the most outstanding leaders in history could preside over such a failure, please remember that people who founded companies have been through a lot to make their creations survivors. Even scale-ups, which are more established businesses that have proven themselves lost their investors money in 30-40% of cases. They are lucky to have odds roughly in line (30% to 40%) with the bloodiest battle of the American Civil War, Gettysburg.

So evaluate managers with this in mind: they are tough if they’ve made it far. They have knowingly crossed the Niemen aware of the odds, and their bravery and achievement, or someone’s in the past where you work, is now responsible for your sustenance and health insurance. We are blessed in our modern age to be able to compete for resources in a much less acute way than our predecessors were forced to. Yet, this lower-intensity competition has produced some of humanity’s most incredible achievements. Remember, it wasn’t a company that achieved the great technological strides that have redefined human existence over the past 20 years. It was the people who started it and the capable people they hired to help them realize visions that seemed impossible. The challenges you face when starting a business resemble what Napoleon faced metaphorically.

The bulk of his casualties weren’t even from the enemy; they were from unforced errors in planning and the inevitable problems that always accompany managing large groups of starving people. Remember that gambling and taking long odds is the game’s name early in a company. Still, as it evolves, risk aversion and thorough contemplation become more necessary to not fall by the wayside as the metaphorical temperature drops. Judge the guy/gal you’re giving your money to accordingly. Experience always is a plus. Mark Zuckerberg was a CEO very early, and Google and Apple pretty much punched him in the nose and took his lunch money despite his significant achievements. It’s a tough gig.

Baby I Got Your Money, Don’t You Worry

There are many ways to judge a management team, and we are just beginning one of a series of continuing fundamental factors we will check in on periodically in this column. Remember that when you’re buying stocks that you’re basically giving someone your money on a wing and a prayer. They have your money, and they don’t have to give it back if things hit the fan or even sometimes if they just don’t do that great despite their best efforts. You want the steward of your money to be capable, serious, and effective at guarding and augmenting your financial interest. You don’t have to like them or agree with them on everything. You certainly don’t have to idolize them because their ultimate obligation is to the shareholder, and as investors, that’s how we choose to judge them for our purposes. Firstly, let’s take you through some of our research heads favorite CEOs to get our conversation started after we give your our top three picks for S&P 500 CEOs.

The corporation is such a strong vehicle for change and collaboration because it allows people of different backgrounds and experience to collaborate on a mutually beneficial basis. Still, somebody always has to call the shots and drive the train. Those who have started a company may appreciate the grim metaphor in this article more than others. But contemplate company management with the old trust but verify approach. We used this metaphor to illustrate the ridiculousness of critique that top-level managers can get. The companies in the S&P 500 are the elite in many ways, and they have everything from founders to professional management teams; both can be practical and different skills are required to manage different life cycles at any company.

When you start a company, you’re enamored to feel there’s no one to tell you what to do, you’re the one in charge, and your new office seems like you’re invincible and on the top of a mountain. After you’ve been running a company for a while, you’ve gone from feeling on top of a mountain to being surrounded in a deep and lonely hole. You’re freaking out because you’re in charge, and there’s no one to tell you what to do. So, to all those who’ve made it across the Niemen and back, we salute you. Failure for startups is most brutal in what we’ll call the retreat phase for purposes of this article from years 2-5; it takes out about 70% of businesses for various reasons.

Most CEOs are competent and well-meaning people in our experience, and despite what it seems like on TV, their tasks and achievements can sometimes be thankless and are nearly always daunting. Heavy is the head. But you have to watch out for the Ken Lays out there and be able to ask why. At the very least, listen to what the sell-side guys are asking management on the calls if you’re going to own a company for the long haul. Adam Gould, our Head of Quantitative Strategy, recently found in some of his new research that increased verbosity in earnings reports is potentially an ominous sign for performance. Put your BS meter up and start sizing up the people who have your money. We have picked three classic and particularly great CEOs. We urge you to read up on them. Understand their stories. Submit some of your favorites to us as well via inquiry@fsinsight.com Three of our favorite CEOs in the S&P 500 are below.

- Jim Farley of Ford (F 0.22% )

- Jensen Huang of Nvidia (NVDA -0.76% )

- Warren Buffett- Berkshire-Hathaway (BRK.A)

These are not recommendations for stocks. See our research heads favorite CEOs over their career:

Tom Lee: Our Head of Research has selected “all founders and CEOs of public companies.” Starting a company is an incredibly hard thing to do. It’s difficult to even maintain solvency. However, those who have made it public are the best of the best. It would help if you always remembered that stocks could amaze you as they did in the wake of the pandemic because of the developed grit of those that kept the lights on during unprecedented challenges. One of Tom’s recurring points is that management teams have recently become extra grizzled by coming through harrowing times. The unprecedented pandemic shutdowns forced companies to cut and innovate and dramatically improved operating leverage at many firms.

Brian Rauscher: Our Head of Global Portfolio Strategy selected Jamie Dimon as his favorite CEO. Mr. Dimon is among the highest-paid CEOs because he gets results, although he recently suffered a rare rebuke in his requested compensation. Dimon is a capable leader and was actually the heir apparent of legendary Citi CEO Sanford Weil for 15 years. Things didn’t work out for Dimon the way he thought at Citi despite his obvious talent, and his mentor, Mr. Weil, fired him. Mr. Dimon was not deterred, and like many great leaders, he learned from adversity and advanced to great heights. We know he makes good hiring decisions since our own Tom Block and Tom Lee worked under his leadership. Mr. Dimon was a solid pick and has navigated two major crises now, and he definitely learned from them both.

Mark Newton: Our Head of Technical Analysis, Mark Newton, has selected one of the most influential managers in history, Jack Welch. He was a visionary manager who helped pioneer the modern definition of the CEO and was very good at interacting with Wall Street in a constructive way. He was given the nickname “Neutron Jack” for cost-cutting, which engendered some resentment from a more labor-centric early-1980s American society. Mr. Welch managed General Electric from 1981 to 2001 and turned it from an appliance company to a multi-national behemoth. Mr. Welch was known for prioritizing his “people decisions.” Mr. Welch spent over half his time getting the right people in the right places and “helping them thrive,” according to an experienced executive search consultant.

Adam Gould: Mr. Gould picked Douglas Peterson, the CEO of S&P Global. Mr. Peters may not be the headline grabber you’d expect, but sometimes that’s a good thing, particularly if you faced an existential regulatory threat only slightly more than a decade ago. He rose internally from the rating division he joined in 2011, so he successfully bore the brunt of regulatory scrutiny. Revenues have more than doubled since he took over in 2013. Employee satisfaction is very high at the company and it’s made some solid acquisitions. This column covered the company individually, and we also featured it in our article on pricing power. Sometimes, like in S&P’s case, a high profile is precisely what you don’t want to see. Just solid execution and building shareholder value.

Tom Block: Our Head of Policy worked closely with his pick JPMC CEO Bill Harrison. Mr. Block worked with Mr. Harrison to change the face of American banking forever in a way that has supported our country, having the deepest and most advanced capital markets on the planet. Did you ever wonder how JPM became America’s biggest bank? With Tom Block’s assistance, Bill Harrison helped advance reforms to cumbersome interstate branching restrictions that led to inefficiency. Mr. Harrison’s mergers paved the way for the banking landscape we see today, which was immensely helpful in ensuring the economy didn’t collapse during COVID. Mr. Harrison was a prolific deal maker and found a way to grow aggressively in a mature industry. It’s nice to get CEO a pick from a man who was instrumental to their pick’s achievements.

Sean Farrell: Our Head of Digital Assets Research picked Microsoft CEO Satya Nadella. He is a CEO that inherited a mess, refined the company vision, and delivered value to shareholders. Under Gates, Microsoft became the door to the internet via its Windows operating system, Office products, and free internet browser. Gates left around this time, and Ballmer took over. Understandably, Microsoft was late to mobile, and when they did come around to the new paradigm, they made several strategic blunders. Nadella completely revamped the culture within this 40-year-old Company, favoring bold investments in the cloud so that Microsoft doesn’t miss this wave as they did with mobile. Since Nadella assumed the reins, Microsoft has achieved a 24.8% annualized return, and is the second largest US company by market cap. It is one of only four US companies with a market cap north of $1 trillion. It is still projecting double-digit growth and is once again viewed as an innovator in the space.