Key Takeaways

- Pricing power is a key consideration in markets subject to inflation risk. There are several ways companies can achieve pricing power, by selling essential components, having strong brand value, or continually providing more value to consumers.

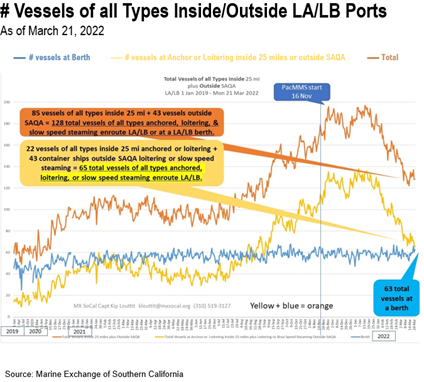

- Inflation has been persistently high as a result of supply chain kinks and an anomalous ratio of goods consumption to services consumption.

- We believe inflationary pressure from the war in Ukraine could be prolonged, but it could also collapse quickly if a peaceful resolution is unexpectedly achieved.

- In alpha-driven markets, where stock picking becomes more important, the pricing power of a company should always be a key consideration. We discuss five of our favorite names that have this capability.

The last installment of this column was dedicated to picking stocks for an extended commodity shock. We focused on stocks that are idiosyncratically poised to benefit from what will likely end up being the largest commodity shock in modern history given the breadth of affected commodities spanning agriculture, metals, and energy, which are directly impacted by the tragic conflict in Ukraine. While we believed supply chain issues associated with COVID were beginning to alleviate (and there is data to show this), the war threatens to create a whole new set of problems. So, the ultimate direction and persistence of inflation are very much up in the air and unpredictable.

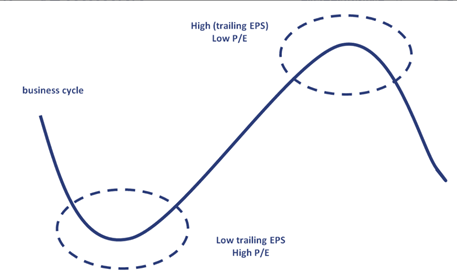

The Molodovosky Effect

Many commodities stocks have been doing great lately, but these companies are subject to something called the Molodovsky Effect, which is the countercyclical relationship that P/E ratios of highly cyclical companies. Typically, the P/E ratios are low for many commodity or cyclical companies, and earnings are high at the top of an economic cycle. At the bottom of the economic cycle, the opposite is true. Of course, this is the reason why normalized EPS is often used to smooth out the impact of cycles. To illustrate why it is important to pay attention to this, let’s take ourselves back to the period between 2013 and 2015 when iron ore demand made the seemingly innocuous change from growth rates of +4% to -2%. The price of iron ore dropped roughly 67% as a result, which would obviously be a major headwind to any miner.

Markets have gone up significantly since the 2/24 low, and they are within striking distance of all-time highs. A significant portion of the market declined by more than 20%, and we believe one way to meet the uncertainty ahead is to focus on stocks with pricing power. That term can seem murky, but it is ultimately a very important one to understand. This column has largely focused on enduring competitive advantage as a key characteristic to seek out in stocks. Pricing power can be a major part of any competitive moat, if not its primary component. What it effectively means is that the utility or the need consumer has for the product outweighs price changes.

Price Elasticity of Demand = Percentage Change in Quantity Demanded/Percentage Change in Price

Pricing power can be literally explained as a product or service that has low price elasticity. Price elasticity is obviously a lynchpin of any successful company strategy and ignoring it can cause undesirable business outcomes. In other words: how much does a change in price affect the consumption of a certain product or service?

Without this data, CAPEX planning and successful strategies are difficult to implement. If rising prices significantly mitigate demand, then that good or service is said to be elastic. For products that are inelastic, like those which consumers need regardless of economic conditions, demand won’t be as affected by the price which is obviously a positive for the sustainability of margins for the companies producing them. All else being equal, companies with greater pricing power have more secure gross margins than those who do not.

How To Spot Pricing Power

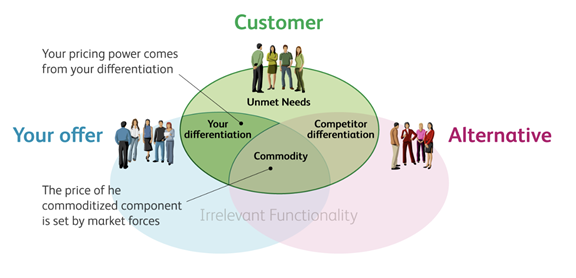

There are both qualitative and quantitative methods for assessing a company’s pricing power. It is an inimitable feature for stocks that compound over time. Some of it is obvious: if you’re the only company producing a certain product, then you have greater pricing power. Indeed, one of the key thrusts of anti-trust efforts is to ensure that no company gets an undue amount of pricing power, which often manifests as a key downside for consumers in monopolistic markets. Great quantitative measurements of pricing power include gross margins themselves, as well as the sustainability of those margins. If a company continually expands margins, then it is probably a good bet that it has a high degree of pricing power. One way to assess companies would be to compare the rate of change of margins over a period.

However, there is an also art to understanding and defining pricing power. Fundamental analysis can easily identify companies with good pricing power, but this is of course subjective and can be often influenced by bias. So, if you believe a company has a good management team with its finger on the pulse of consumer preference and needs, then that company may well be capable of sustaining margins because it is producing or designing products that improve the value and utility enjoyed by the targeted consumers. If consumers’ utility for a product exceeds their price sensitivity, then price changes won’t impact unit sales as much as they otherwise would. Product differentiation that benefits consumers more than the competition is one of the most straightforward ways to achieve pricing power. Of course, building a better mousetrap isn’t always easy or attainable.

Companies with strong brands and brand value tend to have greater relative pricing power as well. There can be all sorts of other variables that affect pricing power: for example, if it costs a lot to switch providers for a good or service, then that will often produce some pricing power benefits as well. If a company is producing a component for an end-product, which is a small portion of the total cost for the entire product, that is also a way it may be able to achieve pricing power.

Luxury brands illustrate this concept nicely as well. For some consumers, price is simply not a consideration in owning the latest design of a purse or other designer item. Health Care is a sector where the government protects pricing power by statute. To incentivize pharmaceutical research by the private sector, the government gives them 7 years to exclusively profit from a patent before generics are allowed to provide relief to consumers. There are different ways to achieve pricing power that help earnings and margins stay sustainable through the thick and thin of cycles. We believe the following five stocks will benefit from their pricing power over the coming quarters and have the potential to outperform stocks that have less pricing power. Pricing power keeps top-line growth coming despite the whims of economic cycles and market-driving headlines.

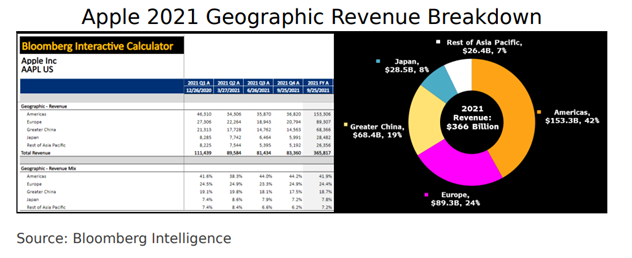

Apple (AAPL)

As we mentioned, good brands are one route to pricing power. So, our first one is a softball. The company is not only the largest company in the world, not only does it make sticky and indispensable products, but it also has the most valuable brand on planet Earth. One of the things pricing power enables a company like Apple to do is to make large investments that will continue to sustain growth and meet the consumer appetite, like its massive project to get into battery electric vehicles (BEVs). Many children were essentially raised by Apple products during the pandemic, giving it another inroad with the consumer of the future.

The company also just recently took the lauded action by the Street of starting the shift to a subscription model for the iPhone. This would reduce the price elasticity of Apple’s flagship product and make the company less dependent on new product launches. Apple has been on our Granny Shots list since the inception of the list. One major risk for Apple is supply chain dislocations. While it is diversifying its manufacturing footprint, it still is overwhelmingly in China which could present some geopolitical risk.

ASML (ASML)

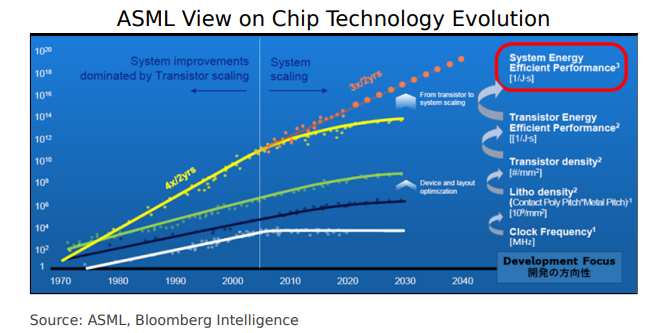

The geographic location of this company, in the Netherlands, could be deceiving if you took it at face value. Despite being in Europe, there is no company more central to US competition with China. ASML builds EUV lithography machines that are needed to produce the leading-edge chips powering the world’s most advanced technology. For example, those making chips for Apple need the technology since chips are constantly shrinking and at the sizes, they have become, ASML’s technology is the only way to produce them.

So, the company has an effective economic monopoly on a product one of the most capital-intensive industries in the world needs. Even though semiconductors are an incredibly cyclical industry subject to back-breaking capital intensity, ASML’s unique technological capability gives it pricing power. The demand for the machines is only slated to grow as major chipmakers up their technological capability. TSMC, Intel, and Samsung are all investing aggressively in EUV technology, where again, the company has a 100% market share. The best kind of pricing power if you can pull it off!

S&P Global (SPGI)

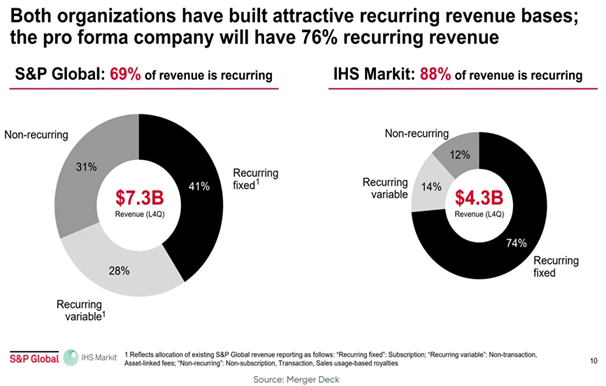

One area where pricing power can also be prominent is in oligopolies of essential services. In this case, our pick is one of the “big three” rating agencies. Remember more than a decade ago when rating agencies were right at the center of the post-crisis financial regulatory overhaul? How did they keep delivering to shareholders despite the increased regulatory burden? Pricing power was likely a prodigious portion of the success. They have received conditional approval for a merger with IHS Markit which we think has synergies that will reward shareholders. S&P Global is becoming a titan of financial data and has been a lynchpin for the financial system since its inception.

An accretive merger that helps S&P Global differentiate itself from its two primary competitors will only serve to increase its pricing power over time if successful. This company is well-managed and has a lot of fantastic talent and we like the management and direction of the strategy. When the firm is measured compared to peers using P/E, it tends to be on the higher end of the spectrum if not the highest. We think this is the market partially sending a message about the durability of the competitive moat. Of course, a major risk would be if the merge fell through. Any financial crisis associated with the ongoing conflict may hurt the name as well. Sustained rising rates can also be a headwind as it reduces the volume-based credit issuance business.

American Tower (AMT)

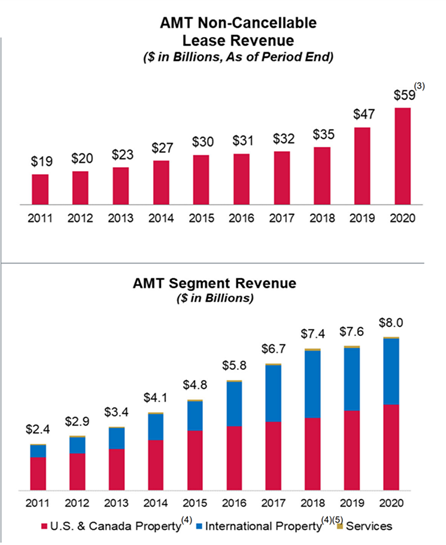

American Tower is a unique technology-connected Real Estate play that has used its pricing power and essential product to climb to the largest component of the Real Estate sector. One route to pricing power is when you own or provide something essential to companies that they essentially must spend on to remain competitive. The long process of upgrading to 5G infrastructure is one such area that benefits this company. This company also has an attractive dividend. The service they provide is almost like a utility and its multi-tenant Real Estate model has proven lucrative. In addition, hard assets like the Real Estate which is one of the company’s primary assets can also serve as a good inflation hedge. Switching costs are prohibitively high in what it provides, so this helps it maintain pricing power as well.

Providing something as essential as necessary 5G infrastructure to companies who need their services to compete gives the company pricing power and makes it a good long-term hold to benefit from compounding. As far as business plans go, the assumptions necessary for AMT’s continued growth seem rock-solid and it uses lawyers to create long-term contracts that also contribute to its pricing power. Could a new technology replace its moat? Yes, and that is a major risk. However, for the time being, things look pretty good at American Tower. Another risk is that global expansion efforts produce lackluster results.

Hilton Worldwide Holdings Inc. (HLT)

Hilton is one of Wall Street’s favorite travel companies. It benefits from several pricing power attributes like having strong brand value, a diversified product and brand structure across quality and geography, and a leading rewards program that helps keep consumers in their commercial eco-system. Another factor that can cause or bolster pricing power is pent-up demand. Like many companies with superior pricing power, it often enjoys an elevated P/E ratio when compared to peers. The convergence of a major retreat of COVID, pent-up demand and the beginning of the first travel season with wholesale removal of many restrictions will likely make this company a great one to own if you believe a travel boom is coming, which we do.

We believe occupancy rates will be significantly increased over the coming months, which of course has a direct bearing on the pricing power of the company. It certainly isn’t a bad strategy to partner your loyalty program with key beneficiaries of network effects like Amazon and Lyft. We believe this is a great strategy and we have confidence that this superb management team will continue using their loyalty program effectively to help the top and bottom lines. Let’s remember too, that this company is a definite “Epicenter” stock that was one of those businesses closest to the economic and social consequences of COVID-19.

While the company experienced credit headwinds during the pandemic, which could certainly be a risk again if a new variant were to emerge and cripple economies again, it has significantly improved its liquidity position. The key risk for this firm would be for leverage to rise too much which could cause headwinds. One thing that gives us confidence though is that the company aggressively cut operating costs which should ultimately turn it into a leaner and more efficient company right as it converges with the travel fever we anticipate is just around the corner.