Key Takeaways

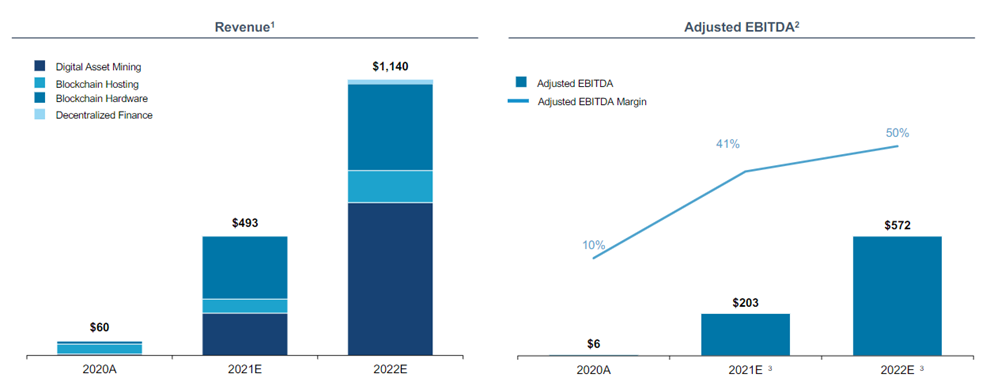

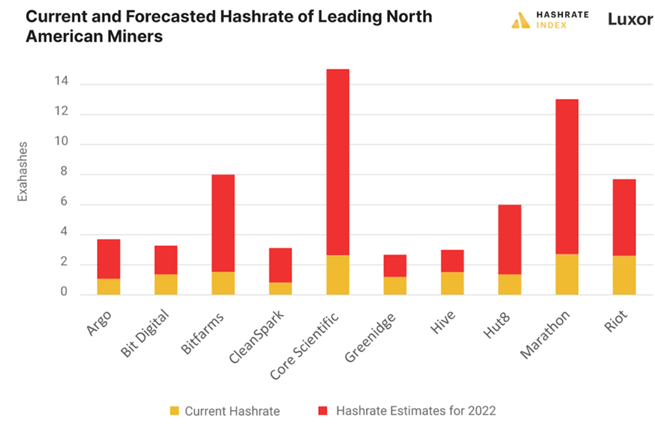

- Core Scientific is the largest North American Bitcoin miner and is going public through a SPAC merger with Power & Digital Acquisition Corporation next year.

- We introduce some of the key economics and considerations when investing in Bitcoin miners and we analyze the competitive environment. We think Core Scientific is a clear leader with enticing competitive advantages, not least of which is its proprietary software stack and IP.

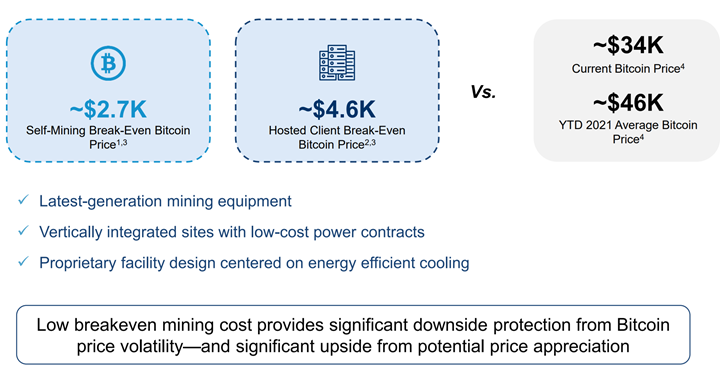

- We are bullish on Bitcoin and owning stocks that mine it is a great way to get exposure if you’re convinced of the macro thesis on cryptocurrency. Miners often outperform Bitcoin spot-price because of their lower-than-market cost basis.

- Bitcoin’s network continues to grow and we believe the first-mover advantage Bitcoin has gotten in cryptocurrency will endure despite a plethora of innovations in the area.

- Based on the valuation of other cryptocurrency miners, we think the economics of the deal make sense and we believe the experienced management team, innovative software platform and cutting edge infrastructure will enable this company to grow as Bitcoin continues to appreciate.

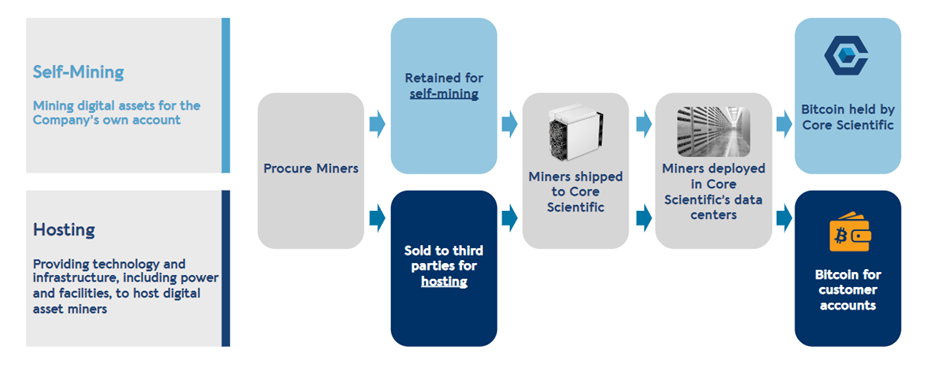

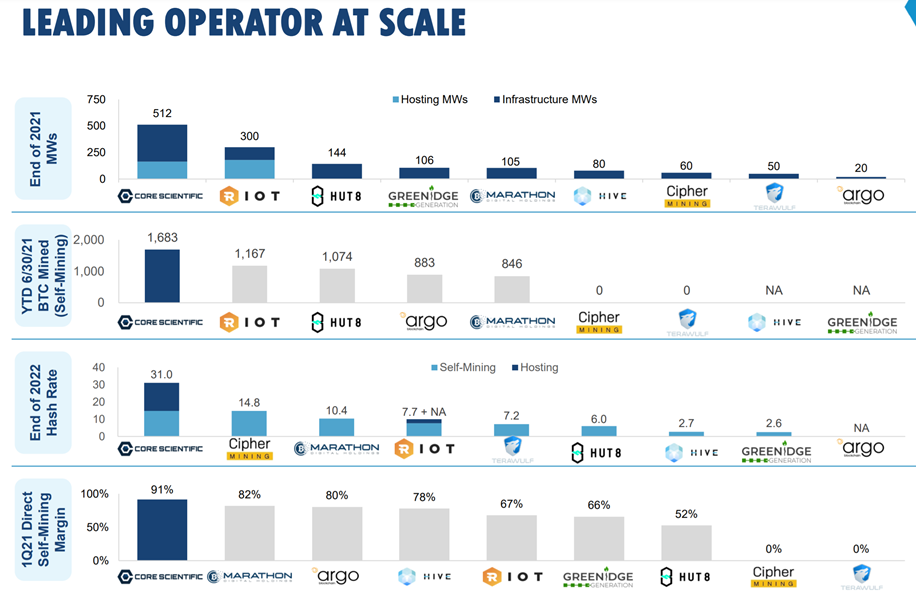

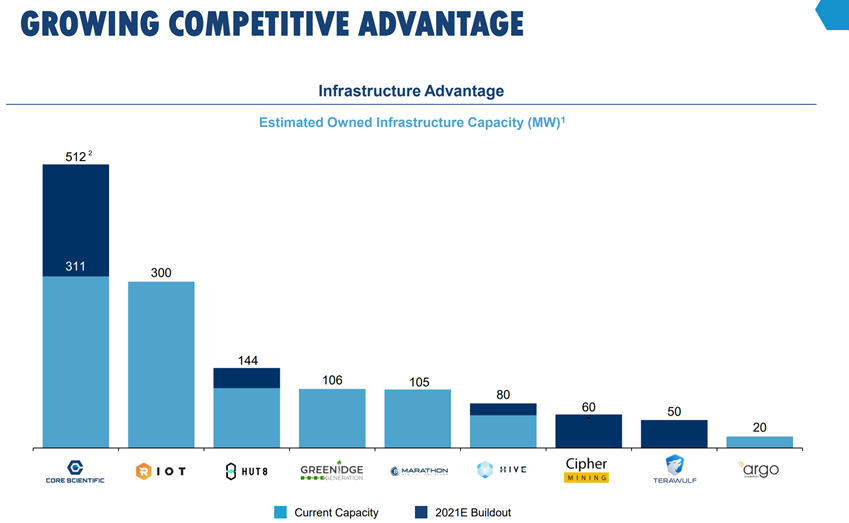

Core Scientific is the largest Bitcoin miner in North America and is a clear industry leader across several vital dimensions. Additionally, this name has its own proprietary software stack and unique hosting abilities which allow the stock to have more stable and consistent revenue sources than a straight mining play. The hosting business is steady revenue which is not directly tied to the price of Bitcoin, which we believe should make this name outperform straight-miners in the event of Bitcoin price weakness.

The late entry to public markets through a SPAC merger with Power & Digital Infrastructure Acquisition Corp. (XPDI) is an opportunity for investors to get exposure to the crypto mining industry through one of the leaders in size, scale and ESG considerations. Black Rock is the anchor investor in this transaction and Core Scientific mines all Bitcoin on a carbon net-zero basis.

While operators like Marathon (MARA) have an asset-light model, our Signal From Noise candidate this week has massive physical infrastructure and associated proprietary software to learn from and develop operating efficiencies from those assets which translates to more value for shareholders than just the Bitcoins retained from mining operations, as lucrative as those may be. Yet, compared to other miners, this name still has a discounted multiple despite it’s very solid financials and relative revenue diversification.

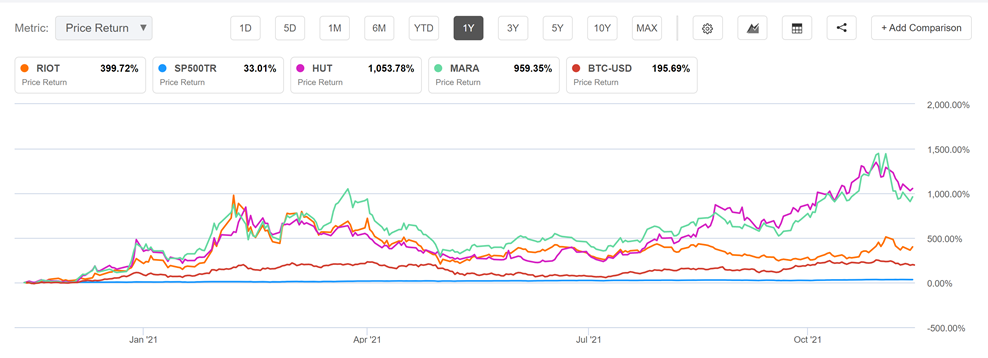

A crypto mining stock, no wait, a crypto-mining SPAC?! Have we lost it? No. We haven’t. We’re used to the hysteria of established market-watchers disparaging a new and hard-to-understand asset class. Our firm was one of the first major Wall Street research shops to recommend and cover Bitcoin. However, it is no longer avant-garde to own Bitcoin miners. Despite the growing acceptance, their price performance continues to significantly outpace the S&P 500 and the spot price of Bitcoin itself.

Today, many institutional heavyweights like Blackrock, Vanguard, Goldman Sachs, Susquehanna and others now own Bitcoin mining stocks. If you don’t want to manage private keys or deal with the futures-based ETF, then owning crypto mining stocks is a great way to get exposure. Miners have outperformed the Bitcoin spot price, whereas ETFs have trailed it.

Equity exposure to Bitcoin miners has outperformed Bitcoin itself over the last year significantly. This is because the miners are akin to a leveraged Bitcoin-play. Since they’re acquiring Bitcoins at a lower-than market cost, given that the asset is near all-time highs, they are experiencing quite a bit of upside. The sudden removal of over half of the mining capacity, when China prohibited the practice in May of last year, also lowered the “hash rate” which we’ll explain more about below, meaning the miners that remained online were able to take advantage of a much more lucrative operating environment.

The lower the hash-rate, the less computing power and therefore energy, is required to mine each coin. The sudden removal of over half of the computing power on the network didn’t result in the security of the network being breached despite a massive loss of computing power. This, in itself, shows that the continued resilience of the network has made the oft-cited possibility by Bitcoin bears of the digital asset reaching zero much closer to approaching zero itself.

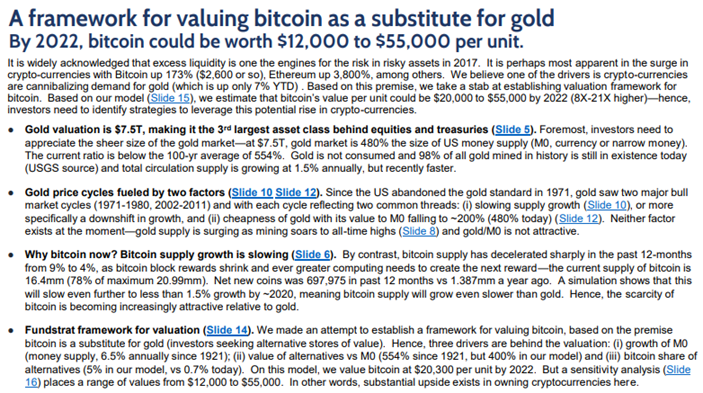

In July of 2017, we released our first report on Bitcoin when it was around $2,600. Based on the assumption that excess liquidity was an engine for asset appreciation and that Bitcoin’s performance as a store-of-value and an investment was outperforming Gold, we estimated that by 2022, the vanguard of cryptocurrencies could reach up to $55,000 per coin.

At the time, the familiar tropes of uber-bullishness were lobbed upon us and some in the institutional world even went so far as to question the integrity of the call. Now that Bitcoin has repeatedly been one of the best performing risk-assets year after year, we’re hoping if you haven’t gotten on the cryptocurrency train you will now.

Coincidentally, if you’re only familiar with our macro research we’ urge you to consider upgrading to FSI Pro, which also gives you access to our extensive and institutional-grade crypto research. We have a deep bench of intelligent and talented individuals on this team and what they produce is industry-leading research based on data and not hype. Our crypto team will soon be releasing a detailed report on the Bitcoin mining industry, and we’ll explore the economics and concepts we do in this article much more in depth. Take advantage of our only sale of the year (which is going on right now) to upgrade to FSI pro and get the immense added value of our top-notch digital assets research!

The Economics Of Crypto Currency Mining

We understand that many folks are still wary of cryptocurrency despite the enormous strides, and enormous financial gains, that have been made over the last years. The flagship cryptocurrency, Bitcoin, was long considered ‘digital gold’ because its design built in the scarcity and incentive through the process of ‘mining.’

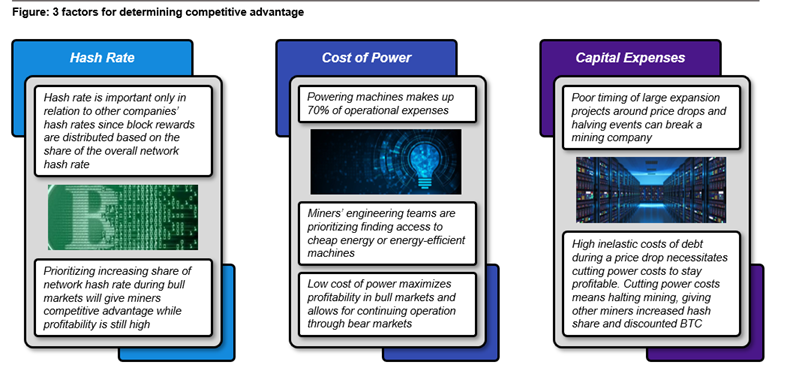

It is a bit of a misnomer since, unlike real mining, the hardware required is dedicated to solving complex computing problems for a reward. Silicon chips, not pickaxes are the method for striking it rich. The three dimensions below are the primary ways to measure the economics of a Bitcoin miner. This is from our Digital Asset team’s upcoming detailed report on crypto mining.

Instead of traditional mining for a physical commodity, Bitcoin mining is all about computing power. Computing power requires energy, and thus, one of the primary input costs is for energy itself. What this means is that there is a perpetual ‘arms race’ occurring between Bitcoin miners who must continually re-invest profits to boost capacity and upgrade the quality of the machines used to mine the cryptocurrency.

When the price of cryptocurrency is doing well profit margins go significantly up toward 80% and the most value is derived from miners capturing more share of the ‘hash rate,’ which is literally the amount of guesses per time period of the complex computing problems required to complete a block. The difficulty of problems is adjusted every two weeks as the collective hash rate ebbs and flows. Halving events occur periodically as a way of increasing scarcity.

This is when the reward per block solved is cut in half and planning for these events are crucial to maintaining viability as a miner. Infrastructure investments must be timed to come online in a way to maximize price gains. If infrastructure investments don’t occur at the correct time, a prolonged period of unprofitable mining can occur.

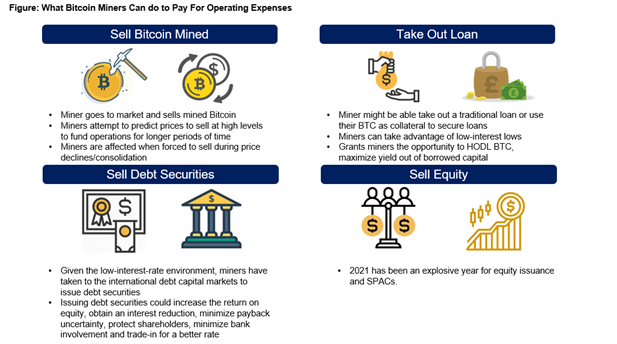

As you can see, there is backbreaking capital intensity required to maintain relevance and profitability in the Bitcoin mining game. All of the industry is of course tied to the price of Bitcoin. The credit risk of each company is inversely related to the price of Bitcoin. So, in environments like today when the price is relatively high, funding options become easier to fund the great CAPEX battle that is required.

Obviously in this business, scale matters greatly. The pick this week has some of the most advantageous metrics across the industry. However, it is still being publicly offered through a SPAC at an attractive multiple. As we’ve mentioned, this company has all it needs to continue to benefit from high Bitcoin prices and also has more desirable characteristics than most miners in the event that Bitcoin prices go down significantly. This is not your typical early-stage crypto SPAC, it is one of the most developed and proven crypto companies in existence.

A SPAC-Tacular Valuation

Many cryptocurrency associated SPACs have not performed the best and on it’s face, it seems like a good sub-category of assets to avoid. We’d say there is plenty of reasons to be wary of early-stage crypto companies without a proven track-record of delivering. However, the risk of a similar outcome as other crypto SPAC blow-ups, given that this company is the largest cryptocurrency miner in North America and leads other operators across multiple dimensions, is significantly diminished.

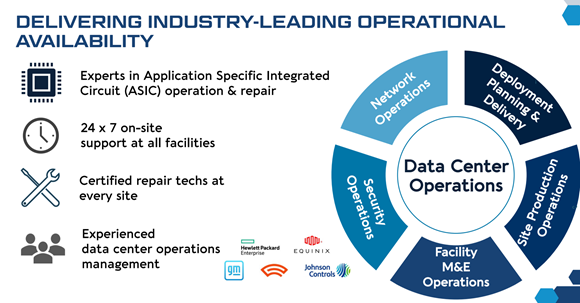

In addition to being more than competitive across the three major crypto metrics of hash rate, cost of power and capital expenses we think the combination of the company’s proprietary software stack and leading-edge expertise in the maintenance and optimization of physical infrastructure will pay dividends over time.

We believe the company’s deep bench of management with relevant expertise, many coming from the data center world, will in the end turn out to be a superior method of creating shareholder value. We’d say the assets create long-term value that can be extracted by the company’s unique strategy as opposed to the short-term benefits shareholders get access to with Marathon’s asset-light business model.

Not only is this the biggest player in an industry with an endurable competitive advantage (a specialty of this column), we believe they have the most diversified business model with ample opportunities for growth outside of just the acquisition of Bitcoin. Software is eating the world as Marc Andreesen once said, and we wouldn’t find it inconceivable that it eventually eats the world of Bitcoin mining as well. Their specialty expertise in ASICs chips will be an addition dimension of monetization separate from the common drivers of Bitcoin miners.

Risks And Where We Could Be Wrong

The risks for a company focused and so heavily correlated to the price of cryptocurrency are probably pretty obvious to most people. The price of Bitcoin is incredibly important to the financial viability of these firms and that mixed with back-breaking capital spending just to remain viable makes these companies have higher-than-average bankruptcy risk. Timing the acquisition of and optimizing computing fleets, however, is a particular specialty of this company. Being the biggest in the game also conveys major scale advantages which we think makes this a less risky name than some other miners.

The business is highly dependent on complex supply chains for digital mining equipment. Again, given the company’s size and scale, it is able to negotiate more preferential supply agreements as it is also able to negotiate long-term contracts with energy providers. Still, the equipment it uses is highly specialized and this industry is acutely affected by semi-conductor shortages. Any slowdown in the demand for blockchain/AI technology could have an adverse effect on the business and growth assumptions.

The price of Bitcoin and any major setback in this area is probably the chief risk for Bitcoin miners, but given that this company is more diversified because of its’ non-price-dependent hosting revenue, we think it is again relatively less for Core Scientific than for some other miners. The back-breaking capital intensity of mining is mitigated by scale, and given this company has the most appealing scale metrics from multiple dimensions, we feel pretty comfortable that relative to other players in this high-octane and high-return industry, risks are lower.

The company’s business model comes with many risks. It may not be able to attract enough customers to keep its hosting business viable if other advances in process and software are made by competitors. And while hosting revenue is less correlated to Bitcoin than some activities, any major price and sustained price drop will likely lead to this revenue drying up as well if it is severe enough.

The company and industry are definitely also subject to ESG concerns around Bitcoin energy consumption. If you’d like to dive deeper into this topic, again, please upgrade to get our crypto research as our team addresses it exhaustively. We do believe a key differentiator is that this company is the ESG leader in the space and is developing processes and technologies to make net-zero Bitcoin mining more viable. We thus see the company as having less risk from any ESG concerns or environmental regulation around Bitcoin mining energy concerns. It seems to be ahead of the pack here.

A business so dependent on hardware is always subject to significant risks if the machinery breaks down for any reason. Power outages or power grid problems that interrupt mining operations are a big risk in addition to regulatory risk. Also, any widespread failure, construction delays in expanding new capacity, or major changes in the economics of how the company pays for and consumes power could materially and adversely impact the earnings power and potential of the company.