Key Takeaways

- The heating up Cold War between the United States and China will require a massive investment and pivot by the United States toward new strategies, weapons and technologies and Raytheon has the right portfolio of products to benefit.

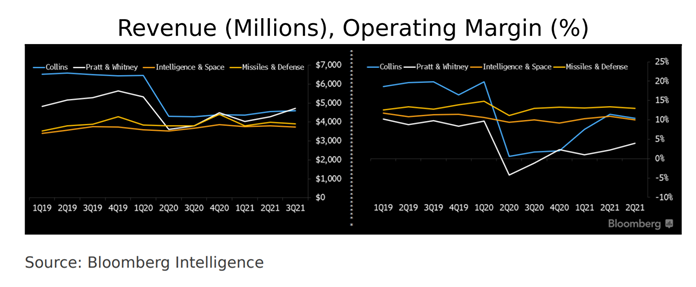

- Raytheon’s merge with United Technologies resulted in it having one of the more robust and competitively competent commercial aerospace capabilities in the world. The marriage is working well so far.

- The changing demands of state competition in an age dominated by the digital transformation is requiring unprecedented collaboration with the private sector for US capabilities to catch up to where they need to be, Raytheon will be huge here because of Space, Cyber and Missile Defense.

- The recent testing of a hypersonic missile by China concerned a lot of folks. Raytheon is one of the undisputed leaders in hypersonic weapons and missile defense which should be another catalyst for growth.

- The stock’s recent merger with United Technologies is taking a while to play out favorably given the delayed return of international travel, but nonetheless, the logic of the tie-up is pretty iron-clad and we believe it will pay off in the medium to long-term as travel normalizes.

The truth is sometimes a poor competitor in the marketplace of ideas—complicated, unsatisfying, full of dilemmas, always vulnerable to misinterpretation and abuse. – George F. Kennan

Some folks recently described China’s test of a hypersonic missile as a Sputnik Moment that caught the United States completely off-guard. While the US defense establishment may even sometimes echo this narrative as it tries desperately to get a calcified government infrastructure to respond effectively to the rising China threat, we’d suggest it’s probably more of a Tsara-Bomba moment.

This is when the USSR tested the largest megaton weapon in history, which was scary for the Western World, but was also likely the world’s most radioactive piece of theater and was of dubious military practicality. In fact, Russia abandoned a Fractional Orbital Bombardment System (FOBS) around the same time. Raytheon scientists are likely less alarmed than the public.

There has been a lot of discussion about a coming Cold War with China. We would contend that this this conflict likely has already begun and could be even more consequential for the future than previous low-intensity conflicts with the Soviet Union after the Second World War. Given the current momentum of events, it seems unlikely that the pre-COVID status quo will ever return.

In many ways this conflict may have seemed inevitable. However, for those who think it hasn’t started or that it won’t be as influential as Cold War I, we’d urge you to consider comments from President Biden’s current national security advisor on the matter.

He has argued that the Soviet Union was never even close to supplanting the US position of economic dominance; meanwhile, China is a much larger and more capable adversary on the technological and economic front. Beijing sees itself, as the inevitable successor to the United States as the next global hegemon, and this view certainly could become reality.

The STATE of Affairs In Cold War II

From 1618 to 1648 a conflict was fought largely within the Holy Roman Empire between religious factions. It was the world’s most devastating conflict up until that point and it killed up to 8 million people, or over 1% of the world’s population at that time. Some parts of Germany experienced deaths of over half the population and this horrendous and traumatic event was the backdrop against which the modern state would be birthed.

In 1648, a key part of the Treaty of Westphalia, which ended the devastating conflict, was establishing the concept of sovereignty within territorial borders. The rise of the Chinese and American technology giants has eroded the concept of territorial sovereignty as the networks that have changed all our lives and connected millions of people have simultaneously become a new and crucial domain of war. Autocracies have reverted to ‘cyber privateers’ that stretch the conceptions of traditional conflict.

State sovereignty is certainly one of the most profound and lasting developments of diplomacy and has largely defined the organization of political authority ever since. To understand the complexity and nuance of what is going on both between the United States and China and within both nation states, we direct you to one of the key insights about what defines the state as introduced by Political Scientist Max Weber. Famously, he has defined the modern state as a “human community that claims the monopoly of the legitimate use of force within a given territory.”

This definition may have some flaws, and perhaps no state has ever fully successfully achieved this reality. However, it is not difficult to understand why this definition has lost its relevance in a digital world. The traditional monopoly of armed force in a conventional military context, and the advent of awe-inspiring weapons of mass destruction, defined Cold War I. Despite the horrendous proxy conflicts of that low-intensity conflict, the rules and norms of the state helped prevent it from developing into what surely would have been an incomprehensibly catastrophic conflict.

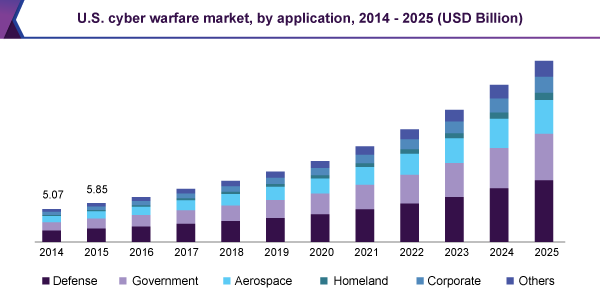

The emerging and ongoing low-intensity conflict between the US and Chinese state, which may be called Cold War II, has so far been defined by conflict in new domains of warfare like the cyber, space and digital realms. Thus far, a Cold War II, the emerging and ongoing low-intensity conflict between the US and Chinese state, is currently being defined by conflict in the new domains of warfare like the cyber, digital and space domains. Additionally, unlike the centuries-old framework for diplomacy between states, at present there are no rules, and competition is taking the form of an unrestrained free-for all.

Raytheon Is Crucial To Both Conventional Military and Next-Generation Military Capabilities

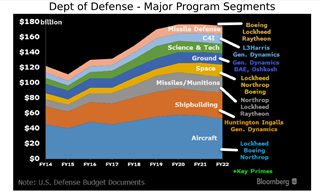

The US Defense budget has experienced a lot of growth in the last decades, but it has begun to flatten. In general, the beginning of a shift to meet the demands of Cold War II. Not only is it a leader in crucial conventional capabilities that will serve as a deterrent to an aggressive and modernized Chinese army, but also the leading-edge capabilities such as offensive and defensive cyber abilities, hypersonic missile defense and the final frontier of space. In other words, Raytheon is positioned to benefit from the areas of the defense budget that will likely grow despite the flattening aggregate level.

The Aerospace and Defense industry used to be more of a bloc during the decades-long confrontation with the Soviet Union and Lockheed Martin and Boeing reigned supreme. If you pay close attention to the US Defense budget and also the work of think tanks like The Center for New American Security who issued an independent assessment for Congress entitled Rising To The China Challenge, then you will see the preparations for the coming conflict are very different than preparing for an all-out apocalyptic slugfest on the Fulda Gap and the skies over Alaska.

The document is certainly not as military centric and includes actions across virtually every facet of our Democratic society. The leading thinkers are very aware that this will be a national effort requiring unprecedented coordination and reform across the government and also partnerships with the most influential commercial interests in the history of our planet.

So, while the two most powerful states in the world prepare to engage in a heated competition, they are also both dealing with how to contain, partner and respond to their respective Technology industries. In both countries, there has been a segmentation within each respective sector between Technology companies who want to partner with and profit off the state and companies that rose in a more benign era of globalization and just-in-time supply chains.

Ian Bremmer did an excellent job in his recent Foreign Affairs article, The Techno-polar Moment on elaborating on this unique dynamic of our transitional time.We’d say this adds a pretty complex layer to what’s going on and should make you always take ideologically-charged commentary grounded in “Cold War I Thinking” with a heavy grain of salt!

It is more complex than just conventional military equipment is not as relevant to the ongoing conflict as it was to confront the Soviet Union. Raytheon will be helping us show-up to Cold War II quite a bit more prepared than without them. This company is essential to the US government.

Similar to how the advent of nuclear weapons led to unpredictable and largely counterintuitive developments to the time-honored human practice of slaughtering each other on behalf of our respective states, Information Warfare, as the Pentagon calls it will likely define and evolve in ways that are very hard for folks to understand. Rene’ Girard, the French historian, put it nicely when he said “We are thus more at war than ever, at a time when war itself no longer exists.”

Cyber And Space Are Rising In Prominence Quickly and Raytheon Will Likely Benefit

So, what will likely be the greatest and most influential competition between two major powers since at least the Second World War is occurring during a time when in many ways the dominance of the state appears to be in decline as ossified government structures on both sides of the Pacific have struggled to keep up with the greatest technological strides humans have ever achieved. It’s going to be an interesting couple years ahead.

While the United States has been seen as somewhat of a victim to the recent rise in cyber crime and may appear flat-footed on the defensive side of information warfare the offensive side is an entirely different story. We wouldn’t want to be on the National Security Agency’s bad side that’s for sure. Just ask the key players in Iran’s nuclear program.

We’re pretty sure they could shut off Russia’s power grid if they wanted to, but that’s all very hush, hush. Who knows, maybe the NSA is Satoshi Nakamoto, although this is pure conjecture! By the way, cryptocurrency will likely have a large role in these monumental issues as the projection of state power is redefined by the ongoing asymmetric conflict. China doesn’t like it because it compromises capital controls and the US government can probably gain a lot from the influential technology with an open-minded approach.

Raytheon has simultaneously developed some of the leading organic abilities in the information warfare spectrum and has also acquired leading pioneers of the new field like Bolt Beranek and Newman which it acquired in 2009. Many of the services Raytheon provides and has an advantage in are both highly technical and highly classified, particularly in the domains of Space, Cyber and Missile Defense. However, its prowess and competence is undeniable and it will be a lynchpin of the US strategy to meet the China challenge.

So while it makes very secret, and very prolific strides on the offensive side of cyber capabilities, the lack of defense of the US-technology complex should actually prove a prime and continuing advantage for the company as this domain of war evolves quite quickly. The Forcepoint solution Raytheon provides is defense-level cyber options for the private sector. This also highlights another strength of this company, an incredibly diverse coalition of customers across the governments and commercial sectors of the Occidental world.

A Modern House With Bells and Whistles In A Nice Old Neighborhood

Have you ever been driving through a New York City suburb primarily consisting of older, often very sturdy houses, but then all the sudden you see some modern monstrosity that sticks out and catches the eye? Well, we’re not approaching this stock purchase from the perspective of the local Homeowners Association. The strides toward becoming an essential and highly modern component of the US defense complex is a benefit for shareholders as this new era of inter-state conflict begins in earnest.

Raytheon’s advantage in cyber-warfare isn’t just specific to that domain. A key part of modern US military dominance is the situational awareness and connectivity that digital technologies provide. Protecting these networks is Raytheon’s specialty and this applies to every single domain of war, even ye olde Land, Sea and Air. It is a leader in space technology like protecting essential satellites and is knee-deep in the efforts of the Intelligence Community to best our adversaries on the digital battlefield.

The commercial side of the business is very strong as well. It gives the stock diversification as well because the long-term efforts on the commercial side of the aerospace industry will be highly lucrative and likely margin expanding as international travel, where the company’s specialty wide-body aircraft will make a comeback, should be a welcome development for shareholders particularly in conjunction with the robust buyback program the company’s management is carrying out. Recent EPS beats, despite slight revenue misses, are a positive side. In addition, our Technical Strategy vertical is positive on the stalwart defense names and see’s recent price action as very bullish.

Risks And Where We Could Be Wrong

The risks are abound for this name, but as their CEO said on their recent call the company understands them very well. There is a major wildcard in Artificial Intelligence and the Chinese government has made a lot of technological strides. Artificial Intelligence breakthroughs, if they occur ahead of the United States, could fundamentally alter the balance of military and technological power. A recent report highlights this risk and can give you the lay of the land for assessing it effectively.

As we mentioned, the company’s diverse product portfolio and customers as well as their strong credit profile are all positives that we like to see that are highlighted by buybacks. However, a lot of the commercial airline revenue is derived from wide-body aircraft which have been experiencing a dearth and demand as international travel struggles to return to pre-COVID levels. We’d say this will continue to be a risk.

The company’s revenue miss this quarter was largely due to the pullout in Afghanistan and supply-chain issues. While sometimes these can be mitigated in the name of national security, a techno-centric company like Raytheon is still at the mercy of many of the shortages that any other company would be. We’d say this company has a good risk-adjusted return from what we can tell, but we will also say that this is definitely one you want to hold for a while. The competitive of advantage we see at this company will likely play out over years, not months, as the great struggle of our time continues to evolve.