Source: SeekingAlpha.com

GoPro was the feature of our Signal From Noise article from March 12, 2021. In this article, we covered how the company was amongst the best of the Epicenter cadre to pivot their business model into something more successful. In a proverbial sense, they made lemons with lemonade. Half a decade ago, the name had a very steep fall from around $90 a share to single digits. Many sell-side analysts still hate the name, maybe partially from getting burned before, and so given the small-cap nature and sour coverage, it doesn’t have the breadth of support a stock without such a scarlet letter might have on fundamentals alone. If you’re looking at fundamentals alone from this latest Q1 earnings report, you’ll likely want to buy the stock here, and we will explain why. Firstly, let’s take a look at Q12021 GoPro earnings.

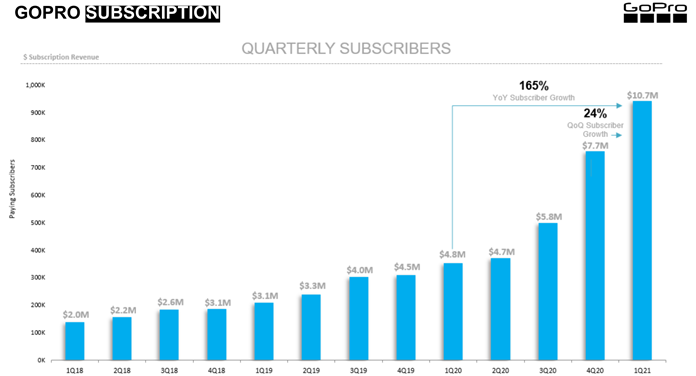

The company posted a surprise profit of $0.03 versus the expectations of breaking even. Revenue is up 71% YoY to $204M. The revenue from subscriptions is growing rapidly, making us reiterate that we think this stock is a very GARP-ey opportunity, particularly given the recent collapse in price. The non-GAAP gross margin is 39.2% and rising as subscriptions take off and consumers continue to splurge on the company’s higher-priced, higher-margin products. They sold 700,00 units with 95% of the retail sales above $300! The company is putting the money where its mouth is. The implications for the valuation of the successful execution of the transition from a consumer electronic hardware company that lets distributors eat into margins to a d2c hybrid subscription model are impressive. We think it’s early innings in the positive developments and subscriber growth for this company! As we mentioned in our last article, this flagship Epicenter stock continues to boost operating leverage and cut expenses. Non-GAAP Operating Expenses were reduced by 17% YoY.

The volatility today is undoubtedly unfortunate. We often think of the complex side of finance and forget that fear, stampede, and panic and the control thereof is near, if not equal in importance. We think patient hands will pay off in this case and think it is a bargain at the price it closed at today! As of the writing of this article, GPRO 2.19% was down roughly 13% on the day. It is now lower than the $9.40 that the stock opened on the day we published our last article. However, after our publication, the stock rose significantly to a high of $13.79. On Friday, it was trading as high as $12.23, so we certainly don’t want to dismiss the excessive volatility and realize it’s pretty unsettling. Some volatility may be explained by the fact that the Wall Street Bets crowd likes the name.

That being said, there was A LOT to like in GoPro’s latest earnings, and we, therefore, see this recent price weakness as a significant opportunity. The earnings report, we think, proves that many of the positive possibilities we saw for the stock are coming to fruition. Management is executing, and more importantly, the company is now gaining traction as a hybrid hardware-SaaS model that we believe should eventually result in the multiple re-rating higher.

Q1 Earnings Show Strength of SaaS-Hardware Hybrid Model- One Million Reasons To Own This Stock

GoPro surpassed one million paying GoPro subscribers. There was more than 180% growth in subscribers on a YoY basis! The subscribers drive high-margin recurring revenue. The virtuous cycle of the company’s direct-to-consumer business pivot is driving a lot of the subscriptions. Nine-tenths of physical purchases result in a paying subscription! One of the things we mentioned we like about this company was that they have a die-hard customer base that loves the product and the brand. This is a strong stock. Margins are significantly improving from both more subscriptions and strong sales. Sales are concentrated at the higher echelon of products, where margins are higher as well.

GoPro is proving that its fairly substantial re-engineering and pivot of its business model is going quite successfully. The company’s margins and profitability are improving, and growth in subscriptions is promising and seems cheap at the current price. We recommended at this price before, and we think it will see the 52 week high again, and higher. The problem is that many analysts do not love this stock. They haven’t been profitable. On the institutional side, there is probably a little bit of a ‘trust but verify’ on profitability before they get into the trade, particularly since many people got burned. Some analysts are catching on. One pointed out on the earnings call that the guidance was quite conservative based on his reading of the numbers. As we pointed out in the last article, Nick Woodman sold shell beads out of his car to start this company. The hardware sales are consistent, and new models are doing well, and this is feeding more and more subscribers into the new GoPro universe. GoPro essentially wants to be the universal solution for getting treasured content out of the black hole of the Apple Camera Roll. The company makes no secret of blatantly disparaging the clunky solution to illustrate its value proposition.

Software Adapts By Rigorous Engagement With Customer Base Every Two Weeks

The insight team has tried the application, Qwik, and it is a fun way to get more out of your content. Its initial clunkiness, we noticed, has already been corrected. Listening closely to the earnings call, we heard something from Nick Woodman that we really liked. Knowing this management team, product, and the culture associated with its most passionate users pretty well, it was good to hear his frenetic focus on the software quality and refinement. He said they have a rigorous process of communicating with their community, the non-GoPro camera community, and others to constantly streamline and upgrade UI and functionality in near-real time to consumer feedback. This obsessiveness that he is known for on the hardware side being observed when he’s talking about the newer software side of the business bodes well in our view. We’ll also say that the company’s Price to Sales compared to peers right now, particularly given its software success, make it look enticingly cheap.

Source: TDAmeritrade

CEO Nick Woodman is a guy who knows his customer base, communicates with them, and is involved deeply in their communities. Our bet is that this application which is also converging with the “Great Re-Opening,” and what history tells us should be several trends that we can expect in the wake of a plague, will be very good for shareholders. According to The Economist article What History Tells You About Post-Pandemic Booms, we can expect many people to be more attracted to risk-taking and take more risks generally. This converges with younger generations who regularly enjoy documenting their activities, and creating content about themselves is a powerful force in GoPro’s favor.

Our in-house video expert, Carrie Presley, evaluated the application with her expertise as an experienced content creator and editor with an impressive track record. She commented that one of its strengths is that it’s pretty simple. Any grom or surfer girl can export footage in seconds. It’s simple to use with the GoPro particularly. It’s also a strength to export footage in seconds, including to Instagram or TikTok quite easily. Generally, people want to share what they will do on their first trip after the giant mess we all just survived. One of the cons she noticed was that TikTok and Instagram stories require one more minor step, which is the ultimate destination of videos, so unless you’re using your GoPro, it can be a bit cumbersome. We are hopeful the company will continually refine UI issues to meet their growth goals and reach their target audiences.

What Are Other Markets Telling Us About GoPro

We’re not exactly sure what, if any, catalyst drove GoPro’s nasty drop yesterday. However, we wanted to monitor some important adjacent markets to assess if there were any reason to believe more selling would follow. Often, the best indicator of what markets will do when people put their money where their mouth is. Therefore, options markets are often considered good indicators and can shed light on the potential direction of markets, strength and breadth of markets, and different risk characteristics of an investment. In the case of GoPro, despite the price action yesterday, the options market appears pretty healthy considering.

Source: Thinkorswim

As you can see, there distribution between bullish call option volume as compared to bearish put option volume was decidedly healthy with a put/call ratio of .454. This means that based on the best options traders are making, the implied direction of price for GoPro would be up. While the future is always uncertain, and this does not predict the future, it is a useful indicator. One investor can always be wrong, but many investors rarely are. As Napoleon Bonaparte said, quite out of character with his attributed egoism, “The only one who is wiser than anyone is everyone.” That’s the same principle behind this options data being useful.

Source: Thinkorswim

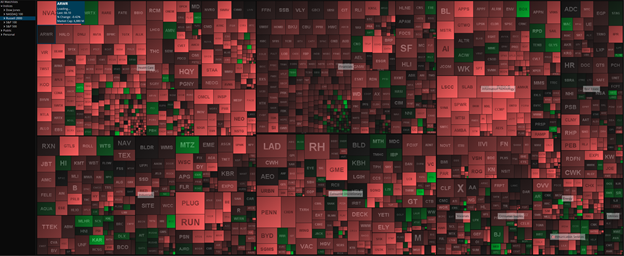

Though the major indexes have been making all-time highs in May, the Russell 2000 has been left behind and has been languishing compared to its peers composed of larger-cap names. So, small caps do often, unfortunately, have considerable volatility when a ‘risk-off sentiment pervades and especially when COVID-19 fears re-emerge. Yesterday, the Russell and small caps, in general, were very weak across the board.

Risks And Where We Could Be Wrong

One of the things we really try to focus on in this article is finding names where the upside is promising and cheap. Given the decline yesterday of GoPro to levels near when we first recommended it, we think this stock is an absolute bargain, especially since the company has made significant strides toward demonstrating the viability of their hybrid hardware-SaaS model. Small caps are not for everyone though, make sure you understand the risks. This is an entirely re-engineered company. We’d say the primary risk with this name is a scenario where COVID-19 emerges and continues to affect behavior and economic activity dramatically.

Of course, we also want to highlight the price risk that exists with a stock that is ‘unloved’ by the sell-side. When institutions don’t look at a stock as a serious investment, despite its impressive growth and diversification of revenue streams, because of past missteps, it means it doesn’t have the support in bids that a name with more institutional interest behind it does. The consequences of this characteristic were on full display yesterday. However, when we look at the progress of this company’s stride, we’re highly encouraged and think the recent weakness in the face of earnings that show the viability of a strategically appealing direction for shareholders is an opportunity for significant alpha for those willing to brave the risks of smaller caps names.

Other Signal From Noise Earnings Updates

We are very conscious that our subscribers have requested ongoing updates and guidance regarding the recommendations made in this column. We try to highlight special opportunities that are particularly aligned with our broader investing themes, particular favorites on our stock lists that we wish to highlight, or other timely and actionable ETFs or SPACs that we think can provide good alpha for Fundstrat and FSInsight members.

Ford (F 0.71% )

We covered Ford on January 14th, 2021. It opened at $8.81 that day. It closed at $11.51 on May 12th, which means it is up a bit over 30% since we recommended it in this column (and even more since it’s been recommended in our stock lists). The stock reached a 52 week high of $13.62 in March. Ford has an absolute blowout of a quarter, making a record $4.8 billion in adjusted pre-tax profits. The adjusted EPS was more than four times Wall Street’s expectations coming at 89 cents per share vs. 21 cents expected. Demand for products is strong, and the brand seems revitalized. However, something else is ‘chipping’ away at investor confidence, and this is a lack of chips caused by supply-chain interruptions. The costs from these came in at the higher end of guidance, and the company painted a somewhat grim picture in guidance in terms of future semi-conductor impact (worse is ahead, but will hopefully trough in the Q2.

Rising commodity costs that have not yet been incorporated into production because of the way contracts work will also be hitting the company’s bottom line in the coming quarters. None of this is good. However, the underlying reasons we recommended Ford are still intact: its exciting product line-up and brand reinvigoration are well-in-hand, its credible plans to clean house in international divisions is progressing well, the impressive strides in innovation and self-driving continue (and it’s ahead of many peers in electric), and Ford’s prodigious lending arm is still booming and adding to profitability. This will likely continue as consumer balance sheets remain strong and the boom is only beginning.

In our January 14th article, the first risk we listed was that the shortages in chips and rising commodity prices could hurt margins. The main risk we saw, which was the continued persistence of COVID-19, appears to be alleviating, especially in the United States. If Ford didn’t have a great management team led by Jim Farley, we’d be a little bit more hesitant. However, Farley and Ford’s adept handling of difficulties during the Global Financial Crisis helped them avoid bankruptcy, whereas the others were unable to pull this off. Ford has never gone bankrupt, and during a crisis, there is no guy we would rather see at the helm than Jim Farley. Given the headwinds, if you’re seeking a balancing position to help mitigate the idiosyncratic risks, we might suggest a complementary position in another stock we recommended in this column, ASML -0.06% .

Ford said the shortage could hit earnings by 1 to 2.5 billion during the last earnings. Basically, the company is guiding that it will make $6 billion instead of its initially guided number of $7.6 billion, which is a decline of 21%, so it is not negligible. That being said, the things within management’s control have been firing on all cylinders, or maybe the saying should be changed to ‘fully charged’ as CEO Jim Farley mused.

Exxon-Mobil (XOM -0.95% )

We covered Exxon Mobil on February 5th. It opened that day at $49.18, and it closed at $59.91 on May 12th, a percentage gain of 21.81%. We recommended the company in the wake of a difficult quarter that included a massive write-down on Permian-Shale assets. It was a difficult time to recommend the stock. The recent upside surprise caused by the streamlined business model resulted in the company’s cash flow covering both the dividend and capital expenditures. The company also paid down $4 bn of its considerable debt. As time goes on, we think the bottom line improvements should only accelerate with improving demand, the company’s distinct upstream strategy, and a real opportunity to grow at the expense of other competitors in a post-COVID environment.

The core feature of our thesis was that cyclical forces were working in Exxon’s favor, and what it makes would be increasingly in demand. As we also said in our last article, we’re particularly impressed by the way Exxon has handled its upstream CAPEX. It didn’t reduce CAPEX as deeply as competitors and instead revamped its strategy to focus on the lowest-cost production. Much of that production will be producing serious cash flow in a few years, not a decade. Half of FCF will be generated by new projects in 2025, an impressive feat that will help the company pay down debt while maintaining the attractive dividend. This is all still true, and a boon to earnings in the 1st quarter was increasing margins in chemicals.

Exxon’s first-quarter earnings show that people who call the company a ‘dinosaur’ may be correct more in a Jurassic Park than the ‘fossilized’ way they mean it! The company has also made impressive strides in response to activist shareholders in its response to the climate issue. While the company’s public stance has softened along with the American Petroleum Institute, it still has been investing in Energy projects solely based on their profitability and return, unlike some foreign and domestic competitors. This advantage should make itself even starker as time progresses, and the Energy industry feels the results of the CAPEX crunch for years to come. Exxon’s focused management of a challenging situation during COVID-19 will have far-reaching and positive implications for this company. Exxon management’s sacrosanct treatment of the dividend, even at the expense of a downgrade, is a powerful message to investors for an industry that needs to work harder than others to attract investors.

Six Flags (SIX)

We covered the vanguard Epicenter stock, Six Flags, on February 26th, 2021. It opened at $43.95 that day, and it closed at $41.16 on May 12th, which is not necessarily the best day for comps, but it’s the one we have. The stock is down 6.34% since we recommended it after hitting a $51.75 high in mid-March. While the Q1 results were a loss of $1.12 a share, it was about 13% better than expectations. This was a challenging quarter for comps for the theme park icon, which enjoyed a YoY growth rate in revenues of 1,569% (obviously a number of little use given mandatory shutdowns). The company is expected to report full years sales of between 950 million and 1.31 billion, but as with our feature this week GPRO 2.19% , we think the ability to underestimate the upside in SIX given the unique convergence with the needs of consumers and its product can lead estimates informed by historical data to undershoot severely. As we mentioned, the tendency after pandemics is for folks to gravitate towards risk-taking. We don’t know if you’ve recently been on one of Six Flag’s more modern roller coasters, but some on our staff did, and let us tell you it should CERTAINLY benefit from this trend!

Another thing that hasn’t changed and may even make Six Flags a macabre beneficiary is that COVID-19 is not vanquished in the rest of the world, not by a long shot, but the recovery in the US is well ahead. SIX has theme parks sprawled across the United States within driving distance of most major metropolitan areas. Getting out in safe outdoor fun with the family is achievable at these theme parks. The touchless entry feature and cognizant staff do a fantastic job at making the customer feel safe while still preserving the fun atmosphere required to be successful in the theme park industry. In park per capita, spending is increasing, and charge-ups for things like the “Flash Pass” to bypass lines are also helping margins. The company adeptly manages relationships with local governments to implement safe and effective re-opening.

We understand the price action has been frustrating. However, we would unabashedly say the stock is a buy at this level given the strong demand trends and impressive success the company has made toward safely re-opening every theme park it operates in North America. The general demand for driveable, outdoor entertainment this summer makes us think you want to own SIX. It’s a bargain since the company has a fantastic product as consumers re-engage with the experiential economy. The stock going down in the face of increasing vaccination progress is likely due to with the size of the stock and the tendency toward risk-off in the past weeks. In a philosophical sense, we believe the relative value of this company’s unique product is rising; management is doing what it needs to increase the quality of earnings. We think the convergence of top and bottom line tailwinds will make this name can potentially really sing in the coming quarters! The folks on our staff who have visited recently cannot wait to return!

Deutsche Bank (DB -3.65% )

We covered Deutsche Bank on March 5th. It opened that day at $12.82 and closed at $13.79 on May 12th, a 7.5% increase. The stock touched $14.20 recently as a recent high after it presented fantastic Q1 earnings. The company reported its best quarterly profit in seven years, aided by the virtuous cycle in declining funding costs and increasing reputational capital that we pointed out in our initial piece. In true Epicenter fashion, DB significantly exceeded the analyst expectations of 642.95 million euros for net income by an astounding 41%! Revenue also came in significantly higher but not to that degree. More traditional banking metrics are improving to like Return on Tangible Equity which more than doubled to 7.4% compared to the same quarter last year. The impressive growth and earnings beat is even more so when you remember that this bank has a negative rate environment to contend with in its home market. As Europe improves, this bank’s outperformance could go gangbusters. Imagine what this bank would be doing in a positive environment on the accrual side of the business.

Much to our collective relief at Fundstrat, DB did an incredibly adept job at navigating around the massive Archegos losses that particularly ensnared some of its European peers. The pristine and traditional German credit assets of the bank paired with a high-flying investment bank that is enjoying positive momentum has the type of risk/reward profile that we often gravitate toward in our Signal From Noise column. The bank is making steady progress toward implementing its goals. It is also measurably outperforming its European laggard peers CS and UBS and even American counterpart STT on a one-year, YTD, and monthly basis. The market recognizes the impressive turnaround this bank has made. The delayed upside that will come to the stock whenever Europe recovers may provide your financial holdings with some positive diversification.

DB’s price to book value of .33 is still incredibly low. We believe the bank’s continued success along the lines of this most recent quarterly report will result in significant additional upside. Management has successfully rid the company of many ‘bad bank’ assets, and it’s showing in continued improvement in funding costs! Unlike many European banks, DB does not have exposure to problematic Southern-European consumer credit markets; traditional solvency was never the issue investors had with this bank. Growth, profitability, and competitiveness were the market’s issues with DB. The company is on track to complete its restructuring plan and is also answering the previous criticisms with resounding and powerful results that should give shareholders optimism.

Schlumberger (SLB -0.61% )

We did a Signal on Oilfield Services giant Schlumberger on March 20, 2021. It closed at $27.05 on Friday, March 19th, and it closed yesterday on May 12th, at $32.10 for a percentage increase of 18.67%, much of which has been recent. The case for this firm has even increased since we recommended it. Tom Lee has highlighted the major shortfall in Energy CAPEX that occurred since the beginning of the pandemic. Astonishingly the decline in investment will lead to an annual shortfall in production equivalent to the entire nation of Iraq and more than some OPEC members! If there is one company that will significantly benefit from the return of Energy CAPEX, which we believe has troughed, it should be the industry stalwart, but also a technological leader, Schlumberger.

This firm is the largest holding of OIH 1.99% , which our research team regularly recommends.

Schlumberger’s French roots also mean that the company has a diverse clientele. One of the boons in this latest quarter was growth in Latin America. Also, in many areas where oil majors would be chased out of town or are at least not welcome, Schlumberger operates comfortably and effectively. It is far less exposed to, say, the CAPEX in the Permian-Basin, the outcome of which is far less specific than many competitors. Cutting edge efforts in renewable technologies like its lithium extraction plant in Nevada and other impressive strides from its New Energy section will continue to create new growth opportunities. The firm is a global leader in de-carbonization technology.

In a cyclical expansion of the magnitude that we think we are about to witness, the size and geographic diversification of Schlumberger should be a significant asset. Their efforts to trim the fat and boost operating margins over the past year have been a shareholder’s dream, and the company’s latest results had some impressive outcomes. Free cash flow continues to be solidly positive, and operating margins have been expanding for three consecutive quarters now. The company looks like it will be able to progress on its stated goal of deleveraging the balance sheet. The recent cyberattack on US Energy infrastructure also puts a premium. It perhaps expedites and augments demands for Schlumberger’s suite of products centered at the convergence of digitization and the Energy industry. We believe over time, the multiple of this company will re-rate to reflect its technological prowess and the addition of new recurring digital revenue streams. This company is becoming more like a niche-technology company as time progresses; again, traditional cyclical assets which seem on the verge of really humming with underpriced growth opportunities are probably part of what landed this name on our Power Epicenter Trifecta list!

Real Networks (RNWK) Post-Earnings Update

We received a request to check in with our subscribers on Real Networks (RNWK), the undoubted Red-Headed Step Child of a portfolio of Red-Headed Step-Children. We provided an earlier update on the name, so this one will be brief. As we have stated, Real Networks (RNWK) suffers from reputational damage on Wall Street and enjoys no sell-side coverage. When we initially covered the stock, the float was incredibly small, and the company has taken subsequent action to augment it, which we actually consider a positive. CEO Rob Glaser is thinking forwardly when he speaks about transforming the company into an AI firm from a digital media firm. He specifically articulated that he will use the legacy assets as a source of financial stability and as a source of data to feed the high-growth AI initiatives.

This is in a sense confirming our take on the stock, which is that it is more like having access to a potentially high-return but also very high-risk Seattle-style AI tech startup. The benefit of this investment is you have a seasoned management team and a solid financial bulwark to insulate you against some of the risks associated with such an investment. In a small-cap name with so much volatility recently, we choose to focus on the progress of the growth initiatives. SAFR, the main reason we like the stock, has grown at 160% YoY, and the company expects double-digit growth in 2022-2023 from its initiatives. Recent progress with the USAF and high ratings from NIST makes us think the company can pull it off. It has also taken action to develop high-impact sales channels for the SAFR product. The other AI play is hard to measure progress on since revenue will likely come in the form of a deal with a large telecom carrier.

This is a high-risk stock, and we are right there with you on the frustration over the rise and fall of the name; and we again reiterate that we think the recent equity raise was priced too low. That being said, with a small-cap name like this, we want to keep our eye on the progress of the growth initiatives that attracted us to it, and on those lines, all is good. Comparable valuations compared to the success of the company’s product so far indicate that there is still a lot of upside. You may have to be patient as the company works to attract additional sell-side interest to get some refuge from volatility. Still, nonetheless, we have seen nothing but positive developments on the product front for SAFR!