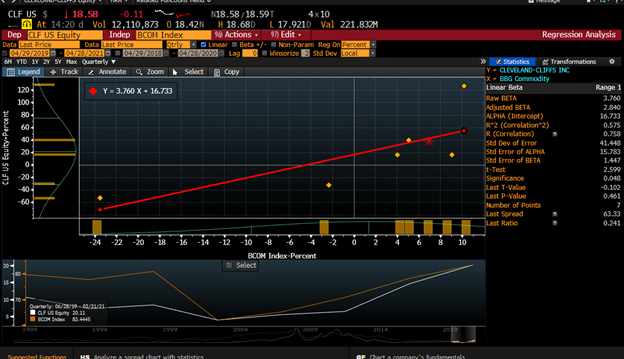

Our Signal From Noise column is focused on highlighting special opportunities for our subscribers to gain alpha. We often highlight names that have been unfairly castigated for one reason or another, or may for whatever reason be defying the odds and consensus. This name is yet another Epicenter stock that demonstrates just how much the cycle has been broken, how powerful the recovery will likely be, and how even in a later-stage industry adept management can make stellar turnarounds that really reward shareholders. Cleveland Cliffs (CLF 3.99% ) is highly cyclical play that has its price correlated to commodities. You can see the strong correlation below.

Source: Fundstrat, Bloomberg

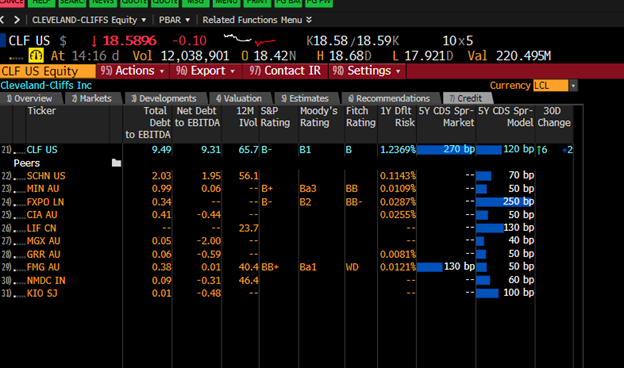

In addition to this, CEO Lourenco Goncalves, a steely (pun intended) industry veteran with a knack for practicality, is dedicated to using this once-in-a-generation cyclical tailwind to improve the company’s balance sheet. This is a very wise decision by management, particularly given that compared to competitors, borrowing costs are a particular weakness of the firm. Rectifying this dramatically brightens the prospects for shareholders alone. This is not even including the many other benefits and opportunities for margin expansion that the company has accessed through shrewd acquisitions that placed it, in our view, at the apex of the American steel industry. An expected improving debt profile over the next year is a major reason we think many consensus price targets are low. We will elaborate further below.

Source: Fundstrat, Bloomberg

An Aggressive Acquisition Strategy That Paid Off

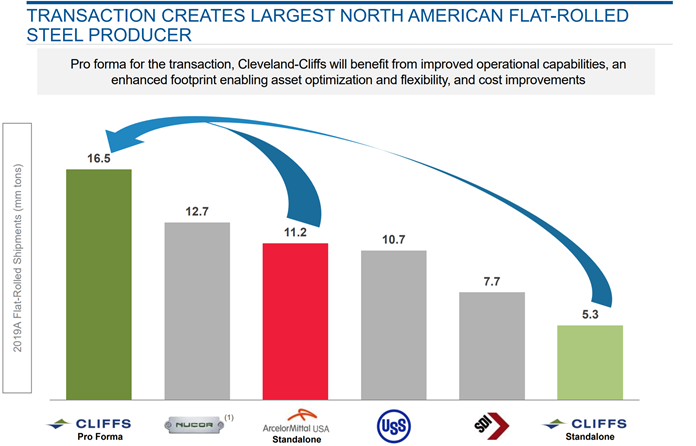

Epicenter stocks have utilized a variety of different strategies to meet the moment and reorient and rejuvenate business models at a pace and scale that shareholders could, in many cases, have found difficult to imagine. One way companies and adept managers have been doing this is through M&A. Cleveland Cliffs recently closed two mergers that catapulted it into a leading position in the US Steel industry, in our view.

Source: Company Reports

Not only is Cleveland Cliffs the largest company in the steel industry by steel output, its assets give it unique pricing advantages, and the ability to respond to the changing nature of steel demand. One thing we note is the trajectory of its forecasts over recent weeks. Five weeks ago the company projected 2021 EBITDA of $2.7 billion, two weeks later it raised it to $3.5 billion, and in the most recent earnings report, it raised it raised it again to $4 billion. Even this recent full-year forecast of $4 billion seems low to us, with steel prices currently at $1,400 per ton compared to the $1,100 per ton in the company’s Q1 forecast. Some back of the envelope math, not considering margin mix and other factors, would suggest the company’s EBITDA for 2021 could be around $5 billion based strictly on the percentage differential in the steel price. And prices could increase further.

The last decade has been difficult for the steel industry. However, it is also a highly cyclical industry, and the expected tailwinds of infrastructure spending in the United States, the changing nature of steel demand toward higher quality products, and the multi-year highs in commodity prices, are all reasons why, if you want to pick a an industry “comeback kid”, Cleveland Cliffs would be a good choice. It has an experienced and practical management team that prioritizes shareholders while balancing environmental and social responsibility and maintaining a motivated, well-paid, and well-trained workforce. It generates substantial free-cash flow that it projects will be used to pay down all its debt. Yes, the company plans to use its considerable cash flow to clear its balance sheet of debt. This would be considerably beneficial to shareholder value. It would also be naïve not to point out the natural alignment of this company’s espirit de corps with the current political winds coming from the White House. President Biden’s decision to “buy American” as outlined in his recent joint address to Congress, should greatly benefit the firm as infrastructure spending plays out. There is a certain intangible value to having all the stakeholders invested in the mission and happy to be there. By all accounts, workers are happy. Union negotiations have gone well recently.

Happy Marriages Payoff

Source: Company Reports

Vertical integration and industrial capitalism are like peas and carrots, and this dated, but powerful tool can sometimes be underestimated by an investing world focused on shiny things that aren’t steel, metaphorically speaking. However, in the steel industry, Cleveland Cliffs is as shiny as it gets. The benefits of its strategically beneficial mergers right on the heels of what will likely be the greatest industrial cyclical expansion of our life times, post-COVID, further heightened by government infrastructure spending, could be substantial.

Cleveland Cliffs had a strong first full quarter after two large acquisitions that elevated it to being the largest and most vertically integrated steel producer in the United States. Its first quarter seems to suggest that these mergers are going smoothly. This company has been raising revenue projections, as we noted earlier, and we will go through some basic analysis to show why we think the current forecasts are still likely too low, given the momentum of steel prices and the potential for demand. The other thing about this company is that it is not just on the right side of vertical integration but it is also gaining cost advantages due to its production of the highest quality steel. There are a number of expanding applications for this type of steel. areas For example, electric vehicles need less steel than current vehicles, but they need a higher proportion of the high-quality, high-margin steel that CLF now has an advantage in producing.

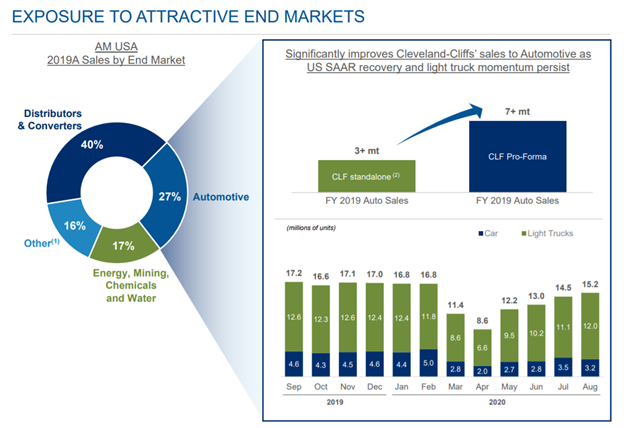

Source: Company Reports

So another benefit of CLF’s recent merger is its exposure to the auto market. The anticipated growth of electric cars is actually an opportunity for margin expansion over the coming years for CLF. We also believe that as time goes on, the already considerable benefits from the recent mergers will continue to compound as cultures integrate and synergies are explored and exploited.

Ok, But It’s A Steel Company – How High Can It Go?!

Good question and we’re glad that you asked. Some analysts, like those at Keybanc, have questioned how much higher the stock can go. We think consensus may be underestimating the staying power of high steel prices. In our view, the current momentum has shown consensus to be wrong and overly pessimistic on this company. So, we want to do a deep dive into the company’s fundamentals and associated forecasts, to demonstrate, against the tendency of consensus being overly pessimistic, what happens if we slightly raise forecasts in some key areas to the implied price of the stock.

If we raise forecasts to reflect the current price of steel at around $1,400 a ton, the implied stock price climbs considerably higher, as you can see below. The average price very well could be higher for a litany of reasons going forward, and CLF is well-positioned to capitalize on positive price pressure.

Source: Thinkorswim, Trefis

Let’s also consider that CLF is well- positioned because of its economies of scale and vertical integration to dominate in the rapidly developing markets for high quality steel in areas like green energy, electric cars and, of course, infrastructure projects. One thing that also has to be done in tandem to support a future where electric vehicles are dominant is to revolutionize the power grid. This will require large amounts of exactly the types of steel that CLF is best at producing, and at which it will likely get better and more efficient at in the future. So, based on these premises, and the poor track record of consensus, we will assume some better numbers on the company’s margins, within reason. Look at what the implied price is now, below.

Source: Thinkorswim, Trefis

So you can see that if you tweak the forecasts slightly, the outcomes begin to change for the better. Based on Biden’s “buy American” campaign, we can also probably assume that CLF might be able to sell more steel over the coming years than consensus expects. So, if we up those forecasts as well, the company’s implied price goes to $38.30 (below). This is even more interesting when you consider that a lot of the synergies and benefits from CLF’s recent merger also apply to the North American iron ore segment. We didn’t change any assumptions there, but it is also likely to improve beyond what consensus currently expects.

Source: Thinkorswim, Trefis

So, as you can see, even though this is purely an exercise and shouldn’t be construed as an actual price forecast, it nonetheless shows the dynamics at play in the price of CLF, and why we think it is far more likely that this stock is undervalued rather than overvalued. There are a lot of top and bottom line tailwinds converging, and CLF is as well-equipped as any player in the steel industry to capitalize on them in a way that rewards its shareholders. Management is definitely doing its job. The median EV-to-EBITDA multiple in the steel industry is around 7x. CLF is currently trading at around half this level. If it were trading at the industry median, the implied stock price would be $44. We think there’s a lot of room to the upside here, and we think the tailwinds for the steel industry are likely being underestimated.

Risks and Where We Could Be Wrong

The steel industry is capital-intensive and dependent on cyclical swings in commodity prices. A multitude of factors, including government demand, should mitigate this. The vertical integration in CLF’s supply chain should also mitigate this typical risk for the industry. Being that steel is so dependent on economic activity, a primary risk to continued progress for the name would be a resurgence of COVID-19. Temporary headwinds that exacerbate the debt position before the company is able to make good on its promise to pay down its debt could be problematic, but given where we are in vaccination progress in the United States, we find this outcome relatively remote. There could always be other innovations in materials that diminish the utility of steel, as has happened in the past, but CLF is at the cutting edge of advanced steel manufacturing and may even have an opportunity to gain market share at the expense of other industrial metals like aluminum.