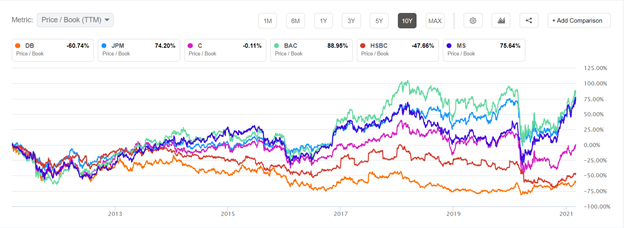

Deutsche Bank is priced very cheaply compared to its main competitors. It also is in a turnaround and had its first profit in many years; we think more profitable quarters lie ahead. The stock, we believe, presents a significant opportunity, particularly given its last earnings beat. Germany’s largest lender posted a full-year net profit of 113 million Euros compared to an expected loss of 201 million euros. Similarly, the bank netted a 51 million euro profit in the fourth quarter compared to what analysts thought would be a 325 million loss. This is even more incredible given that the company is undergoing aggressive restructuring, which was the primary reason for its 5.7 billion loss in 2019. It did better in a pandemic year than a normal one! Higher revenues and cost-cutting more than offset a rise in loan-loss provisions due to the virus. The positive momentum makes the bank’s Price/Book of .35 seem like a bargain.

Source: Seeking Alpha

One thing that has been true during the pandemic-induced global depression on both sides of the Atlantic that was not true in the Global Financial Crisis is that large banks have been crucial in mitigating the effects of economic devastation rather than being a source of it. Deutsche Bank (DB) was an essential part of the German Government’s response, as were many American banks in the distribution of stimulus, working with distressed lenders and other similar activities.

Deutsch Bank has passed a real-life stress-test with flying colors, has managed impressive growth in a domestic negative rate environment, has much more limited credit risk than even its American peers (who are valued far higher), and has seen an impressive and well-managed come-back of its previously beleaguered investment bank. In addition to this, management has proven quite adept at making significant cost cuts, shedding problematic “bad bank” assets and subsidiaries, and stabilizing its funding costs. S&P just upgraded the bank’s credit outlook. Barclays upgraded soon after. Funding costs had already come down to around the cost of peers before this positive development.

Source: Bloomberg

A Euro-Epicenter, Contrarian, and Value Stock

There are a few major reasons we like this stock. Is it essentially a European ‘Epicenter’ stock with incredibly low valuation risk compared to its peers? Yes, it certainly is that. However, we also think it makes an additional portfolio addition for a few reasons, particularly on market days like today when we are all reminded that visceral pain volatility can cause. The bank has most likely seen it through the worst of the pandemic; Germany is less dependent on tourism than its southern counterparts. The German credit assets that DB has on its books are pristine compared to portfolios of American credit card debt. Did Deutsche Bank also pass all of its restructuring plan goals with flying colors? Yes, it did, and we always love to see that.

In addition to this, though, the vast majority of the recent outperformance was due to the investment bank. While DB retains enormous amounts of traditional banking assets, compared to its peers, the investment bank is more critical to underlying profitability. The IB performance was outstanding in 2020, and while some bears might expect it to return close to 2019 levels, we think it is more likely that DB has increased its market share and will maintain IB revenues higher than pre-COVID levels. This, we believe, gives it more counter-cyclical resilience than its European peers. The ‘virtuous cycle’ predicted by CFO von Moltke appears to be coming to fruition as funding costs go down, profits go up, which then, in turn, inspire funding costs to reduce even further. It looks to us like the firm’s cost of funds will continue reducing to pre-pandemic levels, directly impacting profitability positively.

The reputational damage done in the 2008 crisis has begun to recede in America. Still, amongst investors, European banks and DB have been persona non grata, as evidenced by the change in Price/Book over ten years. However, DB’s management has significantly turned the picture around over the last year and has met or exceeded every single target concerning its aggressive restructuring plan, as showed above.

Source: Seeking Alpha

Many of the issues people associate with European banks have never been problems the German Bank, whose native culture is stern and conservative in terms of credit risk. The question of this bank was always achieving profitability and revenue growth. It has clearly turned the corner and answered this question in a way that pleases the market. The investment bank languished over previous years as the bank’s cost of funds went materially above its peers. This can be a death sentence in investment banking and was likely the reason for the dismal returns over recent extended periods. As we’ve shown, this has begun to reverse, as evidenced by the bumper-year that their IB just had. It significantly outperformed expectations throughout 2020. We believe the outperformance will continue and that this will be returned to shareholders.

What About The Technical Picture?

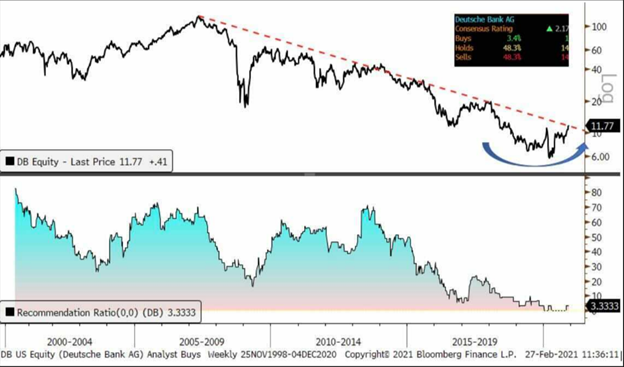

Deutsche Bank (DB) has performed well this year and has come significantly off its’ COVID-19 lows. We took a look at it from a technical perspective and found some interesting insights. We think the name has a negative recency bias, which negatively affects the price and sentiment around the stock, but we think this will reverse. Very few analysts have a buy rating on the stock, which is a contrarian positive for us, particularly after looking at the bottom-up picture and success the bank has had under incredibly trying circumstances over the past year. Management is engaged, accountable, and on-track. Technical analysis suggests that the next level of upward resistance will be at $31. So, we think there’s much upside in this name and its early days in a ‘Cinderella’ story.

Risks And Where We Could Be Wrong

The investment banking business is a difficult one, and fortunes can turn quickly. We would say this is a significant risk. Suppose the activity that DB was earning fees from and the volatility it was successfully trading subsides. In that case, profitability may take a hit, mainly since the investment banking business is primarily responsible for recent outperformance. The business’s accrual side still faces a negative rate environment and an uncertain economic picture; however, we think it is likely the German bank is more insulated from these risks than its Southern peers. Any re-emergence of European sovereign debt issues will probably weigh heavily on the bank, but again, less so than similarly sized peers from less financially stable nations.