-JPM stock hit hard in the COVID-19 bear market but lately starting to recover nicely

-Not too late to invest in arguably the best run, most profitable big bank in the U.S.

-More typical EPS growth should return next year; stock could have 25% upside

I’ve noted in previous pieces that among investors the financials still rank low in the rally since March 23. Since then, the financials are up 30%, good for number nine among the eleven Standard & Poor’s 500 index sectors.

I’d like to give you our view on the preeminent big bank in the U.S., and the reasons it could be a good long-term investment in pretty much any portfolio. It’s probably no surprise: JPMorgan Chase (JPM). And right now, the shares look cheap, even after a 10% leap this week.

JPM is widely acknowledged as a great bank. That said, the stock’s demise is simply too overdone in my opinion to ignore. Despite JPM’s well-known name, I suspect some investors overlook its attractions, given the way financials have done.

Yes, it’s a beast of a bank, with a market cap over $300 billion. Despite that, it is agile for its size, well run, methodical in its approach and has enough different earnings levers that once the world economy begins to resemble its old self, it should bring back the prospect of the positive growth results that investors were accustomed to prior to the coronavirus (COVID-19) outbreak.

Despite making profits of $132 billion in the last five years, JPM has seen its shares hit hard, from a pre-COVID-19 high of $141 to as low as $77. Today the stock is around $100 per share, after a 10% leap this week. For an investor looking beyond COVID-19 and towards a restart of both the U.S. and world economy, that seems a bargain to me. I think there’s 25% upside with a 3.6% dividend yield.

Beyond a potentially long-lingering COVID-19 outbreak, the bear case on JPM is an industry one in the main. Interest rates will probably stay low. Some worry they might even go negative here, as they have in parts of Europe. In addition to loan loss worries from the economic shutdown, I think some investors might be having nasty flashbacks to the devastation among banks wrought by the 2008-09 financial crisis.

This is understandable, but the Federal Reserve is on record saying negative rates are not contemplated. More importantly, interest rates have been exceedingly low for many years now and yet JPMorgan has managed to grow its profits at a scale that beats its main competitors. As for the financial crisis, JPMorgan, as well as American banks in general, have beefed up their capital cushions and are vetted every year by the Fed’s well known “stress test.” JPM’s common equity Tier 1 capital ratio is 12%, adequate to withstand another crisis, in my view.

It would not be too much of an exaggeration to say that JPMorgan is the best all-around bank in the world, adept at producing profits from many levers: commercial banking, capital markets, prop trading, consumer lending and banking, treasury services, real estate lending, to name a few. You could argue that certain banks are better at trading or at mortgages in particular, but only JPMorgan can boast of being among the best in numerous bank business lines.

For someone dipping their toe back into financials, “this is the first financial I would buy and the one with the most confidence,” says Jack De Gan, who runs money manager Harbor Advisory, which owns JPM shares for clients.

Even if JPM’s profits this year are down 50% from last year, you are talking about nearly $20 billion. JPM will do better in 2021, assuming the world economy restarts, he adds. It’s already taken a massive reserve for COVID-19 compromised debt, and remember this bank made money even during the 2008-09 financial crisis. In a public forum Tuesday, Chairman and CEO Jamie Dimon said banks may not need to build more loan loss reserves in H2, which ignited the shares.

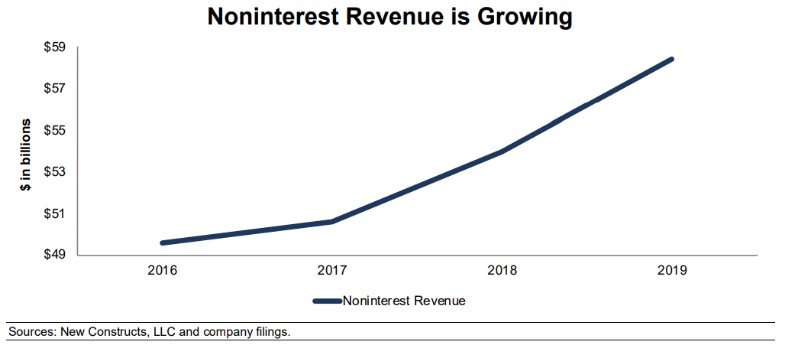

While lower interest rates hurt the net interest margins, JPM can make it up elsewhere, De Gan notes. Take a look at the nearby chart of noninterest revenue growth, supplied by New Constructs, an independent stock valuation research firm using both fundamental analysis and AI to scrub regulatory documents.

The bank continues to grow its total net interest margin profits, even as rates have fallen sharply over the past decade. According to New Constructs, the company generated positive FCF in each of the past ten years and a cumulative $109 billion (39% of market cap) over the past five years. JPMorgan’s $31 billion in FCF over the TTM period equates to a 10% FCF yield, significantly higher than the sector average of 4%.

Additionally, in time of stress, the better run companies take market share from the weaker struggling with lower rates, and that’s what I think JPM could do, thanks to its strong profitability and balance sheet. JPMorgan’s current ROIC of 12% is greater than its banking peers and well above the 7% earned at the depths of the Financial Crisis in 2008, according to New Constructs.

The technical picture looks attractive, too, as our head of technical analysis, Robert Sluymer, points out that JPM continues to show evidence of bottoming, with the pullback into May 14th likely completing a retest of the March lows. In addition, JPM is just beginning to reverse its 1Q relative performance downtrend vs. the S&P 500.

What about valuation? Currently, JPM stock trades around ten times the 2021 analyst EPS consensus, compared to its long-term average of 10-11 times. It also is near to its cheapest price-to-economic book value (PEBV) ratio (0.6) since 2012, and nearly equal to 2009. New Constructs says this ratio implies the market expects JPM net operating profit after tax to permanently decline by 40%. That doesn’t seem a reasonable risk. New Constructs says the shares are worth $125 per share in a moderate economic rebound, and I agree, assuming during an economic recovery JPM can approach the $10 EPS of 2019 and receives its median multiple of 12-13 times.

Where I could be wrong: JPMorgan benefits from the leadership of Jaime Dimon, but the 63-year old has had health issues. There is speculation of a political ambition. If he left the company it would be a blow. If the COVID-19 outbreak lasts a long time, that could hurt results.

Bottom Line: For an investor wading back into financials, JPMorgan looks among the best long term. Dimon called JPM a “very valuable” franchise “at these prices” and suggested the dividend would not be modified. JPMorgan should continue its ability to grow profits at industry leading rate over the long term.

Prior “Signals”

| Date | Topic | Subject / Ticker | The Signal |

| 5/20/20 | Stock | Horizon (HZNP) | Horizon Therapeutics Is Inexpensive; 2 Drugs Show Promise |

| 5/13/20 | Stock | Bank OZK (OZK) | ‘Plain Vanilla’ Bank OZK Could Be Long Term Opportunity |

| 5/6/20 | Stock | Graham Holdings (GHC) | Post COVID-19, Graham Holdings Could Return to Growth |

| 4/29/20 | Stock | Pacira (PCRX) | Pacira To Benefit from Surgery Trend Away from Opioids |

| 4/22/20 | Stock | Avalara (AVLR) | Avalara Stock Could Benefit from Catalysts Boosting Amazon |

| 4/15/20 | Stock | First Republic (FRC) | First Republic Stock Looks Cheap in Post COVID-19 World |

| 4/8/20 | Stock | Galapagos (GLPG) | If Galapagos Arthritis Drug Is Approved, Stock Looks Cheap |

| 4/1/20 | Stock | DaVita (DVA) | In Uncertain Markets, DaVita’s Stable Rev/EPS Look Attractive |

| 3/25/20 | Q&A | InsiderInsights | In Roiled Market, Insider Activity Could Offer Directional Clues |

| 3/18/20 | Market | US Stock Market | Market Discounts Recession; GDP, EPS Growth Worries Mount |

| 3/11/20 | Market | COVID-19 | COVID-19 Worry Overblown; Market Discounts Recession |

| 3/4/20 | Stock | iHeartMedia (IHRT) | iHeartMedia Stock Could Rise on Cost Cuts, Digital Revenue |

| 2/26/20 | Market | South Korean Stock Market | When Virus Fears Ease, Hard Hit Korean Stocks Look Cheap |

| 2/19/20 | Q&A | Atlantic Investment Management | Atlantic’s Concentrated Approach Yields Strong Returns |

| 2/12/20 | Stock | Casper Sleep (CSPR) | Casper Stock Might Not Let You Get a Whole Lot of Sleep |

| 2/5/20 | Stock | Arch Coal (ARCH) | After Sentiment Plunge, Arch Coal Stock Looks Inexpensive |