-Trend away from meat products should help benefit Mowi’s big salmon business

-Salmon demand growing 7% but supply only 3%

-Stock could rise 40% or more

One of the biggest surprises in the U.S. stock market this year was the IPO for Beyond Meat (BYND), which I wrote about on this website May 30th. From the IPO price of $25 that stock has soared to over $200 per share, confounding skeptics and burning shorts. BYND is a pure play on the idea that consumers, particularly young ones, are moving to a diet that is low on or avoids meat products. The reasons usually are environmental or health-based.

I doubt there will be another BYND-like jump for any stock in that space as the secret is out. But what about adjoining spaces? For example, the trends supporting the craze for BYND products don’t necessarily stop at meat, as I’ll explain below.

Another company that could exploit some of those trends—albeit at a different level—is Mowi ASA, a Norwegian seafood processor and fish farming company. This stock, which admittedly has done pretty well in the past five years—up 150% in local currency terms—could do well in the next few years if trends away from meat are sustainable. Mowi (MOWI NO) trades on the Oslo Exchange and as an OTC ADR (MHGVY) in the US, which is 1:1 with the ordinary shares.

Norway supplies roughly 50% of the world’s salmon meat and Mowi provides about half of that, so it’s a dominant provider inside the dominant country. The other big country is Chile, with roughly 30%. With a $13 billion market cap, Mowi is global and no small fry.

From an anecdotal basis, in the past five years there are an increasing number of vegetarian restaurants opening, while supermarkets have upped their offerings of alternatives to meat, BYND being just the most recognized.

Depending on which survey you consult, some 5% of Americans are vegetarians, that is, non-meat eaters. It’s probably a higher percentage outside North America. The trend toward avoiding red meat—epitomized starkly by BYND—is there, particularly among younger demographics. It will probably continue to grow. According to MOWI, food consumption habits are changing: 36% of consumers want to reduce their meat consumption and 32% want to increase their fish consumption.

So what’s good about salmon? Well it’s high in Omega 3, a fatty acid essential to good health and the highest concentrations in fish can be found in salmon. Moreover, from an ESG point of view, salmon farm fishing has about 10% the carbon footprint of meat production, and supplies about 3-5 times the edible meat relative to a kilogram of feed. So there’s that.

There are significant barriers to entry. Salmon farming can only be done in a few places, such as the waters of Norway, Chile and Nova Scotia, and supply is key, says Frederick A. Brimberg, a savvy investor and award-winning portfolio manager. He’s a fan and notes that demand is growing about 7% but supply—thanks to the peculiarities of fish farming and regulations—is growing mostly at 3%, so there’s a natural boost to results there.

The Mowi analyst community, most of whom are in Europe, isn’t especially enthusiastic, with just 40% bullish, a good contrarian sign.

Even after a big run, the stock looks cheap compared to other slower growing packaged food companies, which are typically awarded price earnings ratios of 20 times, and higher in some cases. Granted, MOWI is smaller but it’s growing earnings per share faster at 10% or higher with a ROE of 22%, notes Brimberg. MOWI’s P/E is less than 14 times 2022 projected EPS of 1.87 euros. (It reports in euros but the stock is priced in Norwegin krone.)

Moreover, like BYND, Mowi is a unique global company, where public market comparables are few on the ground. Given the potential growth and possibility of expanded P/E towards the group level, the stock could reach over 300 krone (NOK) from 221 currently (EUR/NOK at 9.6).

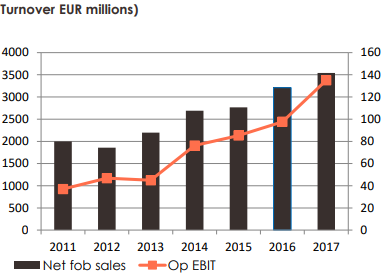

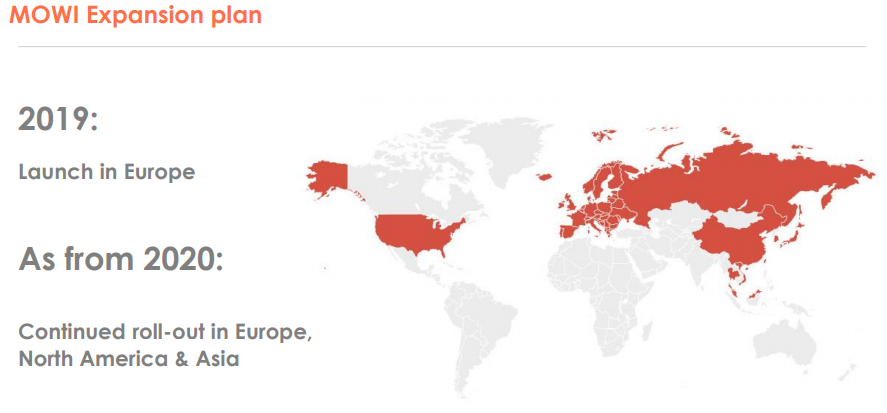

MOWI has growth plans: With processing facilities in 24 countries around the world, Mowi is also working on branding its salmon, which should help protect margins in

cases of lower consumer demand or excess supply. The branding effort launched this year in Europe and will roll out in North America and Asia next year. It’s aiming for 100 million euros additional EBIT by 2022. (See nearby chart.)

Where could I be wrong: Salmon prices could decline sharply if land-based fish farming ever took off or if a plant-based fish substitute became popular. And like cattle, salmon are susceptible to occasional disease outbreaks, though this would tend to drive salmon prices up and could prove a good entry point in the long run.

Bottom Line: If MOWI were to get just a fraction of the rating investors give BYND, it would lead to a big rise in the stock.