There’s usually some headline-driven action during the World Economic Forum’s annual meeting in Davos, Switzerland, but this year (and this week), it opened with a bang. Ahead of his arrival in Davos, President Trump made increasingly strident demands for the U.S. takeover of Greenland, implying that both a purchase and an invasion were on the table to achieve his goals. As Denmark’s European/NATO allies aligned in opposition, the president escalated by again threatening to impose tariffs on European goods.

Yet after equities plummeted on Tuesday, Fundstrat Head of Research Tom Lee suggested that concerns about Greenland’s sovereignty and the NATO alliance likely had less to do with the decline than surging interest rates in Japan. In that sense and consistent with the view of Treasury Secretary Scott Bessent, Trump’s rhetoric was “a distraction,” Lee told us.

The 10-year-yield in Japan surged to levels not seen since 2011, sparked by remarks by Prime Minister Sanae Takaichi proposing increased government spending and tax cuts, which in turn resulted in concerns about the Japanese government’s already high debt levels. As Lee put it, this “really reflects the fact that the Bank of Japan may have lost some of the confidence of the bond market.” Why do Japanese rates affect U.S. stocks? The concern is likely that if the Bank of Japan does not resume yield-curve control, it would affect the profitability of the yen carry trade. But for right now, Lee sees the impact for U.S. investors is “actually nothing for the moment.”

If the Greenland issue had any impact on markets on Tuesday, by Wednesday Trump had de-escalated, taking both a military invasion of a NATO ally and new tariffs off the table. Stocks rebounded Wednesday, and the volatility metrics subsided. It is arguably an indication of resilience that the S&P 500 and Nasdaq Composite ended the week more or less close to flat: the S&P 500 slipped just 0.35% for the week, and the Nasdaq Composite barely dipped 0.06%..

It is the view of both Lee and Head of Technical Strategy Mark Newton that what happens to markets at the beginning of the year often foreshadows what will happen for the year as a whole. As Newton put it, “Normally the saying goes that what happens in January sometimes can happen for the rest of the year.”

At our weekly research huddle, he followed this up by noting that “when I look at overall performance, energy and materials are actually the leading sectors for the year thus far.” With breadth improving, healthcare making a multi-year breakout, and the small-cap Russell 2000 also having broken out with significant outperformance, Newton views the market as “incredibly healthy.”

Chart of the Week

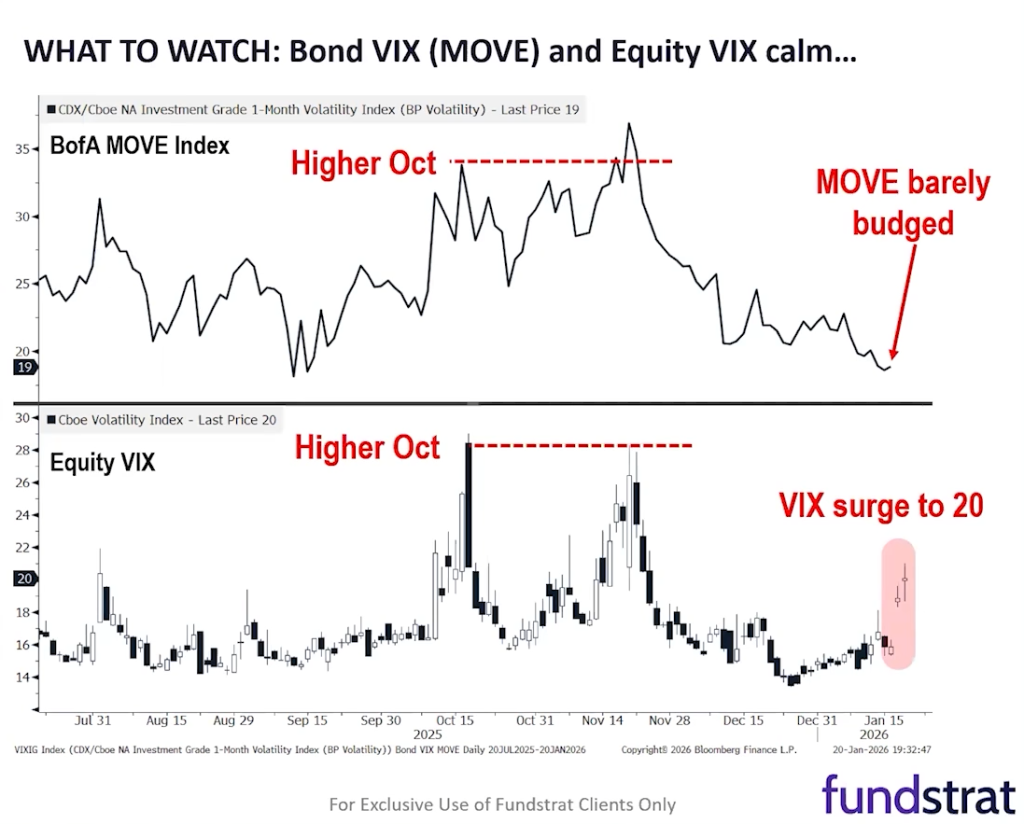

Despite the headlines surrounding Greenland and worries regarding Japanese interest rates, Fundstrat’s Tom Lee stayed calm due to his assessment of equity- and bond-volatility indices, as measured by the VIX and MOVE indicators shown above. As Lee pointed out on Tuesday evening at the height of market uncertainty, the reaction of the VIX and the MOVE index (essentially the VIX analog for the bond market) was somewhat muted – significantly less than the reaction seen during the 7% drawdown back in October.

Recent ⚡ FlashInsights

- we have seen this before

- risk off as tariff sabers rattle

- peak fear and investors sell in anger

- major bottom

FS Insight Video: Weekly Highlight

Key incoming data

1/22 8:30 AM ET: 3Q T GDP QoQTame1/22 11:00 AM ET: Jan Kansas City Fed Manufacturing SurveyTame1/23 9:45 AM ET: Jan P S&P Global Services PMITame1/23 9:45 AM ET: Jan P S&P Global Manufacturing PMITame1/23 10:00 AM ET: Jan F U. Mich. 1yr Inf ExpTame- 1/26 8:30 AM ET: Nov P Durable Goods Orders MoM

- 1/26 10:30 AM ET: Jan Dallas Fed Manuf. Activity Survey

- 1/27 9:00 AM ET: Nov S&P Cotality CS 20-City MoM SA

- 1/27 10:00 AM ET: Jan Conference Board Consumer Confidence

- 1/27 10:00 AM ET: Jan Richmond Fed Manufacturing Survey

- 1/28 2:00 PM ET: Jan FOMC Decision

- 1/29 8:30 AM ET: Nov Trade Balance

- 1/29 8:30 AM ET: Dec Core PCE MoM

- 1/29 8:30 AM ET: 3Q F Unit Labor Costs

- 1/29 8:30 AM ET: 3Q F Nonfarm Productivity QoQ

- 1/29 10:00 AM ET: Nov F Durable Goods Orders MoM

- 1/30 8:30 AM ET: Dec Core PPI MoM

Stock List Performance

In the News

| More News Appearances |