Stocks took a breather this week, dragged down by rapidly changing policies in the White House catching Wall Street off guard.

The S&P 500 tumbled 0.4% this week, putting its annual gains at 1.4% — which still marks its best start to a year since 2023 when AI unleashed a monster rally in tech stocks.

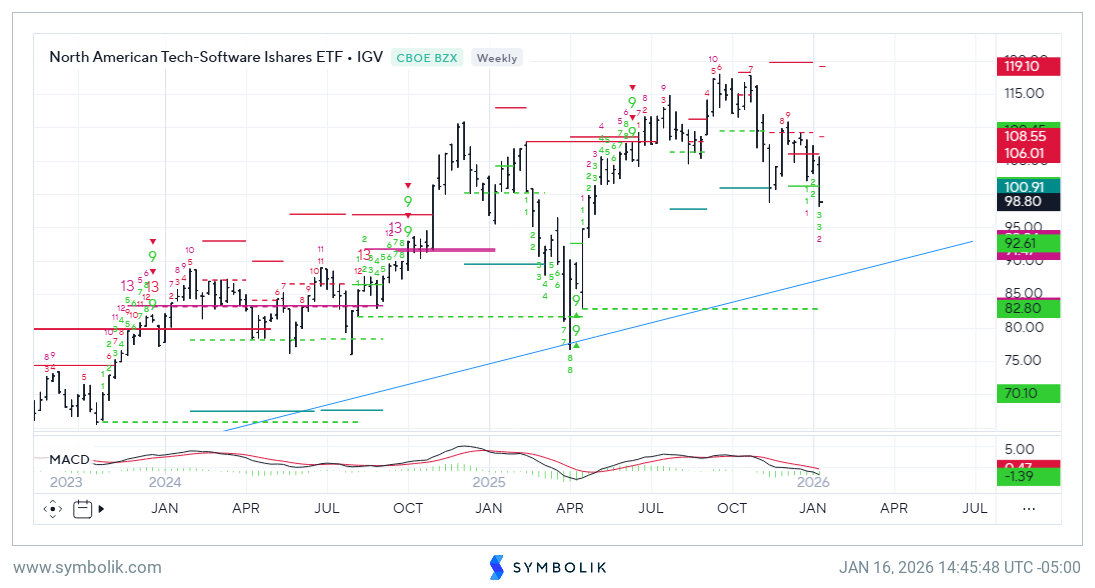

What’s different this time is that last year’s laggards are leading the way this year, instead of the typical tech stocks. Cyclical sectors like industrials, energy, and materials are the top performers in 2026 so far, up 7.6%, 6.8%, and 7.2%, respectively. That has led some investors to question whether the market can extend its gains without the likes of tech stalwarts.

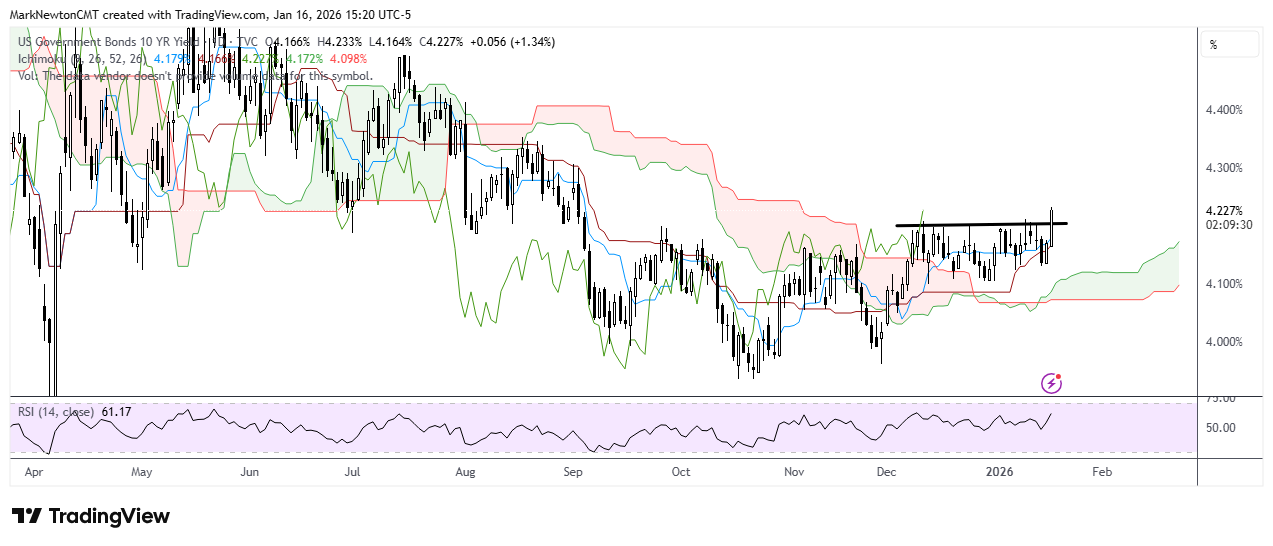

“The ones that had been showing really good strength over the last few months, meaning healthcare, technology, have all been lagging,” said Fundstrat Head of Technical Strategy Mark Newton during our weekly huddle. “I would say there’s an increasing amount of bifurcation right now between large-cap technology and the broader market.”

Newton expects that stocks will have a “pretty decent performance” over the next month, but his work calls for markets to start to turn down in the spring. He added that it’s “possible if tech can’t really manage a very strong rebound off these levels.”

Investors were laser-focused this week on a flurry of news coming out of the White House. Head of Research Tom Lee identified four losers from White House-related news so far: (1) credit card companies, from a proposal to cap interest rates charged on credit cards at 10% (2) the Federal Reserve from a criminal investigation into the Fed Chair Jerome Powell (3) institutional buyers of residential homes from a proposed ban on them from buying single-family homes (4) mortgage rates from an announcement that Fannie Mae and Freddie Mac would buy $200 billion of mortgage bonds.

“Washington is picking the winners and losers,” Lee said. “It’s tough to buy things that Washington decides are losers.”

Lee encouraged investors to look at how earnings growth is accelerating. Analysts surveyed by FactSet expect earnings for companies in the S&P 500 to rise 8.2% in the fourth quarter from a year earlier, the tenth consecutive quarter of year-over-year earnings growth for the index.

Blockbuster earnings from Taiwan Semiconductor Manufacturing Co. reinforced the AI boom even for U.S. stocks, allowing chip makers to recover some. Advanced Micro Devices shares rallied 8.2%, Intel added 27%, and Broadcom increased 1.6%.

“TSMC is the first of the AI-related names to report earnings this season and it’s been so good, honestly,” said Head of Data Science “Tireless” Ken Xuan. “It almost looks like it’s too good to be true.”

Lee believes stocks have a lot of upside left before hitting his year-end price target of 7,700, especially because stocks inched higher during the first five days of the year, which is typically a positive omen for future performance.

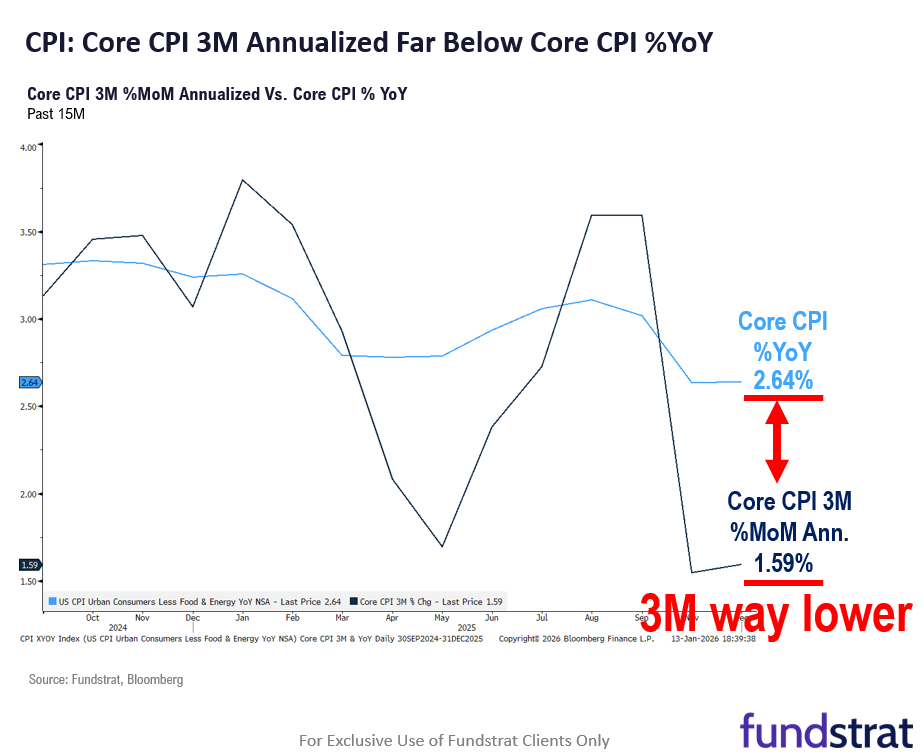

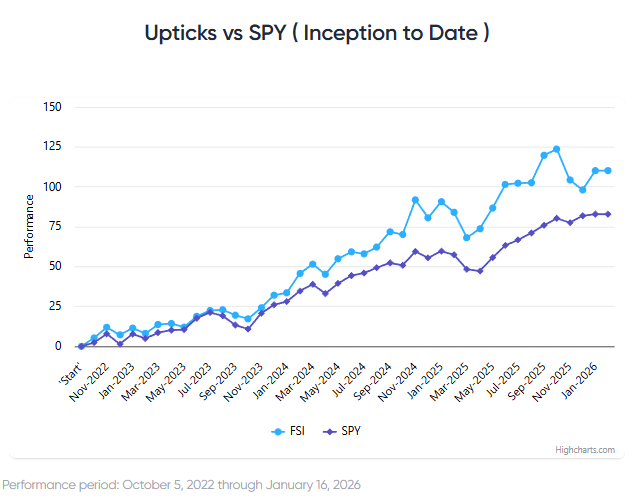

Chart of the Week

In economic data, the consumer-price index report showed that prices in December rose 2.7% from the prior year, while core prices rose 2.6%. Fundstrat Head of Research Tom Lee said “that’s really soft.” Meanwhile, the December producer-price index report showed that inflation rose 3% from the year before. Head of Data Science “Tireless” Ken Xuan believes that means “there’s almost no chance for a cut” because “nothing has changed to the picture for the next FOMC meeting.” Traders in the futures markets are pricing in a 95% chance that the Fed keeps rates steady next week.

Recent ⚡ FlashInsights

FS Insight Video: Weekly Highlight

Key incoming data

1/13 6:00 AM ET: Dec Small Business Optimism SurveyTame1/13 8:30 AM ET: Dec Core CPI MoMTame1/13 10:00 AM ET: Oct New Home SalesTame1/14 8:30 AM ET: Nov Retail SalesTame1/14 8:30 AM ET: Nov Core PPI MoMTame1/14 10:00 AM ET: Dec Existing Home SalesTame1/15 8:30 AM ET: Jan Philly Fed Business OutlookTame1/15 8:30 AM ET: Jan Empire Manufacturing SurveyTame1/15 4:00 PM ET: Nov Net TIC FlowsTame1/16 10:00 AM ET: Jan NAHB Housing Market IndexTame- 1/22 8:30 AM ET: 3Q T GDP QoQ

- 1/22 11:00 AM ET: Jan Kansas City Fed Manufacturing Survey

- 1/23 9:45 AM ET: Jan P S&P Global Services PMI

- 1/23 9:45 AM ET: Jan P S&P Global Manufacturing PMI

- 1/23 10:00 AM ET: Jan F U. Mich. 1yr Inf Exp

Stock List Performance

In the News

| More News Appearances |