A decline in shares of risky, glitzy companies didn’t bother the S&P 500 too much but weighed on the tech-focused Nasdaq composite in the new year.

The S&P 500 added 0.2% on the first trading day of 2026, with eight of the 11 sectors finishing in the green. Cyclical corners of the market, such as the energy, utilities, and materials sectors, were the top performers on Friday. The broad-based index finished the week down about 1%.

The Nasdaq composite, meanwhile, was unchanged on Friday, and the Dow Jones Industrial Average added 0.7%. Over the holiday-shortened trading week, they fell 1.5% and 1.3%, respectively.

Shares of Tesla fell 2.6% Friday, after the electric-vehicle maker reported a second straight annual drop in vehicle deliveries. Instead, Chinese carmaker BYD is the top seller of EVs across the globe. Other laggards this week were AppLovin, with shares of the mobile advertising platform down 13%, while Palantir and Carvana fell 11% and 8.7%, respectively.

Their stocks have been on a roller-coaster ride in recent months, but the losses this week could have been exacerbated by low trading volume, a hallmark of the year-end.

The declines could also be a sign that investors are reconsidering some of the more risky parts of their portfolios due to worries about AI companies overspending on capex with no clear path to monetization. AI-related companies were trading sideways during most of the second half of last year.

Among the areas of the market that were in the green on Friday were shares of chipmakers. Nvidia shares rose 1.3% and Intel added 6.7% on Friday. In particular, memory-chip makers posted a furious rally, with Micron and SanDisk shares up 11% and 16%, respectively.

As an exception to investors’ risk-off mood in 2026, bitcoin rose 1.3% Friday. The cryptocurrency faced steep losses in 2025, falling 6.3%.

Editor’s Note: As our research heads were on a well-earned holiday break this week, they didn’t publish research. We will resume sharing their latest commentaries next week.

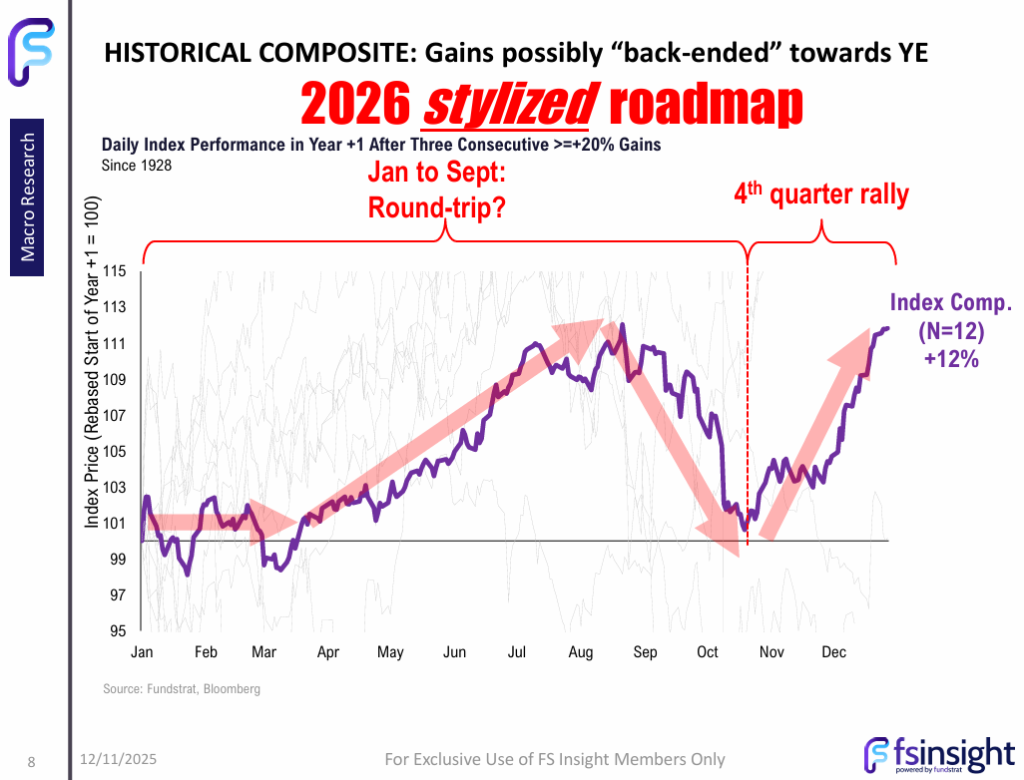

Chart of the Week

There were few economic reports released over the week, so the Federal Reserve’s minutes on Tuesday were in focus, which further showed just how divided officials were on Dec. 10 regarding the final decision to cut interest rates by a quarter-percentage point. With the current Fed chair’s term set to finish in May, the expectations are that the new Fed chair will be dovish. Our Chart of the Week has more details on how we expect it to affect stocks this year. The yield on the 10-year U.S. Treasury note was at 4.187% to end the week, compared with 4.137% last Friday.

Recent ⚡ FlashInsights

FS Insight Video: Weekly Highlight

Key incoming data

2/22 8:30 AM ET: Nov Chicago Fed Nat Activity IndexTame12/23 8:30 AM ET: 3Q S GDP QoQTame12/23 10:00 AM ET: Dec Conference Board Consumer ConfidenceTame12/23 10:00 AM ET: Dec Richmond Fed Manufacturing SurveyTame12/29 10:30 AM ET: Dec Dallas Fed Manuf. Activity SurveyTame12/30 9:00 AM ET: Oct S&P Cotality CS 20-City MoM SATame12/31 2:00 PM ET: Dec FOMC Meeting MinutesMixed- 1/5 10:00 AM ET: Dec ISM Manufacturing PMI

- 1/6 9:45 AM ET: Dec F S&P Global Services PMI

- 1/7 10:00 AM ET: Dec ISM Services PMI

- 1/7 10:00 AM ET: Nov JOLTS Job Openings

- 1/7 10:00 AM ET: Oct F Durable Goods Orders MoM

- 1/8 8:30 AM ET: 3Q P Nonfarm Productivity QoQ

- 1/8 8:30 AM ET: Oct Trade Balance

- 1/8 8:30 AM ET: 3Q P Unit Labor Costs

- 1/8 11:00 AM ET: Dec NYFed 1yr Inf Exp

- 1/9 8:30 AM ET: Dec Non-farm Payrolls

- 1/9 10:00 AM ET: Jan P U. Mich. 1yr Inf Exp

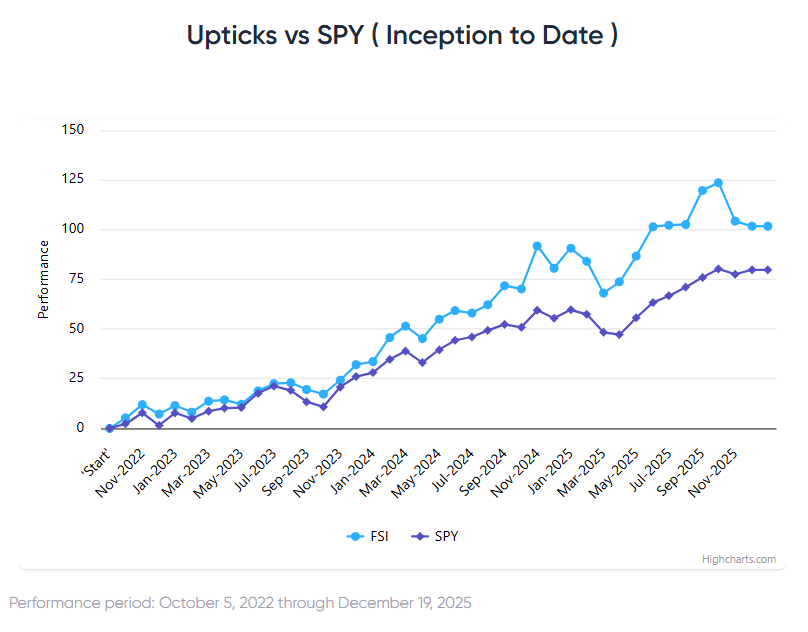

Stock List Performance

In the News

| More News Appearances |