Stocks have been largely flat of late, with the S&P 500 creeping up ever-so-slightly last week and the Nasdaq Composite showing similarly modest gains. These numbers are the result of improving breadth and performance in sectors outside of technology. The larger tech stocks have largely felt pressure in the face of continued concerns about AI, punctuated by recent news from Broadcom (AVGO -0.67% ) and Oracle (ORCL -4.48% ).

Oracle reported funding issues for its planned Michigan AI center, with Blue Owl Capital notably declining to provide backing despite having frequently done so for Oracle in the past. But as Fundstrat Head of Research Tom Lee reminded us, this does not necessarily reflect on the viability of the AI thesis. “Progress in AI will never be a straight line up and to the right,” he pointed out, “and this setback, to us, seems like a normal course of business.” He added, “Not every deal will have the same set of partners.”

Similarly, Head of Data Science “Tireless” Ken Xuan seemed largely unperturbed about Broadcom’s earnings (and the market’s reaction to them) during our weekly research huddle. “I thought the earnings numbers were fine, they show that the business is still growing,” he told us, though he acknowledged that Broadcom’s ASIC-focused business is arguably more prone to competitive pressures.

Head of Technical Strategy Mark Newton sees near-term constructivism as justified. “It’s interesting that growth projections continue to rise, which would be great for earnings, and inflation appears to be potentially nonexistent. To me, that’s a real Goldilocks-type scenario for the market, at least in the short run.”

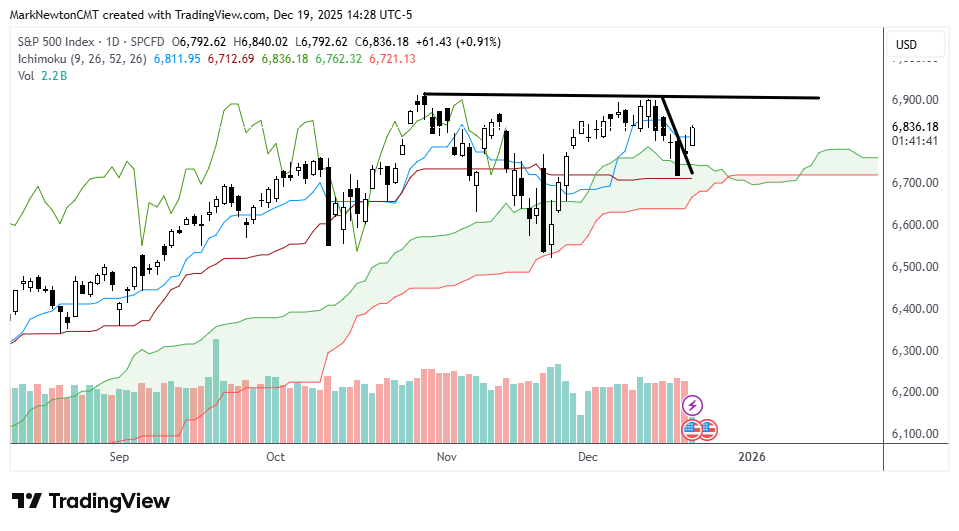

Though broader indices have not exactly wowed casual observers this week, Newton told us “the market is really not as bad as what the tape has shown. Breadth in the last two weeks has actually gone straight up,” he continued, with new highs in view for equal-weighted S&P 500, small caps, and Dow transports. “Those are all very big positives,” he asserted. The S&P 500 successfully exceeding 6,800 on Thursday gave Newton optimism for a rally over the last two weeks of the year. “This, to me, suggests that we are likely going to 7,000 between now and end of year.”

That’s a call that puts Newton’s near-term views largely in line with Lee’s, who wrote that “seasonals remain favorable, and we see at least 5% upside into year-end which implies S&P 500 at 7,000 or more.”

[Editor’s note: FS Insight Snapshot will not publish on Dec. 28, 2025. It will return Jan. 4, 2026. We wish all members of the FS Insight community a happy holiday season and a healthy, prosperous 2026.]

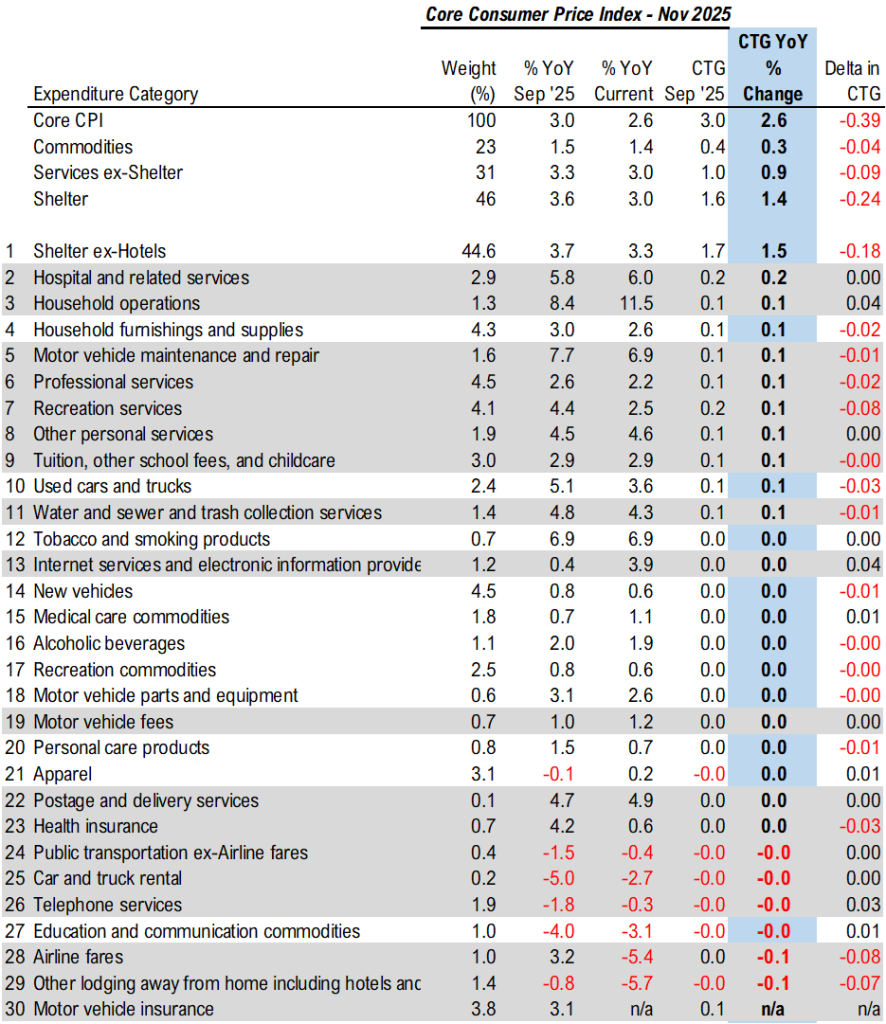

Chart of the Week

Our Chart of the Week shows a drill-down of the latest CPI report, comparing November with September. (Due to the federal government shutdown, October 2025 CPI was not compiled.) The latest inflation numbers are supportive of a constructive thesis for stocks as we look forward: Core CPI coming in at 2.6% YoY, significantly lower than consensus expectations of 3.0%. As Fundstrat Head of Research Tom Lee notes, falling inflation arguably leaves the Federal Reserve free to focus on the other part of its dual mandate – supporting a high level of employment. In his view, “this means a Fed ‘put’ is now in place for the economy.” To him, “a Fed put on the economy is bullish for stocks, because the quickest way to strengthen the economy is the wealth effect – for stocks to rise.”

Recent ⚡ FlashInsights

FS Insight Video: Weekly Highlight

Key incoming data

12/15 8:30 AM ET: Dec Empire Manufacturing SurveyTame12/15 10:00 AM ET: Dec NAHB Housing Market IndexTame12/16 8:30 AM ET: Nov Non-farm PayrollsMixed12/16 9:45 AM ET: Dec P S&P Global Services PMITame12/16 9:45 AM ET: Dec P S&P Global Manufacturing PMITame12/17 9:00 AM ET: Dec M Manheim Used Vehicle IndexTame12/18 8:30 AM ET: Dec Philly Fed Business OutlookTame12/18 8:30 AM ET: Nov Core CPI MoMTame12/18 11:00 AM ET: Dec Kansas City Fed Manufacturing SurveyTame12/18 4:00 PM ET: Oct Net TIC FlowsTame12/19 10:00 AM ET: Dec F U. Mich. 1yr Inf ExpTame12/19 10:00 AM ET: Nov Existing Home SalesTame- 12/22 8:30 AM ET: Nov Chicago Fed Nat Activity Index

- 12/23 8:30 AM ET: 3Q S GDP QoQ

- 12/23 10:00 AM ET: Dec Conference Board Consumer Confidence

- 12/23 10:00 AM ET: Dec Richmond Fed Manufacturing Survey

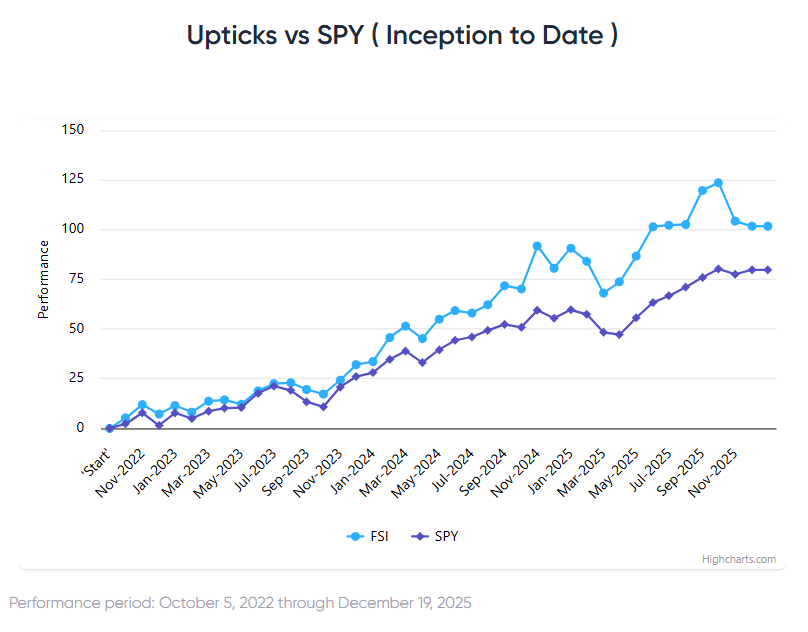

Stock List Performance

In the News

| More News Appearances |