AI juggernaut Nvidia’s earnings blew through obscenely high expectations, but it wasn’t enough to overturn the bearish sentiment prevalent this month. The S&P 500 lost 1.9% this week, while the Nasdaq Composite declined 2.7%.

Stocks declined to start the week, but there was hope that Nvidia’s earnings after the close on Wednesday could help turn the tide.

And they did, for a short while at least. It reported record third quarter sales of $57 billion, up 62% from a year ago, which beat expectations.

About an hour after the market opened on Thursday, however, Nvidia quickly reversed its gains, and there was no particular reason for it. Since it’s the S&P 500’s biggest weight, its sharp declines also took down the rest of the market.

“Thursday was disappointing,” Fundstrat Head of Research said in his Macro Minute video. “But I think that there were some things in the orbit that were contributing to the weakness.”

Among the top reasons, Lee believes that a series of tweets from President Trump in the morning that said that democratic veterans urging service members to refuse to follow unlawful orders would be considered “seditious behavior,” which of course, “rattled markets.”

He also thinks that investors are nervous if a famous markets individual is named in the Epstein Files, which could be leading someone to liquidate their position. Plus, crypto has been “bleeding lower” since Oct. 10, and there is a sign of market makers really being “hampered.”

Lee said that “I still think we’re closer to the bottom here.”

He recommends that investors buy the dip. Meanwhile, the U.S. economy added 119,000 jobs in September, according to a shutdown-delayed jobs report. That was more than economists’ expectations of a 50,000 increase. The unemployment rate, however, nudged up to 4.4%, the highest level in four years.

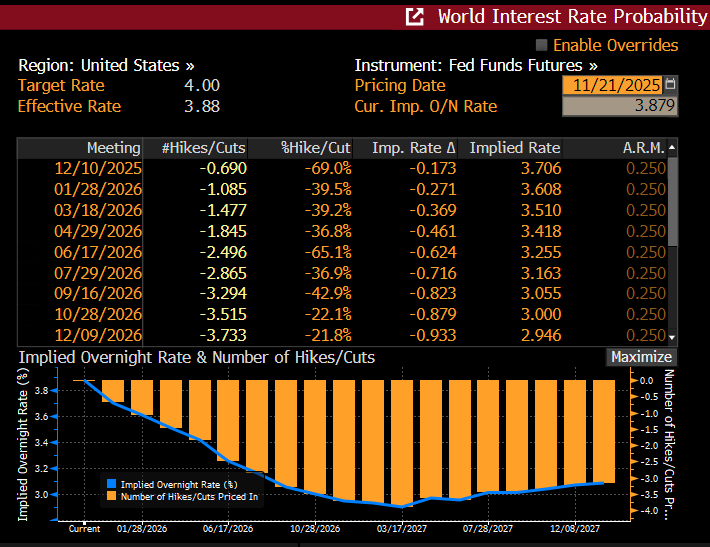

The report supports the Federal Reserve to hold interest rates steady because the “job market’s not that bad.”

Fed minutes on Wednesday showed that central bankers remained divided, with many market participants supporting a cut and others backing a pause.

Head of Data Science Ken Xuan said that cutting in December or January doesn’t really make a difference. “If you’re a long term investor, you should zoom out. I don’t think a cut is really changing much for the overall trajectory,” he added.

Head of Technical Strategy Mark Newton is bullish, as well. He wrote, “I still feel like the final six weeks of 2025 have the potential to show a rally, and that 2026 would be the more likely time for a lengthier decline, not into and throughout December.”

Chart of the Week

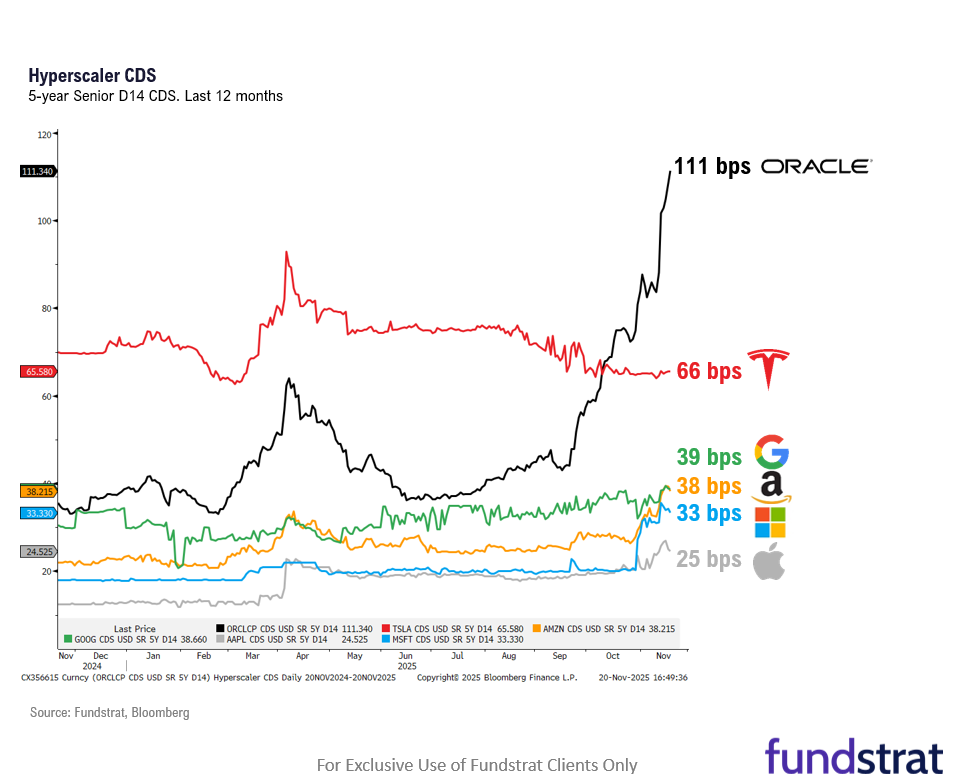

Fundstrat’s Head of Research Tom Lee says that Oracle’s credit-default swaps, a measure of risk, are exploding, as shown, which is also contributing to rattling the markets on Thursday after Nvidia’s blockbuster earnings.

Recent ⚡ FlashInsights

FS Insight Video: Weekly Highlight

Key incoming data

11/17 8:30 AM ET: Nov Empire Manufacturing SurveyTame11/18 10:00 AM ET: Aug F Durable Good Orders MoMTame11/18 10:00 AM ET: Nov NAHB Housing Market IndexTame11/18 4:00 PM ET: Sep Net TIC FlowsTame11/19 9:00 AM ET: Nov M Manheim Used Vehicle IndexTame11/19 2:00 PM ET: Oct FOMC Meeting MinutesDovish11/20 8:30 AM ET: Sep Jobs ReportHot11/20 8:30 AM ET: Nov Philly Fed Business OutlookTame11/20 10:00 AM ET: Oct Existing Home SalesTame11/20 11:00 AM ET: Nov Kansas City Fed Manufacturing SurveyTame11/21 9:45 AM ET: Nov P S&P Global Services PMITame11/21 9:45 AM ET: Nov P S&P Global Manufacturing PMITame11/21 10:00 AM ET: Nov F U. Mich. 1yr Inf ExpTame- 11/24 8:30 AM ET: Oct Chicago Fed Nat Activity Index

- 11/24 10:30 AM ET: Nov Dallas Fed Manuf. Activity Survey

- 11/25 9:00 AM ET: Sep S&P Cotality CS 20-City MoM SA

- 11/25 10:00 AM ET: Nov Conference Board Consumer Confidence

- 11/25 10:00 AM ET: Nov Richmond Fed Manufacturing Survey

- 11/26 8:30 AM ET: Oct P Durable Goods Orders MoM

- 11/26 8:30 AM ET: 3Q S GDP QoQ

- 11/26 10:00 AM ET: Oct Core PCE MoM

- 11/26 10:00 AM ET: Oct New Home Sales

- 11/26 2:00 PM ET: Fed Releases Beige Book

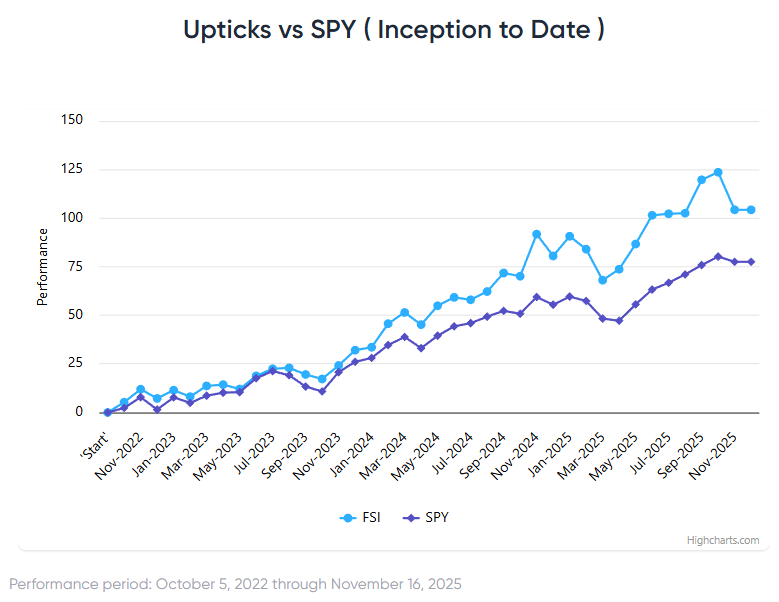

Stock List Performance

In the News

| More News Appearances |