Stocks are in the midst of the “November chop” that Fundstrat Head of Research Tom Lee had anticipated as a possibility at the beginning of the month. Some of this choppiness is arguably the result of various news stories perpetuating worries about a possible AI bubble.

Across Fundstrat, there is a fairly consistent view on the matter. Is there an AI bubble? Here’s how Fundstrat Head of Data Science Ken Xuan responded at our weekly research huddle: “I don’t think so.” He posted a rhetorical question to frame his argument: “Over the past few years, how many times have we heard this kind of bubble talk, this chatter about bubbles?” In his view, it’s been “too many.” Xuan added, “our base case about AI hasn’t really changed, and neither have our views on its likely impact on the economy and the labor force.”

Head of Technical Strategy Mark Newton has a similar view. “I don’t really agree with the bubble narrative,” he chimed in. From a long-term perspective, “trends are intact.”

It wasn’t just speculation about an AI bubble that weighed on investors’ minds, however. Fundstrat Head of Research Tom Lee sees a wall of worries contributing to recent market choppiness. All of this has caused AAII sentiment to plunge, falling to one of the lowest levels of the year – net bears of -17.5. From a contrarian perspective, this is arguably a positive signal. As Lee recalled, “the last time readings were this bad, it was actually a decent entry point.”

Although the recent choppiness has not caused Newton to panic, continued breadth deterioration continues to concern him. “The market has some work to do in broadening out the percentage of stocks within 20% of 12-month highs,” he said, pointing out that this number has been rolling over in the last few months. “I think it is important that we start to regain this very quickly if we hope to have this big rally in December.”

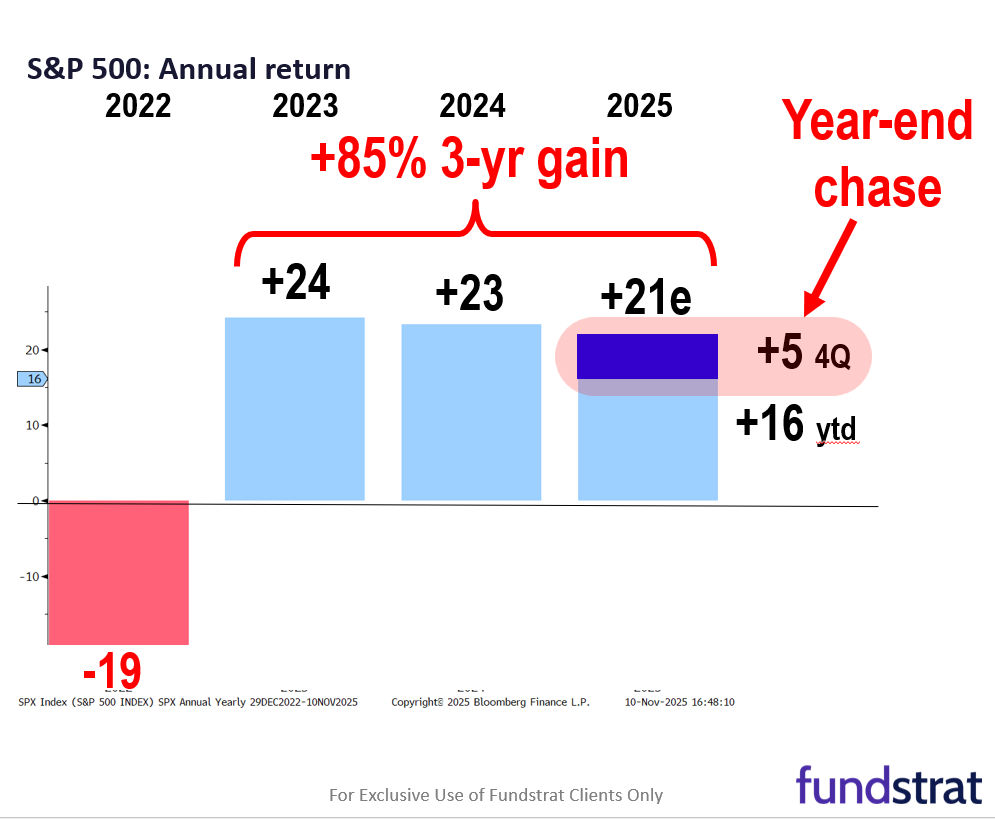

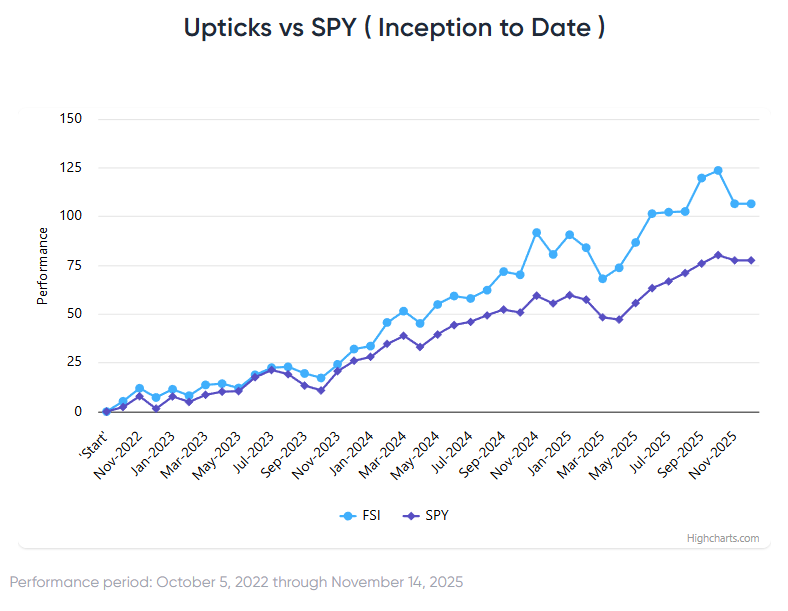

Nevertheless, Lee sees the likelihood of active-fund managers boosting the market as they try to make up for their YTD underperformance, with only about 20% of active fund managers beating their benchmarks as of Sept. 30. (Our Chart of the Week below illustrates this point more clearly.)

Chart of the Week

As Fundstrat’s Tom Lee notes, “We are on track to have three years of back-to-back 20%-plus gains,” he pointed out. “As you know, many institutional funds are measured on three-year gains. Are fund managers properly positioned to show those kinds of returns over this time period?” Lee suspects not, and “in my opinion, that means there’s going to be a year-end chase,” he said. This is illustrated in our Chart of the Week.

Recent ⚡ FlashInsights

FS Insight Video: Weekly Highlight

Key incoming data

11/11 6:00 AM ET: Oct Small Business Optimism SurveyTame11/13 8:30 AM ET: Oct Core CPI MoMDelayed due to Shutdown11/14 8:30 AM ET: Oct Core PPI MoMDelayed due to Shutdown11/14 8:30 AM ET: Oct Retail SalesDelayed due to Shutdown- 11/17 8:30 AM ET: Nov Empire Manufacturing Survey

- 11/18 10:00 AM ET: Nov NAHB Housing Market Index

- 11/18 4:00 PM ET: Sep Net TIC Flows

- 11/19 9:00 AM ET: Nov M Manheim Used Vehicle Index

- 11/19 2:00 PM ET: Oct FOMC Meeting Minutes

- 11/20 8:30 AM ET: Nov Philly Fed Business Outlook

- 11/20 10:00 AM ET: Oct Existing Home Sales

- 11/20 11:00 AM ET: Nov Kansas City Fed Manufacturing Survey

- 11/21 9:45 AM ET: Nov P S&P Global Services PMI

- 11/21 9:45 AM ET: Nov P S&P Global Manufacturing PMI

- 11/21 10:00 AM ET: Nov F U. Mich. 1yr Inf Exp

Stock List Performance

In the News

| More News Appearances |