Investors’ unwavering exuberance for stocks over the past three straight weeks showed signs of cooling down this week.

The S&P 500 declined 1.6%, with four out of 11 sectors finishing in the red. The Nasdaq Composite lost 3%, wrapping up its worst week since April.

But the S&P 500 remains 2.4% off its all-time highs, while the Nasdaq is 4% away, even as the economy gears up for day 40 of the longest-ever shutdown in history.

“It’s a testament to the stock market that we have this shutdown, and we’ve been pretty resilient,” Fundstrat Head of Technical Strategy Mark Newton said during our weekly huddle. “When that’s resolved, we will have some money that will be thrown in a lot of different areas that will be helpful.”

The declines were primarily led by shares of highflying tech stocks coming back down to earth. Palantir’s performance was perhaps the most notable, with its shares sliding 7.9% a day after its earnings on Monday showed that revenue climbed to another record, and it even has robust commercial contracts.

But its extremely expensive valuations have drawn skepticism from investors. Among the most prominent of the skeptics was Michael Burry, the investor of the book and movie “The Big Short,” who disclosed that he is betting on Palantir’s declines, likely fueling even more declines.

Burry’s far from the only one cautious about this rally. Goldman Sachs Chief Executive David Solomon and Morgan Stanley Chief Executive Ted Pick said they expect drawdowns of more than 10% in the next year. That may have also contributed to spooking investors, as it just validated their fears that AI enthusiasm might be a bubble.

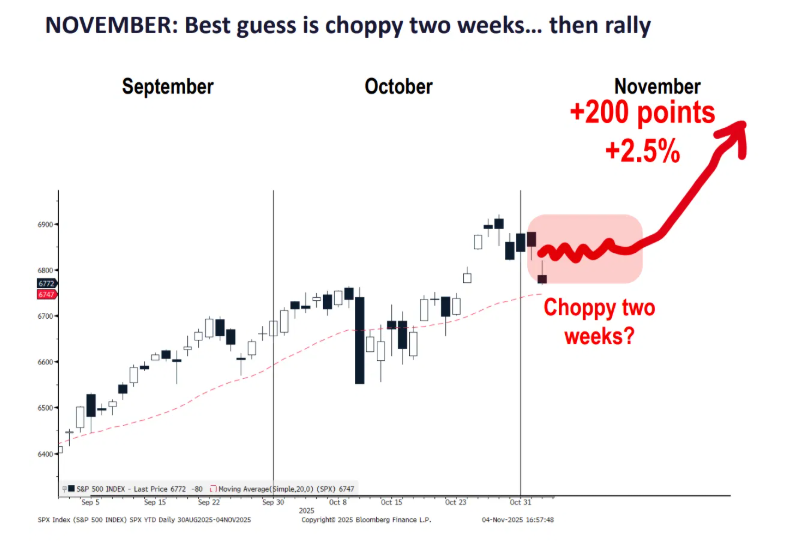

Even with the recent declines, Head of Research Tom Lee expects that November will be an up month for stocks, especially once investors are done climbing this wall of worry that includes everything from the government shutdown to the result of the New York City mayoral race and private credit stress.

“Keep in mind that worries, especially walls of worries, eventually get resolved, and then they become tailwinds,” Lee said.

He expects that there will be a couple choppy weeks in the beginning but then a rally later in the month.

He likes that third-quarter earnings show that margins are expanding for seven out of 11 sectors, a welcome surprise for those who had thought that margins would collapse by this quarter because of tariffs.

He also said this week that the AI supercycle remains alive and well.

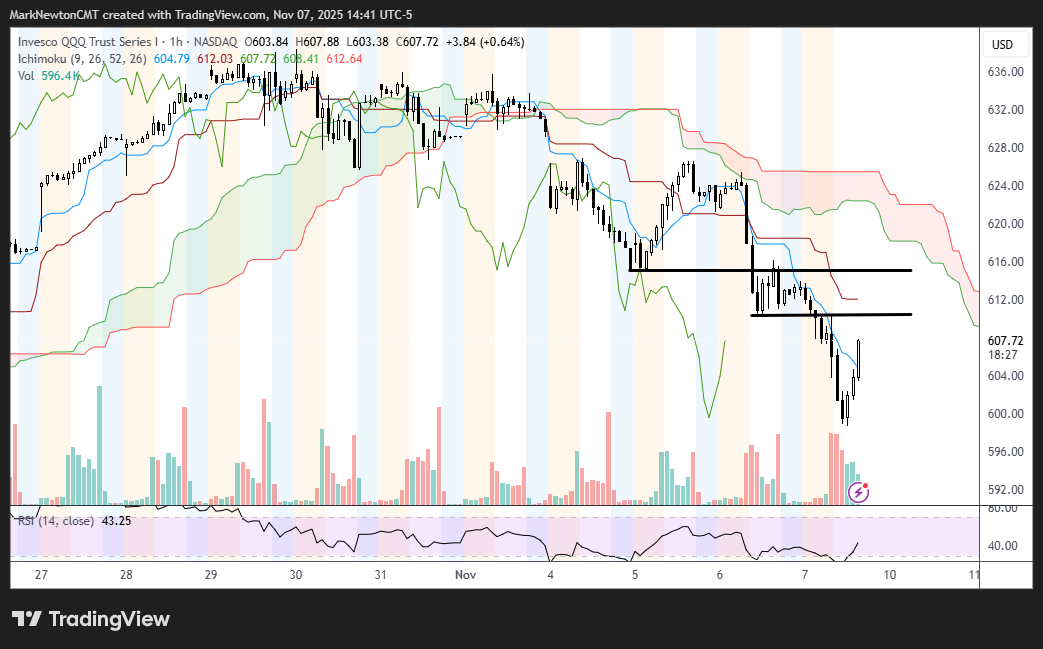

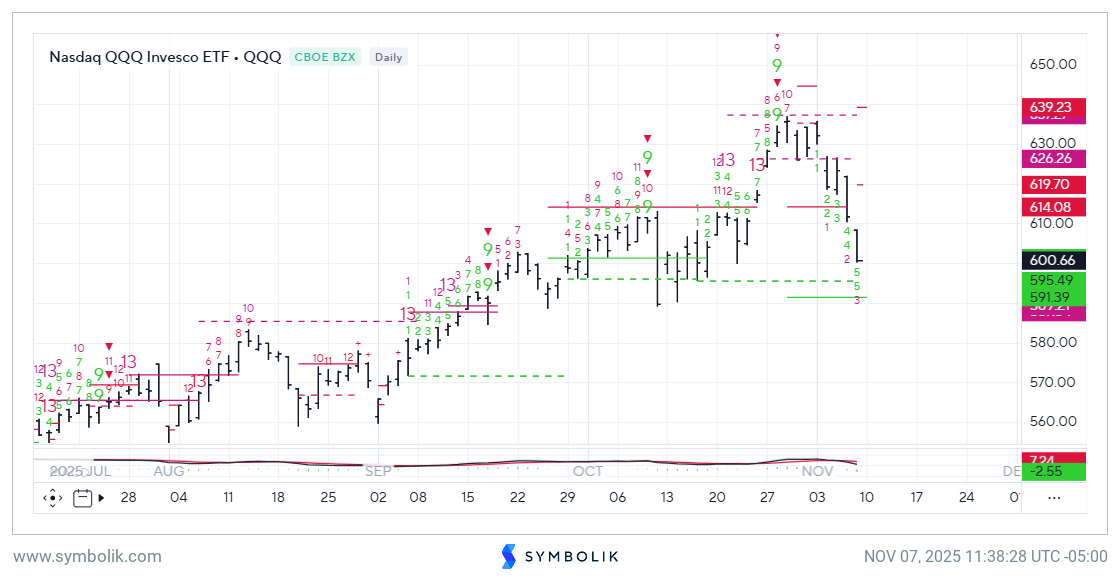

Newton’s in agreement with Lee there. “For those worried about a larger correction, you need to see evidence of that in stocks like Nvidia, Apple, Alphabet, and Tesla, and they all still look very, very good,” he said. “So it’s tough to make too bearish a case.”

Chart of the Week

“In our view, equities will be up this month,” Fundstrat Head of Research Tom Lee said. “How many times in the last 100 years, has the market been up six months in a row through October? It’s been six times. And if you look at November, only 1942 was flat, so every other month was positive. I’d say the odds are good.” The median gain in those six cases was 2.5%. That’s why Lee thinks that in November, the S&P 500 is likely to go up another 200 points.

Recent ⚡ FlashInsights

FS Insight Video: Weekly Highlight

Key incoming data

11/3 9:45 AM ET: Oct F S&P Global Manufacturing PMITame11/3 10:00 AM ET: Oct ISM Manufacturing PMITame11/4 8:30 AM ET: Sep Trade BalanceDelayed due to Shutdown11/4 10:00 AM ET: Sep F Durable Goods Orders MoMDelayed due to Shutdown11/4 10:00 AM ET: Sep JOLTS Job OpeningsDelayed due to Shutdown11/5 9:45 AM ET: Oct F S&P Global Services PMITame11/5 10:00 AM ET: Oct ISM Services PMITame11/6 8:30 AM ET: 3Q P Unit Labor CostsDelayed due to Shutdown11/6 8:30 AM ET: 3Q P Nonfarm Productivity QoQDelayed due to Shutdown11/7 8:30 AM ET: Oct Non-farm PayrollsDelayed due to Shutdown11/7 9:00 AM ET: Oct F Manheim Used Vehicle IndexTame11/7 10:00 AM ET: Nov P U. Mich. 1yr Inf ExpTame11/7 11:00 AM ET: Oct NYFed 1yr Inf ExpTame- 11/11 6:00 AM ET: Oct Small Business Optimism Survey

- 11/13 8:30 AM ET: Oct Core CPI MoM

- 11/14 8:30 AM ET: Oct Core PPI MoM

- 11/14 8:30 AM ET: Oct Retail Sales

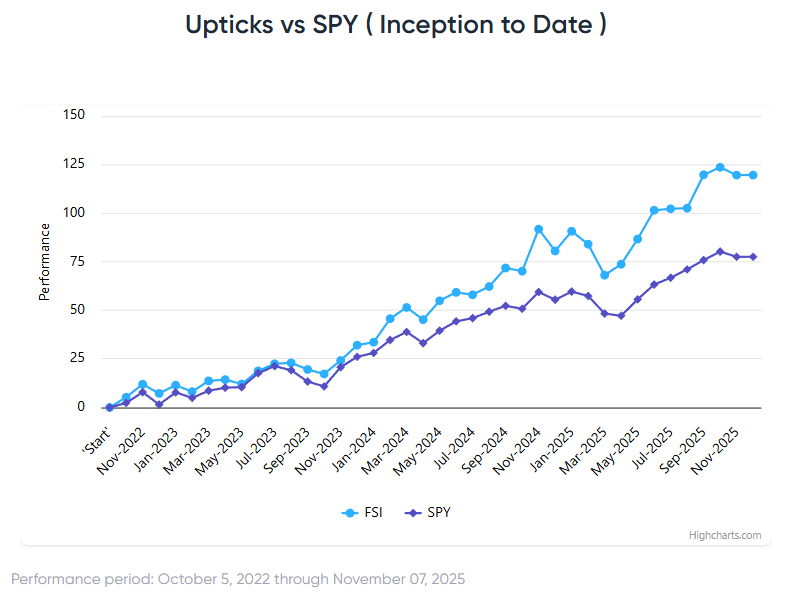

Stock List Performance

In the News

| More News Appearances |