The American Association of Individual Investors (AAII) survey showed sentiment flipping to net bullish this week – only mildly, but still putting an end to a seven-week streak of net-bearish sentiment. Coincidentally, this shift was accompanied by a slight decline in both the S&P 500 and the Nasdaq Composite.

Those two together are arguably a good thing, according to Head of Technical Strategy Mark Newton. Despite the slight AAII improvement, “overall levels of sentiment are still pretty skittish,” he told us at our weekly research huddle, “and that should support dip buying even further for a push up into probably mid to late October.”

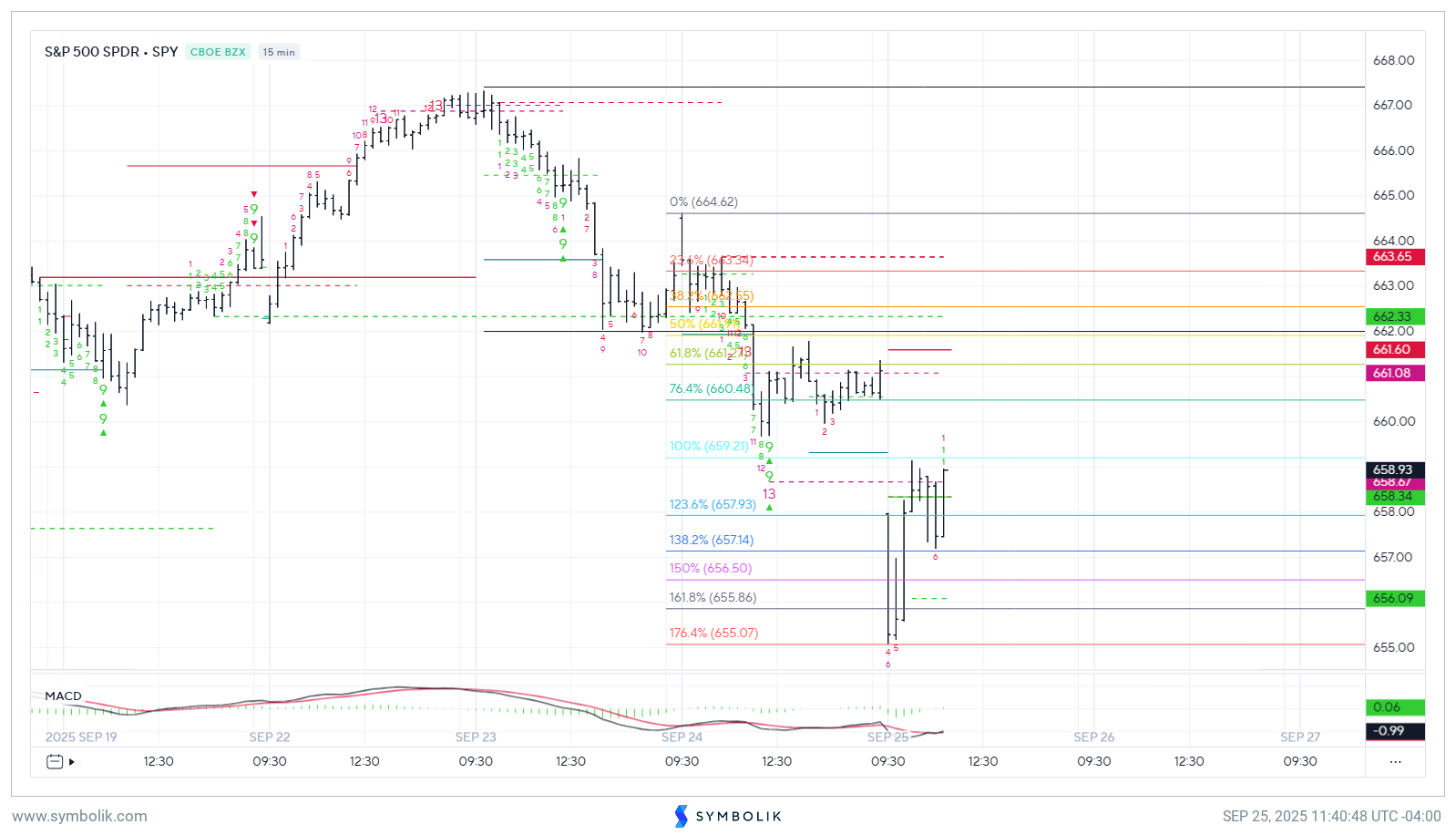

That’s a view largely shared by Fundstrat Head of Research Tom Lee, who views a “local top” as unlikely in the immediate term. Currently, the S&P 500 is 10.4% above its 200-day moving average. Yet, as Lee pointed out, since the Oct 2022 lows, we have only seen the S&P 500 make a “local top” when this figure is above 13%, for instance July 18, 2023; March 22, 2024; and July 16, 2024. (See the “Chart of the Week” below for more on this.)

Lee’s view contrasts with remarks made by Federal Reserve Chair Jerome Powell on Tuesday that put some of the week’s downward pressure on stocks. “I think if you look at some prices, then they’re elevated relative to historical levels,” Powell said during an event in Providence, R.I.

While expressing respect for Powell, Lee downplayed the significance of this view. “Please don’t see this as any ominous sign,” he recommended. After all, “when was the last time the Fed ever said stocks are ‘attractively priced’? (Hint: never).”

Chart of the Week

Assessing the likelihood of an imminent “local top,” Fundstrat’s Tom Lee observed that the S&P 500 was about 10% above its 200-day moving average as of Friday’s close. “At that level, the S&P 500 is just not that extended,” in his view. Since October 2022, local tops have occurred only when the S&P 500 is 13% or more above the 200 dma. For reference, 15% above the current 200 dma would imply a level around 6,950, consistent with Lee’s year-end target for the broad-based index.

Recent ⚡ FlashInsights

FS Insight Video: Weekly Highlight

Key incoming data

9/22 8:30 AM ET: Aug Chicago Fed Nat Activity IndexTame9/23 9:45 AM ET: Sep P S&P Global Services PMITame9/23 9:45 AM ET: Sep P S&P Global Manufacturing PMITame9/23 10:00 AM ET: Sep Richmond Fed Manufacturing SurveyTame9/24 10:00 AM ET: Aug New Home SalesTame9/25 8:30 AM ET: Aug P Durable Goods OrdersTame9/25 8:30 AM ET: 2Q T GDPMixed9/25 10:00 AM ET: Aug Existing Home SalesTame9/25 11:00 AM ET: Sep Kansas City Fed Manufacturing SurveyTame9/26 8:30 AM ET: Aug Core PCE DeflatorTame9/26 10:00 AM ET: Sep F U. Mich. Sentiment and Inflation ExpectationTame- 9/29 10:30 AM ET: Sep Dallas Fed Manuf. Activity Survey

- 9/30 10:00 AM ET: Sep Conference Board Consumer Confidence

- 9/30 10:00 AM ET: Aug JOLTS Job Openings

- 10/01 8:15 ET: Sep ADP Employment Change

- 10/01 9:45 ET: Sep F S&P Global US Manufacturing PMI Sep F

- 10/01 10:00 ET: Sep ISM Manufacturing

- 10/03 8:30 ET: Sep Change in Nonfarm Payrolls

- 10/03 9:45 ET: Sep F S&P Global US Services PMI

- 10/03 9:45 ET: Sep F S&P Global US Composite PMI

- 10/03 10:00 ET: Sep ISM Services Index

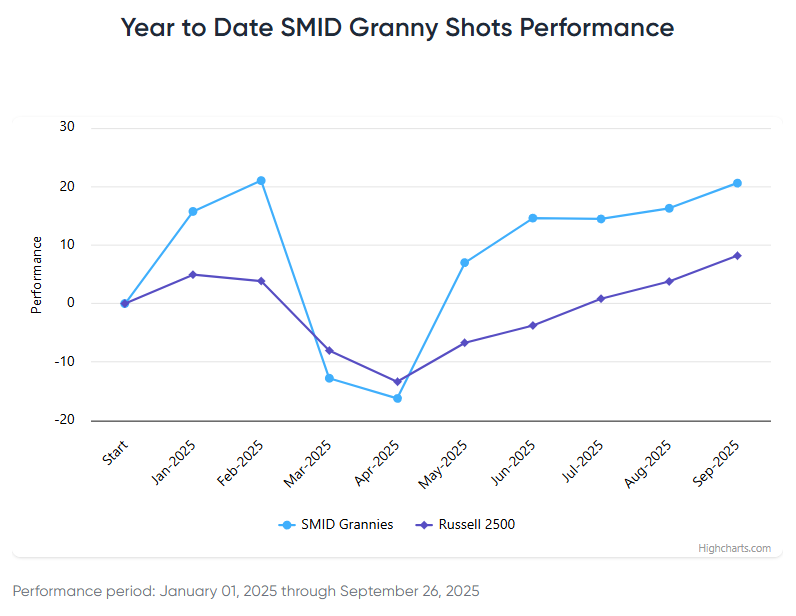

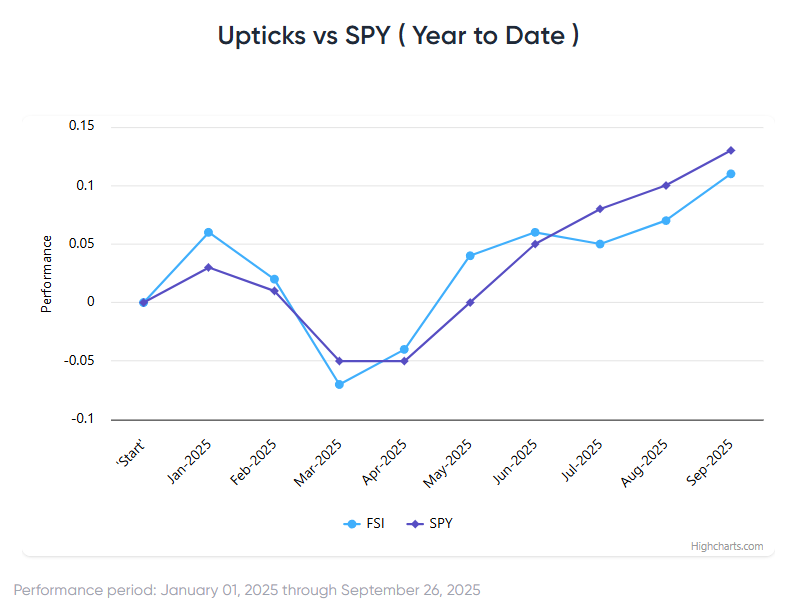

Stock List Performance

In the News

| More News Appearances |