Stocks are posting records after records in a defiance of the typically negative September seasonality.

The S&P 500 rose 1.6% to 6,584.29 points, putting it on course to gain 1.9% this month. If it holds onto that to finish the month, it’d be the second consecutive September it’s risen, which would mark the longest winning streak since the one ending in 2019 that logged gains for three straight Septembers.

A big reason for the increase? Labor market data came in soft, while inflation data wasn’t too hot, giving investors and likely the Federal Reserve, too, confidence that interest rates can be brought down as soon as next week.

Earlier in the week, an annual revision to the jobs number showed that the U.S. economy overstated jobs by 911,000 over the 12-month period ending in March. Then on Thursday, the initial jobless claims number rose to its highest level since October 2021.

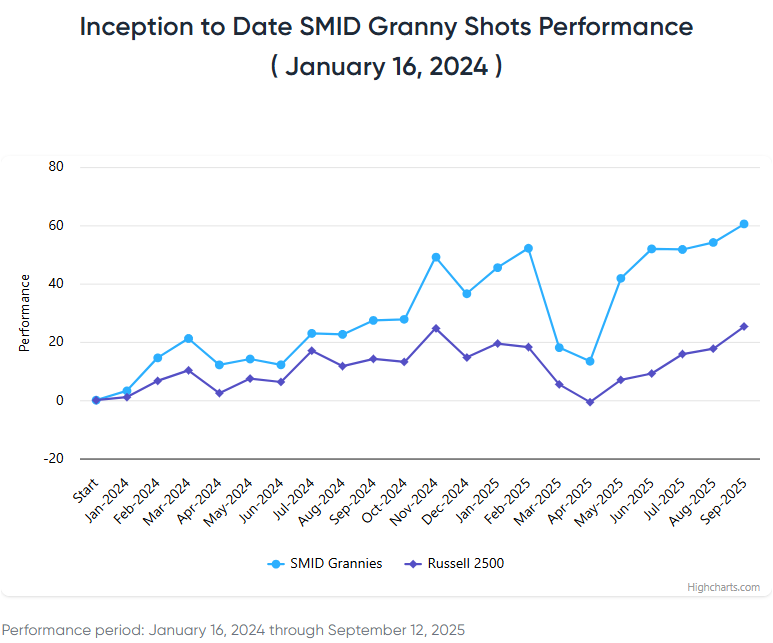

While both of those reports signal that the job market is in a precarious position, it’s also overwhelmingly “dovish” for the Fed’s next move, according to Fundstrat Head of Research Tom Lee, which helps support his “nonconsensus view that September will be an up month.”

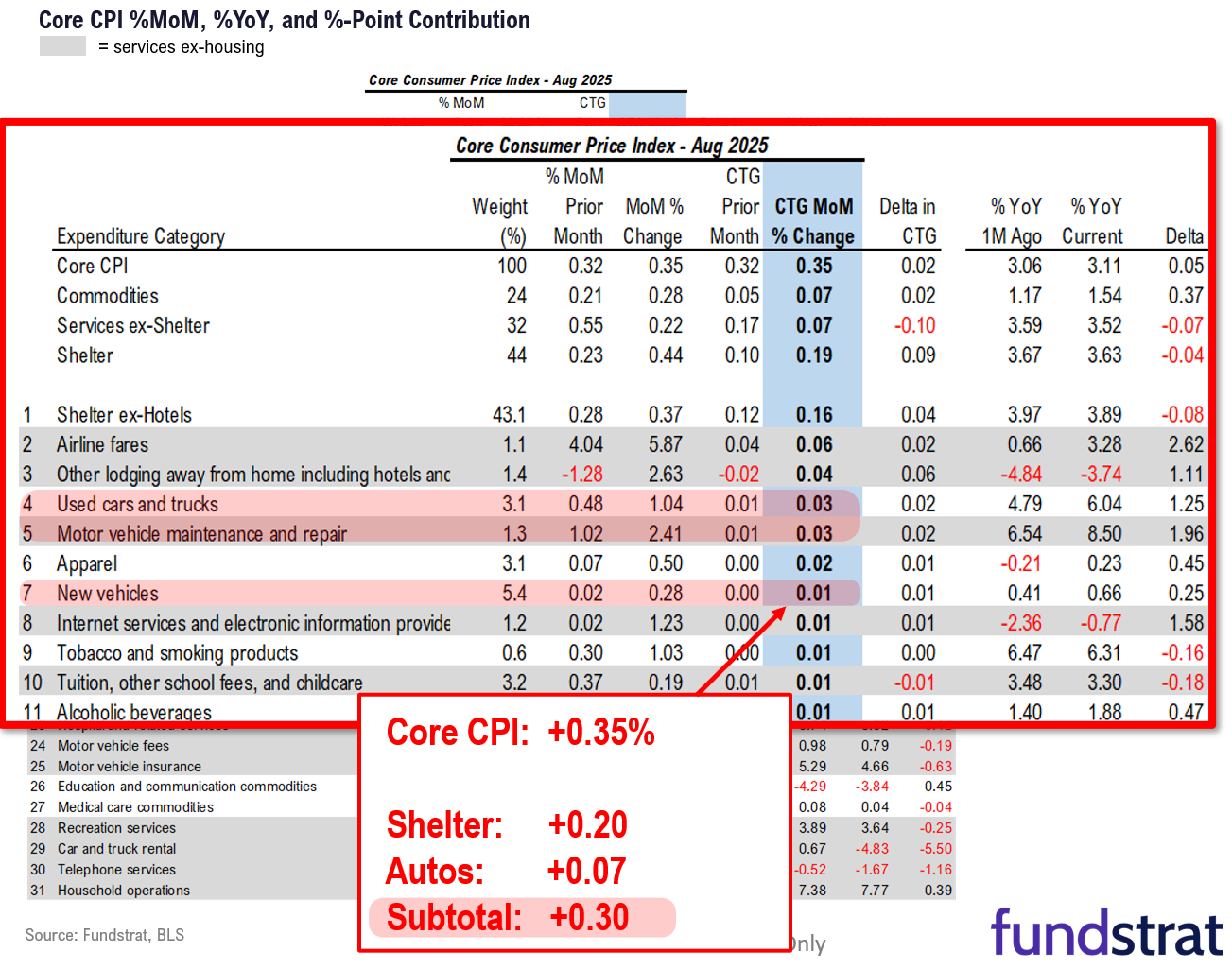

The headline and core number in the August wholesale inflation report on Wednesday both came in lower than expected. The monthly consumer-price index report the following day came in hotter-than expected for the headline number, rising 0.3% from a month ago compared to expectations of a 0.2% increase.

Lee added, “I actually don’t think this report is as bad as it looks on paper.” He doesn’t think that the CPI number numbers signal the start of “another wave of inflation.”

In corporate news, Oracle posted an eye-popping gain of 36% on Wednesday after reporting earnings that showed it expects to collect over $450 billion in revenue, mostly from OpenAI. The jump is a testament to how fast Oracle has caught up in the AI race.

“I just think that AI stocks are undervalued. How else do you explain Oracle rising as much as it did?” Lee said. He reaffirmed his view that stocks remain in a bull market.

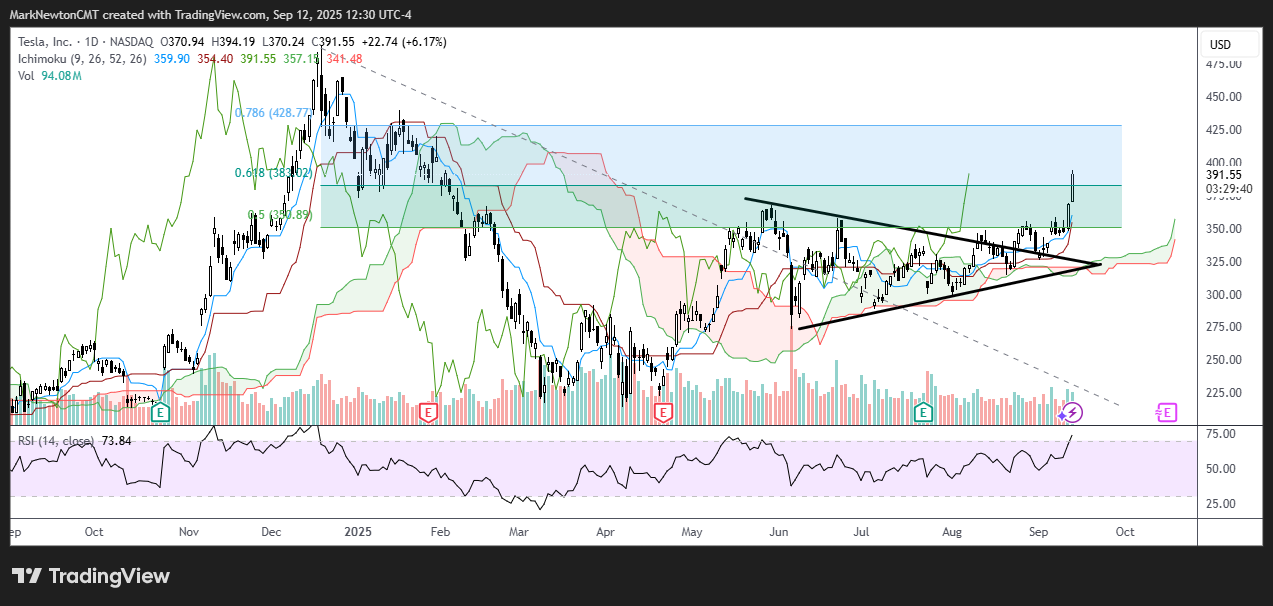

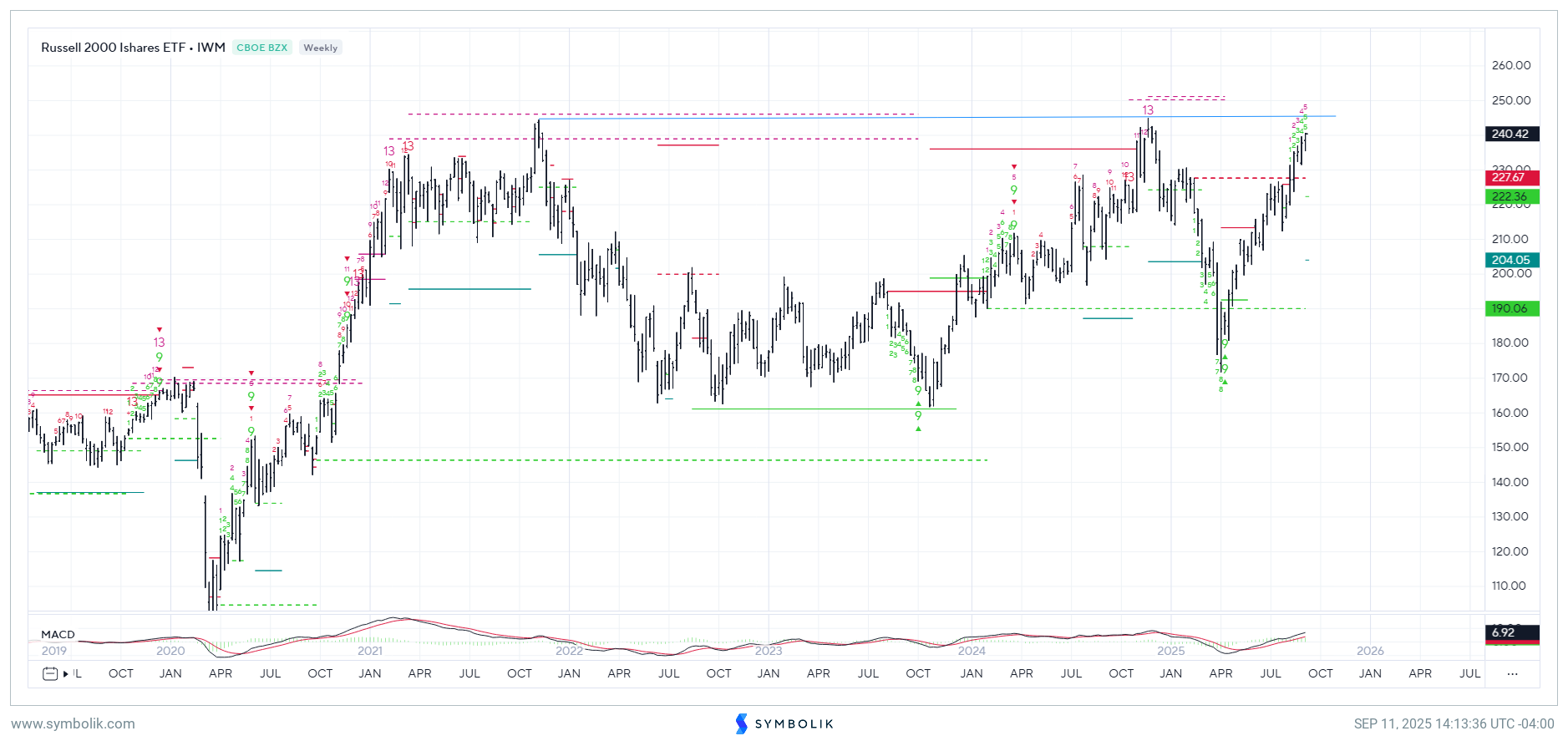

Head of Technical Strategy Mark Newton said that “it’s a great market right now,” but added that “it’s largely tech,” which is a little worrying because it’s better for the longevity of the rally when stocks from different sectors participate.

“It’s tough to find too much fault just yet, but there has been a little bit of a breadth drop-off in recent weeks,” he said. “The key in my mind is, when does the weak data stop serving as a positive for equities?”

Chart of the Week

The reason why Lee thinks the inflation report doesn’t look too bad is because he focuses on core inflation—which excludes the volatile food and energy components. That number came in line with expectations of a 0.3% increase from a month ago and 3.1% from a year ago. Lee pointed out that shelter and autos were a big contributor to monthly increase in core CPI , as shown in the Chart of the Week. He recommended investors to “take a step back and think about how much of shelter and autos is tariffs-related?”

Recent ⚡ FlashInsights

FS Insight Video: Weekly Highlight

Key incoming data

9/8 9:00 AM ET: Aug F Manheim Used Vehicle IndexTame9/8 11:00 AM ET: Aug NY Fed 1yr Inf ExpTame9/9 6:00 AM ET: Aug Small Business Optimism SurveyTame9/10 8:30 AM ET: Aug Core PPITame9/11 8:30 AM ET: Aug Core CPIMixed9/12 10:00 AM ET: Sep P U. Mich. Sentiment and Inflation ExpectationTame- 9/15 8:30 AM ET: Sep Empire Manufacturing Survey

- 9/16 8:30 AM ET: Aug Retail Sales Data

- 9/16 10:00 AM ET: Sep NAHB Housing Market Index

- 9/17 9:00 AM ET: Sep M Manheim Used Vehicle Index

- 9/17 2:00 PM ET: Sep FOMC Decision

- 9/18 8:30 AM ET: Sep Philly Fed Business Outlook

- 9/18 4:00 PM ET: Jul Net TIC Flows

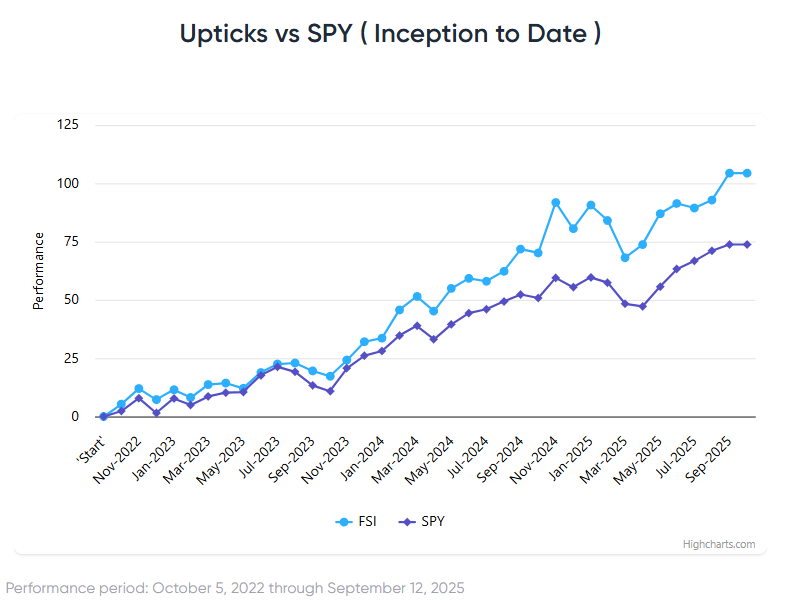

Stock List Performance

In the News

| More News Appearances |