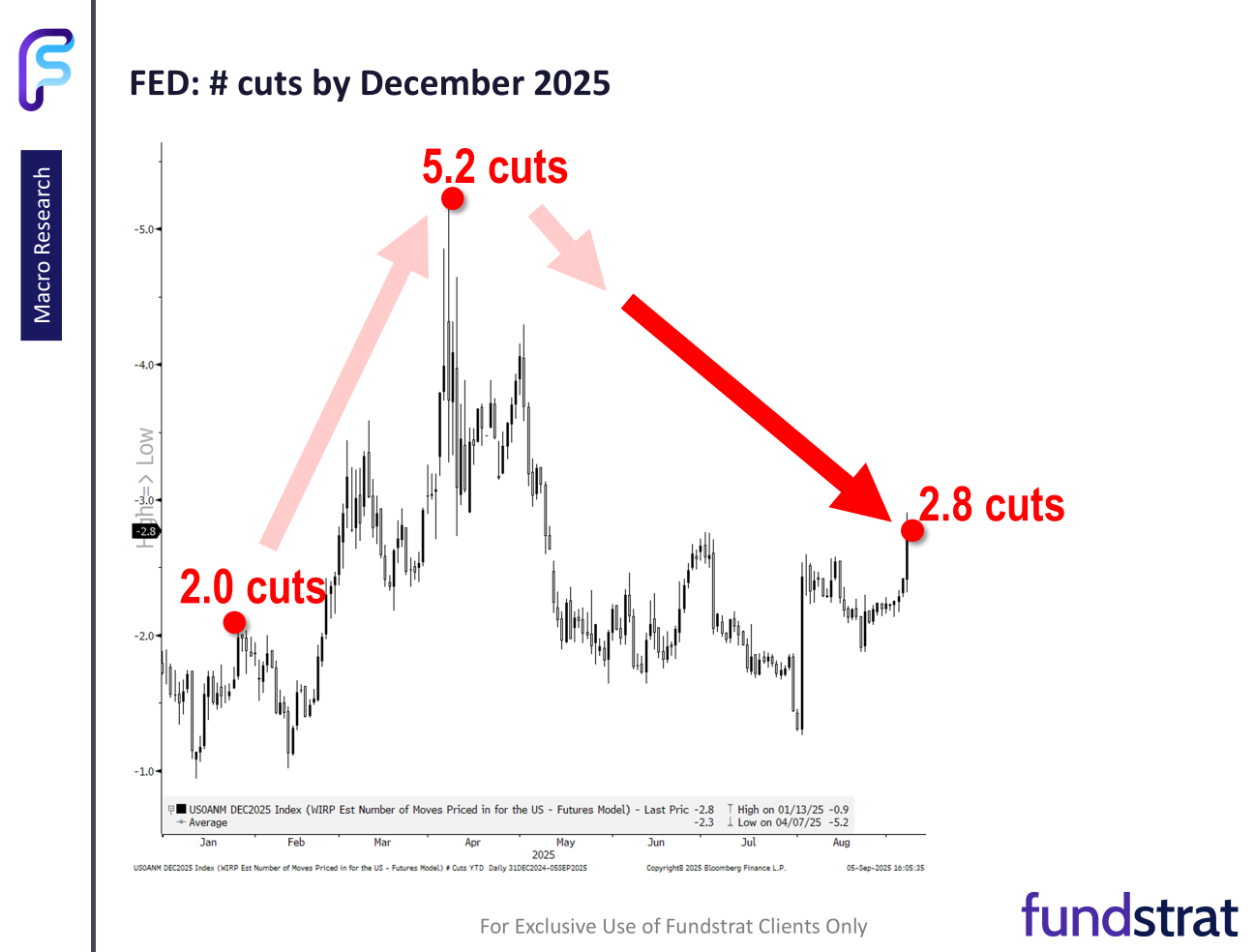

Calls for an interest-rate cut in September grew louder this week after economic data showed that the jobs market is slowing down dramatically.

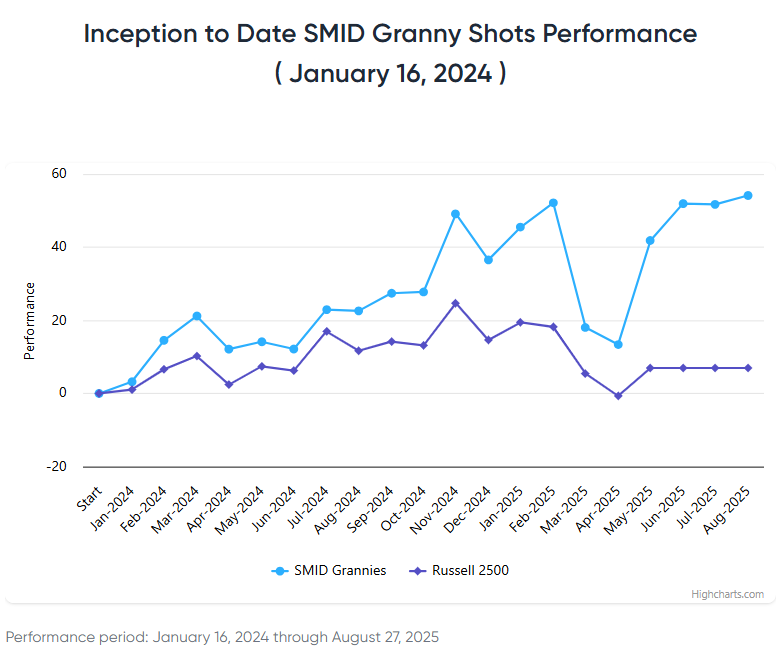

The S&P 500 hit a fresh record on Thursday and added 0.3% this week, while the Nasdaq Composite rose 1.1%.

Fresh data released Friday showed the U.S. economy added 22,000 jobs in August, way below the expectations of 75,000 jobs. A big yikes came from the downward revision of the June number—which showed that the economy lost 13,000 jobs—the first contraction since December 2020.

The unemployment rate edged up slightly to 4.3% from 4.2% in July.

Other than hospitality, no other industry reported a gangbusters level of job growth.

But there’s a silver lining in this cooling job market, according to Fundstrat Head of Research Tom Lee.

“This is a downside miss, and it now strengthens the case for the Fed to resume cutting. This is good. Bullish for stocks, especially small caps and crypto,” he wrote Friday morning.

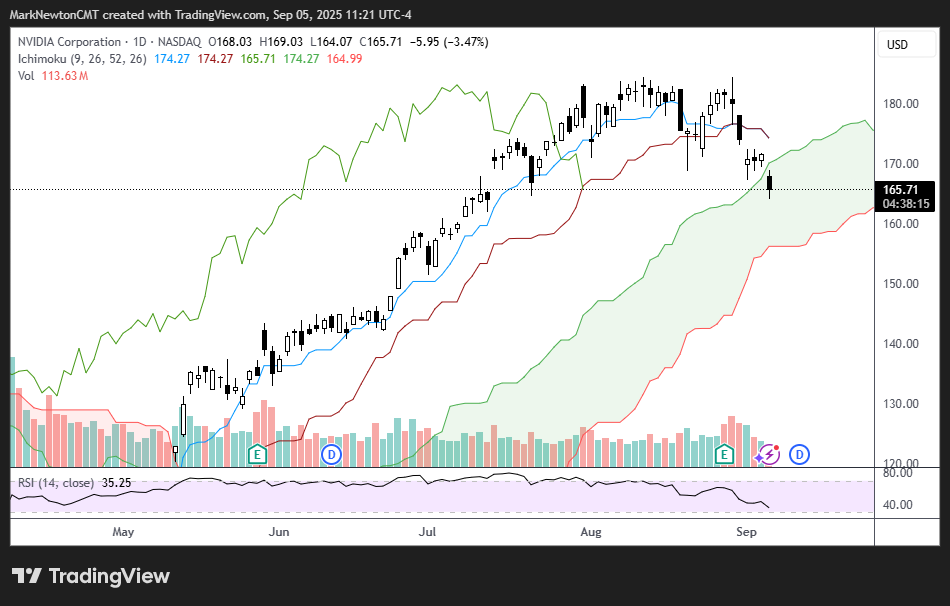

While Lee believes that the month will defy seasonality constraints, Head of Technical Strategy Mark Newton believes differently.

“I think in the next two or three weeks, we do have a chance of a little bit of a pullback. I think it will prove to be minor,” Newton said.

That’s mostly because he doesn’t believe the idea that “bad news is good news can last too long.” In recent years, when economic data has come in weak, it has sparked hopes of cuts, which typically ended up boosting stocks, but Newton doesn’t think that’ll be the case for a handful of weeks at least.

He’s also concerned about market breadth “drop-off” seen since July. Technology has underperformed sharply—except for Google and Apple, which recovered some of their losses from earlier in the year. This week, Google shares added 10%, while Apple rose 3.2%.

Newton expects the market will rally after the Fed hopefully cuts rates and into October, with the S&P 500 going up to 6,700, representing a gain of 3.4% from its Friday close. If stocks do fall before the Fed’s September meeting, Newton recommends investors to buy it.

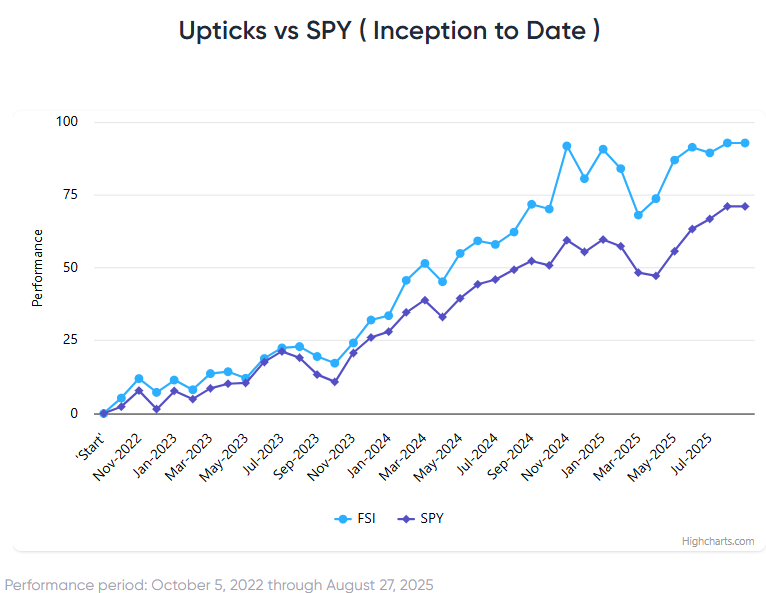

Chart of the Week

Investors are pricing in a 90% chance that the Fed cuts rates by 25-basis points at its September meeting, and a 71.6% chance of another same-sized cut at the October meeting. Fed Governor Chris Waller showed his inclination toward cutting rates earlier this week as well, which Lee highlighted. Waller said, “I think we need to start cutting rates at the next meeting and then we don’t have to go in a locked sequence of steps. We can kind of see where things are going because people are still worried about tariff inflation. I’m not, but everybody else is.” Lee said he is paying extra attention to what Waller says, as according to Polymarket, he is the heavily favored pick for the Fed chair.

Recent ⚡ FlashInsights

FS Insight Video: Weekly Highlight

Key incoming data

9/2 9:45 AM ET: Aug F S&P Global Manufacturing PMITame9/2 10:00 AM ET: Aug ISM Manufacturing PMITame9/3 10:00 AM ET: Jul F Durable Goods OrdersTame9/3 10:00 AM ET: Jul JOLTS Job OpeningsTame9/3 2:00 PM ET: Sep Fed Releases Beige BookTame9/4 8:30 AM ET: Jul Trade BalanceTame9/4 8:30 AM ET: 2Q F Unit Labor CostsTame9/4 8:30 AM ET: 2Q F Non-Farm ProductivityTame9/4 9:45 AM ET: Aug F S&P Global Services PMITame9/4 10:00 AM ET: Aug ISM Services PMITame9/5 8:30 AM ET: Aug Non-Farm PayrollsTame- 9/8 9:00 AM ET: Aug F Manheim Used Vehicle Index

- 9/8 11:00 AM ET: Aug NY Fed 1yr Inf Exp

- 9/9 6:00 AM ET: Aug Small Business Optimism Survey

- 9/10 8:30 AM ET: Aug Core PPI

- 9/11 8:30 AM ET: Aug Core CPI

- 9/12 10:00 AM ET: Sep P U. Mich. Sentiment and Inflation Expectation

- 9/15 8:30 AM ET: Sep Empire Manufacturing Survey

- 9/16 8:30 AM ET: Aug Retail Sales Data

- 9/16 10:00 AM ET: Sep NAHB Housing Market Index

- 9/17 9:00 AM ET: Sep M Manheim Used Vehicle Index

- 9/17 2:00 PM ET: Sep FOMC Decision

- 9/18 8:30 AM ET: Sep Philly Fed Business Outlook

- 9/18 4:00 PM ET: Jul Net TIC Flows

Stock List Performance

In the News

| More News Appearances |