Sleepy stocks got a much-needed adrenaline boost at the end of the week when Federal Reserve Chair Jerome Powell greenlit the idea of interest-rate cuts as soon as September.

The S&P 500 added 1.5% on Friday, while the Nasdaq Composite surged 1.9%. The small-cap focused Russell 2000 outperformed both, adding 3.9%.

Powell said shifting risks may warrant adjusting the central bank’s policy stance. Many investors liked that the chair is paying greater attention to the labor market, which is much needed because of the recent downward revisions to the jobs report.

“Overall, while the labor market appears to be in balance, it is a curious kind of balance that results from a marked slowing in both supply of and demand for workers,” he said. “This unusual situation suggests that downside risks to employment are rising. If those risks materialize, they can do so quickly in the form of sharply higher layoffs and rising unemployment.”

As for inflation, Powell reiterated that tariffs will likely cause a one-time increase.

“Fed speech is dovish. Positive for small caps, positive for Bitcoin, and positive for Ethereum,” Fundstrat Head of Research Tom Lee wrote. Ethereum prices briefly set a new all-time high Friday afternoon.

This week, the S&P 500 added 0.3% and the Nasdaq Composite fell 0.6%.

Seasonality trends suggested that the month might be challenging.

“We’re in very much a seasonal part of the year where normally we do get some weakness, which usually happens from August into October,” Fundstrat Head of Technical Strategy Mark Newton noted at our weekly huddle. “Honestly, I would argue the trend has held up a little bit better than what this indicates should be the case.”

Newton is in agreement with Lee that the upward path for equities till year-end is unlikely to be a straight line.

Chart of the Week

As we head into the final trading week of August and look toward the last quarter of the year, Fundstrat Head of Research Tom Lee told us that he sees the markets as having seen three phases thus far in the year. The first was marked by tariff-related uncertainty, while the second was a V-shaped rally that ran from April to August. Lee sees Phase III as likely to result in the S&P 500 reaching 6,800-7,000 points by the end of the year, with the likelihood of the Fed turning dovish as a key driver of this constructivism. The three-phase view of the 2025 stock market is illustrated above.

Recent ⚡ FlashInsights

FS Insight Video: Weekly Highlight

Key incoming data

8/18 10:00 AM ET: Aug NAHB Housing Market IndexTame8/19 9:00 AM ET: Aug M Manheim Used Vehicle IndexTame8/20 2:00 PM ET: Jul FOMC Meeting MinutesMixed8/21 8:30 AM ET: Aug Philly Fed Business OutlookTame8/21 9:45 AM ET: Aug P S&P Global Services PMIMixed8/21 9:45 AM ET: Aug P S&P Global Manufacturing PMIMixed8/21 10:00 AM ET: Jul Existing Home SalesTame- 8/25 8:30 AM ET: Jul Chicago Fed Nat Activity Index

- 8/25 10:00 AM ET: Jul New Home Sales

- 8/25 10:30 AM ET: Aug Dallas Fed Manuf. Activity Survey

- 8/26 8:30 AM ET: Jul P Durable Goods Orders MoM

- 8/26 9:00 AM ET: Jun S&P CS home price 20-City MoM

- 8/26 10:00 AM ET: Aug Conference Board Consumer Confidence

- 8/26 10:00 AM ET: Aug Richmond Fed Manufacturing Survey

- 8/28 8:30 AM ET: 2Q S GDP QoQ

- 8/28 11:00 AM ET: Aug Kansas City Fed Manufacturing Survey

- 8/29 8:30 AM ET: Jul Core PCE MoM

- 8/29 10:00 AM ET: Aug F U. Mich. 1yr Inf Exp

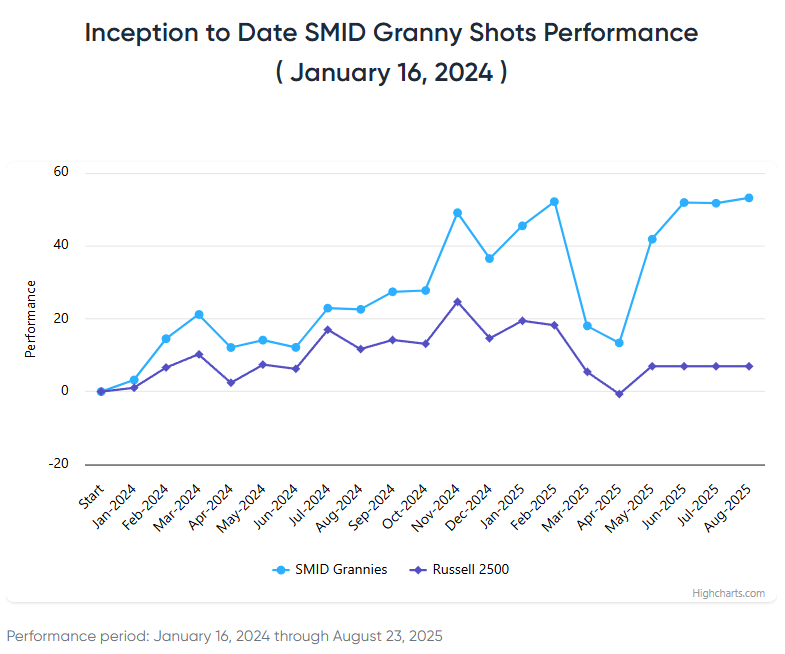

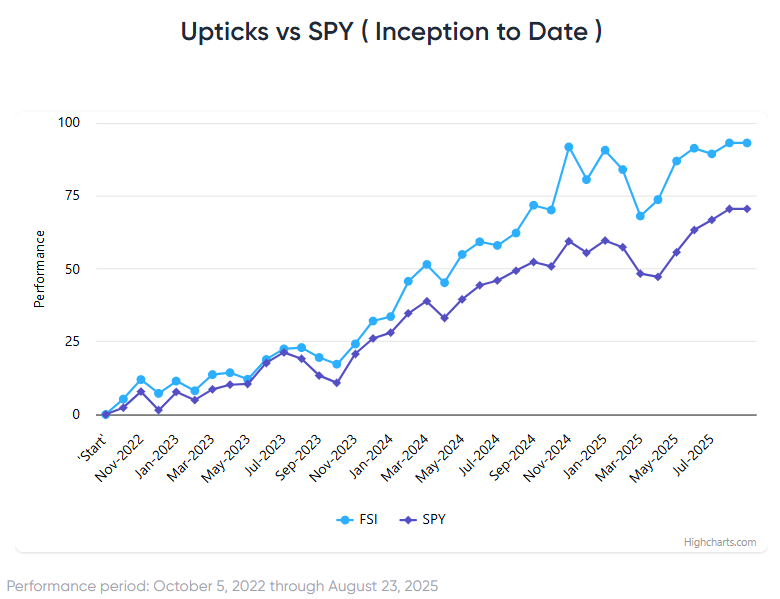

Stock List Performance

In the News

| More News Appearances |