The U.S. stock market continues to roll forward, with the S&P 500 and Nasdaq Composite both continuing to climb last week despite unpleasant inflation readings and August seasonality. Stocks rose after ever-so-slightly higher-than-expected Core CPI readings on Wednesday. Then on Thursday, Core PPI came in at levels that Fundstrat Head of Research Tom Lee described as not just hot, but “blazing,” briefly jolting investors. Nevertheless, equities recovered to eke out a small gain and record-high close on Thursday as well.

It is arguably a constructive signal for stocks to rise on bad news, and Lee views this as indicating either that markets might have been expecting higher inflation readings or that many investors view a rise in inflation that might emerge as likely to be transitory rather than structural — possibly both.

Does the latest hot PPI reading signal that tariffs are finally about to drive up inflation? Not necessarily. “Keep in mind, June Core PPI was negative,” recalled Lee, suggesting that this month’s reading might have been a statistical aberration.

In the meantime, Newton found it curious that despite new records being set by the S&P 500, sentiment continues to be subdued. “So as the market has scaled upwards, you would think people would be getting more bullish,” he proposed at our weekly research huddle, “but it’s actually the opposite. The AAII [Investor Sentiment Survey] continues to get more and more negative.”

What does he think this means? “I suspect people are expecting we’re going to get some sort of a fall correction,” he said. Certainly, sentiment indicators do not indicate an extreme level of bullishness, and “for me, that’s very optimistic for the second-half of this year,” Newton told us. “Even if we do eventually get a pullback, which I think probably happens in September into October, I think it’s early now, and I think it’s still right to stay the course and buy.”

That’s broadly consistent with Lee’s view: “We continue to be constructive on stocks in August and we expect equities to continue to strengthen,” he said.

Chart of the Week

Despite the hot PPI release last week, the perceived odds of a Fed rate cut did not change much. As implied by Fed funds futures trading, the market still sees the likelihood of a 25-basis point cut in September and 2.3 cuts before the year is out.

Recent ⚡ FlashInsights

FS Insight Video: Weekly Highlight

Key incoming data

8/12 6:00 AM ET: Jul Small Business Optimism SurveyTame8/12 8:30 AM ET: Jul Core CPI MoMTame8/14 8:30 AM ET: Jul Core PPI MoMHot8/15 8:30 AM ET: Aug Empire Manufacturing SurveyTame8/15 8:30 AM ET: Jul Retail SalesTame8/15 10:00 AM ET: Aug P U. Mich. 1yr Inf ExpMixed8/15 4:00 PM ET: Jun Net TIC FlowsTame- 8/18 10:00 AM ET: Aug NAHB Housing Market Index

- 8/19 9:00 AM ET: Aug M Manheim Used Vehicle Index

- 8/20 2:00 PM ET: Jul FOMC Meeting Minutes

- 8/21 8:30 AM ET: Aug Philly Fed Business Outlook

- 8/21 9:45 AM ET: Aug P S&P Global Services PMI

- 8/21 9:45 AM ET: Aug P S&P Global Manufacturing PMI

- 8/21 10:00 AM ET: Jul Existing Home Sales

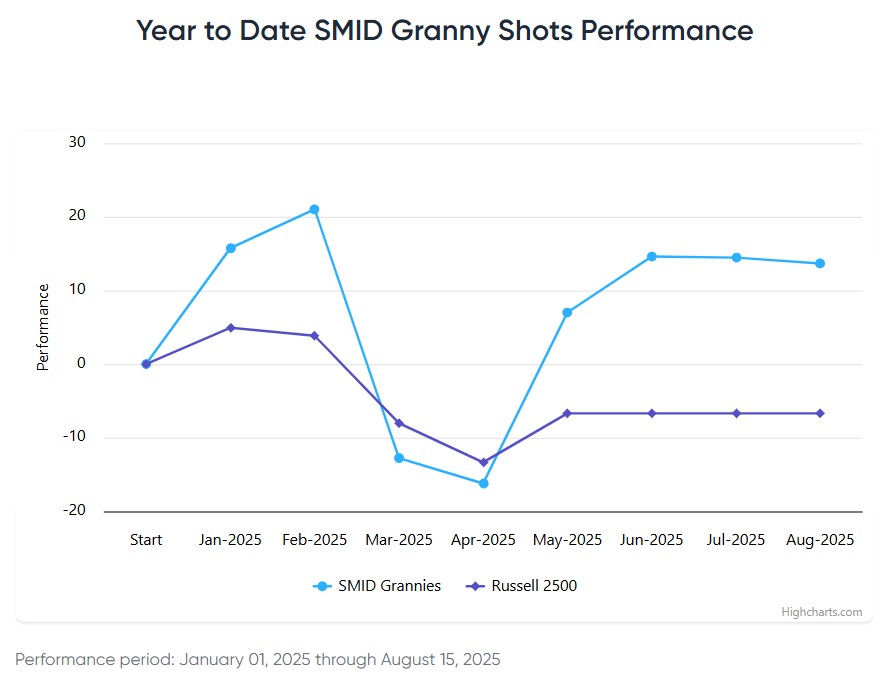

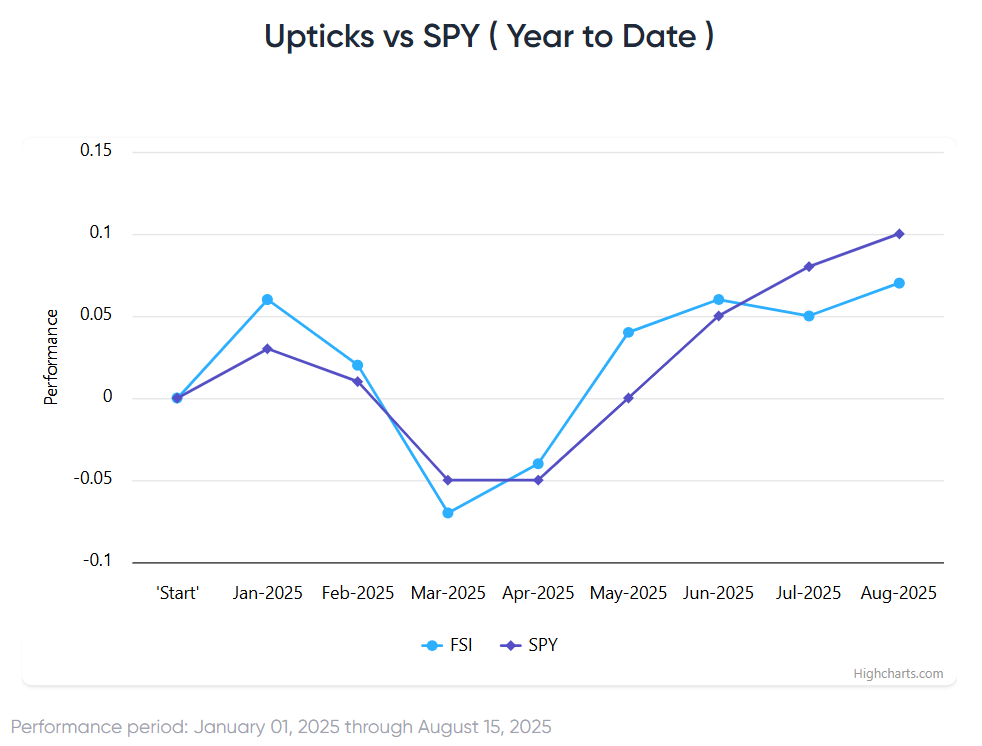

Stock List Performance

In the News

| More News Appearances |

- but this is the odd thing

- every single cohort, Dems, Independents, Republicans expect less inflation

- how does the total inflation line rise?

- maybe more “Dems” in the survey

Bottom line: highlighting why this survey is increasingly less reliable