Stocks didn’t pull through in a challenging week.

The S&P 500 tumbled 1.6% this week, its worst week since late May, while the Nasdaq Composite fell 2.2%.

At the beginning of the week, there were signs of optimism. A trade deal with Europe was struck, and officials from the United States and China agreed to extend the trade truce to mid-August to give themselves time to reach an agreement. Both of those were considered positive developments ahead of the Aug. 1 midnight deadline for resuming tariffs.

That date ended up being pushed to Aug. 7 with new rates set on many countries, such as 35% on Canada and 39% on Switzerland.

Since investors were already on edge Friday, it didn’t help when the much-awaited jobs report for July painted an abysmal picture for the labor market, further dragging down stocks and sending yields tumbling.

It was perceived as so bad that President Trump fired the Bureau of Labor Statistics commissioner.

The U.S. added 73,000 jobs last month, much lower than the 100,000 economists’ estimated. What was even more worrisome is that the numbers for the previous two months noted larger-than-normal revisions. The May number decreased to 19,000 from 144,000 and the June number fell to 14,000 from 147,000.

It could be argued that stocks didn’t fall even more afterward because a softer labor market strengthens the case for the Federal Reserve to cut interest rates this year, which in turn would boost stocks

“The economy is solid and soft enough that the Fed needs to make insurance cuts,” Fundstrat Head of Research Tom Lee wrote on Friday.

Just on Wednesday, the Federal Reserve said it would keep interest rates unchanged, with chair Jerome Powell arguing that the board wants to be cautious in case tariffs lead to inflation. But Friday’s market reaction shows that investors are betting that worries about a weakening labor market will take precedence over any potential inflation.

So Lee recommended to investors that Friday’s declines were an “obvious buy the dip moment.”

Head of Technical Strategy Mark Newton agrees. “I do feel that today’s dip is buyable and should begin to stabilize by next Monday or Tuesday at the latest,” he wrote.

Newton recommends tech stocks, even though many of the heavyweights’ earnings failed to impress investors this week. Amazon shares fell 8.3% a day after earnings, and Apple tumbled 2.5%.

“For now, I see further downside as being short-lived and largely contained.”

Chart of the Week

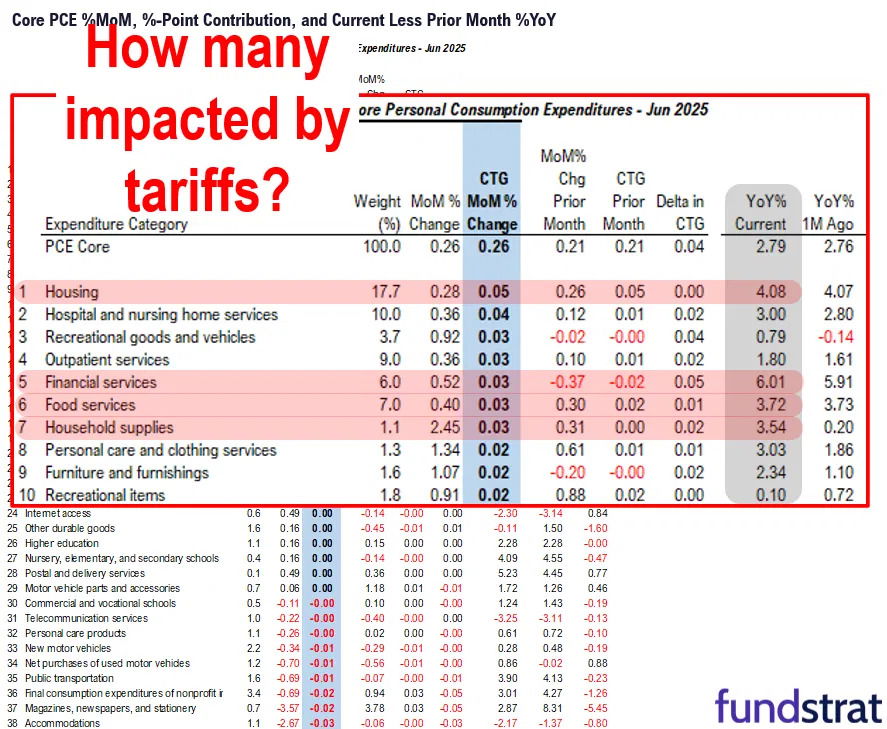

One other reason why Lee thinks the case for the Fed to keep rates steady is weakening is because the central bank’s preferred inflation gauge came in lower than expected. On Thursday, the PCE index showed that inflation in June rose in line with expectations. The top contributors were housing, financial services, food services and household supplies, which were unlikely to have been impacted by tariffs, as shown in our Chart of the Week. Of that, Lee said “we understand why the Fed is on hold, but to us, inflation is not necessarily accelerating.”

Recent ⚡ FlashInsights

- shows the market is expecting the Fed to make more cuts in 2025 than Fed stated just a few days ago

- July jobs was soft a +73k vs 104k expected

- July ISM manufacturing 48.0 vs 49.5

- U Mich 1-yr inflation lower at 4.5% vs 5.0% last month

- VIX surged to 20.0 +20% today

FS Insight Video: Weekly Highlight

Key incoming data

8/1 8:30 AM ET: Jul Non-farm PayrollsMixed8/1 9:45 AM ET: Jul F S&P Global Manufacturing PMITame8/1 10:00 AM ET: Jul F U. Mich. 1yr Inf ExpTame8/1 10:00 AM ET: Jul ISM Manufacturing PMITame- 8/4 10:00 AM ET: Jun F Durable Goods Orders MoM

- 8/5 8:30 AM ET: Jun Trade Balance

- 8/5 9:45 AM ET: Jul F S&P Global Services PMI

- 8/5 10:00 AM ET: Jul ISM Services PMI

- 8/7 8:30 AM ET: 2Q P Unit Labor Costs

- 8/7 8:30 AM ET: 2Q P Nonfarm Productivity QoQ

- 8/7 9:00 AM ET: Jul F Manheim Used Vehicle Index

- 8/7 11:00 AM ET: Jul NYFed 1yr Inf Exp

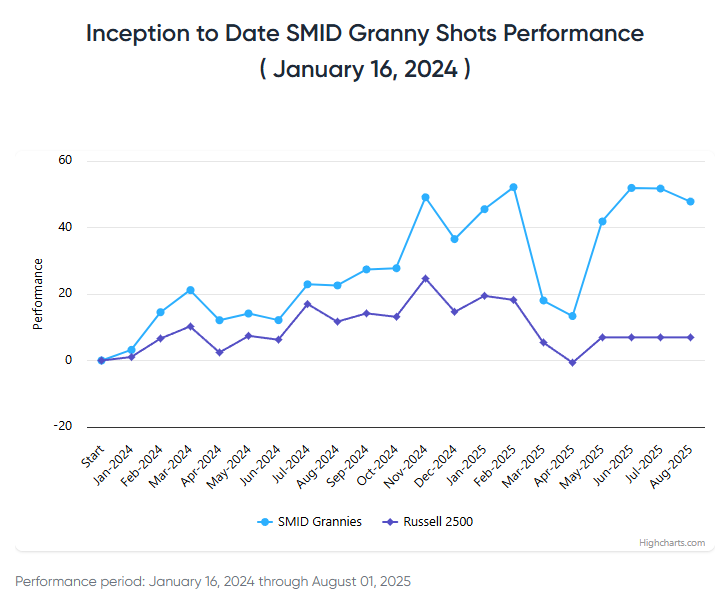

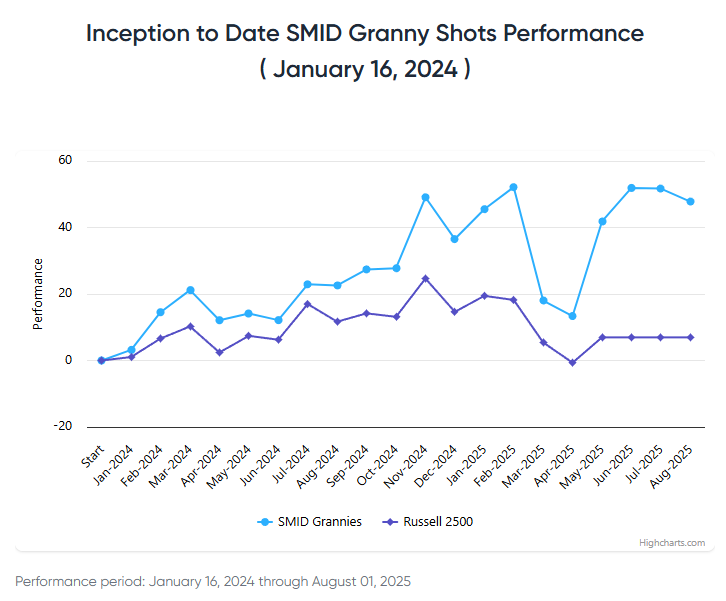

Stock List Performance

In the News

| More News Appearances |