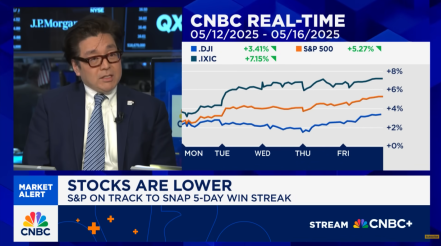

Last week, all eyes were on the inflation data. Headlines about CPI data, released Tuesday, refueled tariff-related worries from those already inclined to see them in the pipeline. Fundstrat Head of Research Tom Lee is still not one of them.

“I think inflation is falling like a rock underneath the noise that’s coming from tariffs,” he said. That’s not to say that tariffs won’t affect consumers, however. There is a likelihood that they will cause a one-time increase in prices. Nevertheless, “tariffs are actually a tax on companies,” and taxes typically do not cause inflation.

Although stocks pulled back after the CPI release, the hammering got a little quieter the next day when core PPI came in about as benign as it gets. As Lee noted, not only was it far lower than consensus expectations, it came in at “basically zero.” As a reminder, PPI measures wholesale inflation and thus is viewed as a leading indicator of CPI.

So to recap, consumer inflation is trending below expectations, while wholesale inflation is suggesting this will continue. Lee also notes that from July to October CPI readings will benefit from easier comparisons (relative to 2024). “Put together, these establish the conditions for a dovish Fed surprise in the second half of the year,” he said.

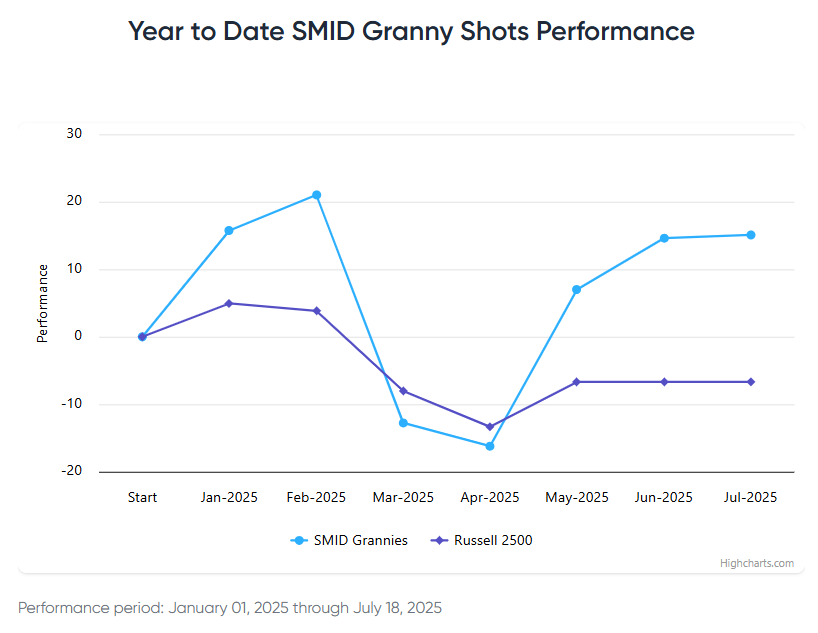

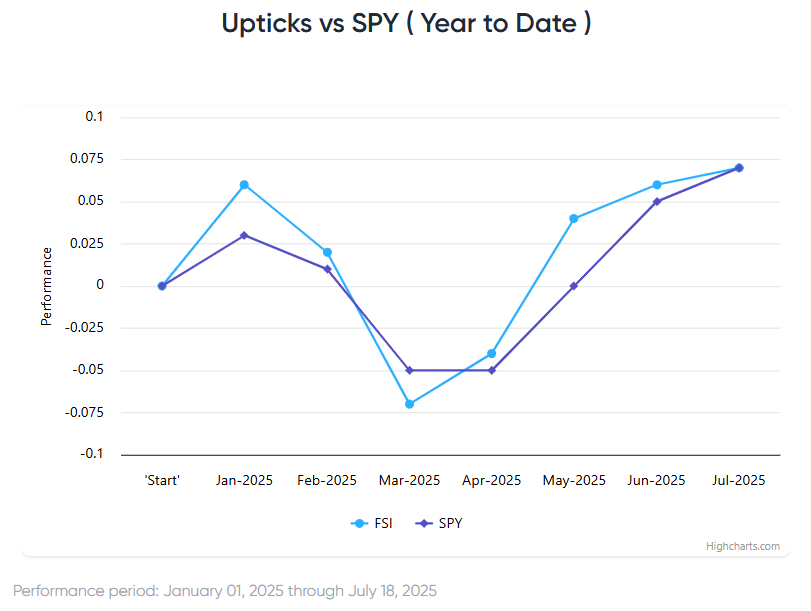

One likely beneficiary if that surprise materializes is small-caps, a sector Lee favors that has outperformed the broader S&P 500 for the past month or so. For Head of Technical Strategy Mark Newton, this move by small-caps is further evidence that the investment environment has changed. “The texture of the market has changed a bit in the last couple weeks versus what we saw back in April, May, June. We did see a nice broadening out in late June,” he told us at our weekly research huddle.

However, “something I’m watching,” Newton told us, “is the ratio of equal-weighted discretionary versus equal-weighted staples. If discretionary is outperforming strongly, that generally means the market is in pretty good shape. When it starts to roll over and staples start to outperform and discretionary, that’s when markets can start to lag.” So what does it look like now? “For right now, the ratio is still in good shape, trending up, and it looks like we’re going to push up into August,” he said. “Based on timing, it looks like we have about another three or four weeks of gains in this.”

Chart of the Week

To Fundstrat’s Tom Lee, the real story from last week’s macroeconomic data is that for the fifth straight month, “actual, delivered core CPI came in below consensus [as shown in our Chart of the Week]. That’s what I’d call a trend, right?” he asked rhetorically. The fact that core CPI readings are consistently coming in below expectations reinforces an observation Lee has been making for some time: “I think that fundamentally, there’s a lot of people who have inflation hammers and [thus] think everything is a nail.”

Recent ⚡ FlashInsights

FS Insight Video: Weekly Highlight

Key incoming data

7/15 8:30 AM ET: Jun Core CPI MoMTame7/15 8:30 AM ET: Jul Empire Manufacturing SurveyTame7/16 8:30 AM ET: Jun Core PPI MoMTame7/17 8:30 AM ET: Jul Philly Fed Business OutlookTame7/17 8:30 AM ET: Jun Retail SalesTame7/17 9:00 AM ET: Jul M Manheim Used Vehicle IndexTame7/17 10:00 AM ET: Jul NAHB Housing Market IndexTame7/17 4:00 PM ET: May Net TIC FlowsTame7/18 10:00 AM ET: Jul P U. Mich. 1yr Inf ExpTame- 7/22 10:00 AM ET: Jul Richmond Fed Manufacturing Survey

- 7/23 10:00 AM ET: Jun Existing Home Sales

- 7/24 8:30 AM ET: Jun Chicago Fed Nat Activity Index

- 7/24 9:45 AM ET: Jul P S&P Global Services PMI

- 7/24 9:45 AM ET: Jul P S&P Global Manufacturing PMI

- 7/24 10:00 AM ET: Jun New Home Sales

- 7/24 11:00 AM ET: Jul Kansas City Fed Manufacturing Survey

- 7/25 8:30 AM ET: Jun P Durable Goods Orders MoM

Stock List Performance

In the News

| More News Appearances |

- these figures improved to 4.4% YoY from 5.0% last month

- Dem respondent dropped from 9.3% to 7.7% and is main reason

Suggets consumers not viewing tariffs as driving a sustained rise in inflation. Overall, a decent data point