Wins for stocks start coming, and they don’t stop coming. The S&P 500 extended its record run this week, climbing another 1.7% to finish at a high of 6,279.35. The same euphoria catapulted the Nasdaq Composite to gain 1.6% to close at a record of 20,601.10.

None of it would have been possible without tech stocks once again leading the charge higher. Nvidia rose to another record, ticking up 1% this week. Apple rose 6.2%, lifted by reports that it may outsource AI development to power a new version of Siri—helping ease investor concerns over the company’s lagging AI strategy.

And bitcoin’s recent push to all-time highs may be signaling there’s more room to run. Fundstrat Head of Research Tom Lee views the cryptocurrency as a key leading indicator, and with its promising performance in mind, he reaffirmed his year-end target of 6,600 on the S&P 500.

On Wednesday, the ADP report painted a worrying picture about the labor market, showing a steep 33,000 decrease in private-sector employment in June. But these fears were erased by the June jobs report, which showed that the U.S. economy added 147,000 new jobs, well above expectations for a 110,000 gain. This stronger-than-expected number indicates continued labor market resilience.

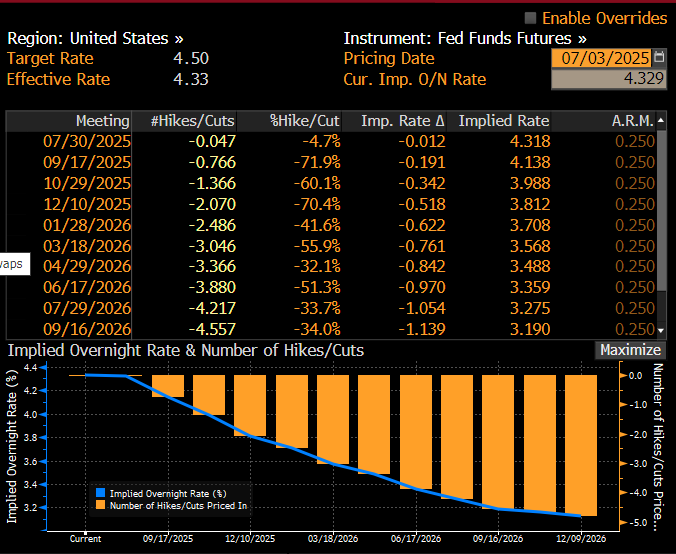

After the report, the small number of odds placed on a July rate cut mostly evaporated. This year, investors are wagering on slightly more than two cuts. The figure has been creeping up because the economy is showing signs of no longer being as hot and inflation is falling. Federal Reserve officials, however, anticipate making two cuts this year.

“The question, of course, is if the Fed is talking about two cuts and the market is pricing in a bit more, is the Fed behind the curve?” Lee said.

Head of Technical Strategy Mark Newton doesn’t expect to see much selling pressure in July and expects it to be a positive month because of seasonal behavior noted during the first year of a presidential term.

However, he added that there might be a few days of weakness, which will eventually lead to a sharp rally back to monthly highs in August.

“Investors should pay close attention if there appears to be some weakness in stocks that have gotten overbought and are now rolling over to violate ongoing uptrends. At present, I don’t suspect this will prove to affect all of technology. However, recent history suggests it’s wise to pay attention during this time,” Newton said.

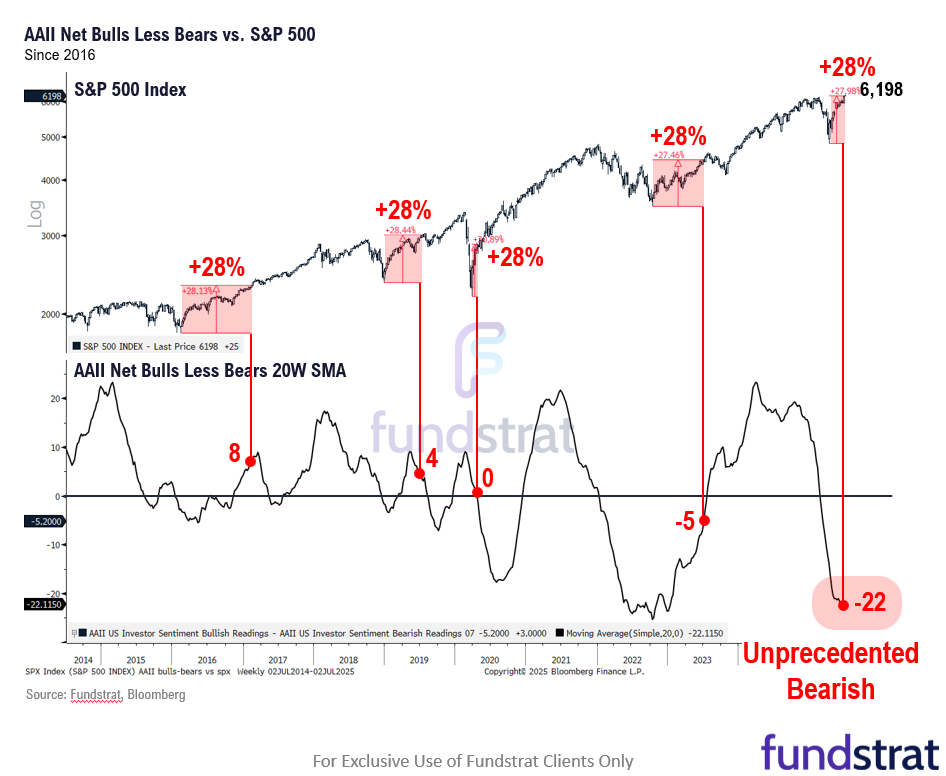

Chart of the Week

It seems like gone are the days when tariff worries dictated investors’ every move. The broad-based index has rebounded about 28% since the Liberation Day-driven April lows, but investors don’t trust it. A 20-day simple moving average of net bulls less bears remains down 22%, according to the latest American Association of Individual Investors survey. “If you look at 28% rallies, and we just had one since April lows, sentiment is usually a lot more positive, so you can see this is unprecedented,” said Fundstrat Head of Research Tom Lee in his Macro Minute videos. “This is the most-hated rally basically ever.”

Recent ⚡ FlashInsights

FS Insight Video: Weekly Highlight

Key incoming data

7/1 9:45 AM ET: Jun F S&P Global Manufacturing PMITame- 7/

1 10:00 AM ET: May JOLTS Job OpeningsMixed 7/1 10:00 AM ET: Jun ISM Manufacturing PMITame7/3 8:30 AM ET: Jun Non-farm PayrollsMixed7/3 8:30 AM ET: May Trade BalanceTame7/3 9:45 AM ET: Jun F S&P Global Services PMITame7/3 10:00 AM ET: May F Durable Goods Orders MoMTame7/3 10:00 AM ET: Jun ISM Services PMITame- 7/8 6:00 AM ET: Jun Small Business Optimism Survey

- 7/8 9:00 AM ET: Jun F Manheim Used Vehicle Index

- 7/8 11:00 AM ET: Jun NYFed 1yr Inf Exp

- 7/9 2:00 PM ET: Jun FOMC Meeting Minutes

- 7/15 8:30 AM ET: Jun Core CPI MoM

- 7/15 8:30 AM ET: Jul Empire Manufacturing Survey

- 7/16 8:30 AM ET: Jun Core PPI MoM

- 7/17 8:30 AM ET: Jul Philly Fed Business Outlook

- 7/17 8:30 AM ET: Jun Retail Sales

- 7/17 9:00 AM ET: Jul M Manheim Used Vehicle Index

- 7/17 10:00 AM ET: Jul NAHB Housing Market Index

- 7/17 4:00 PM ET: May Net TIC Flows

- 7/18 10:00 AM ET: Jul P U. Mich. 1yr Inf Exp

- 7/22 10:00 AM ET: Jul Richmond Fed Manufacturing Survey

- 7/23 10:00 AM ET: Jun Existing Home Sales

- 7/24 8:30 AM ET: Jun Chicago Fed Nat Activity Index

- 7/24 9:45 AM ET: Jul P S&P Global Services PMI

- 7/24 9:45 AM ET: Jul P S&P Global Manufacturing PMI

- 7/24 10:00 AM ET: Jun New Home Sales

- 7/24 11:00 AM ET: Jul Kansas City Fed Manufacturing Survey

- 7/25 8:30 AM ET: Jun P Durable Goods Orders MoM

- 7/28 10:30 AM ET: Jul Dallas Fed Manuf. Activity Survey

- 7/29 9:00 AM ET: May S&P CS home price 20-City MoM

- 7/29 10:00 AM ET: Jul Conference Board Consumer Confidence

- 7/29 10:00 AM ET: Jun JOLTS Job Openings

- 7/30 8:30 AM ET: 2Q A GDP QoQ

- 7/30 2:00 PM ET: Jul FOMC Decision

- 7/31 8:30 AM ET: Jun Core PCE MoM

- 7/31 8:30 AM ET: 2Q ECI QoQ

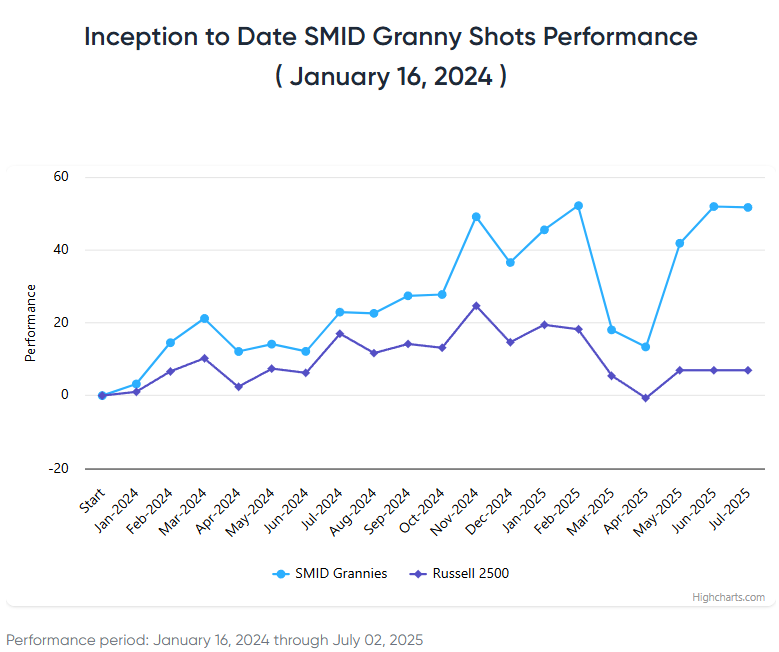

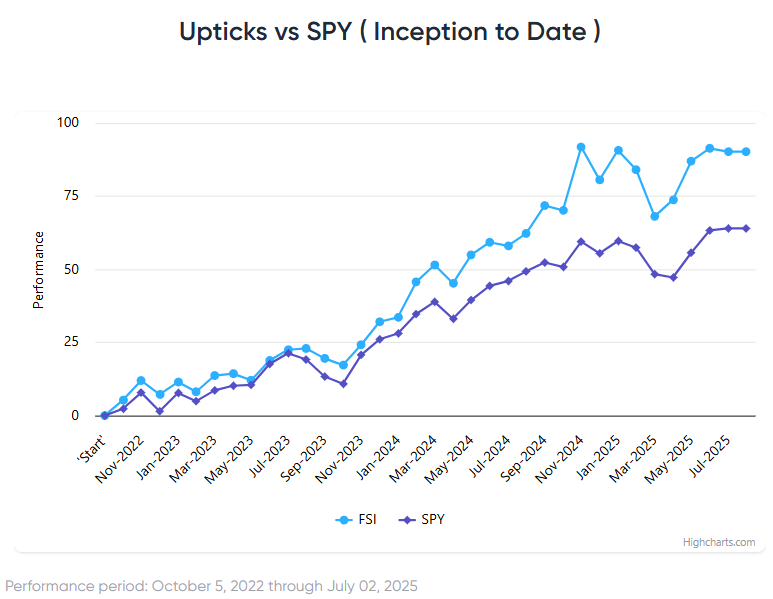

Stock List Performance

In the News

| More News Appearances |