Stocks lost momentum after Middle East tensions flared up Friday, reversing gains from earlier in the week. The S&P 500 tumbled 0.4% this week, with seven of the 11 sectors declining. The slide was led by the financials and industrials sectors, down 2.6% and 1.6%, respectively.

The index’s loss would be bigger if not for the energy sector’s 5.7% gain this week, the largest outperformer. Oil prices were steadily jumping higher all week long due to worries about rising tensions in the Middle East. Those fears came true Thursday night when Israel launched a series of airstrikes against Iran, rattling global markets the next trading day. A prolonged conflict could disrupt key oil infrastructure in the region.

On Friday, investors retreated from risky assets. Haven asset gold rallied 3.2% while Bitcoin fell 0.7%. Wall Street’s fear gauge, VIX, spiked 4.4% to 18, signaling rising anxiety.

On the other hand, tech stocks, which have led the S&P 500’s recovery since the April 8 low, took a breather this week. The information technology sector—home to the likes of Apple and Nvidia—and communication-services sector—which includes Alphabet and Meta Platforms—fell less than 0.1% and 0.8%, respectively, this week.

Fundstrat Head of Technical Strategy Mark Newton said he doesn’t make too much of tech’s recent pause. “Tech is hitting a brick wall. They’re likely tired after this fast move up so they need to do some backing and filling, but there’s no new structural change,” he said. Given their outsized weight in the major indexes, tech stocks play a crucial role in driving the direction of the broader market.

Even with the latest worries, Head of Research Tom Lee believes that stocks continue to be “bid up every day.” He added that, “We have long written that war events have human consequences, and of course, dominate headlines. But they have a little impact on equity markets, medium and long term.” The S&P 500 remains 2.7% off from all-time highs.

“I still get questions from clients saying, ‘Tom, when are you going to turn bearish?’ It comes up on every Zoom [call],” said Lee in one of his Macro Minute videos. “But to me, that’s a contrarian bullish signal because when people think that they’re looking for top, that means they’re not positioned positively.”

CPI and PPI reports released during the week further solidified hopes that inflation is slowing down and moving down toward the Federal Reserve’s target of 2%. “Inflation is falling like a rock, and that’s the real signal. Tariffs are somewhat auxiliary to that,” Lee said.

Newton remains optimistic about this summer. He had initially thought that June would be the pivotal month where we see some big moves, but now it looks like that has been pushed out to July.

“The rally is still intact and ongoing,” he said.

Chart of the Week

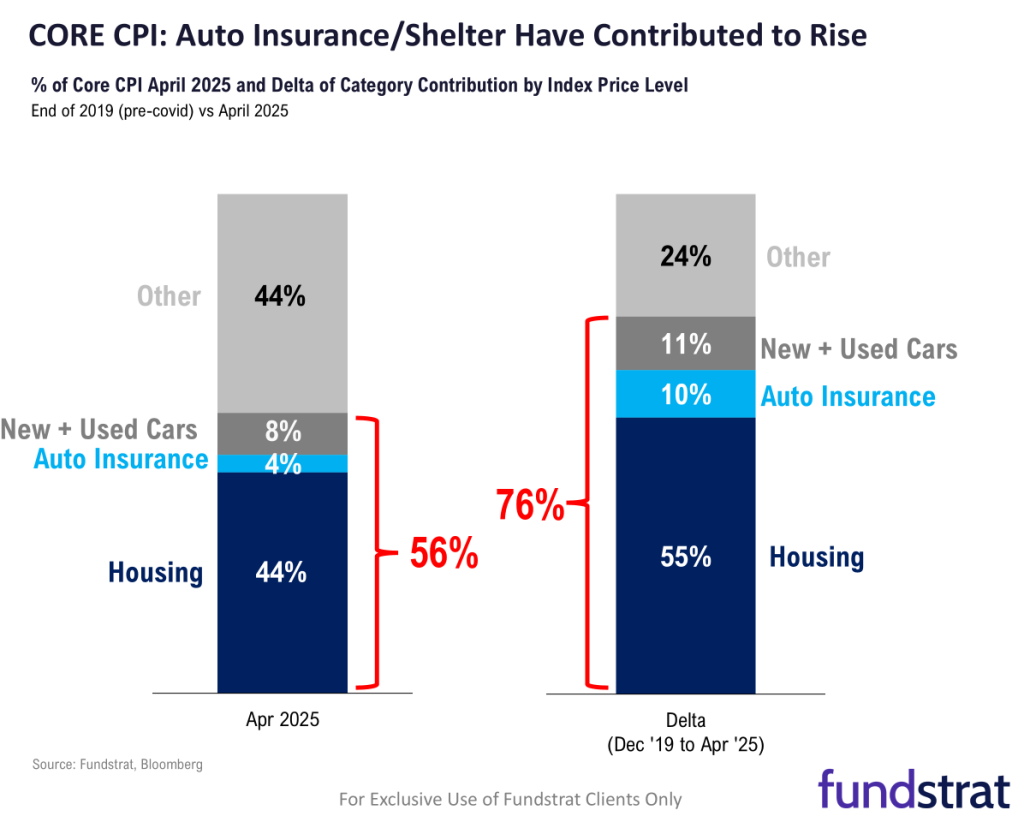

On Wednesday, the consumer-price index’s headline inflation for May edged 0.1% higher from a month ago and 2.4% from a year ago. Core CPI—which excludes the volatile food and energy components—rose 0.1% from a month ago and 2.8% from a year ago. The biggest decline was led by housing, without which there’d be negative inflation for the month, Fundstrat Head of Research Tom Lee said. In the index, housing contributes to 55% of inflation, while housing and auto-services together compose 76% of the index. “If shelter is cooling, the market is going to conclude that inflation is cooling,” Lee said.

Recent ⚡ FlashInsights

FS Insight Video: Weekly Highlight

Key incoming data

6/2 9:45 AM ET: May F S&P Global Manufacturing PMITame6/2 10:00 AM ET: May ISM Manufacturing PMITame6/3 10:00 AM ET: Apr JOLTS Job OpeningsTame6/3 10:00 AM ET: Apr F Durable Goods Orders MoMTame6/4 9:45 AM ET: May F S&P Global Services PMITame6/4 10:00 AM ET: May ISM Services PMITame6/4 2:00 PM ET: Jan Fed Releases Beige BookMixed6/5 8:30 AM ET: 1Q F Unit Labor CostsTame6/5 8:30 AM ET: 1Q F Nonfarm Productivity QoQTame6/5 8:30 AM ET: Apr Trade BalanceTame6/6 8:30 AM ET: May Non-farm PayrollsTame6/6 9:00 AM ET: May F Manheim Used Vehicle IndexTame6/9 11:00 AM ET: May NYFed 1yr Inf ExpTame6/10 6:00 AM ET: May Small Business Optimism SurveyTame6/11 8:30 AM ET: May Core CPI MoMTame- 6

/12 8:30 AM ET: May Core PPI MoMTame 6/13 10:00 AM ET: Jun P U. Mich. 1yr Inf ExpTame- 6/16 8:30 AM ET: Jun Empire Manufacturing Survey

- 6/17 8:30 AM ET: May Retail Sales

- 6/17 10:00 AM ET: Jun NAHB Housing Market Index

- 6/18 9:00 AM ET: Jun M Manheim Used Vehicle Index

- 6/18 2:00 PM ET: Jun FOMC Decision

- 6/18 4:00 PM ET: Apr Net TIC Flows

- 6/20 8:30 AM ET: Jun Philly Fed Business Outlook

- 6/23 9:45 AM ET: Jun P S&P Global Services PMI

- 6/23 9:45 AM ET: Jun P S&P Global Manufacturing PMI

- 6/23 10:00 AM ET: May Existing Home Sales

- 6/24 9:00 AM ET: Apr S&P CS home price 20-City MoM

- 6/24 10:00 AM ET: Jun Conference Board Consumer Confidence

- 6/24 10:00 AM ET: Jun Richmond Fed Manufacturing Survey

- 6/25 10:00 AM ET: May New Home Sales

- 6/26 8:30 AM ET: May P Durable Goods Orders MoM

- 6/26 8:30 AM ET: May Chicago Fed Nat Activity Index

- 6/26 8:30 AM ET: 1Q T GDP QoQ

- 6/26 11:00 AM ET: Jun Kansas City Fed Manufacturing Survey

- 6/27 8:30 AM ET: May Core PCE MoM

- 6/27 10:00 AM ET: Jun F U. Mich. 1yr Inf Exp

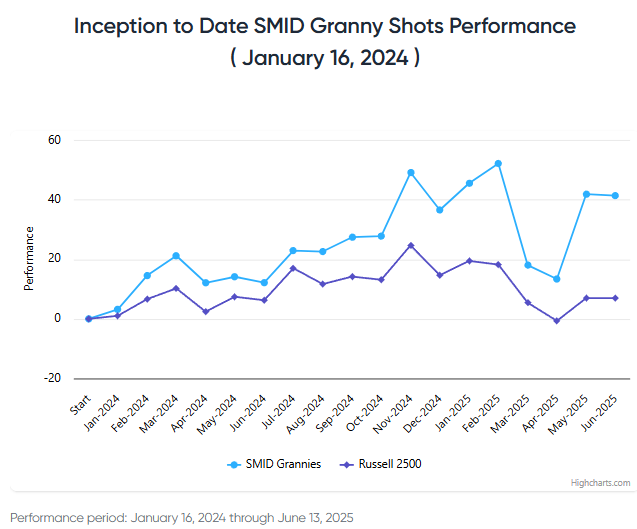

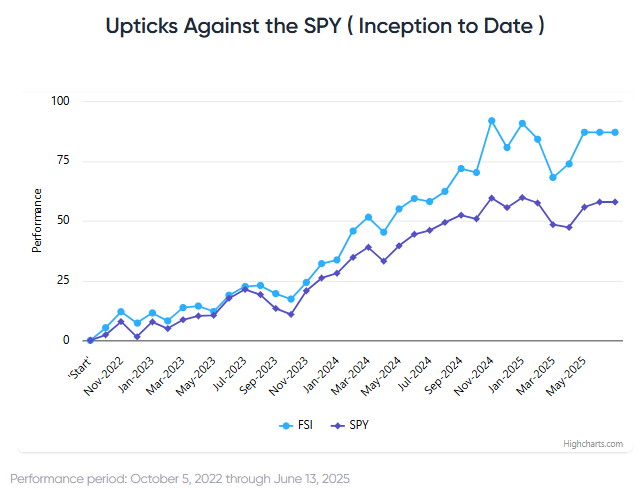

Stock List Performance

In the News

| More News Appearances |