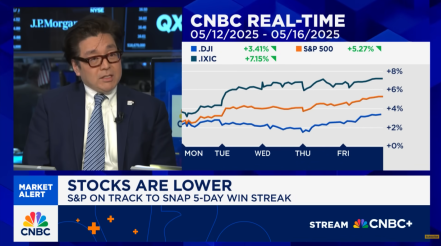

Stocks burst out of the gate to start June, building on gains from the prior month.

The S&P added 1.5% this month and crossed the key level of 6,000, while the Nasdaq Composite gained 2.2%. Losers from earlier this year—semiconductor stocks—were responsible for the latest advance. Other than the usual stars like Nvidia and Advanced Micro Devices, another chip company re-joined the ranks: Broadcom, whose shares increased 2%.

The broad-based index is up 2% this year and off just 2.3% from all-time highs, even as many investors argue that the rally has no legs because there’s been little-to-no tariffs resolution and worries about a ballooning U.S. budget deficit haven’t gone away. Despite that, stocks are mounting a rebound.

The ADP jobs report on Wednesday, which focuses on private-sector job creation, hit its lowest level in May in more than two years, prompting calls from President Donald Trump to lower interest rates.

“I don’t think that’s entirely bad news because if we have a weak employment report, I do think it sets the stage for the Fed to be more dovish,” Head of Research Tom Lee said.

The jobs report Friday showed a different picture, showing that the U.S. economy added 139,000 jobs in May, above the 125,000 expected by economists but below the revised April jobs number of 147,000. Stocks rallied sharply in response, but Treasury yields shot up.

The headlines this week were dominated by Tesla Chief Executive and former DOGE lead Elon Musk, who called Trump’s One Big Beautiful Bill a “disgusting abomination,” setting off a public spat between the two former friends.

In response, Trump said, “I don’t know if we will have a great relationship with Elon anymore.”

Head of Technical Strategy Newton expects that the S&P 500 will make a run for 6,100-6,140.

“Momentum is really starting to cross over, so even if we stall here and have some churning, my expectation is still for an eventual push up into the month of August,” he said. “The next couple of months are going to be very, very good.”

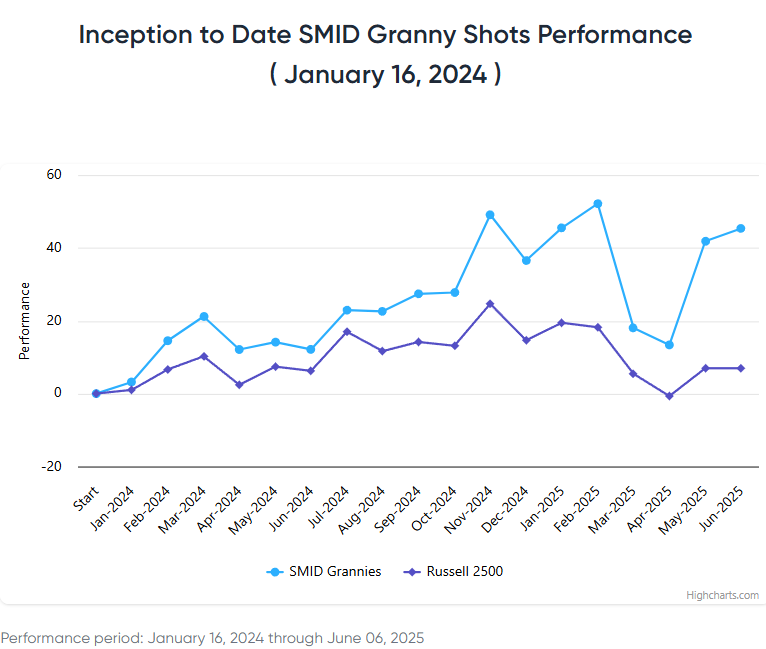

He noted the recent rally in small-cap stocks, which have gained 21% since the April 8 low, slightly outperforming the S&P 500’s 20% gain.

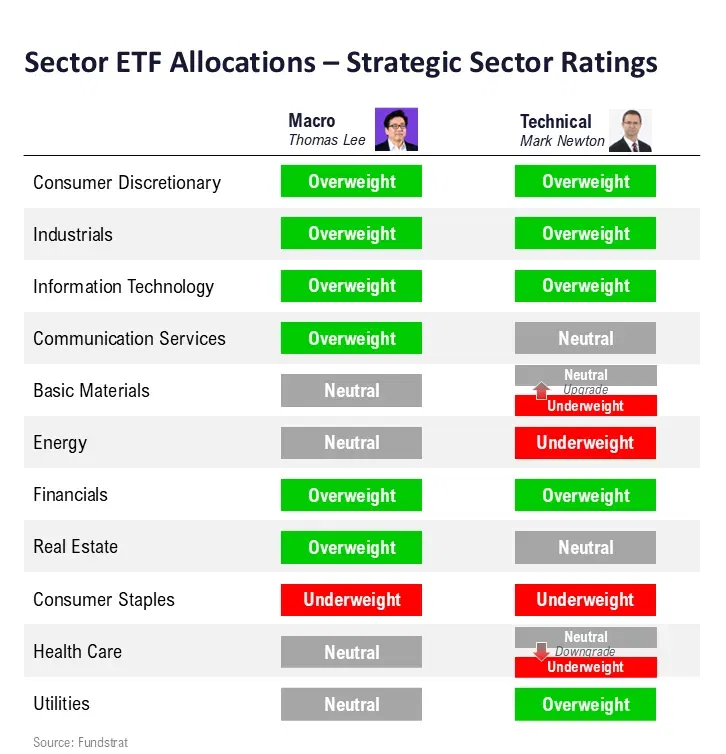

Sector Allocation Strategy

These are the latest strategic sector ratings from Head of Research Tom Lee and Head of Technical Strategy Mark Newton – part of the June 2025 update to the FSI Sector Allocation Strategy. FS Insight Macro and Pro subscribers can click here for ETF recommendations, precise guidance on strategic and tactical weightings, detailed commentary, and methodology.

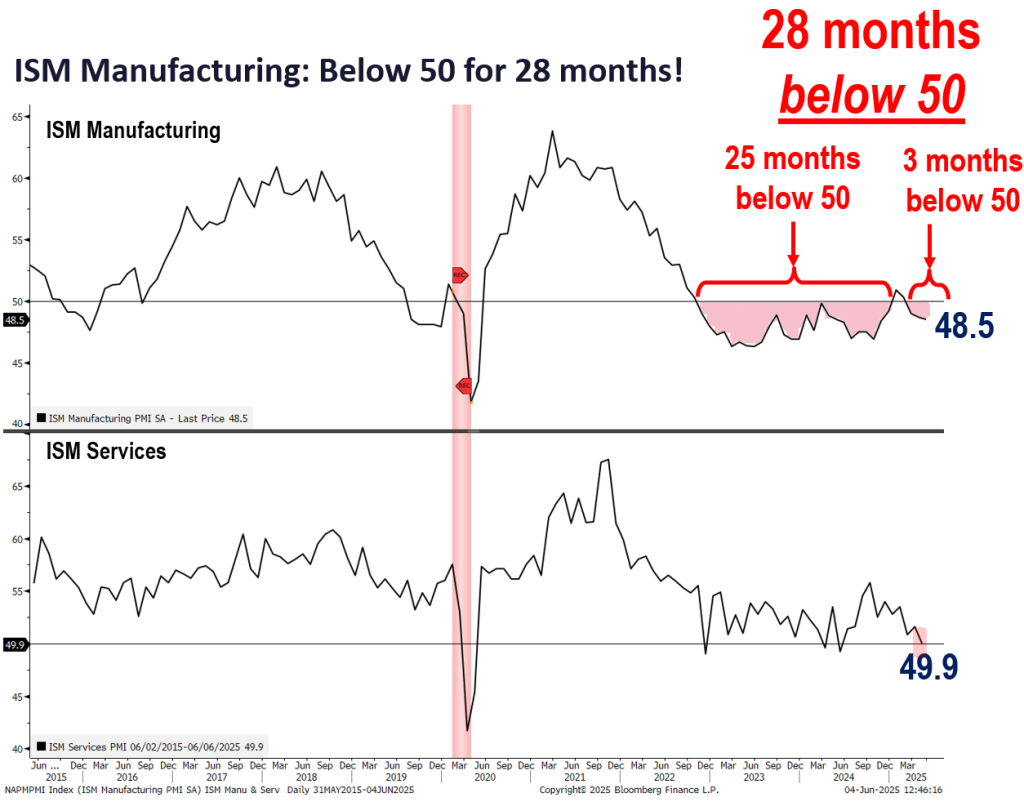

Chart of the Week

Fundstrat Head of Research Tom Lee says that, to him, the current rally resembles an early bull market. He expects the gains to continue, partly because the Institute for Supply Management’s purchasing managers’ index of manufacturing activity (PMI) has come in below 50, indicating a contractionary economy, for many months. The latest release showed the index fell to 48.5 in May from 48.7 in April. “I don’t think the S&P 500 has peaked until the ISM has moved above 50,” Lee said during his Macro Minute videos. “Conditions remain in place for what would be a face ripper, especially as we cross to all-time highs.”

Recent ⚡ FlashInsights

FS Insight Video: Weekly Highlight

Key incoming data

6/2 9:45 AM ET: May F S&P Global Manufacturing PMITame6/2 10:00 AM ET: May ISM Manufacturing PMITame6/3 10:00 AM ET: Apr JOLTS Job OpeningsTame6/3 10:00 AM ET: Apr F Durable Goods Orders MoMTame6/4 9:45 AM ET: May F S&P Global Services PMITame6/4 10:00 AM ET: May ISM Services PMITame6/4 2:00 PM ET: Jan Fed Releases Beige BookMixed6/5 8:30 AM ET: 1Q F Unit Labor CostsTame6/5 8:30 AM ET: 1Q F Nonfarm Productivity QoQTame6/5 8:30 AM ET: Apr Trade BalanceTame6/6 8:30 AM ET: May Non-farm PayrollsTame6/6 9:00 AM ET: May F Manheim Used Vehicle IndexTame- 6/9 11:00 AM ET: May NYFed 1yr Inf Exp

- 6/10 6:00 AM ET: May Small Business Optimism Survey

- 6/11 8:30 AM ET: May Core CPI MoM

- 6/12 8:30 AM ET: May Core PPI MoM

- 6/13 10:00 AM ET: Jun P U. Mich. 1yr Inf Exp

- 6/16 8:30 AM ET: Jun Empire Manufacturing Survey

- 6/17 8:30 AM ET: May Retail Sales

- 6/17 10:00 AM ET: Jun NAHB Housing Market Index

- 6/18 9:00 AM ET: Jun M Manheim Used Vehicle Index

- 6/18 2:00 PM ET: Jun FOMC Decision

- 6/18 4:00 PM ET: Apr Net TIC Flows

- 6/20 8:30 AM ET: Jun Philly Fed Business Outlook

- 6/23 9:45 AM ET: Jun P S&P Global Services PMI

- 6/23 9:45 AM ET: Jun P S&P Global Manufacturing PMI

- 6/23 10:00 AM ET: May Existing Home Sales

- 6/24 9:00 AM ET: Apr S&P CS home price 20-City MoM

- 6/24 10:00 AM ET: Jun Conference Board Consumer Confidence

- 6/24 10:00 AM ET: Jun Richmond Fed Manufacturing Survey

- 6/25 10:00 AM ET: May New Home Sales

- 6/26 8:30 AM ET: May P Durable Goods Orders MoM

- 6/26 8:30 AM ET: May Chicago Fed Nat Activity Index

- 6/26 8:30 AM ET: 1Q T GDP QoQ

- 6/26 11:00 AM ET: Jun Kansas City Fed Manufacturing Survey

- 6/27 8:30 AM ET: May Core PCE MoM

- 6/27 10:00 AM ET: Jun F U. Mich. 1yr Inf Exp

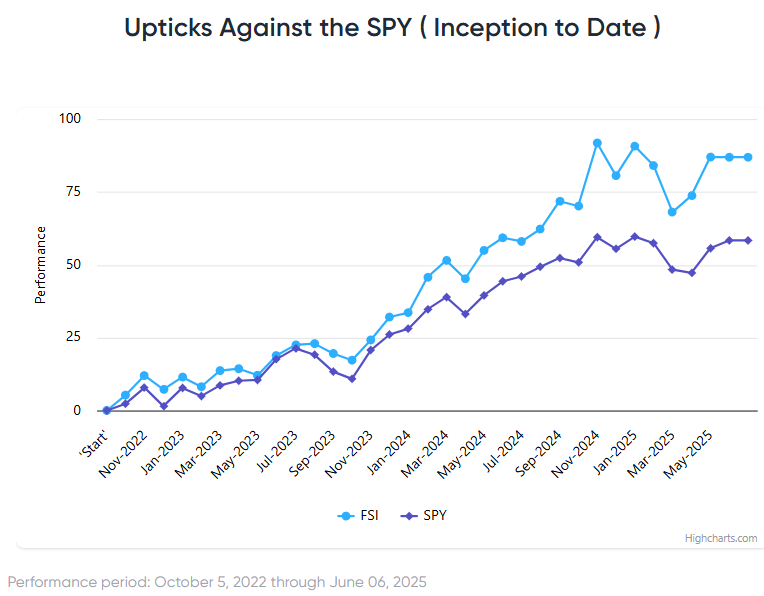

Stock List Performance

In the News

| More News Appearances |