Despite lackluster trading activity on the last trading day of May, it was a good week and a good month for stocks. The S&P 500 closed the month of May up nearly 4%, while the Nasdaq gained 6.36% for the month. This month also saw Bitcoin hit new all-time highs of USD $111,681 on May 22.

While that last part was obviously welcome news for BTC investors, it was a good signal for the equities market as well. As Fundstrat Head of Digital Asset Strategy Sean Farrell noted, “Bitcoin being further out on the risk curve than other asset classes means that it often moves first.”

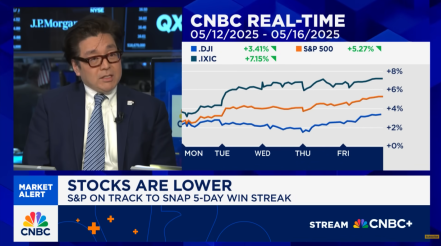

Fundstrat Head of Research Tom Lee concurs. “We view Bitcoin as a leading indicator and thus, we expect stocks to reattain all time highs, which Bitcoin achieved last week.” he wrote. For those curious about Lee’s longer-term outlook, he reaffirmed the year-end target he forecast for the S&P 500 in December 2024: “We see S&P 500 reaching 6,600 by year-end,” he reiterated.

On Wednesday evening, the U.S. Court of International Trade ruled against the Trump administration, ruling that Trump exceeded the presidential authority granted by the International Economic Emergency Powers Act (IEEPA) to unilaterally impose tariffs in April. Another federal court in Washington, D.C. issued a similar ruling shortly thereafter, and an appellate court then imposed a stay, temporarily reinstating the tariffs pending White House appeal.

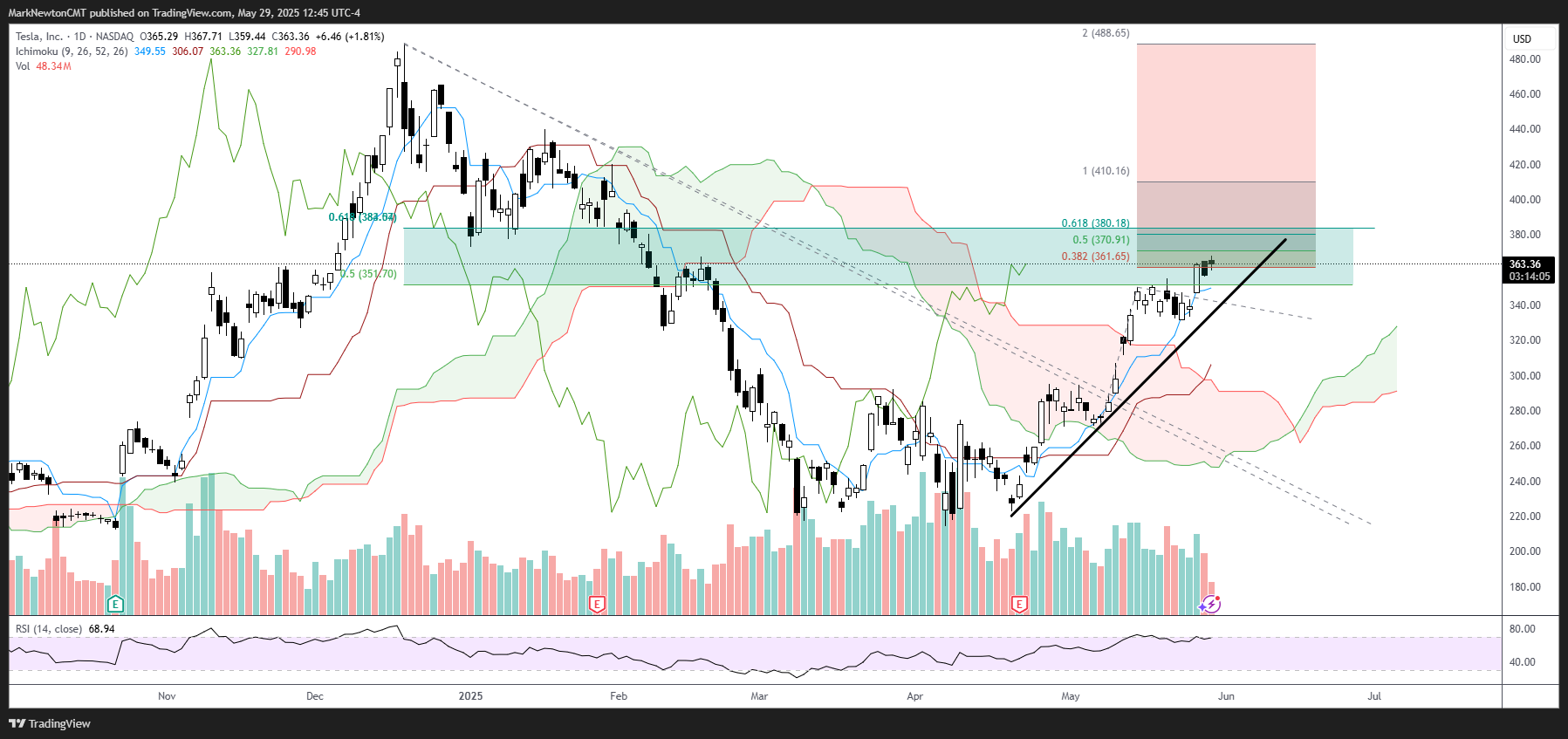

At the Fundstrat weekly research huddle, more than one team member was skeptical that this would be the end of tariffs. Head of Technical Strategy Mark Newton said, “I don’t think this whole tariff rollback is really going to amount to anything,” he said. “I know this issue obviously is important, but in my view, [tariffs do not] affect markets to the extent people think.”

A number of legal experts have noted that the White House can still proceed with other ways to implement tariffs even if he loses this court battle. Lee views that as less relevant for investors. “To me, this is not the central point,” he said. “The White House is arguably losing leverage on these negotiations, which suggests to us the White House is looking for an ‘off ramp.’ This is a positive for stocks,” he told us.

Chart of the Week

This week, Nvidia reported quarterly results that beat on both top and bottom lines while reaffirming the AI thesis. As shown in our Chart of the Week, Fundstrat’s Tom Lee views Nvidia and Apple as important stocks to watch. He remains constructive on the Mag Seven stocks. Ahead of Nvidia’s earnings, Mark Newton had remarked on the stock’s recent comeback, viewing its moves as supportive of the semiconductor industry in general. Yet, he suggested that “maybe you get another 10 points [to around 153], but Nvidia is probably going to stall for a little bit.” That doesn’t change his long-term constructivism on the company and tech in general: “I still like tech. I think it’s a great sector,” he told us.

Recent ⚡ FlashInsights

FS Insight Video: Weekly Highlight

Key incoming data

5/27 8:30 AM ET: Apr P Durable Goods Orders MoMTame5/27 9:00 AM ET: Mar S&P CoreLogic CS home priceTame5/27 10:00 AM ET: May Conference Board Consumer ConfidenceTame5/27 10:30 AM ET: May Dallas Fed Manuf. Activity SurveyTame5/28 10:00 AM ET: May Richmond Fed Manufacturing SurveyTame5/28 2:00 PM ET: May FOMC Meeting MinutesMixed5/29 8:30 AM ET: 1Q S GDP QoQTame5/30 8:30 AM ET: Apr Core PCE Deflator MoMTame5/30 10:00 AM ET: May F U. Mich. Sentiment and Inflation ExpectationMixed- 6/2 9:45 AM ET: May F S&P Global Manufacturing PMI

- 6/2 10:00 AM ET: May ISM Manufacturing PMI

- 6/3 10:00 AM ET: Apr JOLTS Job Openings

- 6/3 10:00 AM ET: Apr F Durable Goods Orders MoM

- 6/4 9:45 AM ET: May F S&P Global Services PMI

- 6/4 10:00 AM ET: May ISM Services PMI

- 6/4 2:00 PM ET: Jan Fed Releases Beige Book

- 6/5 8:30 AM ET: 1Q F Unit Labor Costs

- 6/5 8:30 AM ET: 1Q F Nonfarm Productivity QoQ

- 6/5 8:30 AM ET: Apr Trade Balance

- 6/6 8:30 AM ET: May Non-farm Payrolls

- 6/6 9:00 AM ET: May F Manheim Used Vehicle Index

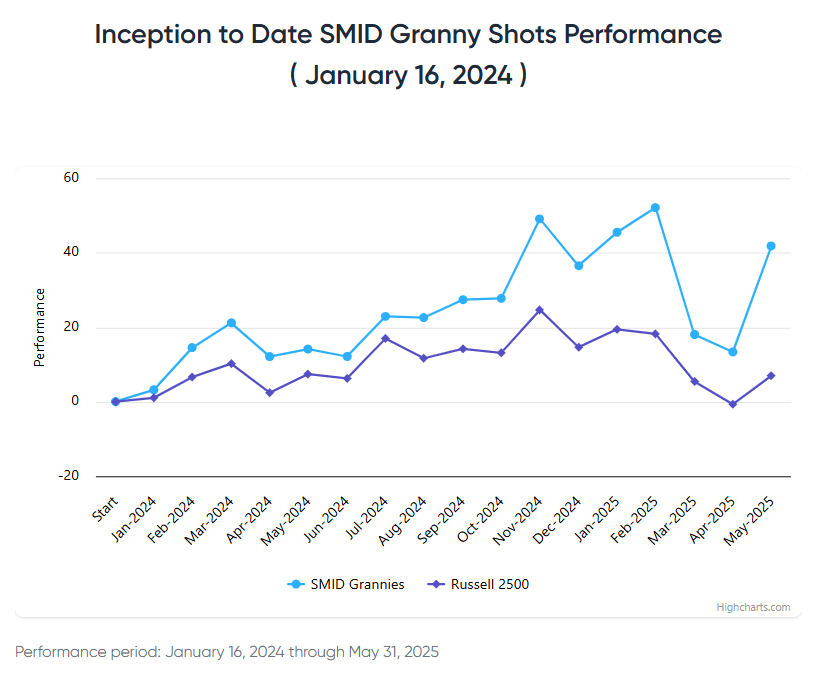

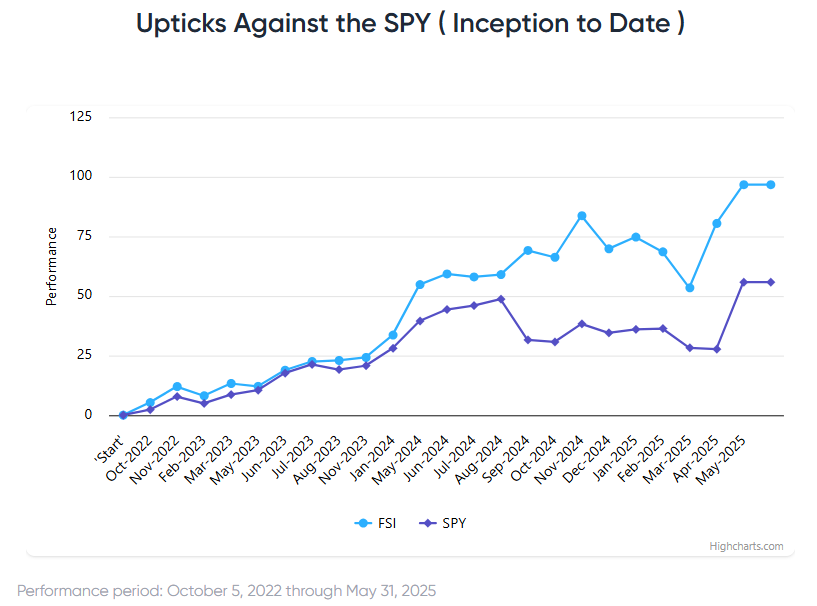

Stock List Performance

In the News

| More News Appearances |