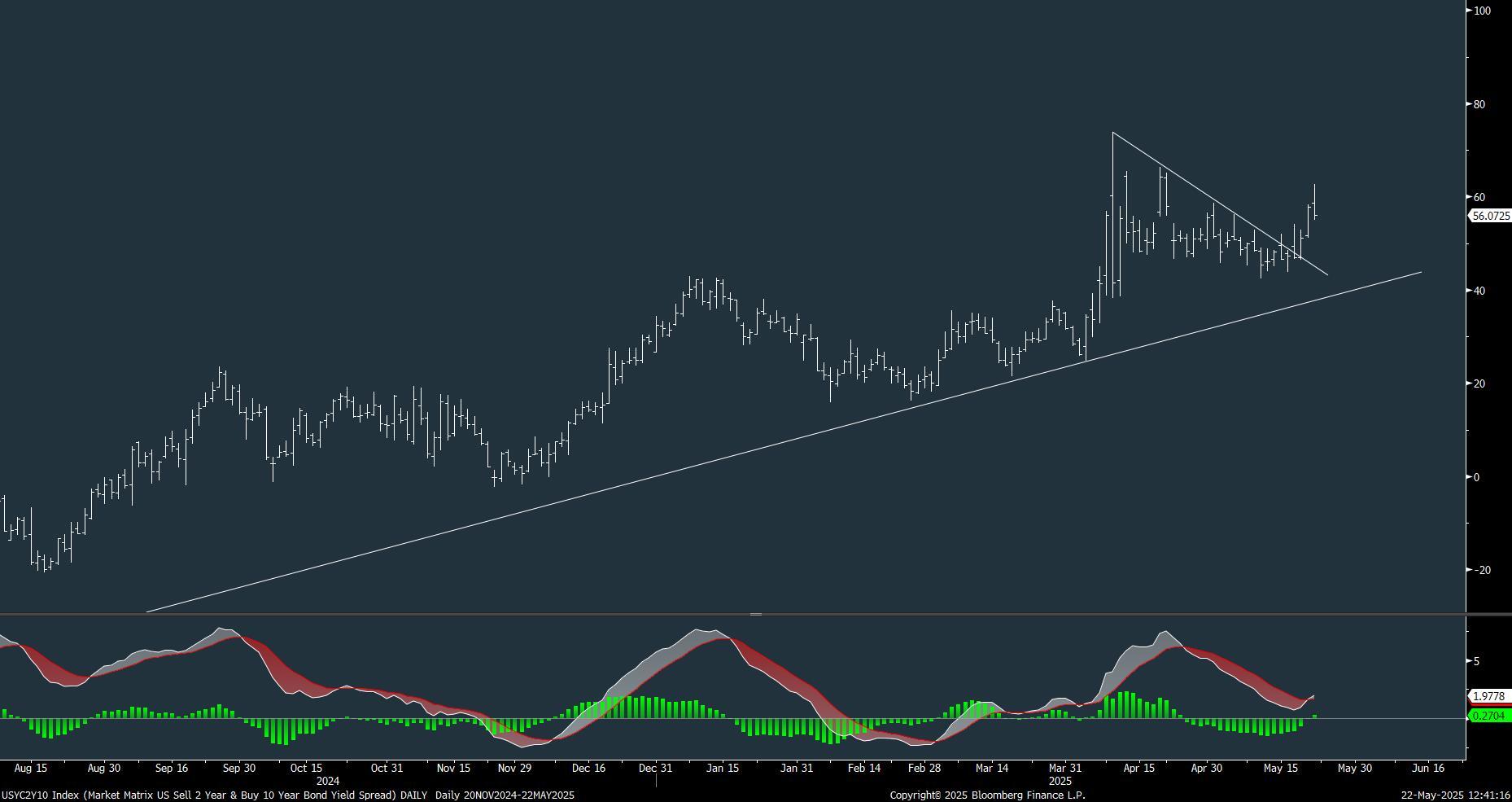

A weeklong rebound in stocks showed signs of a pause this week, dragged down after a punishing move higher in Treasury yields.

While investors largely shrugged off Moody’s downgrading U.S. debt earlier in the week, they couldn’t ignore a weak 20-year Treasurys auction, which sent stocks tumbling and longer-term yields surging higher. A bigger hit came Thursday when the House narrowly passed President Trump’s “one big, beautiful bill.” Investors are worried that the bill includes more tax cuts than spending decreases, which threatens to deepen the fiscal deficit by nearly $3 trillion through 2034 – instead of reining it in.

The 30-year Treasury yield hit over 5.041% this week, up from 4.575% a year ago. Meanwhile, the 10-year yield jumped to 4.518% compared to 4.470% a year ago.

That weighed on stocks, as higher yields reduce the value of companies’ future earnings. The S&P 500 logged a decline of 2.6%, while the Nasdaq Composite fell 2.5%.

“The market has weakened, as the overall narrative is now back to the worry about the U.S. deficit,” Fundstrat Head of Data Science Ken Xuan said during the weekly huddle. He didn’t find the auction to be particularly worrying.

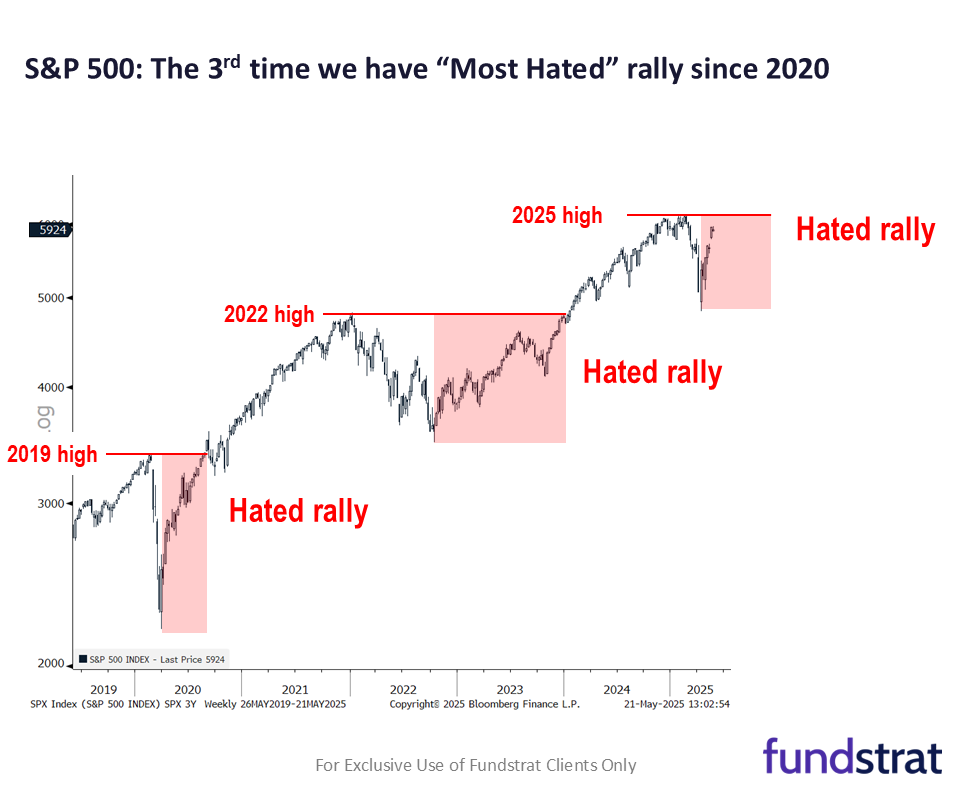

Head of Research Tom Lee remains positive about the big picture, focusing instead on how the S&P 500 is off 5.6% from its all-time highs.

“We’ve had a bull run since April, but nobody believes it,” he said in his Macro Minute videos. “Investors we speak to are still looking for reasons for stocks to fall and not reasons for upside.”

Head of Technical Strategy Mark Newton agrees, arguing that technically the market still looks to be in very good shape.

“We’ve seen some meaningful improvement in technical momentum and breadth and participation in technology, which has been helpful,” Newton said.

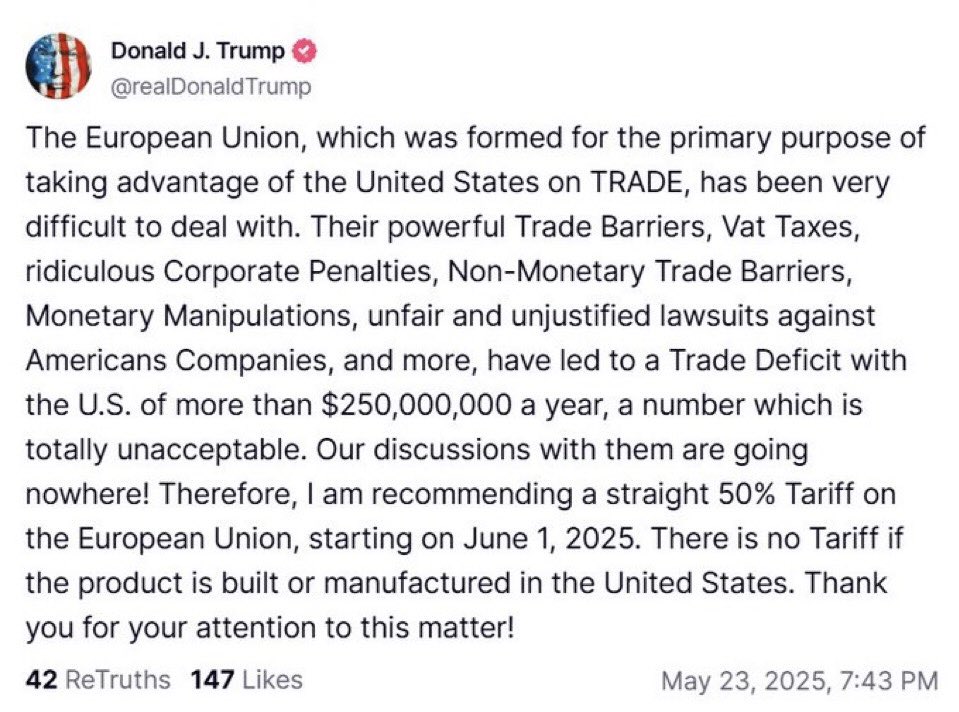

Stocks have swung wildly this year, with investors hanging onto President Donald Trump’s every word about tariffs. Though the tariffs turmoil had started to make way for some reprieve over the past two weeks, they made a reappearance Friday when the president warned of 50% tariffs on Europe from next month. He also took a stab at Apple, saying the iPhone maker will have to pay them. Apple shares fell 3% Friday.

Lee believes there’s “plenty of fuel” for stocks to reach new records because of two main reasons. First, bitcoin prices hit new highs this week, even as stocks fell. The cryptocurrency’s recent performance indicates that it’s a leading indicator for where stocks are headed. Second, investors are underweight U.S. stocks. As the market rallies, investors will be tempted to buy in, keeping the pullbacks shallow.

Chart of the Week

Head of Research Tom Lee said this is the third-most hated rally since 2020. The first one was during the brief Covid-19-driven sell-off. The second one came during 2022 when stocks marked a low in October. In order for the bears to turn into bulls, each time, he said, it required stocks to hit fresh all-time highs.

Recent ⚡ FlashInsights

- we saw scary headlines from April 2-April 15

- How many proved to be buying oppties?

- We believe this is the same situation

FS Insight Video: Weekly Highlight

Key incoming data

5/1 9:45 AM ET: Apr F S&P Global Manufacturing PMITame5/1 10:00 AM ET: Apr ISM Manufacturing PMITame5/2 8:30 AM ET: Apr Non-Farm PayrollsTame5/2 10:00 AM ET: Mar F Durable Goods Orders MoMTame5/5 9:45 AM ET: Apr F S&P Global Services PMITame5/5 10:00 AM ET: Apr ISM Services PMITame5/6 8:30 AM ET: Mar Trade BalanceTame5/7 9:00 AM ET: Apr F Manheim Used Vehicle IndexHot5/7 2:00 PM ET: May FOMC DecisionMixed5/8 8:30 AM ET: 1Q P Unit Labor CostsTame5/8 8:30 AM ET: 1Q P Non-Farm Productivity QoQTame5/8 11:00 AM ET: Apr NY Fed 1yr Inf ExpMixed5/13 6:00 AM ET: Apr Small Business Optimism SurveyTame5/13 8:30 AM ET: Apr Core CPI MoMTame5/15 8:30 AM ET: May Philly Fed Business OutlookTame5/15 8:30 AM ET: Apr Core PPI MoMTame5/15 8:30 AM ET: May Empire Manufacturing SurveyTame5/15 8:30 AM ET: Apr Retail SalesTame5/15 10:00 AM ET: May NAHB Housing Market IndexTame5/16 10:00 AM ET: May P U. Mich. Sentiment and Inflation ExpectationHot5/16 4:00 PM ET: Mar Net TIC FlowsTame5/19 9:00 AM ET: May M Manheim Used Vehicle IndexTame5/22 8:30 AM ET: Apr Chicago Fed Nat Activity IndexTame5/22 9:45 AM ET: May P S&P Global Services PMITame5/22 9:45 AM ET: May P S&P Global Manufacturing PMITame5/22 10:00 AM ET: Apr Existing Home SalesTame5/22 11:00 AM ET: May Kansas City Fed Manufacturing SurveyTame5/23 10:00 AM ET: Apr New Home SalesHot- 5/27 8:30 AM ET: Apr P Durable Goods Orders MoM

- 5/27 9:00 AM ET: Mar S&P CoreLogic CS home price

- 5/27 10:00 AM ET: May Conference Board Consumer Confidence

- 5/27 10:30 AM ET: May Dallas Fed Manuf. Activity Survey

- 5/28 10:00 AM ET: May Richmond Fed Manufacturing Survey

- 5/28 2:00 PM ET: May FOMC Meeting Minutes

- 5/29 8:30 AM ET: 1Q S GDP QoQ

- 5/30 8:30 AM ET: Apr Core PCE Deflator MoM

- 5/30 10:00 AM ET: May F U. Mich. Sentiment and Inflation Expectation

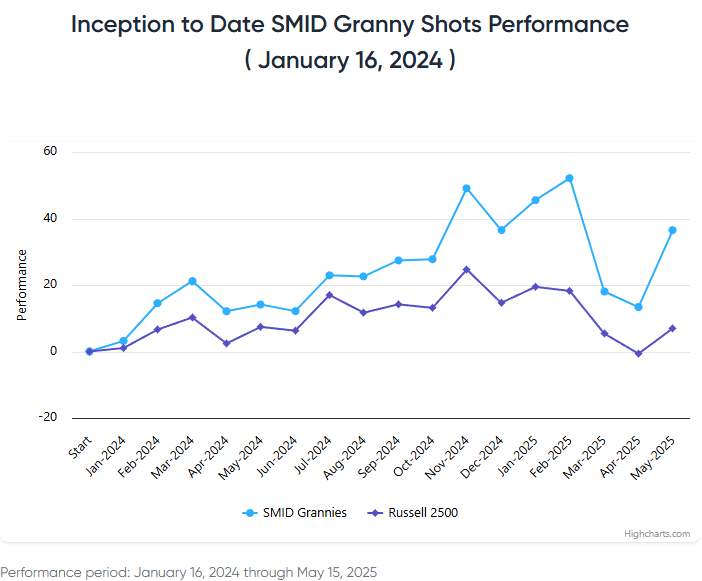

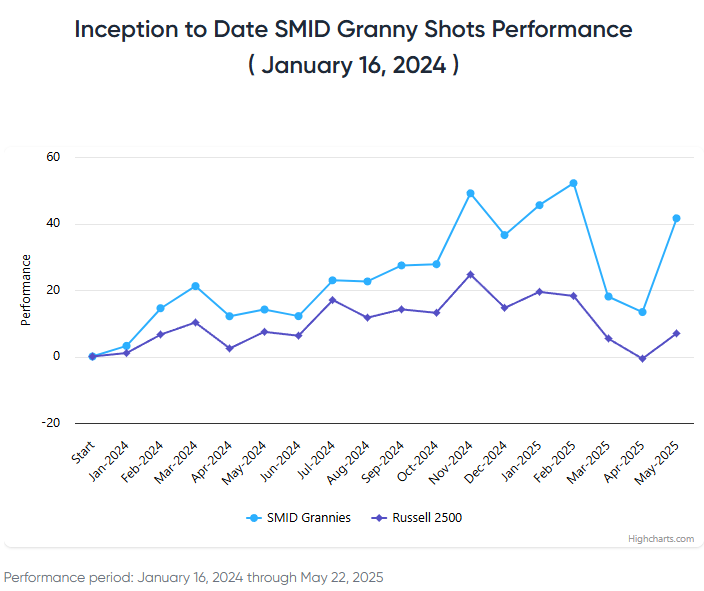

Stock List Performance

In the News

| Start Your 30-Day Free Trial Now! More News Appearances |