This week could have hardly gone any better for stocks.

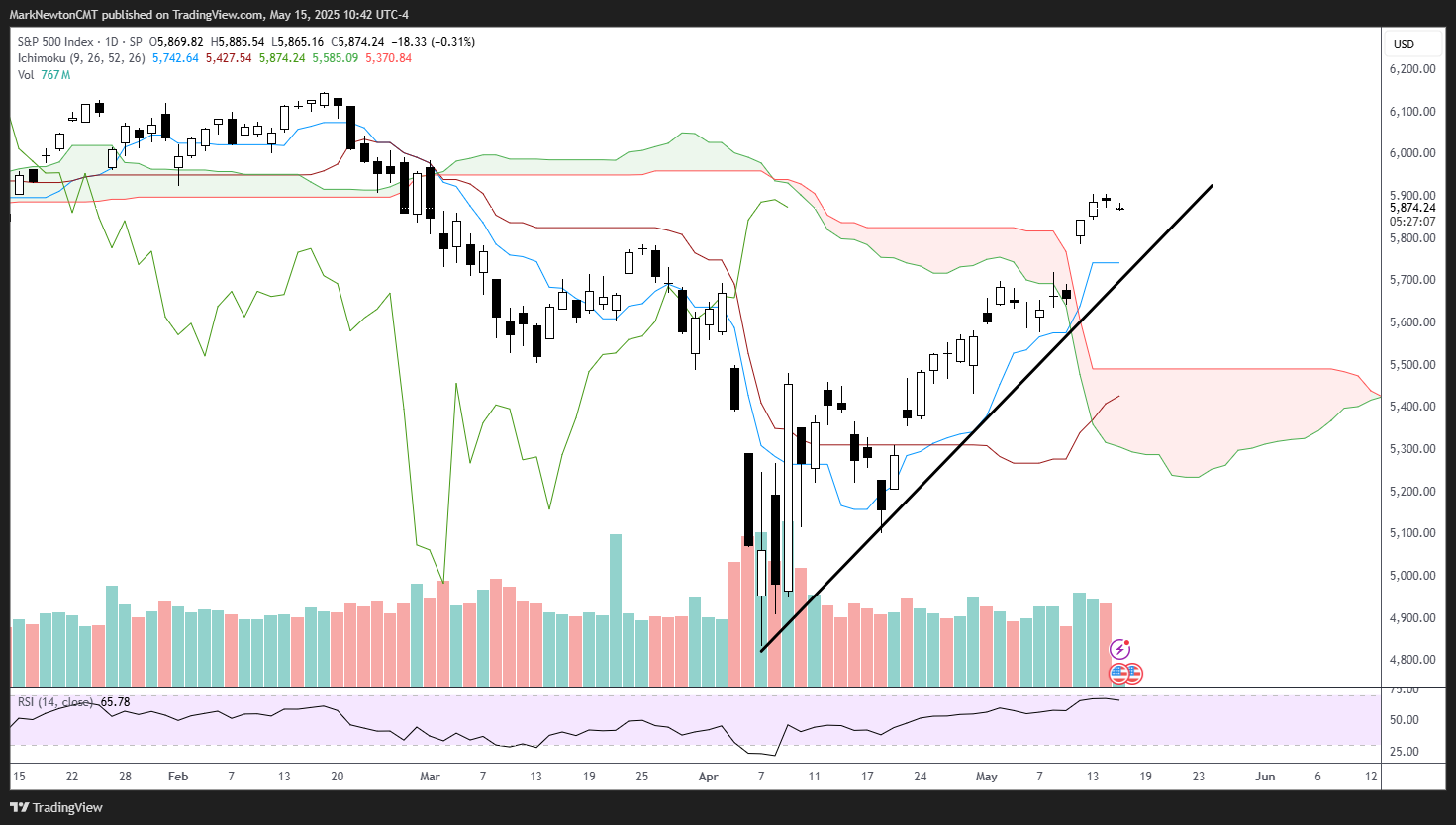

Investors got some much-awaited relief on the U.S.-China trade deal front, helping the S&P 500 erase losses for the year, now up 1.3% in 2025. Since April 7, the index has rallied over 20%, marking the quickest recovery following a decline of the same level from all-time highs since 1998, according to Fundstrat Head of Technical Strategy Mark Newton.

Head of Research Tom Lee, too, is impressed, saying “it’s a miraculous recovery.”

Markets have been roiled in recent weeks by worries about what broad-sweeping tariffs could do to consumer spending and business capital expenditures. Things took a turn for the better this week, leading strategists to raise their S&P 500 year-end price targets and pull back their recession bets.

According to Lee, greater tariffs visibility is one of the reasons why he believes “stocks are in better shape today than they were on Feb. 18 when they were at all-time highs.”

The president left it up to Treasury Secretary Scott Bessent to figure out the percentage of tariffs imposed and other key parameters with China, which many investors considered to be prudent. As Washington Policy Strategist Tom Block has noted, many DC insiders agree, seeing Bessent as “the adult in the room.”

This was the “ultimate reminder that stocks do have a Trump put,” Lee said.

That, along with tariffs relief, helped solidify the recent climb higher for risky assets. Nvidia shares are now in the green for the year, up 16% this week, while Tesla shares are up 17% and Alphabet shares are up 8.8%. Bitcoin crossed the key $100,000 level, while the small-cap focused Russell 2000 has climbed for six weeks straight. Meanwhile, haven asset gold was a loser this week, down over 4%.

“It’s the first time really since February that it feels like life is getting back to normal,” Lee said in his Macro Minute videos. “There’s a lot less anxiety about what could be tweeted, allowing investors to really look at ideas again.”

Lee believes the S&P 500 is now primed to make a new high.

Of course, many questions remain about whether the rally is sustainable. For starters, the 10-year Treasury yield has climbed this week to over 4.4%, reminiscent of the panic caused in the days after Liberation Day. But Newton says that “people don’t need to fear yields going over 5%,” as companies hold a boatload of cash and can use that to earn returns.

Newton said, “For those who are still on the sidelines and underinvested or short, it’s decision time.”

Chart of the Week

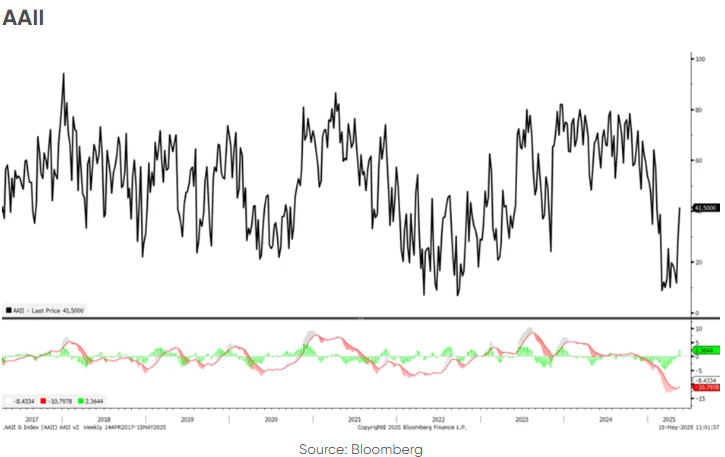

Bullish sentiment is also improving. An American Association of Individual Investors survey showed that the percentage of bears fell below 50% last week after staying above that level for 11 straight weeks, the longest streak on record. Still, there’s much work to do on the sentiment. “It’s the persistent bearishness that has to flip,” Head of Research Tom Lee said.

Recent ⚡ FlashInsights

- “I don’t expect, you know, a significant decline. I think this is possible we can go back toward the lows which is 10%, 15% [from here] so it’s not a calamity,”

FS Insight Video: Weekly Highlight

Key incoming data

5/1 9:45 AM ET: Apr F S&P Global Manufacturing PMITame5/1 10:00 AM ET: Apr ISM Manufacturing PMITame5/2 8:30 AM ET: Apr Non-Farm PayrollsTame5/2 10:00 AM ET: Mar F Durable Goods Orders MoMTame5/5 9:45 AM ET: Apr F S&P Global Services PMITame5/5 10:00 AM ET: Apr ISM Services PMITame5/6 8:30 AM ET: Mar Trade BalanceTame5/7 9:00 AM ET: Apr F Manheim Used Vehicle IndexHot5/7 2:00 PM ET: May FOMC DecisionMixed5/8 8:30 AM ET: 1Q P Unit Labor CostsTame5/8 8:30 AM ET: 1Q P Non-Farm Productivity QoQTame5/8 11:00 AM ET: Apr NY Fed 1yr Inf ExpMixed5/13 6:00 AM ET: Apr Small Business Optimism SurveyTame5/13 8:30 AM ET: Apr Core CPI MoMTame5/15 8:30 AM ET: May Philly Fed Business OutlookTame5/15 8:30 AM ET: Apr Core PPI MoMTame5/15 8:30 AM ET: May Empire Manufacturing SurveyTame5/15 8:30 AM ET: Apr Retail SalesTame5/15 10:00 AM ET: May NAHB Housing Market IndexTame5/16 10:00 AM ET: May P U. Mich. Sentiment and Inflation ExpectationHot5/16 4:00 PM ET: Mar Net TIC FlowsTame- 5/19 9:00 AM ET: May M Manheim Used Vehicle Index

- 5/22 8:30 AM ET: Apr Chicago Fed Nat Activity Index

- 5/22 9:45 AM ET: May P S&P Global Services PMI

- 5/22 9:45 AM ET: May P S&P Global Manufacturing PMI

- 5/22 10:00 AM ET: Apr Existing Home Sales

- 5/22 11:00 AM ET: May Kansas City Fed Manufacturing Survey

- 5/23 10:00 AM ET: Apr New Home Sales

- 5/27 8:30 AM ET: Apr P Durable Goods Orders MoM

- 5/27 9:00 AM ET: Mar S&P CoreLogic CS home price

- 5/27 10:00 AM ET: May Conference Board Consumer Confidence

- 5/27 10:30 AM ET: May Dallas Fed Manuf. Activity Survey

- 5/28 10:00 AM ET: May Richmond Fed Manufacturing Survey

- 5/28 2:00 PM ET: May FOMC Meeting Minutes

- 5/29 8:30 AM ET: 1Q S GDP QoQ

- 5/30 8:30 AM ET: Apr Core PCE Deflator MoM

- 5/30 10:00 AM ET: May F U. Mich. Sentiment and Inflation Expectation

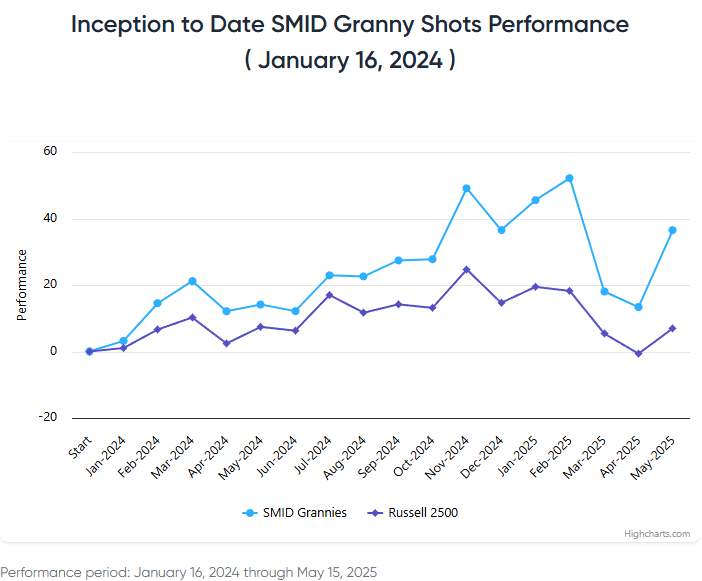

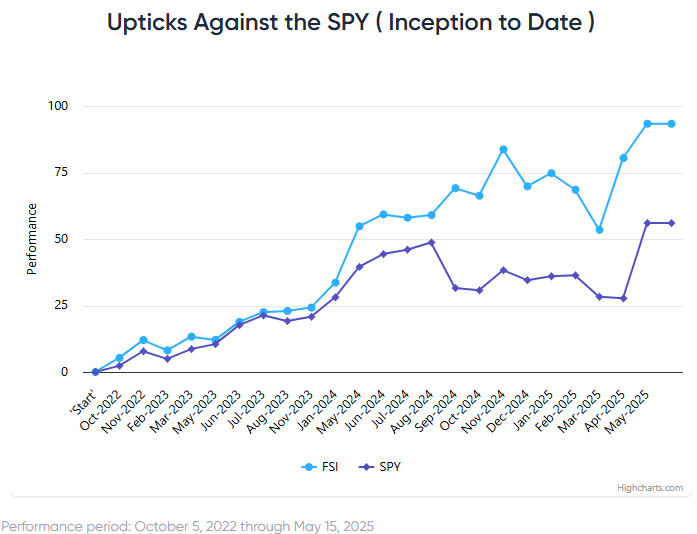

Stock List Performance

In the News

| Start Your 30-Day Free Trial Now! More News Appearances |

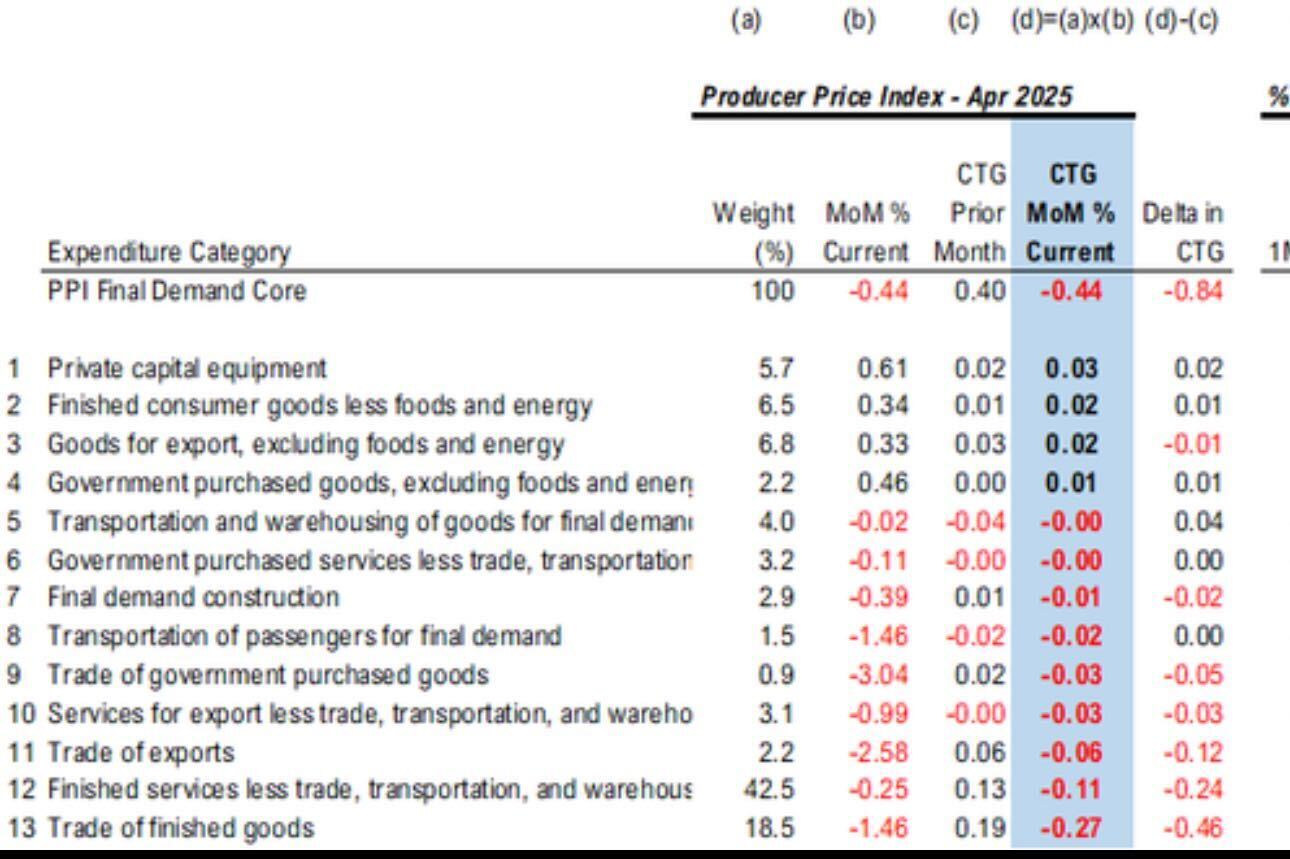

- so much for “tariffs cause inflation” showing up this month

REMINDER: macro data will be polluted next two quarters, but we expect markets to see through this and focus on 2026