Investors’ hopes for a turnaround in stock misfortunes were emboldened after a midweek bonanza rally in major indexes trended higher to finish the week.

On Wednesday, after a 90-day pause on tariffs for most countries was announced, stocks ripped higher. The S&P 500 jumped 9.5%, posting its largest gain since 2008, while the Nasdaq Composite shot up 12% in its second-best day ever. The pause signaled the return of the Trump put, said Fundstrat Head of Research Tom Lee, meaning that President Donald Trump won’t tolerate too much pain in the financial markets. “The White House does care what the stock market is doing,” Lee said.

The enthusiasm didn’t last into Thursday, but stocks sharply rebounded on Friday. The broad-based index added 5.7% this week, and the Nasdaq Composite gained 7.3%. The White House said Friday that slightly over a dozen countries are working on trade deals, which may have contributed to the recovery Friday.

However, the markets aren’t out of the woods yet. Investors are still pricing in the 10% universal baseline tariff in place, and China is dealing with 145% tariffs, with no path in sight for negotiations. To make matters worse, China reciprocated Friday with tit-for-tat tariffs on the U.S.

“There are still a lot of questions that need to be answered—how are tariffs going to work out after a 90-day pause? How are businesses going to actually adjust their plans?” said Head of Data Science “Tireless” Ken Xuan during the weekly huddle.

But he remains positive, saying that a “win is a win, and a pause is better than no pause.”

Head of Technical Strategy Mark Newton agrees. “I don’t sense that this can continue to build upon itself and just take markets right back to new highs right away,” Newton said. He likes tech stocks, especially the Magnificent Seven, as valuations have come down sharply and tech remains the biggest profit center for the U.S. this year. Lee is of the same belief.

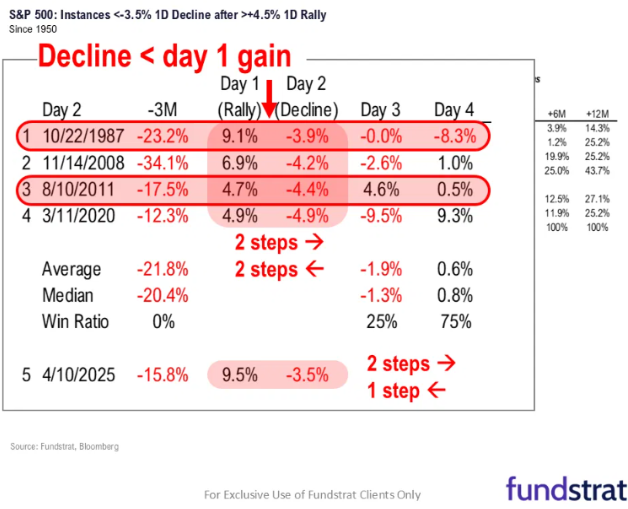

Chart of the Week

Despite the “two steps forward, one step back” move, stocks can still find their footing, as they have in the past, Fundstrat Head of Research Tom Lee said. “Outside of China, it is far less onerous,” he added. “Overall, the trade picture, as much as you might think things have gotten worse, it’s actually getting a little better.”

Recent ⚡ FlashInsights

FS Insight Video: Weekly Highlight

Key incoming data

4/1 9:45 AM ET: Mar F S&P Global Manufacturing PMITame4/1 10:00 AM ET: Mar ISM Manufacturing PMITame4/1 10:00 AM ET: Feb JOLTS Job OpeningsTame4/2 10:00 AM ET: Feb F Durable Goods Orders MoMTame4/3 8:30 AM ET: Feb Trade BalanceTame4/3 9:45 AM ET: Mar F S&P Global Services PMITame4/3 10:00 AM ET: Mar ISM Services PMITame4/4 8:30 AM ET: Mar Non-farm PayrollsHot4/7 9:00 AM ET: Mar F Manheim Used Vehicle IndexTame4/8 6:00 AM ET: Mar Small Business Optimism SurveyTame4/9 2:00 PM ET: Mar FOMC Meeting MinutesMixed4/10 8:30 AM ET: Mar Core CPI MoMTame4/11 8:30 AM ET: Mar Core PPI MoMTame4/11 10:00 AM ET: Apr P U. Mich. 1yr Inf ExpHot- 4/14 11:00 AM ET: Mar NYFed 1yr Inf Exp

- 4/15 8:30 AM ET: Apr Empire Manufacturing Survey

- 4/16 8:30 AM ET: Mar Retail Sales

- 4/16 10:00 AM ET: Apr NAHB Housing Market Index

- 4/16 4:00 PM ET: Feb Net TIC Flows

- 4/17 8:30 AM ET: Apr Philly Fed Business Outlook

- 4/17 9:00 AM ET: Apr M Manheim Used Vehicle Index

- 4/23 9:45 AM ET: Apr P S&P Global Services PMI

- 4/23 9:45 AM ET: Apr P S&P Global Manufacturing PMI

- 4/23 10:00 AM ET: Mar New Home Sales

- 4/23 2:00 PM ET: Apr Fed Releases Beige Book

- 4/24 8:30 AM ET: Mar P Durable Goods Orders MoM

- 4/24 8:30 AM ET: Mar Chicago Fed Nat Activity Index

- 4/24 10:00 AM ET: Mar Existing Home Sales

- 4/25 10:00 AM ET: Apr F U. Mich. 1yr Inf Exp

- 4/28 10:30 AM ET: Apr Dallas Fed Manuf. Activity Survey

- 4/29 9:00 AM ET: Feb S&P CS home price 20-City MoM

- 4/29 10:00 AM ET: Apr Conference Board Consumer Confidence

- 4/29 10:00 AM ET: Mar JOLTS Job Openings

- 4/30 8:30 AM ET: 1Q A GDP QoQ

- 4/30 8:30 AM ET: 1Q ECI QoQ

- 4/30 10:00 AM ET: Mar Core PCE MoM

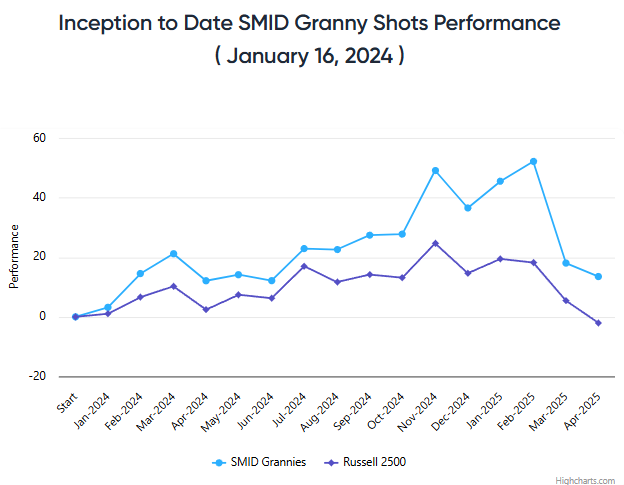

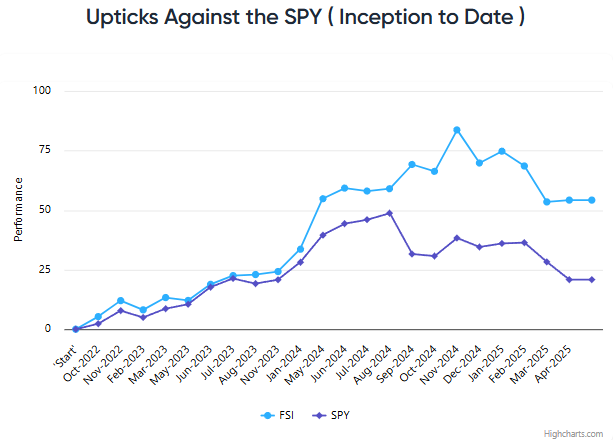

Stock List Performance

In the News

| More News Appearances |

- Get a deal with Japan

- Have a phone call with China

We need Henry Kissinger’s ghost to broker that phone call PS: Commerce Secretary Lutnick is no doubt 100% aware the risks of the bond market liquidity worsening as his cronies at Cantor know this To me, timing matters. And I could see the White House pushing these to happen over the weekend