Investors certainly had their resolve tested this week, with the tech-heavy Nasdaq declining 3.45% and the S&P 500 tumbling 3.1% and posting its worst week of the year to date. While the losses can sting, Fundstrat Head of Research Tom Lee continues to urge clients to maintain fortitude and to “stay on target.”

Head of Technical Strategy Mark Newton is similarly maintaining a proverbial stiff upper lip. “When you strip out the effects of technology, the breadth has actually been quite a lot more positive than we saw back in the middle part of January,” he told us at our weekly research huddle. “So yes, we have done a little bit of damage in the last few weeks, but the broader trends arguably are still intact. Honestly, we’re heading into a level where, in my view, we’re going to find pretty good support and start to turn higher.”

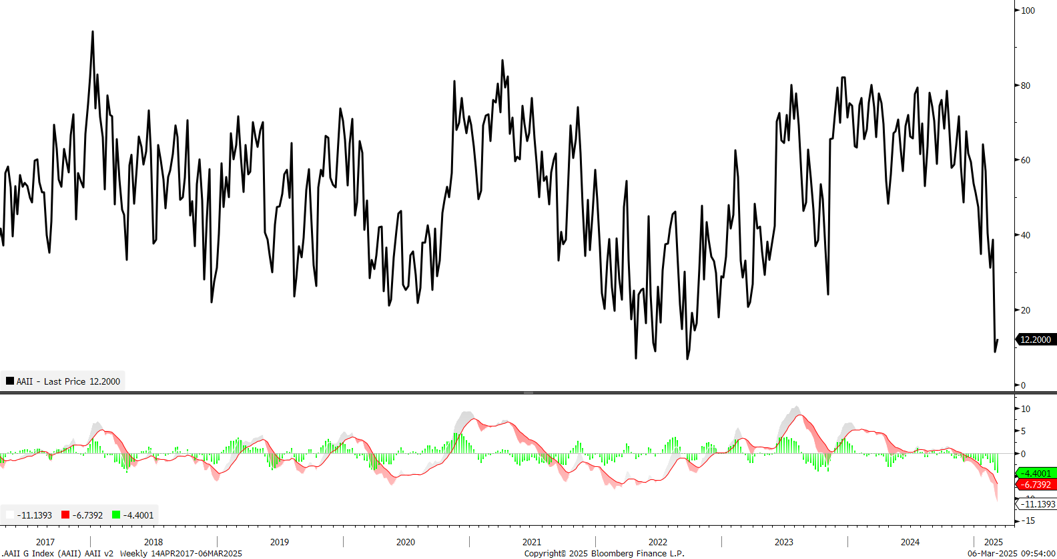

There’s no denying that the Trump administration’s tariff forays have weighed on the market’s mood, sending AAII (American Association Individual Investor) sentiment to levels that Newton described as “almost extreme fear levels.” To him, this seems like an overreaction. “A 5% drawdown is certainly not the end of the world,” he suggested, while reminding us that the last two times that AAII sentiment got this bearish were in 2022 after the market fell 25%, and 2009 after a 40% drawdown. “Nine times out of 10 when [investors get this fearful], it’s really getting close to a time you want to buy the market,” Newton added.

Lee also sees initial signs of a possible turnaround approaching. “The recent stock-market drawdown appears to have triggered a shift in rhetoric from Trump and his team,” he observed, citing this as “evidence of the Trump put returning.” He further noted that this week, the Trump administration made conciliatory statements about tariffs on Canadian and Mexican imports, which “signals some desire to reduce harsh financial market consequences.” In Lee’s view, this week’s weak jobs numbers could not only reinforce the Trump put but also bring the Fed put back into play, potentially “limiting the downside risk for stocks.”

Sector Allocation Strategy

These are the latest strategic sector ratings from Head of Research Tom Lee and Head of Technical Strategy Mark Newton – part of the March 2025 update to the FSI Sector Allocation Strategy. FS Insight Macro and Pro subscribers can click here for ETF recommendations, precise guidance on strategic and tactical weightings, detailed commentary, and methodology.

Chart of the Week

Last week, Fundstrat Head of Research Tom Lee urged investors to “stay on target,” rather than try to time the market with a tactical exit and re-entry. As he reminded us this week, buy-and-hold strategies tend to outperform such efforts, citing the rule of “10 best days,” – to wit, the stock market makes most of its gains in the 10 best trading days of any given year. Since 1928, the S&P 500 has averaged annual returns of 8%. But if one were to exclude returns generated on the 10 best days of each year, those returns transform into average annual declines of 13%. As our Chart of the Week shows, this rule has held up in the past decade. Average annual returns of the S&P 500 since 2015 have been 12%, but excluding each year’s 10 best days, the index has notched an average annual 10% decline. The bottom line is that “investors must remain mindful of the significant opportunity cost associated with remaining sidelined, even during periods of volatility,” he warned.

Recent ⚡ FlashInsights

FSI Video: Weekly Highlight

Key incoming data

3/3 9:45 AM ET: Feb F S&P Global Manufacturing PMITame3/3 10:00 AM ET: Feb ISM Manufacturing PMITame3/5 9:45 AM ET: Feb F S&P Global Services PMITame3/5 10:00 AM ET: Feb ISM Services PMITame3/5 10:00 AM ET: Jan F Durable Goods OrdersTame3/5 2:00 PM ET: Mar Fed Releases Beige BookTame3/6 8:30 AM ET: 4Q F Non-Farm ProductivityTame3/6 8:30 AM ET: Jan Trade BalanceTame3/6 8:30 AM ET: 4Q F Unit Labor CostsTame3/7 8:30 AM ET: Feb Non-Farm PayrollsTame3/7 9:00 AM ET: Feb F Manheim Used Vehicle indexTame- 3/10 11:00 AM ET: Feb NY Fed 1yr Inf Exp

- 3/11 6:00 AM ET: Feb Small Business Optimism Survey

- 3/11 10:00 AM ET: Jan JOLTS Job Openings

- 3/12 8:30 AM ET: Feb CPI

- 3/13 8:30 AM ET: Feb PPI

- 3/14 10:00 AM ET: Mar P U. Mich. Sentiment and Inflation Expectation

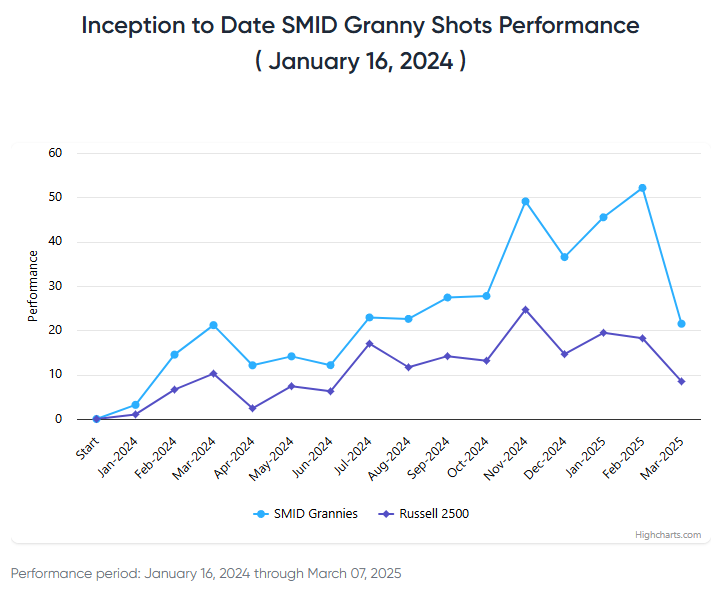

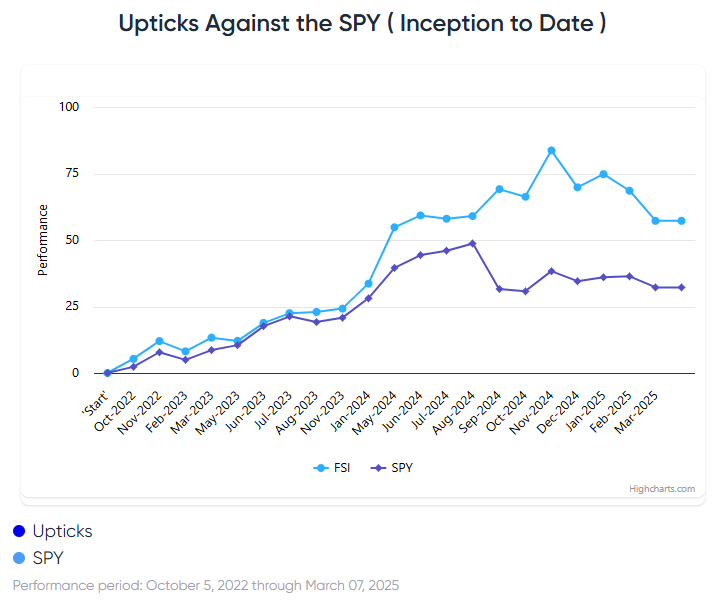

Stock List Performance

In the News

| More News Appearances |