Investor sentiment has been battered of late, and it shows. Despite a Friday afternoon bounce, the S&P 500 closed last week down nearly 1%. We saw selling that Fundstrat’s Head of Research Tom Lee called “broad-based (and indiscriminate), reflective of an abrupt shift to ‘risk off’ coupled with likely margin calls.”

Lee further attributed this souring market mood to a “growth scare.” This week, the Conference Board Consumer Confidence Survey added to worries that the economy might be approaching “stall speed.” The survey showed that headline sentiment fell to 98.3, down seven points from last month’s reading. It also showed that the 1-yr forward inflation expectations rose to 6%, compared to 5.2% in December. Lee noted that “the commentary shows consumers are increasingly reacting to comments from the White House.” However, in his view, “while there are merits to these concerns, we also believe these concerns are likely only ‘flesh wounds’ that do not affect the long-term view for stocks this year.”

But getting back to investor sentiment: As Head of Technical Strategy Mark Newton noted during our weekly huddle, “If we look at AAII [the American Association of Individual Investors sentiment survey], we see that the percentage of bears was at 60% as of this past week. That’s extraordinary.” Head of Data Science “Tireless” Ken Xuan noted that we last saw similar bearish levels of sentiment in September 2022 – shortly before the market emerged from its decline to start its present ascent.

To Lee, the worries could ultimately have positive implications for equity investors. With President Donald Trump’s planned tariffs adding to concerns about a growth scare and the economy potentially hitting stall speed, the Fed might be forced to become dovish, he suggested.

In the meantime, Newton adds a cautionary note: “To me, there’s really a lot of reasons to be optimistic about trying to buy stocks when really the broader technical structure has not been broken. But looking at Presidential cycles going back the last 100 years, historically, when you change administrations, the first quarter of the first year tends to be very choppy.”

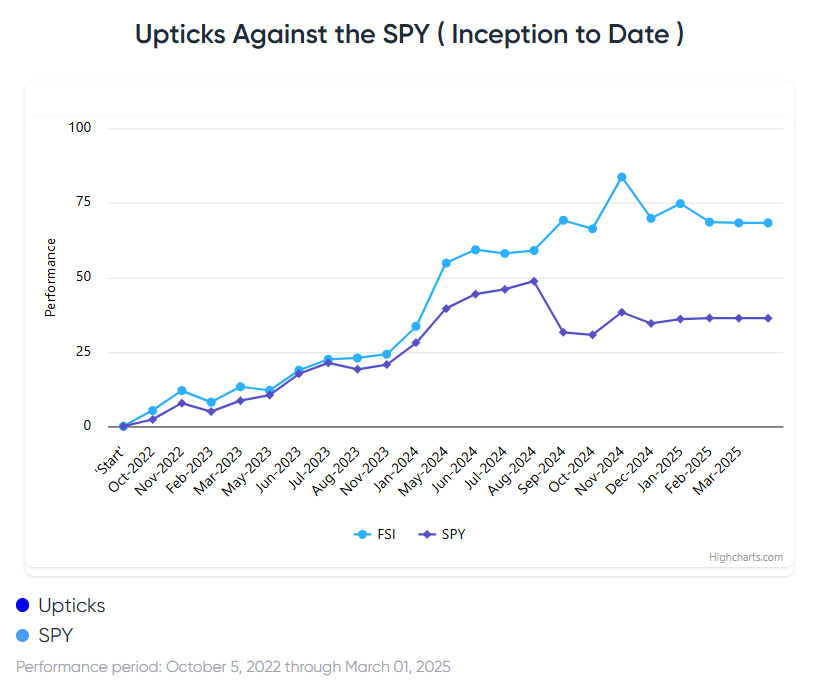

Chart of the Week

Fed officials continued to speak about the need to be inflation vigilant this week, but “the bond market is pricing in a more dovish take,” Lee noted, with trading implying that due to this week’s “growth scare,” investors see higher odds of a rate cut in May and more cuts for 2025. “The potential reintroduction of a dovish stance by the Fed could bolster stocks in the event of lackluster macro trends” – thus activating the “Fed put” that Lee has previously written about. We see this in our Chart of the Week.

Recent ⚡ FlashInsights

FSI Video: Weekly Highlight

Key incoming data

2/24 8:30 AM ET: Jan Chicago Fed Nat Activity IndexTame2/24 10:30 AM ET: Feb Dallas Fed Manuf. Activity SurveyTame2/25 9:00 AM ET: Dec S&P CoreLogic CS home priceMixed2/25 10:00 AM ET: Feb Conference Board Consumer ConfidenceTame2/26 10:00 AM ET: Jan New Home SalesTame2/27 8:30 AM ET: 4Q S GDPTame2/27 10:00 AM ET: Jan P Durable Goods OrdersTame2/28 8:30 AM ET: Jan PCE DeflatorTame- 3/3 9:45 AM ET: Feb F S&P Global Manufacturing PMI

- 3/3 10:00 AM ET: Feb ISM Manufacturing PMI

- 3/5 9:45 AM ET: Feb F S&P Global Services PMI

- 3/5 10:00 AM ET: Feb ISM Services PMI

- 3/5 10:00 AM ET: Jan F Durable Goods Orders

- 3/5 2:00 PM ET: Mar Fed Releases Beige Book

- 3/6 8:30 AM ET: 4Q F Non-Farm Productivity

- 3/6 8:30 AM ET: Jan Trade Balance

- 3/6 8:30 AM ET: 4Q F Unit Labor Costs

- 3/7 8:30 AM ET: Feb Non-Farm Payrolls

- 3/7 9:00 AM ET: Feb F Manheim Used Vehicle index

2/18 8:30 AM ET: Feb Empire Manufacturing SurveyTame

Stock List Performance

In the News

| More News Appearances |