A good week for the stock market quickly turned sour after earnings disappointed from retail giant Walmart and reports emerged of a Department of Justice probe into UnitedHealth Group.

The S&P 500 set fresh records on Tuesday and Wednesday, then fell to end the week down 1.66%. The Nasdaq 100 had set records of its own on Tuesday, yet it fell 2.51% this week. The Dow Jones Industrial Average had just as bad a week, down 2.51% as well. Losses in the blue-chip index accelerated Friday after shares of healthcare titan UnitedHealth fell and a February survey from S&P Global showed declines in services-sector activity.

But Fundstrat Head of Research Tom Lee says it’s been encouraging to see that the market hasn’t declined more, thanks to dip buyers jumping in on any sign of market weakness. On Thursday, for example, Walmart warned investors about slower sales gains ahead, sending its shares plummeting down 6.53%. In contrast, the overall market slipped 0.43%, which Lee categorized as a “modest” retreat. “The S&P 500 has had many chances for a deeper sell-off, but these declines attract dip buyers,” he observed.

For his part, Head of Technical Strategy Mark Newton has been encouraged by recent signs of improved market breadth. “We haven’t seen any real deterioration in equities whatsoever,” Newton said. “The bigger picture is that the market is still in good shape.” He likes that Technology is leading the charge, even with highflyers like Meta and Palantir taking a pause from their rallies.

In the near-term Newton expects to see the markets continue to consolidate over the next 3-5 days before posting a much larger push back to the upside. “I’m bullish, but, yes, there’s some things the market could do that would help to satisfy and make me a little more constructive that stocks can just simply trend up, and we’re clearly not in that regime just yet,” Newton said.

Chart of the Week

Investor sentiment is currently bearish, even though the S&P 500 is trading near all-time highs. As Fundstat’s Tom Lee pointed out, this is highly unusual: There have been just 11 prior instances in which the S&P 500 was within 1% of a 52-week high while AAII’s net bulls metric was at negative 15 percentage points or worse. History suggests this is a constructive signal. In those previous cases, the median 12-month return is 15.7%, with a win-ratio of 83%. Our Chart of the Week shows more details.

Recent ⚡ FlashInsights

- today’s decline on heels of WMT -2.46% disappointment doesn’t change the positive outlook for stocks

FSI Video: Weekly Highlight

Key incoming data

2/18 8:30 AM ET: Feb Empire Manufacturing SurveyTame2/18 10:00 AM ET: Feb NAHB Housing Market IndexTame2/18 4:00 PM ET: Dec Net TIC FlowsTame2/19 9:00 AM ET: Jan M Manheim Used Vehicle indexTame2/19 2:00 PM ET: Jan FOMC Meeting MinutesDovish2/20 8:30 AM ET: Feb Philly Fed Business OutlookTame2/21 9:45 AM ET: Feb P S&P Global Manufacturing PMITame2/21 9:45 AM ET: Feb P S&P Global Services PMITame2/21 10:00 AM ET: Feb F U. Mich. Sentiment and Inflation ExpectationHot2/21 10:00 AM ET: Jan Existing Home SalesHot- 2/24 8:30 AM ET: Jan Chicago Fed Nat Activity Index

- 2/24 10:30 AM ET: Feb Dallas Fed Manuf. Activity Survey

- 2/25 9:00 AM ET: Dec S&P CoreLogic CS home price

- 2/25 10:00 AM ET: Feb Conference Board Consumer Confidence

- 2/26 10:00 AM ET: Jan New Home Sales

- 2/27 8:30 AM ET: 4Q S GDP

- 2/27 10:00 AM ET: Jan P Durable Goods Orders

- 2/28 8:30 AM ET: Jan PCE Deflator

2/3 9:45 AM ET: Jan F S&P Global Manufacturing PMITame

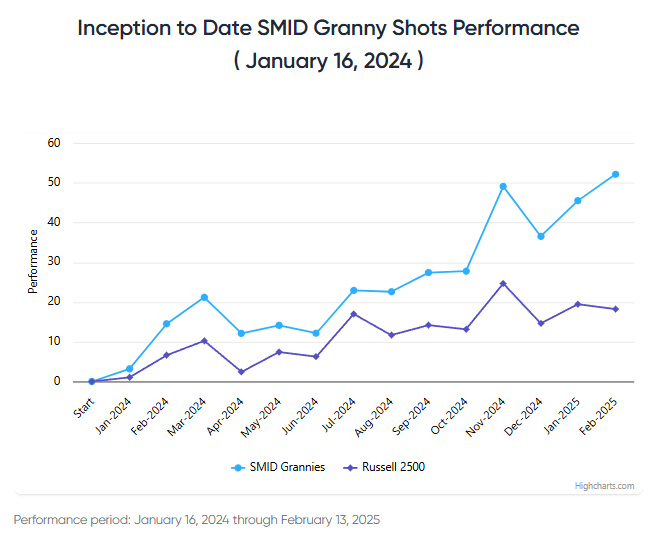

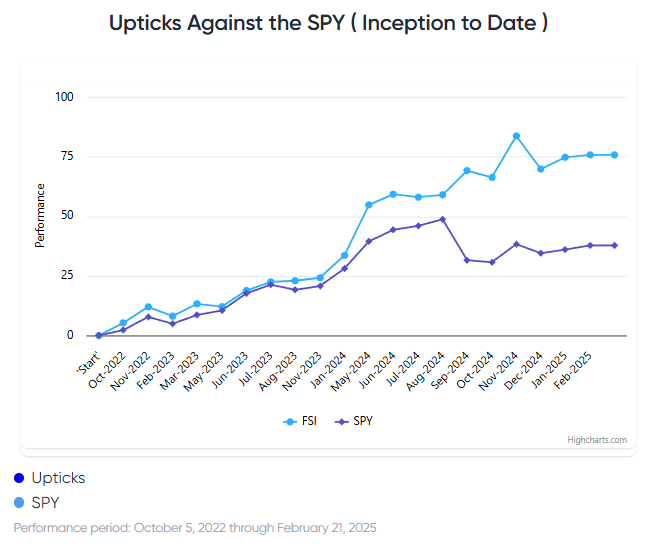

Stock List Performance

In the News

| More News Appearances |