Stocks miraculously finished the week higher, reiterating the belief that the bull market isn’t going anywhere. The S&P 500 added 1.5% this week, despite a hotter-than-expected inflation report and worries about reciprocal tariffs. The broad-based index is up 4% this year.

“The stock market has had many opportunities to sell-off, but it has been resilient,” Fundstrat Head of Research Tom Lee said.

On Wednesday, the Bureau of Labor Statistics reported that consumer prices rose 0.5% from a month ago on a seasonally adjusted basis. That marked the largest increase in the reading since August 2023. On an annual basis, headline CPI rose above 3% for the first time since June.

And just like that, investors were back to worrying about the progress on inflation stalling. The S&P 500 fell 0.3% on Wednesday. Bond yields jumped above 4.6%.

Lee, however, isn’t panicked by the jittery inflationary report, pointing out that Federal Reserve Chair Jerome Powell acknowledged the CPI print during his Congressional testimony, but did not suggest that the progress on inflation had stalled. “This implies the Fed still sees inflation cooling over time,” Lee added.

The market calmed down some Thursday after the producer-price index painted a better picture. That report could imply a softer personal-consumption expenditures report—the Fed’s preferred inflation gauge—as the components that feed into it from PPI were soft in January.

But for now, the market continues to be choppy.

“It’s a big chop-fest, where we haven’t seen a lot of satisfying movement,” Head of Technical Strategy Mark Newton said.

Chart of the Week

Core prices—which don’t include the volatile food and energy components—added 0.45% from December, the largest increase in nearly two years. Core inflation was up 3.3% from a year ago. However, it’s not nearly as bad upon a closer look. Head of Research Tom Lee said that’s because core CPI’s top five contributors—used cards and trucks, leased cars and trucks, auto insurance, shelter and motor vehicle fees—make up 0.37% of the 0.45% increase. In his view, inflation in those categories is not accelerating, nor is their rise in January sustainable.

Recent ⚡ FlashInsights

FSI Video: Weekly Highlight

Key incoming data

2/3 9:45 AM ET: Jan F S&P Global Manufacturing PMITame2/3 10:00 AM ET: Jan ISM Manufacturing PMITame2/4 10:00 AM ET: Dec JOLTS Job OpeningsTame2/4 10:00 AM ET: Dec F Durable Goods OrdersTame2/5 8:30 AM ET: Dec Trade BalanceTame2/5 9:45 AM ET: Jan F S&P Global Services PMITame2/5 10:00 AM ET: Jan ISM Services PMITame2/6 8:30 AM ET: 4Q P Non-Farm ProductivityTame2/6 8:30 AM ET: 4Q P Unit Labor CostsTame2/7 8:30 AM ET: Jan Non-Farm PayrollsTame2/7 9:00 AM ET: Dec F Manheim Used Vehicle indexTame2/7 10:00 AM ET: Feb P U. Mich. Sentiment and Inflation ExpectationHot2/10 11:00 AM ET: Jan NY Fed 1yr Inf ExpTame2/11 6:00 AM ET: Jan Small Business Optimism SurveyTame2/12 8:30 AM ET: Jan CPIHot2/13 8:30 AM ET: Jan PPIHot2/14 8:30 AM ET: Jan Retail Sales DataTame- 2/18 8:30 AM ET: Feb Empire Manufacturing Survey

- 2/18 10:00 AM ET: Feb NAHB Housing Market Index

- 2/18 4:00 PM ET: Dec Net TIC Flows

- 2/19 9:00 AM ET: Jan M Manheim Used Vehicle index

- 2/19 2:00 PM ET: Jan FOMC Meeting Minutes

- 2/20 8:30 AM ET: Feb Philly Fed Business Outlook

- 2/21 9:45 AM ET: Feb P S&P Global Manufacturing PMI

- 2/21 9:45 AM ET: Feb P S&P Global Services PMI

- 2/21 10:00 AM ET: Feb F U. Mich. Sentiment and Inflation Expectation

- 2/21 10:00 AM ET: Jan Existing Home Sales

- 2/24 8:30 AM ET: Jan Chicago Fed Nat Activity Index

- 2/24 10:30 AM ET: Feb Dallas Fed Manuf. Activity Survey

- 2/25 9:00 AM ET: Dec S&P CoreLogic CS home price

- 2/25 10:00 AM ET: Feb Conference Board Consumer Confidence

- 2/26 10:00 AM ET: Jan New Home Sales

- 2/27 8:30 AM ET: 4Q S GDP

- 2/27 10:00 AM ET: Jan P Durable Goods Orders

- 2/28 8:30 AM ET: Jan PCE Deflator

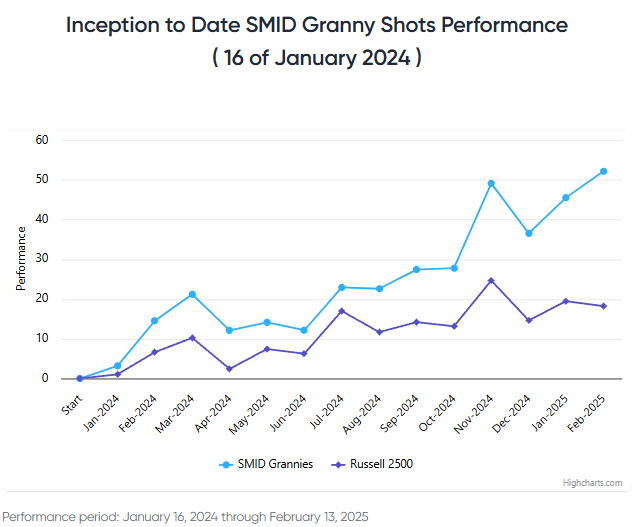

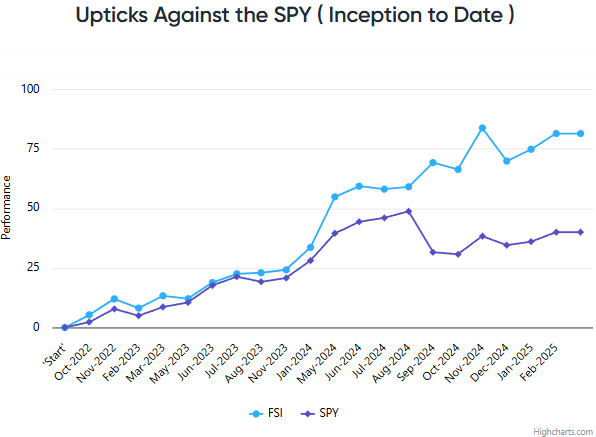

Stock List Performance

In the News

| More News Appearances |