The resolve of the bulls was tested once more last week. Two weeks ago, the Chinese artificial intelligence startup DeepSeek shook up markets with its advanced and purportedly low-cost R1 model. Last week it was President Donald Trump’s Feb. 1 announcement of tariffs to be levied on goods from Canada, Mexico, and China. Yet, as Fundstrat Head of Research Tom Lee noted, “equities seem to have managed to largely shrug off any fears being raised.” The S&P 500 ended the week slightly lower, down 0.24%.

“It feels like the market has gone through a lot, but you know, markets are roughly at the same levels where they were two weeks ago,” Head of Data Science Ken Xuan remarked at our weekly research huddle. Agreeing with Lee’s view of market resilience, “Tireless Ken” also pointed out that year-to-date, every sector except Tech is up.

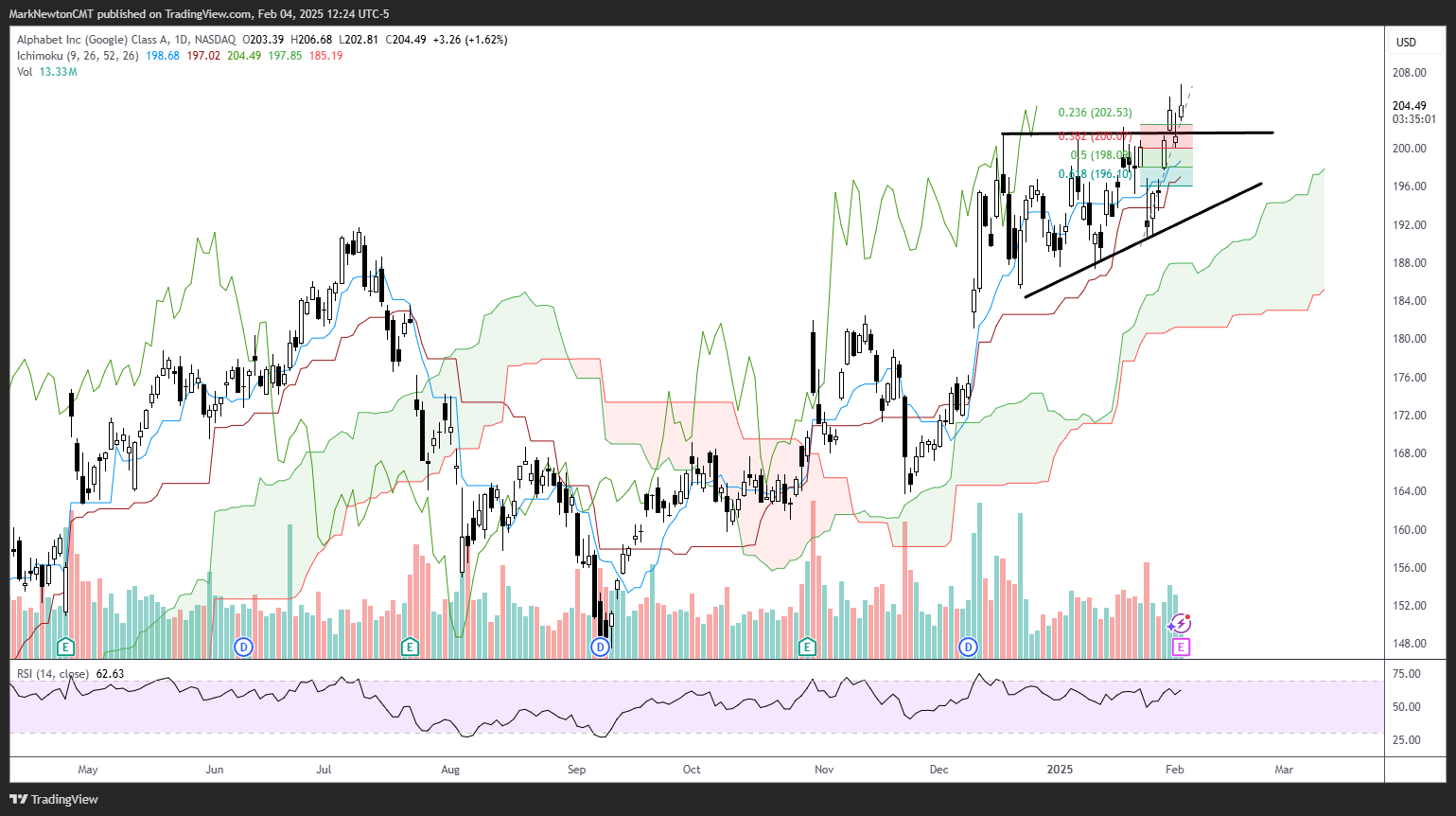

Head of Technical Strategy Mark Newton agreed. “All in all, I think the market’s a lot healthier than what many people would think if you just heard the news flow and you think that things have got to be awful. Technically speaking, the market actually looks quite healthy to me. There’s been no break of any sort of meaningful uptrends.”

Addressing what was arguably the most impactful market news of the week, Newton said that in his view, “this whole fear of tariffs really has not affected the market almost one iota in terms of technical structure.” However, he noted, “it certainly has affected sentiment. Sentiment has gotten a lot more skittish in recent weeks – well off the peaks of last year.”

From a contrarian perspective, this could be seen as positive for investors seeking to get or stay ahead of consensus, he suggested: “My thinking is that it’s right to be optimistic and use this fear as a way of thinking that things likely are going to be resolved back to the upside.”

Chart of the Week

There was a lot of macroeconomic data released this week, and in that respect, Fundstrat’s Tom Lee saw it as a good week, “supporting the view that the US economy is strong.” Notably, the ISM Manufacturing index (released Monday) rose above 50 for the first time in 26 months in January. As Lee explained and as our Chart of the Week below illustrates, this “likely signals accelerating EPS growth for small-caps and broader index,” as it has in every cycle since 1996.

Recent ⚡ FlashInsights

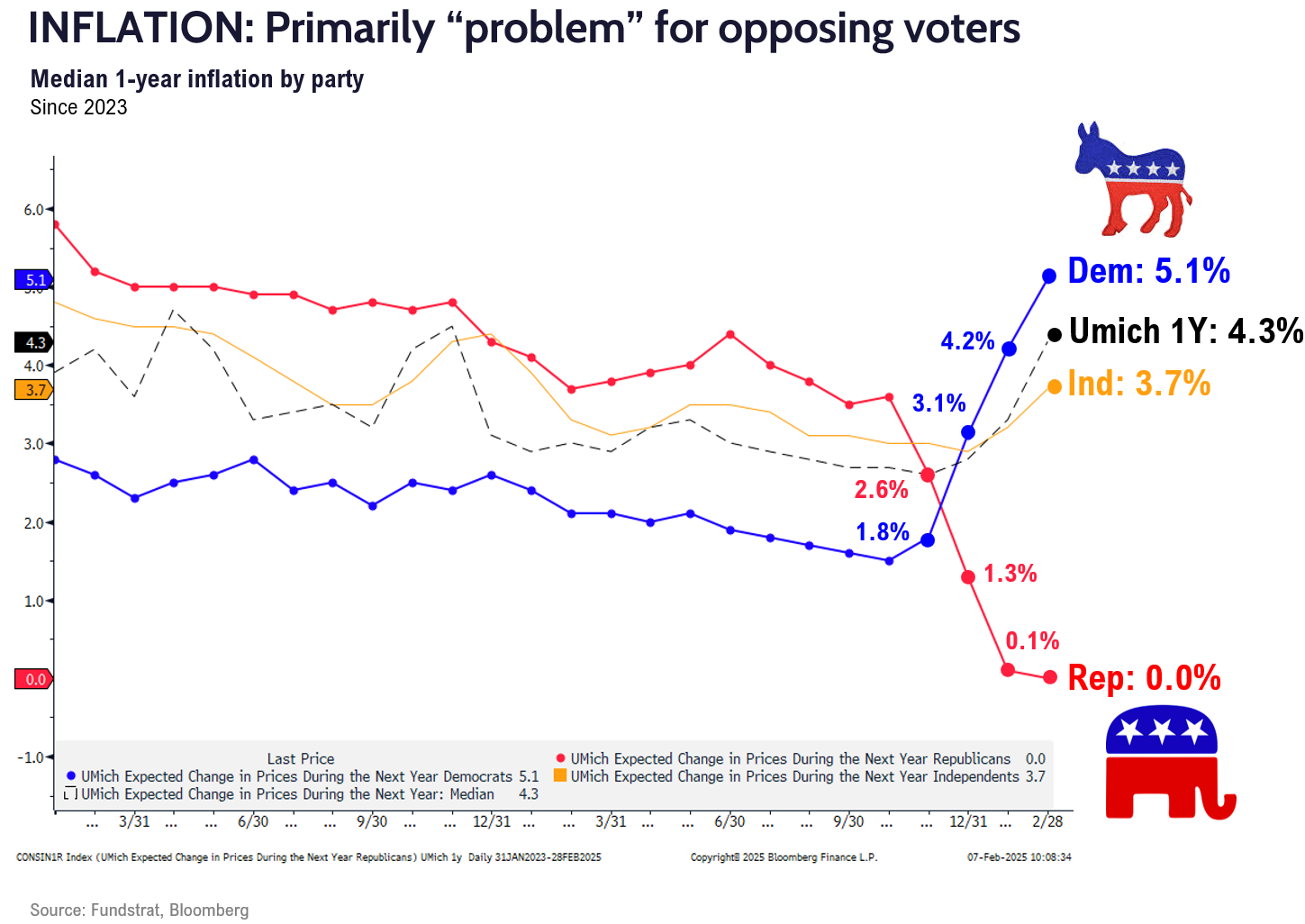

- no, inflation is not suddenly accelerating for consumers

- gasoline was up

- but bigger driver is political views

- Democrats exp. inflation surged to 5.3%

- Republicans went to 0%

- Math will pull up the median since Republicans probably won’t go “negative inflation”

FSI Video: Weekly Highlight

Key incoming data

2/3 9:45 AM ET: Jan F S&P Global Manufacturing PMITame2/3 10:00 AM ET: Jan ISM Manufacturing PMITame2/4 10:00 AM ET: Dec JOLTS Job OpeningsTame2/4 10:00 AM ET: Dec F Durable Goods OrdersTame2/5 8:30 AM ET: Dec Trade BalanceTame2/5 9:45 AM ET: Jan F S&P Global Services PMITame2/5 10:00 AM ET: Jan ISM Services PMITame2/6 8:30 AM ET: 4Q P Non-Farm ProductivityTame2/6 8:30 AM ET: 4Q P Unit Labor CostsTame2/7 8:30 AM ET: Jan Non-Farm PayrollsTame2/7 9:00 AM ET: Dec F Manheim Used Vehicle indexTame2/7 10:00 AM ET: Feb P U. Mich. Sentiment and Inflation ExpectationHot- 2/10 11:00 AM ET: Jan NY Fed 1yr Inf Exp

- 2/11 6:00 AM ET: Jan Small Business Optimism Survey

- 2/12 8:30 AM ET: Jan CPI

- 2/13 8:30 AM ET: Jan PPI

- 2/14 8:30 AM ET: Jan Retail Sales Data

Stock List Performance

In the News

| More News Appearances |