The S&P 500 finished last week down 1.00%. Fundstrat Head of Research Tom Lee described that as “a pretty solid result,” considering the disruptive news coming from China’s DeepSeek on Monday. The startup announced a cutting-edge, high-performing AI model that was purportedly developed and trained at significantly lower cost, using less-advanced, lower-powered chips.

Many in Silicon Valley find these claims credible, but regardless of their accuracy, DeepSeek’s claims called into question the thesis for AI spending and investment, sending markets in a panic. Perhaps the most visible evidence of that panic was Nvidia, whose shares fell 17% on Monday – its ninth-worst single-day decline ever. But as Lee reminded us, “AI remains a multidecade story, and Nvidia is still the leading company in the story of AI. In terms of developing the best chips, it continues to be far ahead of anyone else.”

Head of Technical Strategy Mark Newton noted despite the turbulence on Monday in the markets, the advance-decline ratio was, in his view, “fine.” “In fact,” he added, “the 10-day ratio of the advancing stocks to declines spiked to the highest levels we’ve seen in quite some time. To me, that’s actually a very good sign for the stock market overall, despite some of this short term sort of skittishness we’re seeing.”

Lee remains constructive for the year on equities. “This week, and this month, have seen successful tests of the ‘resolve of the bulls,'” he told us. For him, this has implications for the rest of the year. “This is the ‘January barometer.’ As is often said, ‘as January goes so goes the year.'” Since 1950, stocks have notched January gains 45 times. The median full-year returns for stocks in those years is 19%, with an 89% win ratio.

The 2025 January barometer (S&P 500 rose 1.65% in the first month of 2025) thus strengthens his constructive base-case outlook for the rest of 2025.

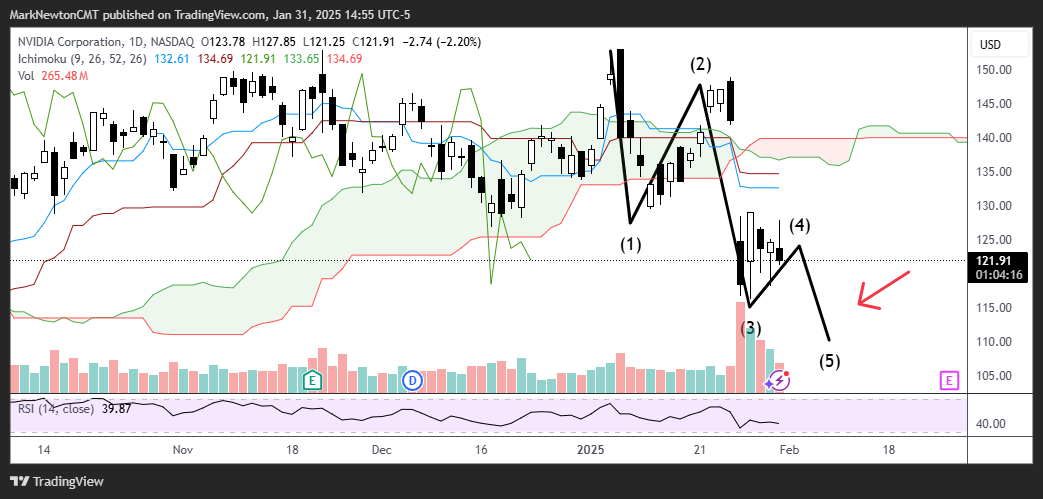

Chart of the Week

Perhaps the most visible evidence of the panic sparked by China’s DeepSeek this week was Nvidia, whose shares fell 17% on Monday – its ninth-worst single-day decline ever. If we exclude bear markets and recessions, Monday’s plunge was the fourth-worst single-day decline for NVDA ever. Yet as Fundstrat’s Tom Lee pointed out, in each of the three worse (Aug 8, 2003, Aug. 6, 2004, and Mar. 16, 2020) non-recession single-day declines, that panic marked the bottom tick. “The stock staged a massive recovery after that bottom tick three out of three times,” he noted, “and in my view, this is likely to happen again.” This is illustrated in our Chart of the Week.

Recent ⚡ FlashInsights

- this evening and Thu eve, 4 of MAG7 report

- likely positive catalysts for stocks

FSI Video: Weekly Highlight

Key incoming data

1/27 8:30 AM ET: Dec Chicago Fed Nat Activity IndexTame1/27 10:00 AM ET: Dec New Home SalesTame1/27 10:30 AM ET: Jan Dallas Fed Manuf. Activity SurveyTame1/28 9:00 AM ET: Nov S&P CoreLogic CS home priceTame1/28 10:00 AM ET: Jan Conference Board Consumer ConfidenceTame1/28 10:00 AM ET: Dec P Durable Goods OrdersTame1/29 2:00 PM ET: Jan FOMC DecisionTame1/30 8:30 AM ET: 4Q A 2024 GDPTame1/31 8:30 AM ET: Dec PCE DeflatorTame1/31 8:30 AM ET: 4Q Employment Cost IndexTame- 2/3 9:45 AM ET: Jan F S&P Global Manufacturing PMI

- 2/3 10:00 AM ET: Jan ISM Manufacturing PMI

- 2/4 10:00 AM ET: Dec JOLTS Job Openings

- 2/4 10:00 AM ET: Dec F Durable Goods Orders

- 2/5 8:30 AM ET: Dec Trade Balance

- 2/5 9:45 AM ET: Jan F S&P Global Services PMI

- 2/5 10:00 AM ET: Jan ISM Services PMI

- 2/6 8:30 AM ET: 4Q P Non-Farm Productivity

- 2/6 8:30 AM ET: 4Q P Unit Labor Costs

- 2/7 8:30 AM ET: Jan Non-Farm Payrolls

- 2/7 9:00 AM ET: Dec F Manheim Used Vehicle index

- 2/7 10:00 AM ET: Feb P U. Mich. Sentiment and Inflation Expectation

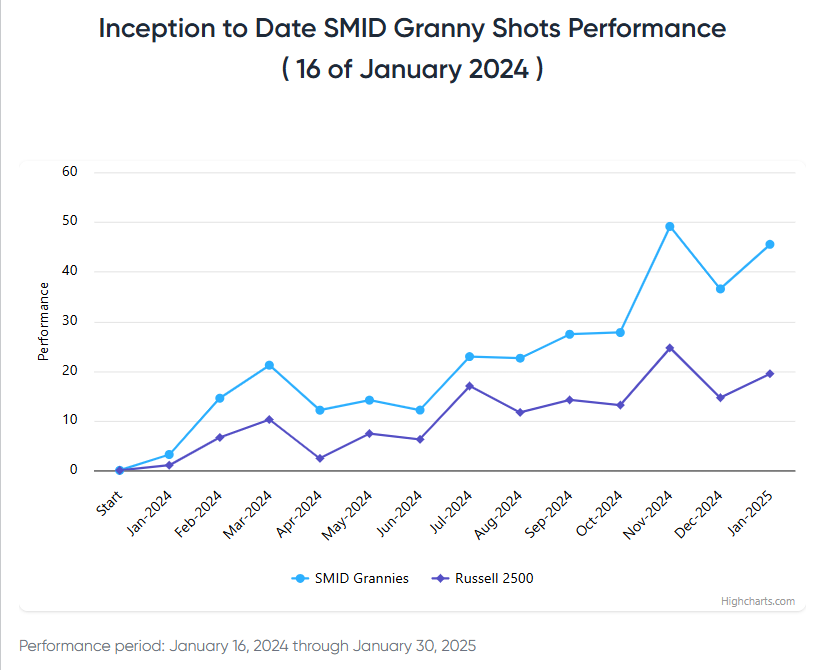

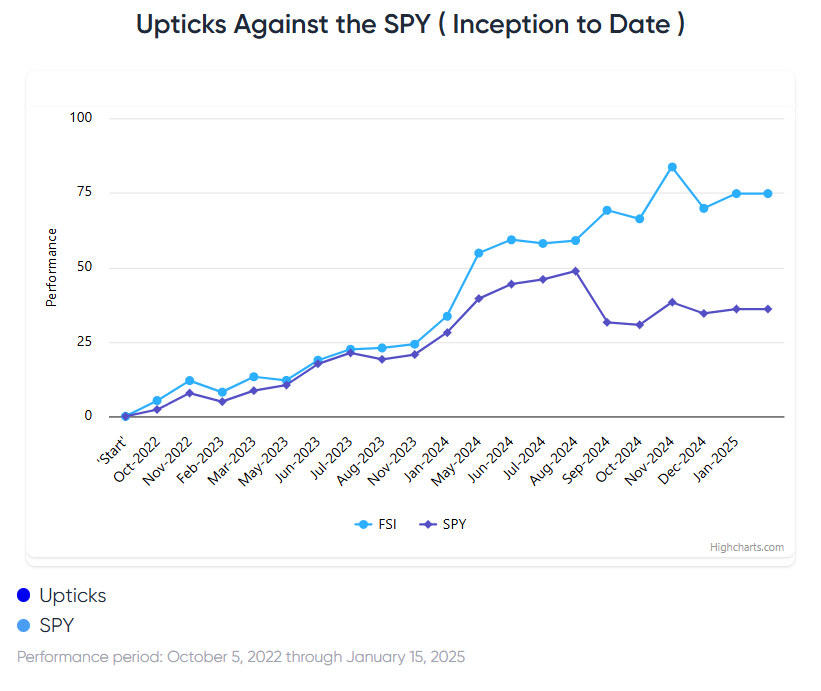

Stock List Performance

In the News

| More News Appearances |