Stocks marched higher for another week, driven by optimism about President Donald Trump’s proposed policy changes to lower corporate taxes and decrease regulation. Meanwhile, the much-feared tariffs weren’t signed, despite a flurry of executive orders.

The S&P 500 advanced 1.74% this week, putting its gains for the year at 3.73%. But the start to 2025 has been volatile, with most of the rally taking place over the past two weeks.

Fundstrat Head of Research Tom Lee says the next week will be especially crucial to watch. If stocks can hold onto those gains to finish higher in January, historical data show that the rest of the year tends to be positive for the market, he added. That trend is known as the January Barometer.

“It would again strengthen the case that markets are gonna be up double digits this year,” Lee said. “The markets look stronger than we expected, which is good, and sentiment really broke down, which is another positive.”

The best news this week was that there was no action from Trump about tariffs. “People were fearing the tariffs would hit, but it looks like those may be either softer or delayed or not as high a priority, but in either case, that’s a positive,” Lee said.

Head of Technical Strategy Mark Newton is of the same opinion, adding that “investors overestimated the degree with which we would see broad-based tariffs.” Newton shared that in the last few trading days, 11 of the 16 major currencies have actually rallied against the greenback. Our Chart of the Week has more details:

“Everybody was fearful, and now that fear is turning into optimism,” Newton added.

Chart of the Week

Fundstrat Head of Research Tom Lee believes inflation is slowing down. The most recent evidence was offered by the new tenant rent index, released by the Bureau of Labor Statistics, which showed that market-based rent prices in the fourth quarter fell in the negative from a year ago. That offers a more promising picture on the shelter inflation front compared to the one in the consumer-price index, which Lee said has lagged because it is more statistically smoothed based on existing rents.

Recent ⚡ FlashInsights

FSI Video: Weekly Highlight

Key incoming data

/2 9:45 AM ET: Dec F S&P Global Manufacturing PMITame1/3 10:00 AM ET: Dec ISM Manufacturing PMITame1/6 9:45 AM ET: Dec F S&P Global Services PMITame1/6 10:00 AM ET: Nov F Durable Goods OrdersTame1/7 8:30 AM ET: Nov Trade BalanceTame1/7 10:00 AM ET: Dec ISM Services PMITame1/7 10:00 AM ET: Nov JOLTS Job OpeningsTame1/8 9:00 AM ET: Dec F Manheim Used vehicle indexTame1/8 2:00 PM ET: Dec FOMC Meeting MinutesTame1/10 8:30 AM ET: Dec Non-Farm PayrollsHot1/10 10:00 AM ET: Jan P U. Mich. Sentiment and Inflation ExpectationHot1/13 11:00 AM ET: Dec NY Fed 1yr Inf ExpTame1/14 6:00 AM ET: Dec Small Business Optimism SurveyTame1/14 8:30 AM ET: Dec PPITame1/15 8:30 AM ET: Dec CPITame1/15 8:30 AM ET: Jan Empire Manufacturing SurveyTame1/15 2:00 PM ET: Jan Fed Releases Beige BookTame1/16 8:30 AM ET: Dec Retail Sales DataTame1/16 8:30 AM ET: Jan Philly Fed Business OutlookMixed1/16 10:00 AM ET: Jan NAHB Housing Market IndexTame1/17 9:00 AM ET: Jan M Manheim Used vehicle indexTame1/17 4:00 PM ET: Nov Net TIC FlowsTame1/24 9:45 AM ET: Jan P S&P Global Manufacturing PMITame1/24 9:45 AM ET: Jan P S&P Global Services PMITame1/24 10:00 AM ET: Jan F U. Mich. Sentiment and Inflation ExpectationHot1/24 10:00 AM ET: Dec Existing Home SalesTame- 1/27 8:30 AM ET: Dec Chicago Fed Nat Activity Index

- 1/27 10:00 AM ET: Dec New Home Sales

- 1/27 10:30 AM ET: Jan Dallas Fed Manuf. Activity Survey

- 1/28 9:00 AM ET: Nov S&P CoreLogic CS home price

- 1/28 10:00 AM ET: Jan Conference Board Consumer Confidence

- 1/28 10:00 AM ET: Dec P Durable Goods Orders

- 1/29 2:00 PM ET: Jan FOMC Decision

- 1/30 8:30 AM ET: 4Q A 2024 GDP

- 1/31 8:30 AM ET: Dec PCE Deflator

- 1/31 8:30 AM ET: 4Q Employment Cost Index

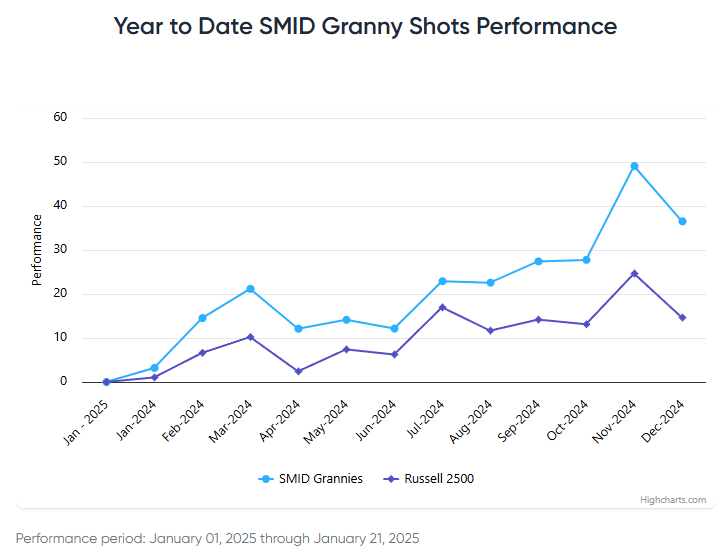

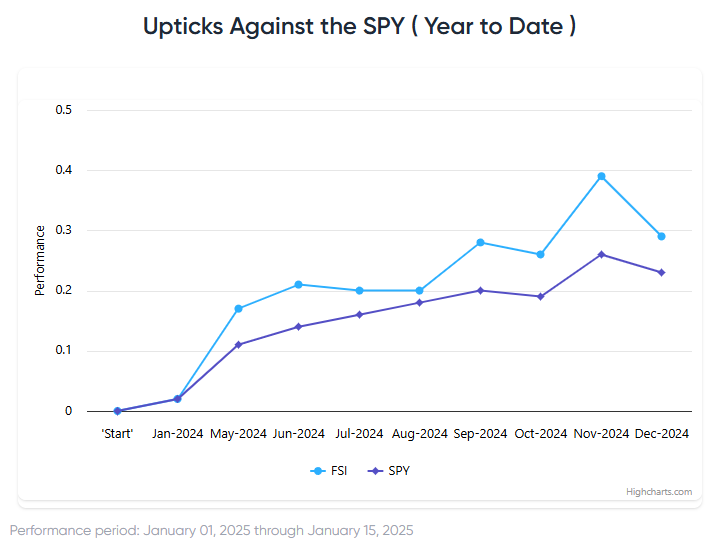

Stock List Performance

In the News

| More News Appearances |