Softer-than-expected economic data and strong bank earnings drove the stock market last week to reverse all of its early 2025 losses. The S&P 500 is up about 2% year to date. Fundstrat Head of Research Tom Lee believes that there are “signs of market capitulation.”

The best news last week came on Wednesday from the December consumer-price index report, which showed prices rose 2.9% from a year ago and 0.4% from a month ago. Core CPI, which excludes the volatile food and energy components, notched its smallest gain since July and reversed three months of rising readings.

In response, the benchmark 10-year Treasury yield fell to 4.653%, and the S&P 500 logged its best day since Nov. 6. Stocks held onto those gains to finish the week higher. The S&P 500 added 1%, while the Nasdaq Composite rallied 1.5%. Both notched their best week since the presidential election.

“This was a positive week with a positive development from the extinguishing of inflation hysteria,” Lee said. Yet, while it may look like the market’s new year doldrums are over, Lee added that a “full capitulation is arguably not here.”

Head of Technical Strategy Mark Newton believes the same. “It’s not wrong to continue to refer to this short-term price action as being part of a bearish short-term consolidation, which began in early December,” he said. “even though this, in turn, is part of a larger bullish uptrend.”

Still, the velocity of change in yields is also something he says is important to watch for all risk assets. “We need to see evidence of yields rolling over before you can really have conviction that the equity market is going to have a sustained gain,” Newton said.

Chart of the Week

After last Wednesday’s dovish CPI print, Fundstrat Head of Research Tom Lee said there are at least two reasons to believe why the trend of lower core CPI readings could continue. First, comparisons from last year (when readings were higher) would be arguably easier to beat. Second, one of the biggest CPI components—shelter—is “cooling sharply” and has been since early 2024. Our Chart of the Week shows more details.

Recent ⚡ FlashInsights

FSI Video: Weekly Highlight

Key incoming data

1/13 11:00 AM ET: Dec NY Fed 1yr Inf ExpTame1/14 6:00 AM ET: Dec Small Business Optimism SurveyTame1/14 8:30 AM ET: Dec PPITame1/15 8:30 AM ET: Dec CPITame1/15 8:30 AM ET: Jan Empire Manufacturing SurveyTame1/15 2:00 PM ET: Jan Fed Releases Beige BookTame1/16 8:30 AM ET: Dec Retail Sales DataTame1/16 8:30 AM ET: Jan Philly Fed Business OutlookMixed1/16 10:00 AM ET: Jan NAHB Housing Market IndexTame- 1/24 9:45 AM ET: Jan P S&P Global Manufacturing PMI

- 1/24 9:45 AM ET: Jan P S&P Global Services PMI

- 1/24 10:00 AM ET: Jan F U. Mich. Sentiment and Inflation Expectation

- 1/24 10:00 AM ET: Dec Existing Home Sales

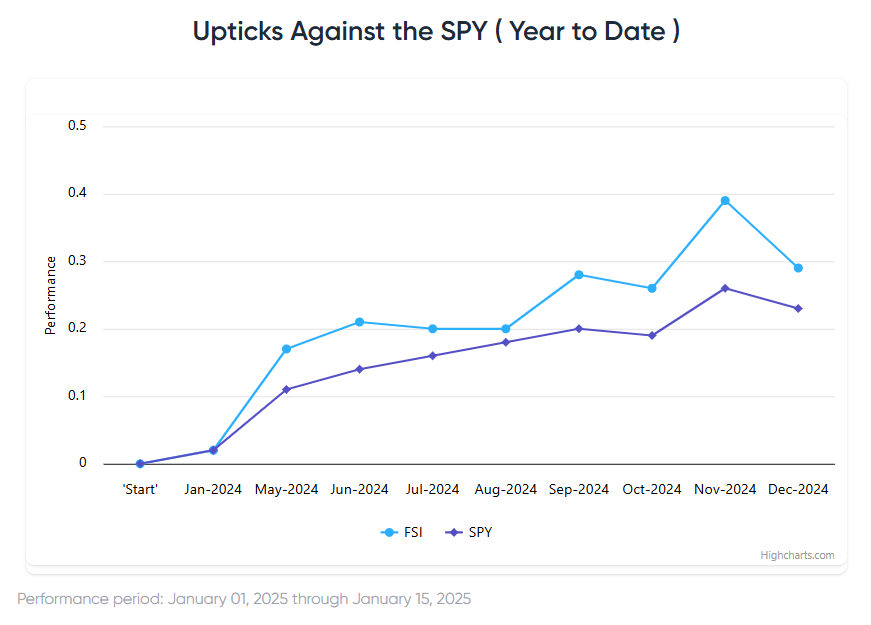

Stock List Performance

In the News

| More News Appearances |