Last week was an abridged trading week, as markets closed on Thursday to honor the passing of President Jimmy Carter. The week itself closed with a sharp selloff on Friday. Yields spiked and equities fell after what Head of Technical Strategy Mark Newton described as a “Goldilocks economic report.” The market entered a “good news is bad news regime” as investors appeared to view strong jobs numbers as increasing the odds of a resurgence of inflation – thus a higher probability of a slower pace for Fed cuts.

Lee doesn’t believe inflation is accelerating, pointing to wage growth holding steady at 3.9% from a year ago. He also highlighted what Chicago Fed President Austan Goolsbee noted on Friday—this is not a level associated with wage-driven inflationary pressures.

There was also some concern after the University of Michigan survey of one-year-forward inflation expectations rose unexpectedly to 3.3%, up from 2.8% last month. Lee pointed out the likely role of political partisanship – the inflation expectations of those identifying as Democrats surged while those of Republicans fell, with supporters on both sides flipping their views between October and January. “To me, this means this U Mich inflation survey looks ‘very political’ because the only change between October and now is the Republicans taking the White House and Congress (and the Harris White House loss).”

Together, these sent the VIX briefly above 20 on Friday, “a sign of panic and a sign we are nearing a bottom,” in Lee’s view. He warned us that “this is turbulent for markets near term.”

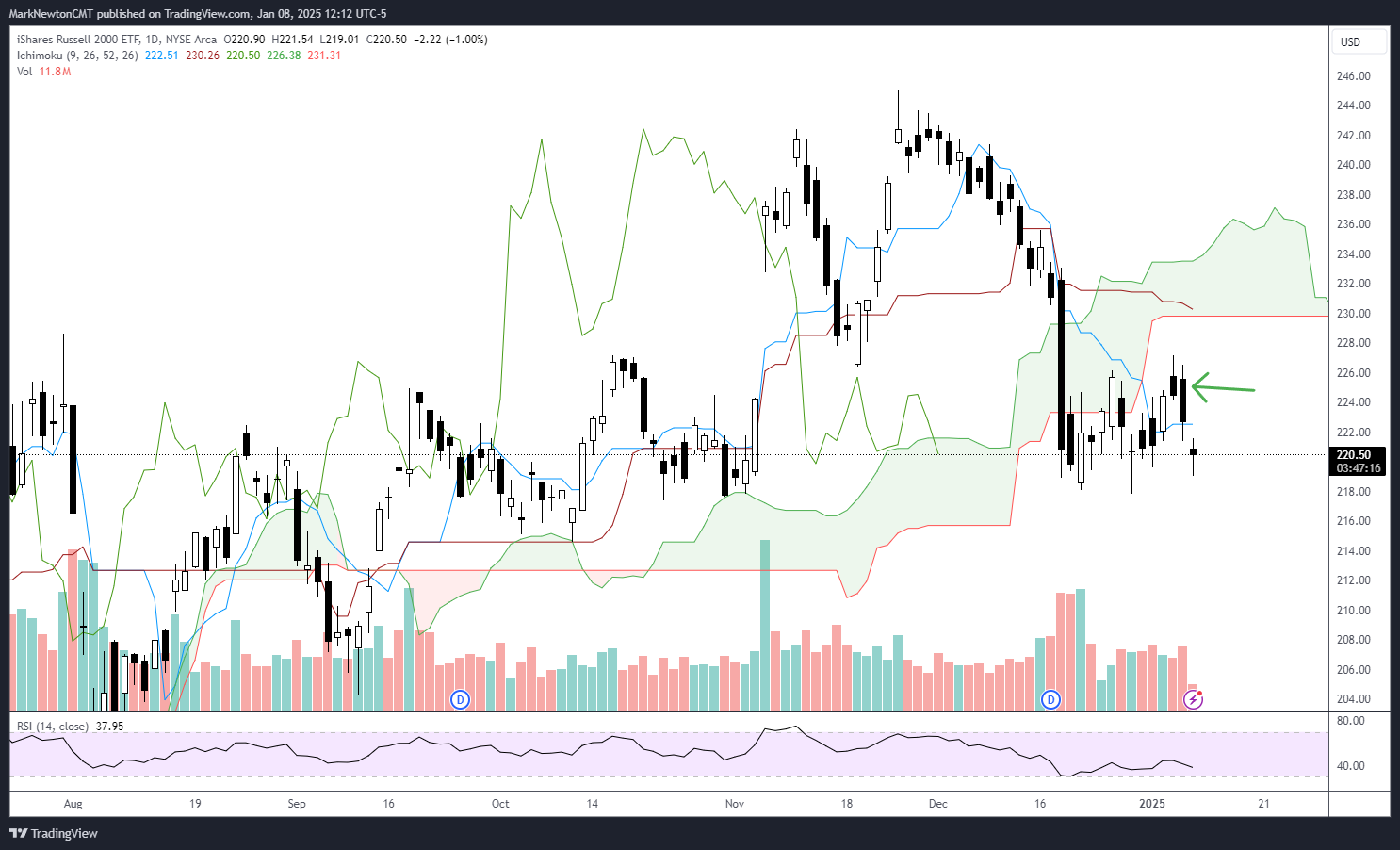

That’s consistent with Newton’s technical analysis-based perspective as well. Newton noted that the S&P 500 is still technically within its bearish short-term consolidation pattern. On Wednesday, he also warned that “SPX looks likely to undercut 5,829 post Friday’s jobs report,” and it did just that, closing the week at 5,827.04. Looking further out, he suggested that based on his work, technical support lies near 5,700. “I suspect that SPX might attempt a bottom by early next week and begin to bounce into mid-to-late January,” he told us.

Sector Allocation Strategy

These are the latest strategic sector ratings from Head of Research Tom Lee and Head of Technical Strategy Mark Newton – part of the January 2025 update to the FSI Sector Allocation Strategy. FS Insight Macro and Pro subscribers can click here for ETF recommendations, precise guidance on strategic and tactical weightings, detailed commentary, and methodology.

Chart of the Week

Thus far in 2025, we have yet to see a full trading week, with U.S. markets closed on Thursday to honor the passing of President Jimmy Carter. But the first five trading days of the year have been good, which Fundstrat Head of Research Tom Lee says bodes well for the rest of the year. “If you close positive in the first five days of the year, this vastly improves the probability that the full year will end up positive as well,” he reminded us. Indeed, as shown in our Chart of the Week, in historical instances in which the preceding year saw gains of more than 10% and stocks then advanced during the first five days of the year, stocks ended the rest of the year up 82% of the time.

Recent ⚡ FlashInsights

FSI Video: Weekly Highlight

Key incoming data

1/6 9:45 AM ET: Dec F S&P Global Services PMITame1/6 10:00 AM ET: Nov F Durable Goods OrdersTame1/7 8:30 AM ET: Nov Trade BalanceTame1/7 10:00 AM ET: Dec ISM Services PMITame1/7 10:00 AM ET: Nov JOLTS Job OpeningsTame1/8 9:00 AM ET: Dec F Manheim Used vehicle indexTame1/8 2:00 PM ET: Dec FOMC Meeting MinutesTame1/10 8:30 AM ET: Dec Non-Farm PayrollsHot1/10 10:00 AM ET: Jan P U. Mich. Sentiment and Inflation ExpectationHot- 1/13 11:00 AM ET: Dec NY Fed 1yr Inf Exp

- 1/14 6:00 AM ET: Dec Small Business Optimism Survey

- 1/14 8:30 AM ET: Dec PPI

- 1/15 8:30 AM ET: Dec CPI

- 1/15 8:30 AM ET: Jan Empire Manufacturing Survey

- 1/15 2:00 PM ET: Jan Fed Releases Beige Book

- 1/16 8:30 AM ET: Dec Retail Sales Data

- 1/16 8:30 AM ET: Jan Philly Fed Business Outlook

- 1/16 10:00 AM ET: Jan NAHB Housing Market Index

- 1/17 9:00 AM ET: Jan M Manheim Used vehicle index

- 1/17 4:00 PM ET: Nov Net TIC Flows

Stock List Performance

In the News

| More News Appearances |