We hope you and your family had a happy and joyous holiday. Stocks ended last week down, continuing a slide that began before the New Year. One obvious question arises: Does this decline signal a turning point for stocks?

“We don’t think so,” responded Fundstrat Head of Research Tom Lee. In his view, the tailwinds that helped 2024 gain more than 20% for a second straight year remain in place. In fact, those tailwinds “are arguably stronger in 2025 than they were in 2024,” he told us.

In the near term, Lee acknowledged that 2024 “ended on a whimper,” but historical precedent suggests that this lackluster year-end could set up a strong January. The last trading week of 2024 saw four straight daily declines, and when the Fundstrat Data Science team looked at historically similar precedents, they found reason for constructiveness.

Since 1928, there have been 10 previous instances of three or more consecutive daily declines in the final trading week of the year. Stocks were up one month later 80% of the time, with a median gain of 3.6%. Looking further out, stocks were up 12 months later 80% of the time as well, with median gains of 12.4%. That doesn’t mean this coming week will necessarily see a bounce, however. Fundstrat Head of Technical Strategy Mark Newton observed that “while I expect that this consolidation should be complete by mid-January, it’s hard to claim technically just yet that lows are in place.”

To Lee, this means that a continued pullback might be possible, but that would represent a buying opportunity. “Buying the dip continues to make sense, in our view,” he concluded.

Chart of the Week

This year, a longer-term tailwind could come in the form of the ISM Manufacturing PMI. The December reading came out on Friday, reaching a nine-month high. This is a metric Lee and his team are closely monitoring. “ISM manufacturing has been below 50 for 26 months (since Oct 2022), and we think it is set to rise above 50 in 2025,” Lee said, with the Federal Reserve in an easing cycle and an incoming White House that is seen as business-friendly. “As we’ve noted in the past, ISM Manufacturing tends to lead S&P 500 PS growth rates by roughly four months,” so “we would see a recovery in ISM to above the 50 mark as a signal for improving EPS growth.” This can be seen in our Chart of the Week.

Recent ⚡ FlashInsights

FSI Video: Weekly Highlight

Key incoming data

12/30 10:30 AM ET: Dec Dallas Fed Manuf. Activity SurveyTame12/31 9:00 AM ET: Oct S&P CoreLogic CS home priceTame1/2 9:45 AM ET: Dec F S&P Global Manufacturing PMITame1/3 10:00 AM ET: Dec ISM Manufacturing PMITame- 1/6 9:45 AM ET: Dec F S&P Global Services PMI

- 1/6 10:00 AM ET: Nov F Durable Goods Orders

- 1/7 8:30 AM ET: Nov Trade Balance

- 1/7 10:00 AM ET: Dec ISM Services PMI

- 1/7 10:00 AM ET: Nov JOLTS Job Openings

- 1/8 9:00 AM ET: Dec F Manheim Used vehicle index

- 1/8 2:00 PM ET: Dec FOMC Meeting Minutes

- 1/10 8:30 AM ET: Dec Non-Farm Payrolls

- 1/10 10:00 AM ET: Jan P U. Mich. Sentiment and Inflation Expectation

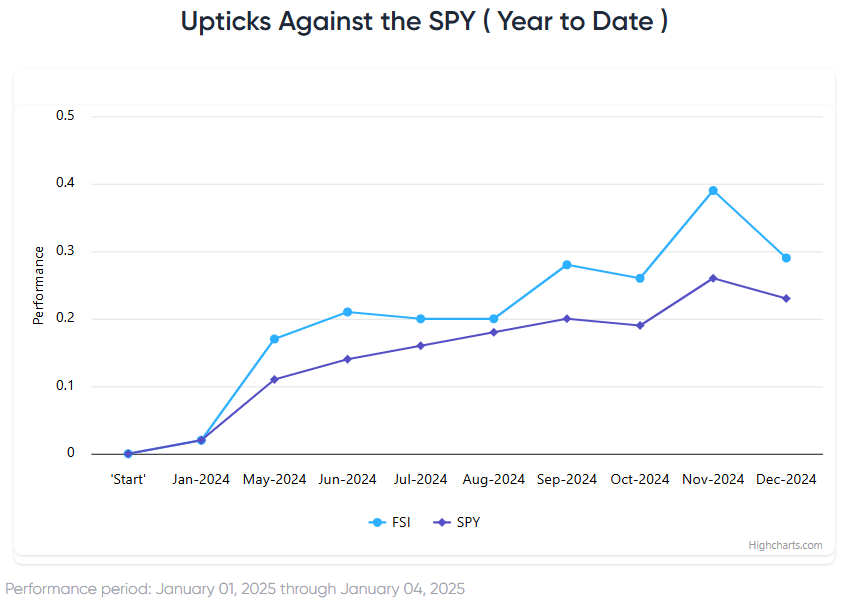

Stock List Performance

In the News

| More News Appearances |