The exuberant stock-market rally that has sent major indexes to records in recent weeks and months came under pressure last week. Worries about rates staying “higher for longer” dragged down markets, but Fundstrat Head of Research Tom Lee believes the declines mark what he calls a “buy the dip moment,” because in his view, the long-term fundamental trends are still intact.

From a technical perspective, it wasn’t a great week for market breadth. Head of Technical Strategy Mark Newton pointed out that the percentage of stocks moving above their 20-day, 50-day and 200-day moving averages tumbled even more. But he still expects markets to bounce back next week. “This is all in the context of a larger bull market, so this is just a corrective-type pattern,” Newton said. “I don’t sense that it’s right to make too much of this, but it is something that is ongoing.”

The declines last week were driven by the conclusion of the Federal Reserve’s meeting Wednesday. As widely expected, the central bank cut the benchmark interest rates by a quarter-percentage-point despite a pickup in inflation. What spooked the markets, however, was that the Fed penciled in just two cuts next year after previously indicating four, suggesting that the era of ultralow rates will take longer to arrive than many had previously anticipated. In response, all three major indexes tumbled Wednesday and struggled to bounce back Thursday.

Lee said the prospect of fewer rate cuts next year doesn’t bother him, because in his view, the Fed is still showing signs of dovishness. During the press conference after the meeting, Fed Chair Jerome Powell noted “inflation has once again underperformed relative to expectations.” But Powell himself also acknowledged that labor-market pressures were not to blame, and as Lee and his team have previously noted, the two biggest reasons for core inflation underperformance have been shelter and auto insurance. “We know [improvements to] shelter inflation are a matter of time, due to the lags of market prices impacting CPI,” Lee reminded us. “And auto insurance is already cooling from elevated levels and does not require further Fed intervention.”

“The S&P 500 has been very strong this year,” Lee said. “It’s avoided many opportunities for weakness, and there’s no reason to believe that what happened [mid-week] has changed any of that.”

All of us at FS Insight wish you and your family a happy, joyous holiday season and a healthy, prosperous 2025.

Chart of the Week

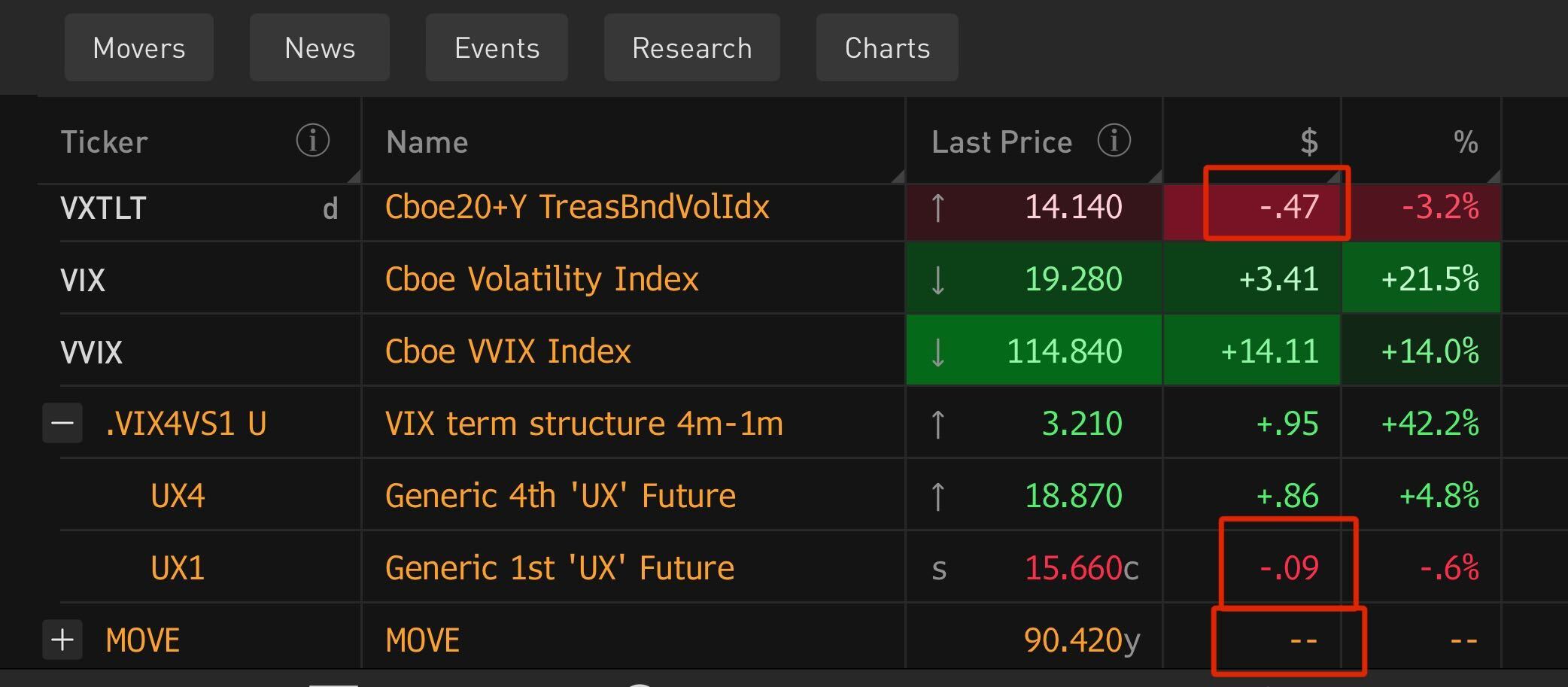

The VIX spiked on Wednesday after the Fed lowered expectations for the number of rate cuts coming in 2025. The index rose 74%, the second highest jump since February 2018 when it shot up 116%, according to data going back to 1990. But the spike in the VIX, widely considered Wall Street’s fear gauge, does not worry Fundstrat Head of Research Tom Lee. Lee reminded us that nine days after the 116% move in 2018, the S&P 500 had already recovered all of its losses. In fact, if one looks at the four biggest VIX spikes in the last 35 years, “what’s notable is how quickly markets recovered from these sell offs,” Lee pointed out. The market ended up higher three months later in all cases. We see this illustrated in our Chart of the Week.

Recent ⚡ FlashInsights

- fewer expected cuts in 2025 2 vs market expecting 3

- Powell notes some FOMC members incorporated Trump policy risk to forecast

- Thus, risk of tariffs or deportations.

- These are “risks” and thus they argue for fewer cuts

FSI Video: Weekly Highlight

Key incoming data

12/16 8:30 AM ET: Dec Empire Manufacturing SurveyTame12/16 9:45 AM ET: Dec P S&P Global Manufacturing PMITame12/16 9:45 AM ET: Dec p S&P Global Services PMITame12/17 8:30 AM ET: Nov Retail Sales DataTame12/17 9:00 AM ET: Dec P Manheim Used vehicle indexTame12/17 10:00 AM ET: Dec NAHB Housing Market IndexTame12/18 2:00 PM ET: Dec FOMC DecisionHawkish12/19 8:30 AM ET: 3Q T 2024 GDPTame12/19 8:30 AM ET: Dec Philly Fed Business OutlookTame12/19 10:00 AM ET: Nov Existing Home SalesTame12/19 4:00 PM ET: Oct Net TIC FlowsTame12/20 8:30 AM ET: Nov PCE DeflatorTame12/20 10:00 AM ET: Dec F U. Mich. Sentiment and Inflation ExpectationTame- 12/23 8:30 AM ET: Nov Chicago Fed Nat Activity Index

- 12/23 10:00 AM ET: Dec Conference Board Consumer Confidence

- 12/24 10:00 AM ET: Nov New Home Sales

- 12/24 10:00 AM ET: Nov P Durable Goods Orders

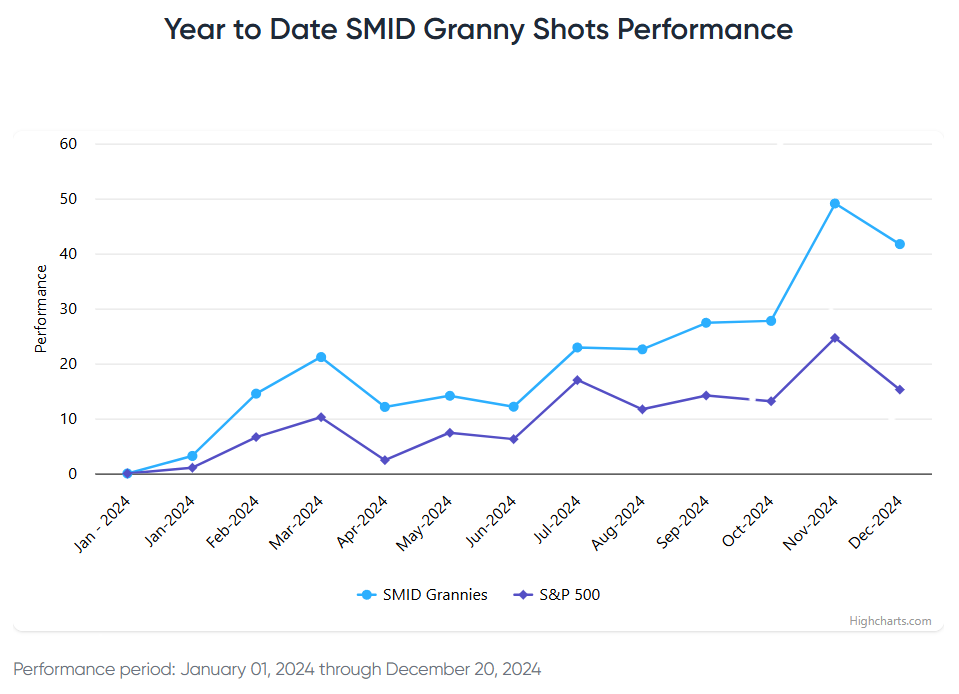

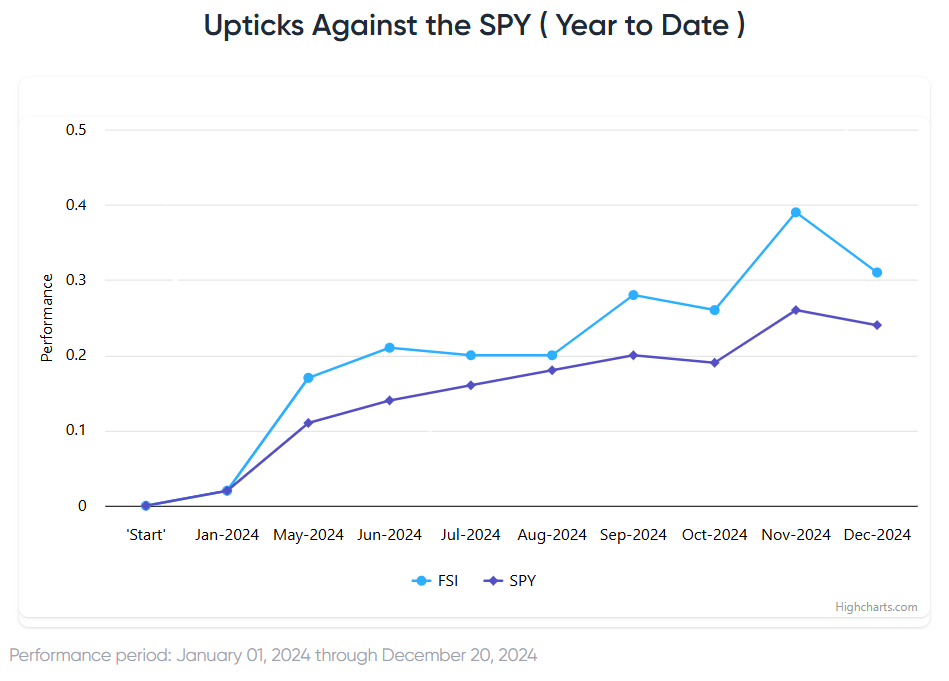

Stock List Performance

In the News

| More News Appearances |

- Spot VIX surging today 21% to 19

- But 1-month VIX is 15.6 and down for the day

- Also bond volatility is down — MOVE and 20-yr bond

This is a positive divergence. Like stocks are “over-reacting” Another reason to “buy this dip” and I would not see as signs stocks topped for the year