Stocks extended their gains for another week, with the S&P 500 and Nasdaq both notching fresh records. That was in line with Fundstrat Head of Research Tom Lee’s and Head of Technical Strategy Mark Newton’s expectations for a December rally. However, that’s not to say Lee sees a straight upward path for stocks until Dec. 31. He doesn’t, and neither does Newton.

“When you break down the S&P 500 into sectors and see that Financials and Industrials are down, that’s interesting given that the market’s at new all-time highs,” Newton observed. “That doesn’t mean we should be bearish per se, but we should stay vigilant instead of just concluding, ‘Oh, the market’s great.'”

Lee explained his view that we could see some bumpy weeks in mid-December: “We believe a few near-term headwinds could combine to create a fundamental ‘zone of hesitation,'” he warned. These primarily revolve around market uncertainty around upcoming macro events, arguably the two most important of which are the November CPI report on December 11 and the Dec. 18 meeting of the Federal Open Market Committee (FOMC). “Once we are through this gauntlet, we expect the usual strong December seasonals to support stocks into year end,” Lee said. “I think 6,300 is very doable,” he suggested, “and I would suggest buying any dips that might occur before the end of the year.”

Bitcoin crossed the threshold of $100,000 this week. Sean Farrell, Head of Digital Asset Strategy noted that “the reasons for constructiveness that we’ve been talking about for the past couple of months are coming together.” Furthermore, in his view, “metrics like breadth, funding rates, and the amount of leverage in the ecosystem all suggest to me that this ‘fruit’ has a little more ‘juice’ to it – my base case is probably a couple more weeks. Stable coin creations are still solid. ETF flows are still solid. And we still have a Coinbase premium. So I’m not rushing to take off too much risk here.”

Sector Allocation Strategy

These are the latest strategic sector ratings from Head of Research Tom Lee and Head of Technical Strategy Mark Newton – part of the December 2024 update to the FSI Sector Allocation Strategy. FS Insight Macro and Pro subscribers can click here for ETF recommendations, precise guidance on strategic and tactical weightings, detailed commentary, and methodology.

Chart of the Week

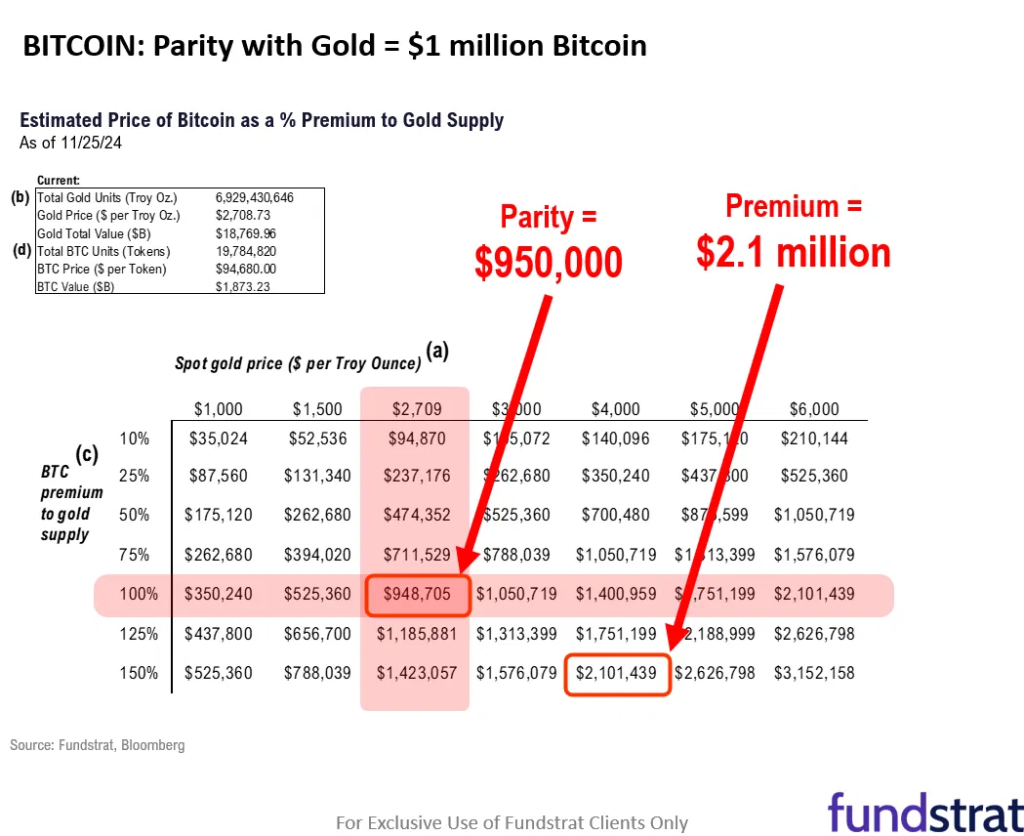

Fundstrat Head of Research Tom Lee was one of the first “traditional finance” strategists to see the potential in Bitcoin. He had this to say about BTC breaking through the $100,000 barrier this week: “I don’t think 100,000 is the ceiling for Bitcoin. Looking at the value of the world’s gold, Bitcoin is already now worth 10% of gold – or maybe more, depending on how worldwide gold quantities and values are calculated. Yet if we look at what it would take for aggregate Bitcoin value to reach parity with gold, that leaves a lot of room for additional upside.” This is shown in our Chart of the Week.

Recent ⚡ FlashInsights

FSI Video: Weekly Highlight

Key incoming data

12/2 9:45 AM ET: Nov F S&P Global Manufacturing PMITame12/2 10:00 AM ET: Nov ISM Manufacturing PMITame12/3 10:00 AM ET: Oct JOLTS Job OpeningsTame12/4 9:45 AM ET: Nov F S&P Global Services PMITame12/4 10:00 AM ET: Nov ISM Services PMITame12/4 10:00 AM ET: Oct F Durable Goods OrdersTame12/4 2:00 PM ET: Fed Releases Beige BookDovish12/5 8:30 AM ET: Oct Trade BalanceTame12/6 8:30 AM ET: Nov Non-Farm PayrollsTame12/6 9:00 AM ET: Nov F Manheim Used vehicle indexMixed12/6 10:00 AM ET: Dec P U. Mich. Sentiment and Inflation ExpectationTame- 12/9 11:00 AM ET: Nov NY Fed 1yr Inf Exp

- 12/10 6:00 AM ET: Nov Small Business Optimism Survey

- 12/10 8:30 AM ET: 3Q F Non-Farm Productivity

- 12/10 8:30 AM ET: 3Q F Unit Labor Costs

- 12/11 8:30 AM ET: Nov CPI

- 12/12 8:30 AM ET: Nov PPI

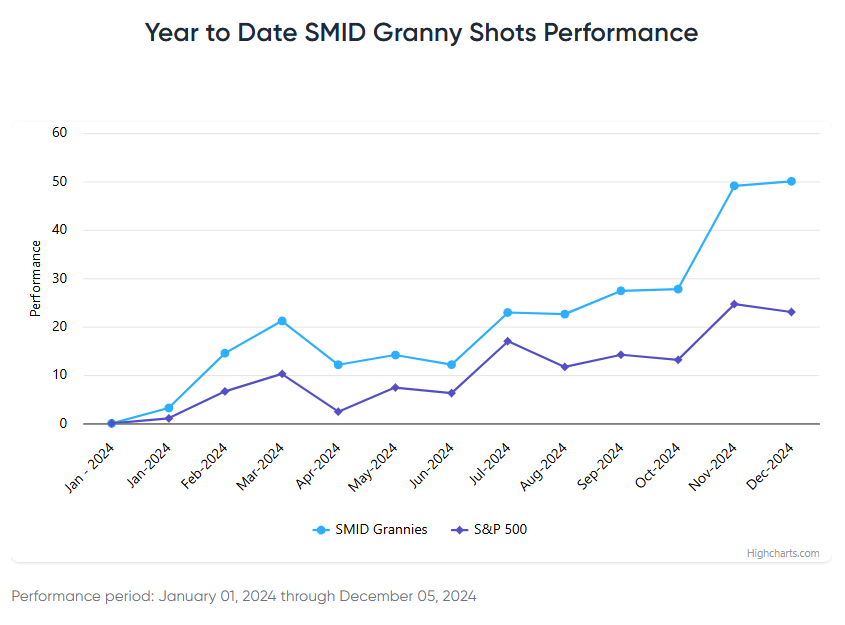

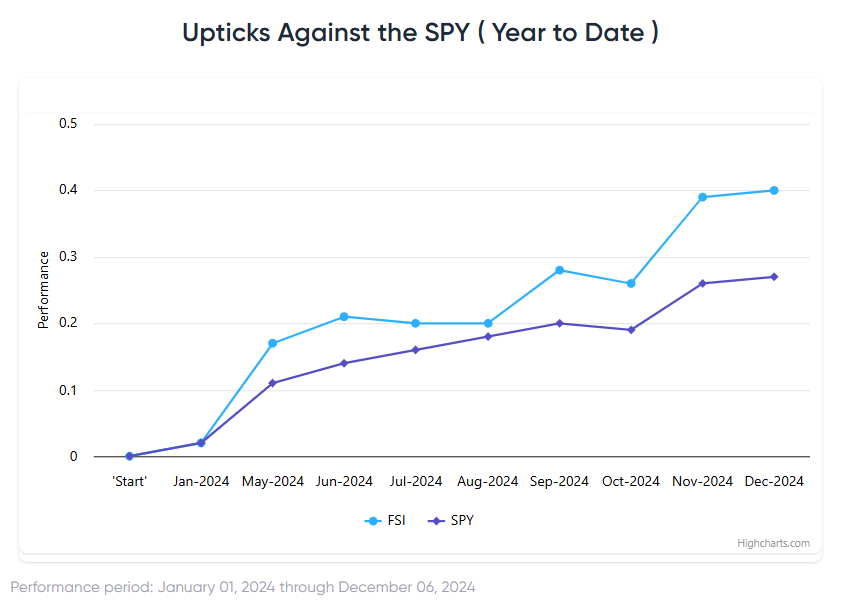

Stock List Performance

In the News

| Start Your 30-Day Free Trial Now! More News Appearances |