We hope everyone in the FS Insight community enjoyed a happy and fantastic Thanksgiving holiday. Despite the last trading week being shortened by the holiday, stocks had enough time to stage a Thanksgiving rally, as Fundstrat Head of Research Tom Lee had predicted. The S&P 500 thus closed out the month up 5% – the best month of 2024.

As Head of Technical Strategy Mark Newton noted, the recent rally has included a comeback in equal-weighted Technology (RSPT -1.12% ) and equal-weighted Materials (RTM -1.18% ), contributing to an improvement in breadth. “Thus far, none of the underperformance from large-cap Technology has adversely affected ^SPX or QQQ -0.05% .” He added, “I expect a coming trend reversal, but as of right now, prices have not broken down. At present, there won’t be much to make of any technical damage until or unless SPX-5853 is undercut.”

A week ago, incoming President Trump picked Scott Bessent to head the Treasury Department, removing a source of uncertainty from the markets. In Lee’s view, “There are plenty of reasons to view [Bessent’s nomination] as market friendly,” including Bessent’s advocacy for the equity-friendly “3-3-3” policy of cutting the budget deficit to 3% of gross domestic product by 2028, spurring GDP growth of 3% through deregulation, and producing an additional 3 million barrels of oil or its equivalent a day. “We think this reinforces the market’s perception of a ‘Trump put’ – of a White House that wants equities to perform well,” Lee said.

Looking past the Thanksgiving holiday, Lee continues to see positive supports for equities as we head into the end of 2024. As a reminder, Lee and Fundstrat’s Data Science team found that in the 31 U.S. Presidential elections since 1900, the stock market gained 61% of the time three months post-election, with a median gain of 5.5%. If we narrow this down to years in which there was no recession and markets were down heading into the election, the stock market rallied every single time (six out of six historical precedents), with median gains of 7.2%. A 7% gain from 2024 Election Day would imply the S&P 500 reaching around 6,300.

Chart of the Week

October core PCE came in last week at +0.27% MoM, slightly better than consensus of +0.28%. Yet Fundstrat’s Tom Lee sees the report as showing inflation to be even weaker (better) than the core PCE number suggests. A large part of this comes from the fact that the third-largest contributor to core PCE rising in October was the “Magazines & Stationary” component, which contributed 0.04% to the core PCE number. As Lee noted, “The monthly rise of this component, +6.23%, is 75% annualized. The subcategory ‘Newspapers and Periodicals’ is rising even faster, at +9.00% MoM or 108% annualized. Does it make sense to consider this as sustainable? Does it make sense to view this component as having caused a structural change to the path of inflation in October?” As our Chart of the Week shows, these are the largest jumps for those components ever. If we exclude this component, Core PCE would have risen +0.22% MoM, or 2.5% annualized, in October. “This is a very good pace and tracking towards the Fed’s 2% target,” Lee told us.

Recent ⚡ FlashInsights

FSI Video: Weekly Highlight

Key incoming data

11/25 8:30 AM ET: Oct Chicago Fed Nat Activity IndexTame11/25 10:30 AM ET: Nov Dallas Fed Manuf. Activity SurveyTame11/26 9:00 AM ET: Sep S&P CoreLogic CS home priceTame11/26 10:00 AM ET: Nov Conference Board Consumer ConfidenceTame11/26 10:00 AM ET: Oct New Home SalesTame11/26 2:00 PM ET: Nov FOMC Meeting MinutesDovish11/27 8:30 AM ET: Oct PCE DeflatorTame11/27 8:30 AM ET: 3Q S 2024 GDPTame11/27 10:00 AM ET: Oct P Durable Goods OrdersTame- 12/2 9:45 AM ET: Nov F S&P Global Manufacturing PMI

- 12/2 10:00 AM ET: Nov ISM Manufacturing PMI

- 12/3 10:00 AM ET: Oct JOLTS Job Openings

- 12/4 9:45 AM ET: Nov F S&P Global Services PMI

- 12/4 10:00 AM ET: Nov ISM Services PMI

- 12/4 10:00 AM ET: Oct F Durable Goods Orders

- 12/4 2:00 PM ET: Fed Releases Beige Book

- 12/5 8:30 AM ET: Oct Trade Balance

- 12/6 8:30 AM ET: Nov Non-Farm Payrolls

- 12/6 9:00 AM ET: Nov F Manheim Used vehicle index

- 12/6 10:00 AM ET: Dec P U. Mich. Sentiment and Inflation Expectation

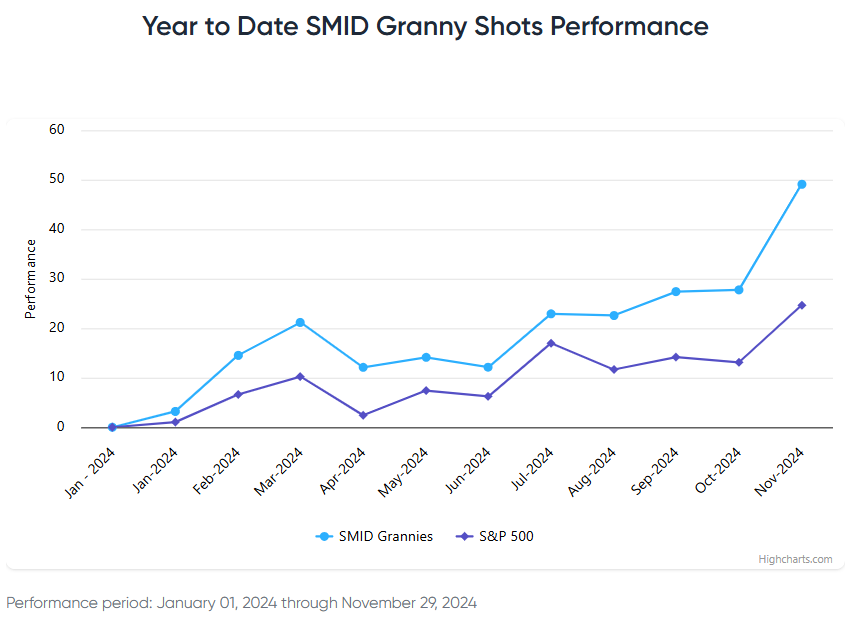

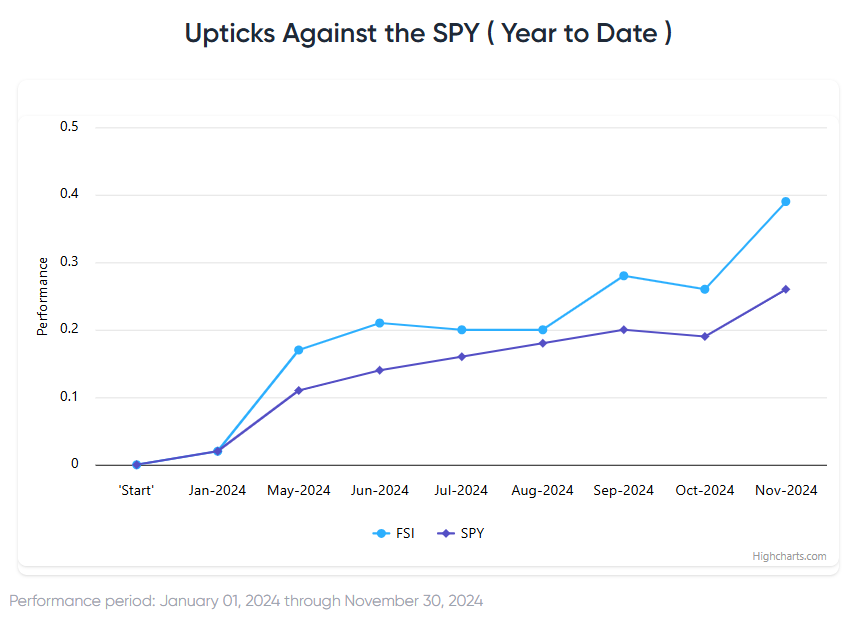

Stock List Performance

In the News

| More News Appearances |

- fell from $99k to $91k

- found support near 20 day moving avg $90k

Polymarket betting markets see 74% odds of $100k in 2024. We believe odds are higher MSTR 1.79% SMLR -5.39% MARA 2.12%