Stocks gave back their gains from the post-election surge last week, and then some. Much of that followed worries about inflation and its effect on Federal Reserve policy. Investors got the chance to review fresh inflation this week, with CPI showing inflation no closer to the Fed’s 2% target. However, Core CPI arrived roughly in line with expectations, and to Fundstrat Head of Research Tom Lee, the October CPI report was actually “better than it appears at first glance.”

A 30% annualized surge in used car prices was one of the largest contributors to the rise in Core CPI MoM. Head of Data Science Ken Xuan hypothesized that used car prices were affected by previous hurricanes, and Lee concurred, viewing it as a “distortion [that] will disappear next month.” As he reminded us, “The used-car CPI component tends to lag Manheim wholesale used car prices by two months. If this trend holds, then based on recent Manheim data. this component is set to tank.”

As implied by Fed Funds futures trading, odds of another rate cut at the FOMC meeting in December surged from 55% to 82% after CPI data was released. Lee saw this as evidence that bond investors agree with his CPI assessment. “In my view, the bond market realizes that this Core CPI of +0.28% should really be viewed as +0.22% MoM if one strips out the impact of the used-car component – and that is basically at the Fed’s target.”

Looking beyond the immediate-term and through to the end of the year, Lee remains constructive. At our weekly research huddle, he suggested that investors are being too skeptical: “Just remember how many times this year that we heard someone warning that a recession was imminent, or that the labor market was falling apart, or that the Fed was behind the curve. I think that same wall of worry is in place now. But we know the seasonals are really pretty strong, and at the end of the day, the Fed is still dovish.” Lee does see a possible near-term issue, which is discussed in the Chart of the Week below.

Head of Technical Strategy Mark Newton also has near-term concern. “Broader breadth, on a larger scale, is very good in my view,” he said, but “short-term breadth is what concerns me. Historically after elections, we’ve seen the market start to turn up sharply, with breadth of four-to-one or even five-to-one positive. But this time it was more like three-to-two. Almost a third of stocks did not participate in the post-Election Day rally. I still have a lot of confidence in the stock market between now and next spring or summer, but I’m just not certain it’s going to be a straight shot. I have short-term concerns, and by short-term I mean probably over the next four or five weeks. I think it’s definitely wise not to get too complacent right now.”

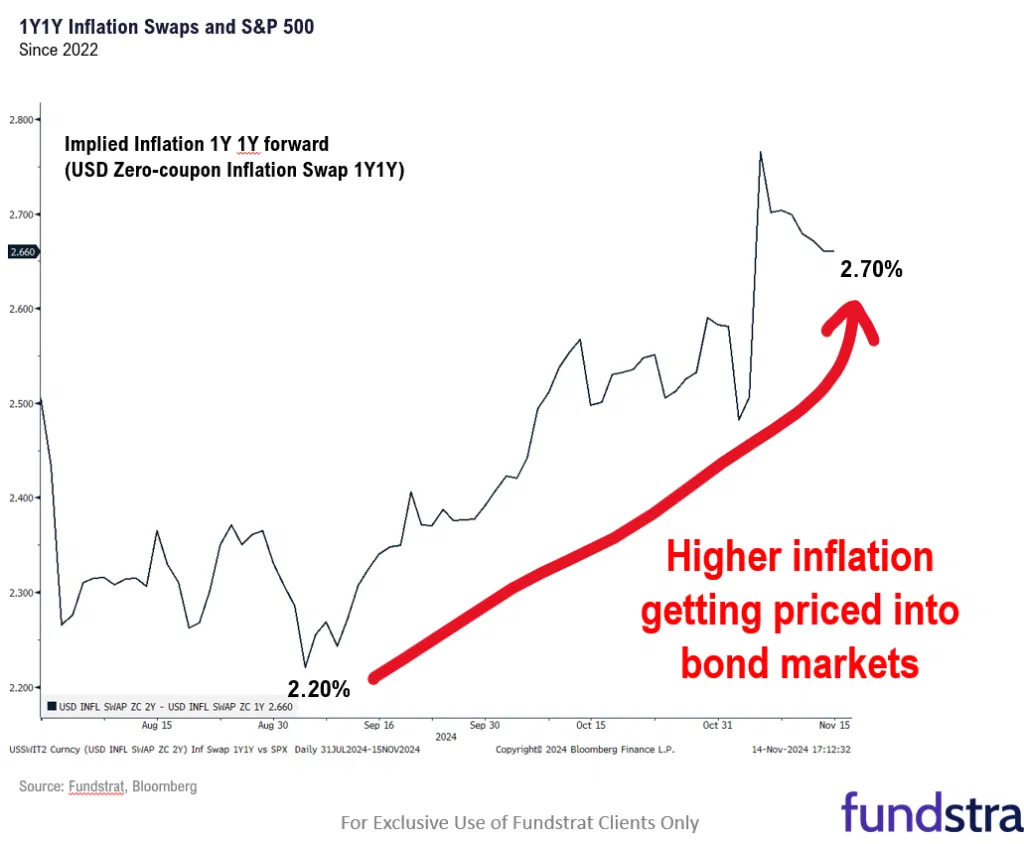

Chart of the Week

Fundstrat’s Tom Lee maintains an intermediate-term constructive outlook on the markets. As for the near term, “the only thing I’m kind of worried about is the one year-one year inflation forward swap,” he told us this week. This implied measure of where the market thinks one-year forward expectations will be one year from now (in other words, inflation from November 2025 to November 2026) has risen sharply over the past two months, nearing “a level that indicates that the market is starting to worry about inflation.” To Lee, these expectations are important “even though we’re not worried about inflation. The Fed responds to these measures, and they influence policymakers.”

Recent ⚡ FlashInsights

FSI Video: Weekly Highlight

Key incoming data

11/12 6:00 AM ET: Oct Small Business Optimism SurveyTame11/12 11:00 AM ET: Oct NY Fed 1yr Inf ExpTame11/13 8:30 AM ET: Oct CPITame11/14 8:30 AM ET: Oct PPITame11/15 8:30 AM ET: Oct Retail Sales DataTame11/15 8:30 AM ET: Nov Empire Manufacturing SurveyHot- 11/18 10:00 AM ET: Nov NAHB Housing Market Index

- 11/18 4:00 PM ET: Sep Net TIC Flows

- 11/19 9:00 AM ET: Oct M Manheim Used vehicle index

- 11/21 8:30 AM ET: Nov Philly Fed Business Outlook

- 11/21 10:00 AM ET: Oct Existing Home Sales

- 11/22 9:45 AM ET: Nov P S&P Global Manufacturing PMI

- 11/22 9:45 AM ET: Nov P S&P Global Services PMI

- 11/22 10:00 AM ET: Nov F U. Mich. Sentiment and Inflation Expectation

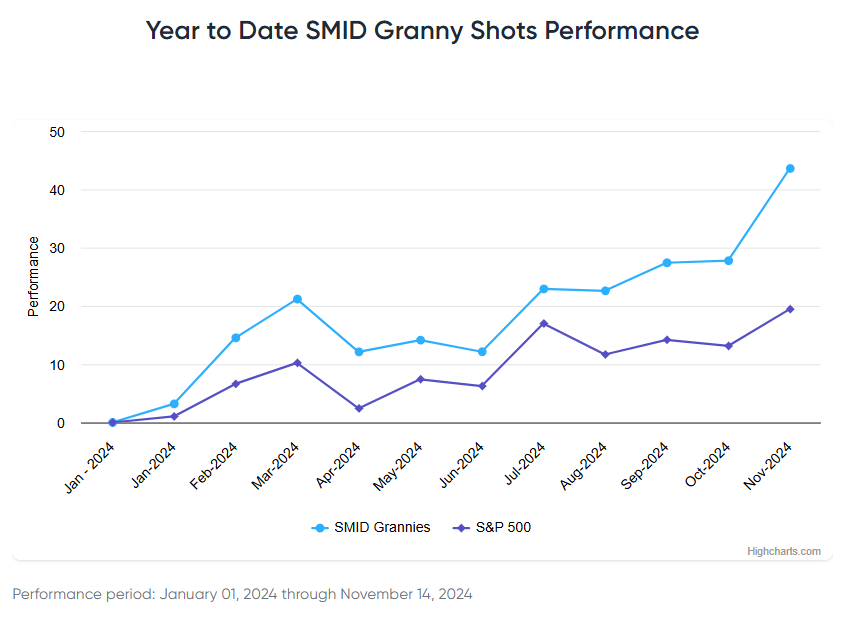

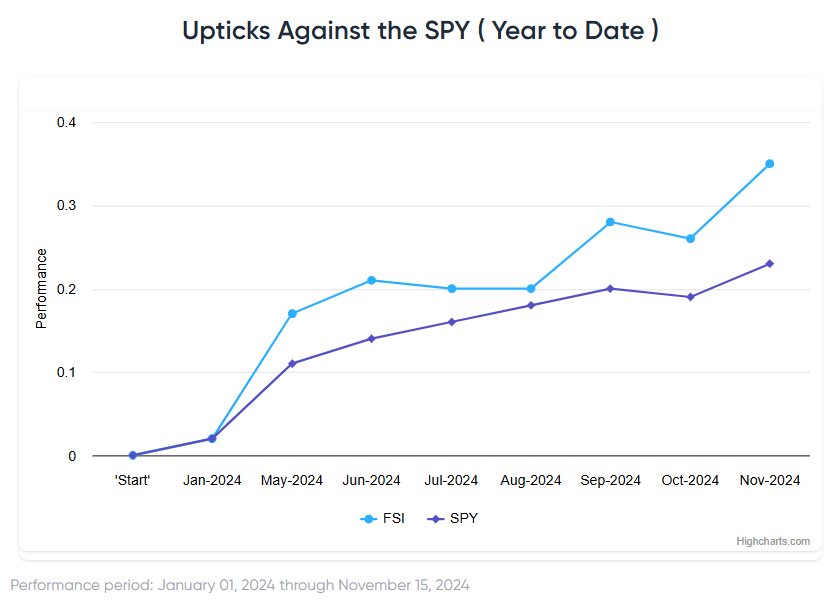

Stock List Performance

In the News

| Start Your 30-Day Free Trial Now! More News Appearances |