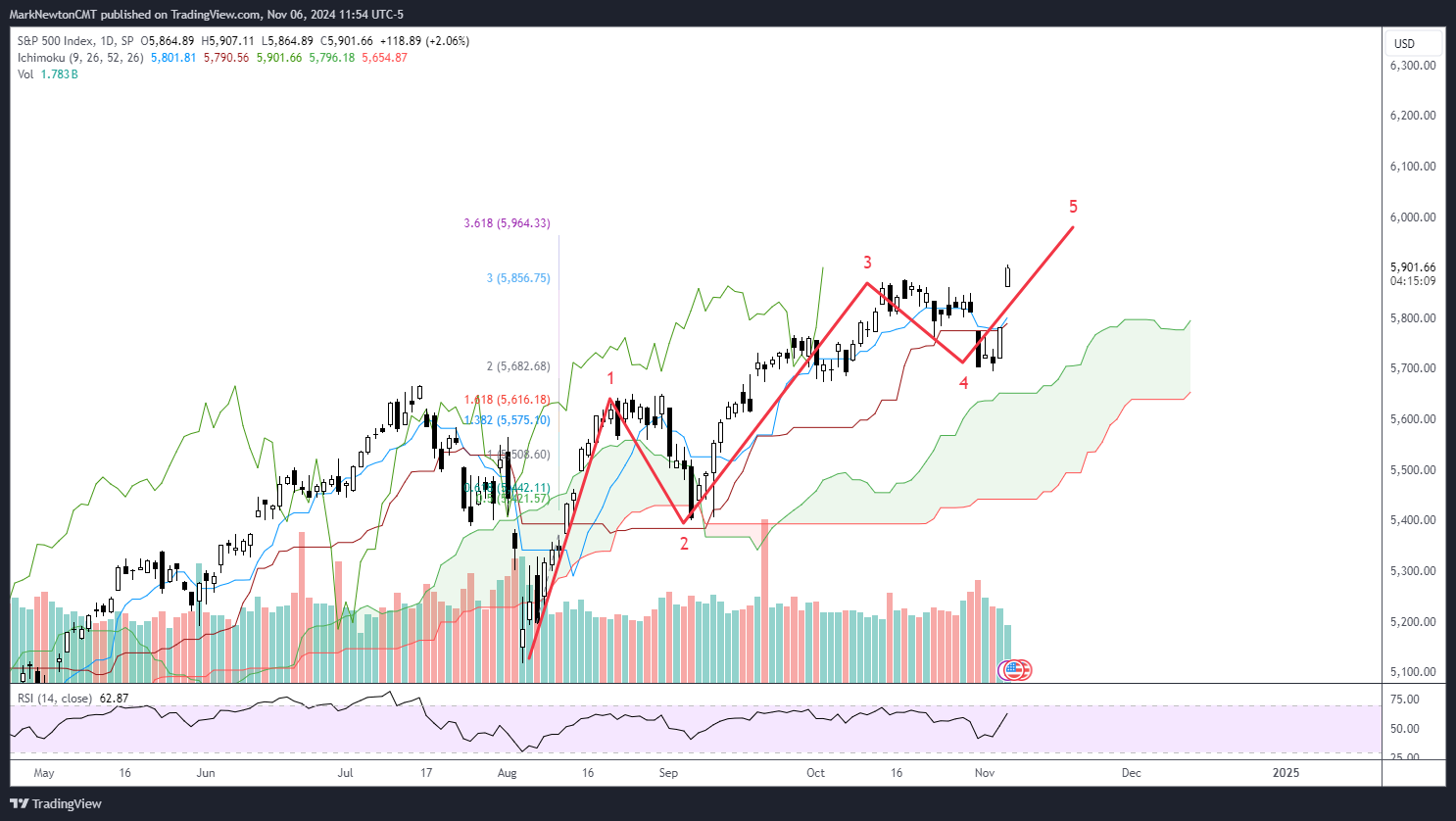

With the outcome of the election emerging far more quickly and more definitively than many expected, markets proceeded to surge. Indeed, the major indices – the S&P 500, Nasdaq, Dow, and last but not least, the small-cap Russell 2000 – recorded their best weeks of the year. As Head of Technical Strategy Mark Newton noted, “We saw a historic move in small caps on Wednesday, getting our long-awaited breakout in IWM above the key 227 level. It was the largest move after an election for small caps that we’ve seen since the inception of Russell 2000 in 1978. The second-largest, by the way, was in 2016, the day after Trump was elected the first time.”

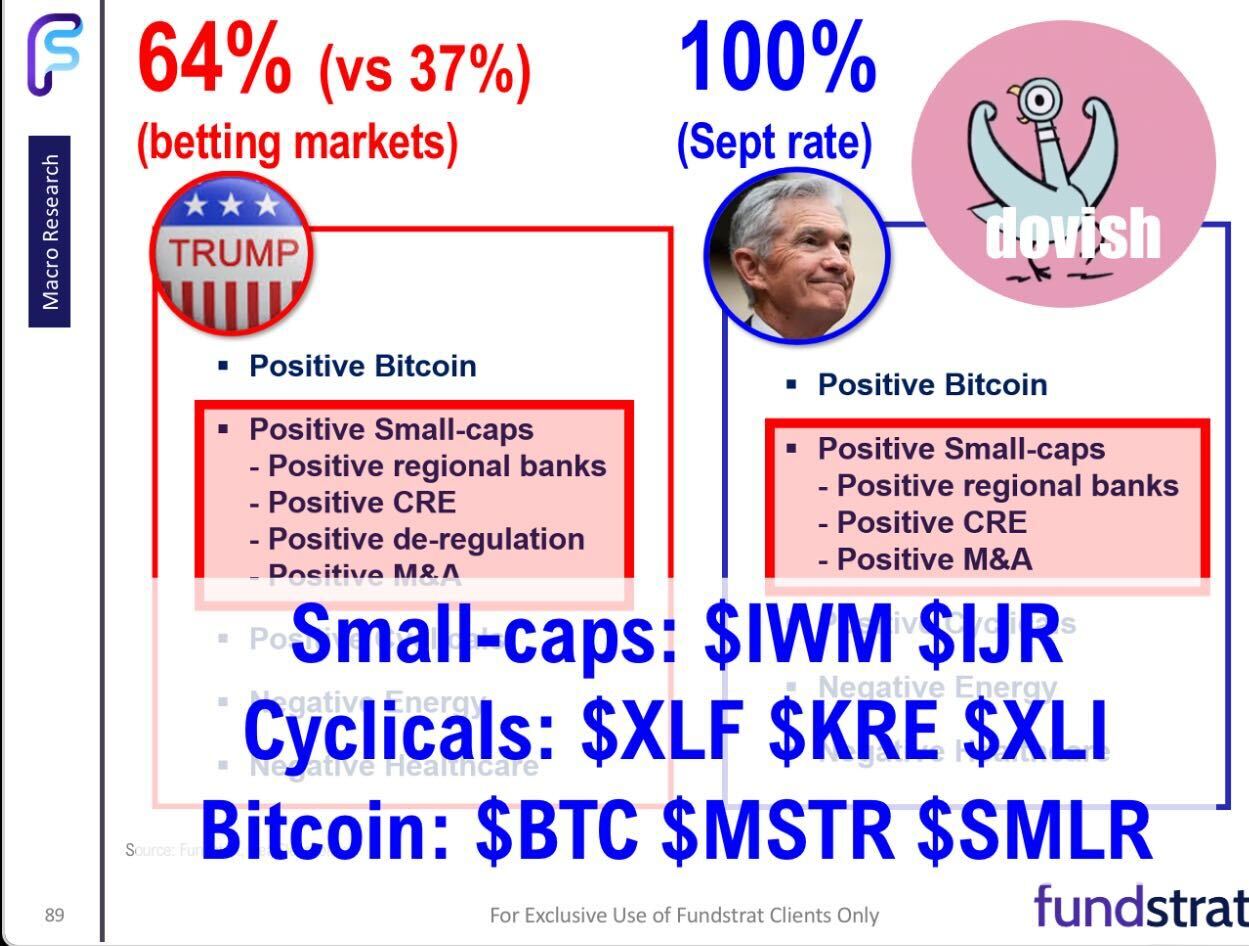

Ahead of the election, Fundstrat Head of Research Tom Lee noted that he expected stocks to do well into the end of the year regardless of which candidate emerged on top. However, with Donald Trump quickly claiming victory, the election uncertainty that has affected markets for the past eight weeks quickly dissipated. As he has written before, “the trades for a dovish Fed and the trades for a Trump victory are the same: small-caps, Bitcoin, Financials, and Industrials.

The Federal Open Market Committee also met last week, voting to lower the target rate by another 25 bp to 4.5% – 4.75%, as widely anticipated. Federal Reserve Chair Jerome Powell told reporters afterwards that “we have gained confidence that [inflation is] on a sustainable path down to 2%.” He also affirmed that “in the near term, the election will have no effect on our policy decisions” given the time it will take for the new administration and Congress to decide on economic policy changes and the time it will take for data about the impact of those decisions to emerge. For Lee, the most important takeaway was that “even though inflation reports recently were slightly ‘hotter’ than expected, and regardless of election results, the Fed is committed to cutting rates. Overall,” he concluded, “this was a dovish meeting and it reinforces the tailwinds for equities into year-end, with Fed cuts boosting the economy.”

The post-election rally was marked in particular by strength not just in small caps, but meaningful advances in Financials and Technology. For Newton, the move in Transports was perhaps just as important. “Transports finally broke out to new all time highs after about three years of going sideways,” he said at our weekly huddle. “To me, that’s a fairly important development that’s going to positively influence the Industrials. For Dow theory purists, it’s a very big positive to see for Dow Theory purists to see Transports finally join the Industrials, to join the Utilities, back at new highs, and it’s a comforting thing for overall market structure.”

Newton has some near-term concerns however. “The post-election activity was overall a very healthy move, but in my view, the S&P 500 has now gotten a little bit stretched on this breakout.” Expanding on that, he noted that though the larger index numbers showed strength, “I have some issues about breadth. There’s a lot of stocks – about a third of the S&P – that did not participate on [last week’s] rally. I’d want to see that improve, and that would really help me to gain conviction.” The bottom line for Newton: “My thinking is that we’re obviously still running up in the short term. I think that probably continues for another three to five days for those who are tactical, and then I expect we’ll probably see some weakness or consolidation in the back half of November.“

Chart of the Week

With the election cycle over, “I think it’s now time to focus on how to position between now and year end,” Fundstrat Head of Research Tom Lee told us. As he has previously written, those areas and sectors most likely to benefit from a Trump victory coincide with those that he has been flagging as benefiting from the Fed moving further into the rate-cut cycle. “These are also what worked after Trump won in 2016,” he noted, and this is shown in our Chart of the Week.

Recent ⚡ FlashInsights

FSI Video: Weekly Highlight

Key incoming data

11/4 10:00 AM ET: Sep F Durable Goods OrdersTame11/5: US Presidential Election 2024Dovish11/5 8:30 AM ET: Sep Trade BalanceTame11/5 9:45 AM ET: Oct F S&P Global Services PMITame11/5 10:00 AM ET: Oct ISM Services PMIMixed11/7 8:30 AM ET: 3Q P Non-Farm ProductivityTame11/7 8:30 AM ET: 3Q P Unit Labor CostsMixed11/7 9:00 AM ET: Sep F Manheim Used vehicle indexTame11/7 2:00 PM ET: Nov FOMC DecisionDovish11/8 10:00 AM ET: Nov P U. Mich. Sentiment and Inflation ExpectationTame- 11/12 6:00 AM ET: Oct Small Business Optimism Survey

- 11/12 11:00 AM ET: Oct NY Fed 1yr Inf Exp

- 11/13 8:30 AM ET: Oct CPI

- 11/14 8:30 AM ET: Oct PPI

- 11/15 8:30 AM ET: Oct Retail Sales Data

- 11/15 8:30 AM ET: Nov Empire Manufacturing Survey

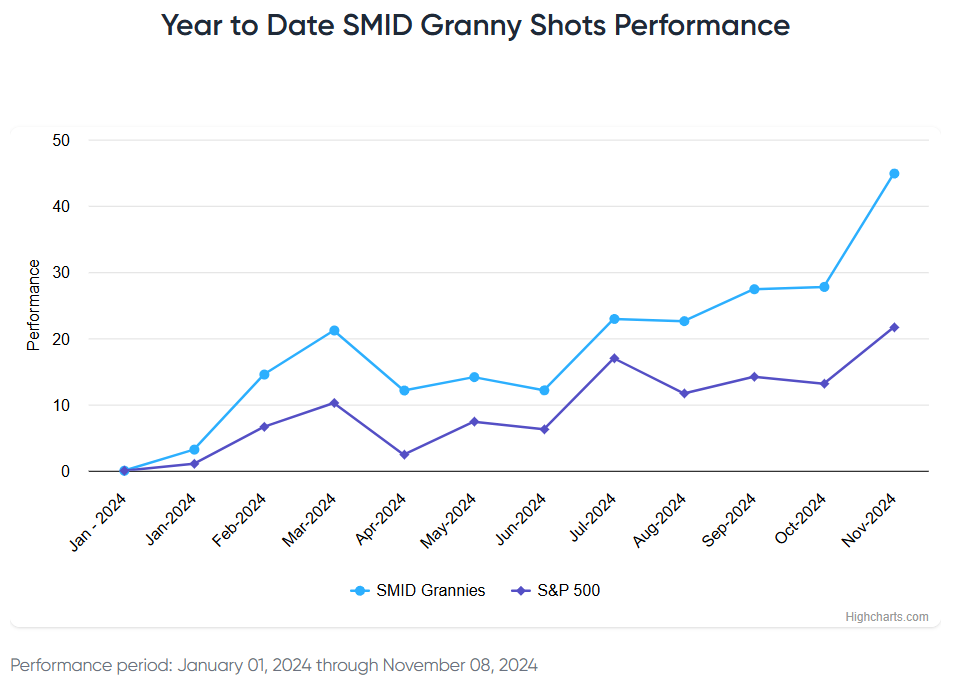

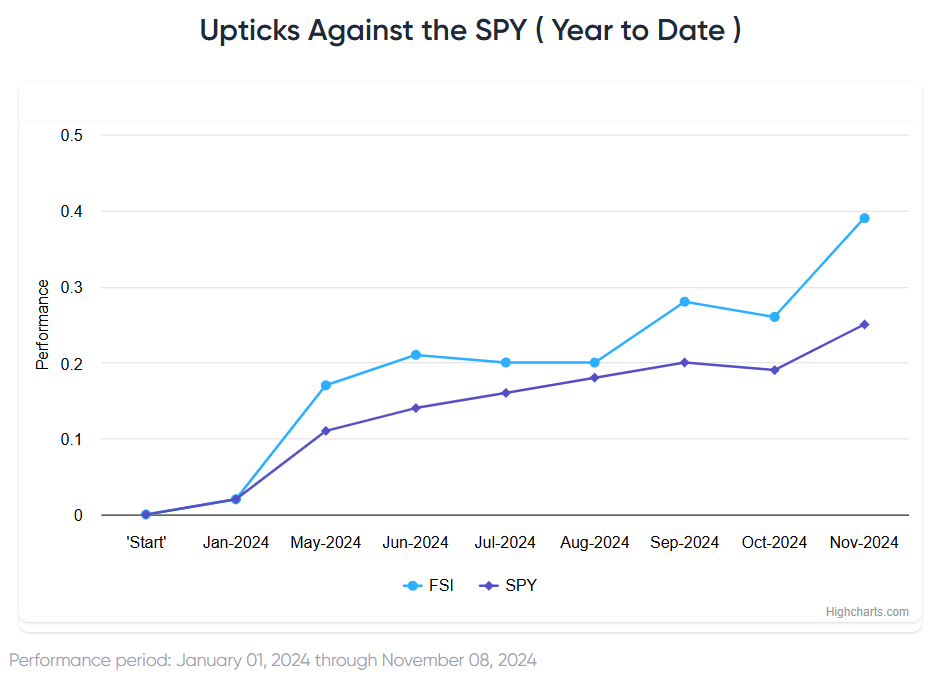

Stock List Performance

In the News

| More News Appearances |

- small caps IWM 1.98%

- financials and industrials KRE 2.86% XLF 1.22% XLI 1.29%

- bitcoin BTC SMLR -4.18% MSTR 7.81%

Today’s open validates these views. Stick with them. Add if you have not added exposure.