A month ago, Fundstrat Head of Research Tom Lee warned that October could be “iffy” for stock investors, and although he was surprised by the strong advances we saw during the month, the S&P 500 ultimately ended down about 1% for the month. That’s not to say that this is the start of a major decline, however. Lee still sees stocks as having solid fundamentals. For one thing, “real revenue growth, adjusted for inflation, is surging,” he told clients during a special election installment of his monthly Market Update webinar.

However, he continues to see the possibility of near-term volatility and challenging conditions for the month of November, due to some recently emerging headwinds. One of those stems from the expectation that the uncertainty surrounding the upcoming election could extend well past November 5, Election Day. A survey of our clients during the webinar showed that roughly 75% of them believe that the results will only be made clear between mid-November and the end of the year. VIX futures trading suggests that the market agrees. The VIX term structure is currently inverted and is staying inverted past election day, implying that markets expect larger volatility moves near-term. This makes sense to Lee: “Intuitively, we can imagine equity markets would be ‘on hold’ until after this election decision is made.”

Fundstrat Head of Technical Strategy Mark Newton is also wary of what might happen to markets in November. This week, he told us that near-term equity trends look “fragile.” This assessment is based in part on recent breadth and momentum readings, which he told us at our weekly research huddle have gotten “increasingly worse in the last couple weeks.” Breadth is now “abysmal,” he said, noting that “the percentage of stocks above their 10-day moving averages is now down at a very low level of 36%.” That’s notable because in recent history, “when we’ve gotten to those levels, like back in September, back in August, back in June and April, the market has shown pretty big corrections into that time.”

“My thinking is that November is going to be a down month,” Newton said. On an intermediate term, however, the market still looks healthy to him. “The overall level of the percentage of stocks that are within 20% of their 52 week highs is still at 84% so that’s still very, very good.”

Sector Allocation Strategy

These are the latest strategic sector ratings from Head of Research Tom Lee and Head of Technical Strategy Mark Newton – part of the November 2024 update to the FSI Sector Allocation Strategy. FS Insight Macro and Pro subscribers can click here for ETF recommendations, precise guidance on strategic and tactical weightings, detailed commentary, and methodology.

Chart of the Week

Fundstrat’s Tom Lee remains sanguine about equities after election uncertainty fades. “The Fed remains dovish, and in my view, Fed cuts are boosting the economy,” he said. Furthermore, “inflation expectations remain in check. When you look at market expectations, you really start to see markets come under pressure when inflation expectations rise above the 4% level – that’s when stocks begin to bottom. We’re not at that point,” he said. This is shown in our Chart of the Week.

Recent ⚡ FlashInsights

[fsi-flash-insights]

FSI Video: Weekly Highlight

Key incoming data

10/28 10:30 AM ET: Oct Dallas Fed Manuf. Activity SurveyTame10/29 9:00 AM ET: Aug S&P CoreLogic CS home priceTame10/29 10:00 AM ET: Oct Conference Board Consumer ConfidenceTame10/29 10:00 AM ET: Sep JOLTS Job OpeningsTame10/30 8:30 AM ET: 3Q A 2024 GDPTame10/30 10:00 AM ET: 3Q24 Treasury Quarterly Refunding Press ConferenceTame10/31 8:30 AM ET: Sep PCE DeflatorTame10/31 8:30 AM ET: 3Q Employment Cost IndexTame11/1 8:30 AM ET: Oct Non-Farm PayrollsTame11/1 9:45 AM ET: Oct F S&P Global Manufacturing PMITame11/1 10:00 AM ET: Oct ISM Manufacturing PMITame- 11/4 10:00 AM ET: Sep F Durable Goods Orders

- 11/5: US Presidential Election 2024

- 11/5 8:30 AM ET: Sep Trade Balance

- 11/5 10:00 AM ET: Oct ISM Services PMI

- 11/6 9:45 AM ET: Oct F S&P Global Services PMI

- 11/7 8:30 AM ET: 3Q P Non-Farm Productivity

- 11/7 8:30 AM ET: 3Q P Unit Labor Costs

- 11/7 9:00 AM ET: Sep F Manheim Used vehicle index

- 11/7 2:00 PM ET: Nov FOMC Decision

- 11/8 10:00 AM ET: Nov P U. Mich. Sentiment and Inflation Expectation

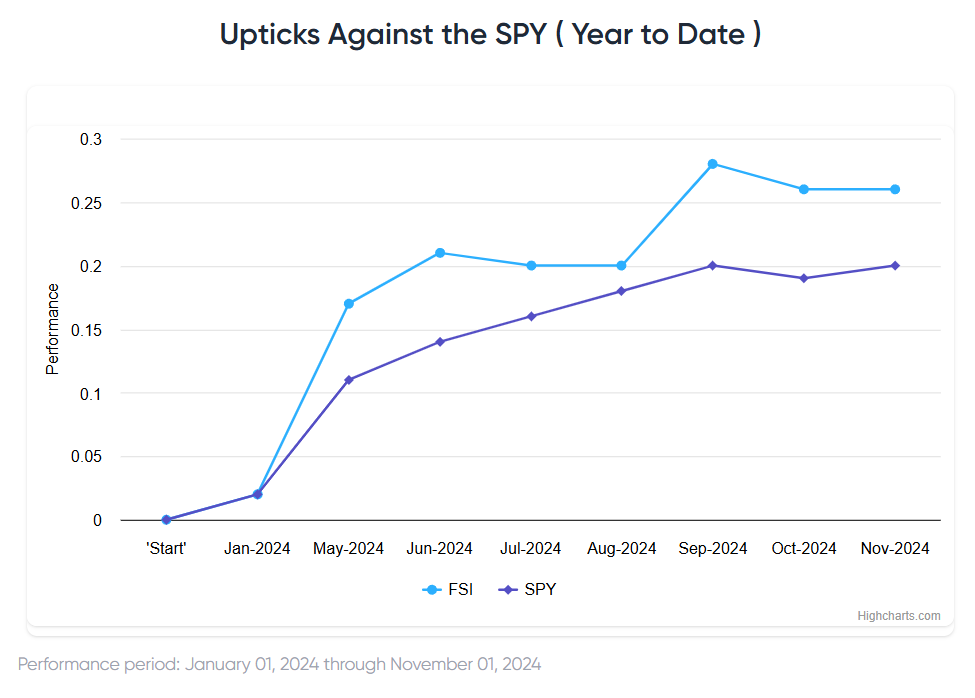

Stock List Performance

In the News

[fsi-in-the-news]