Last week was relatively light on macroeconomic data, arguably making room for earnings season and election news to more prominently influence the markets. On earnings season thus far, Fundstrat Head of Data Science Ken Xuan had this to say: “The large Tech names are still scheduled to report next week, but so far, I think earnings have been solid – just not as good as they have been in the last few years.”

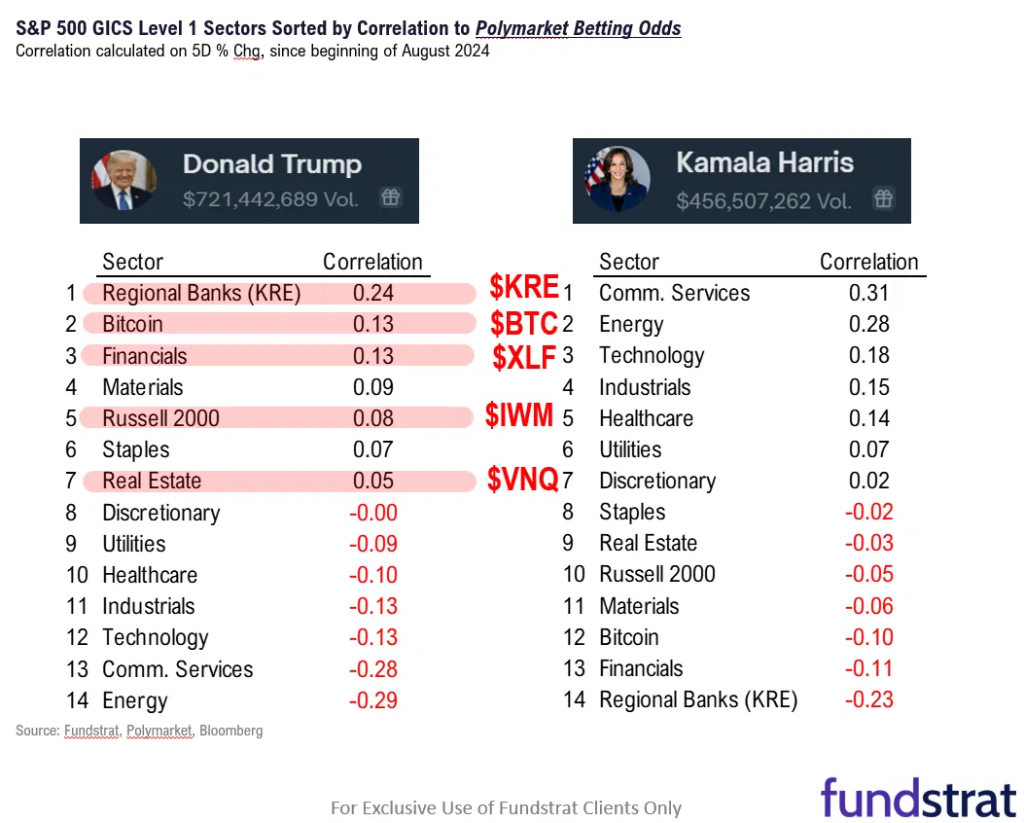

Regarding the election, with traditional polling data increasingly being seen as unreliable due to the shift away from landline phones, many have turned to betting markets to gauge opinion. This week, those markets suggested a surge in the chances for Republicans – and not just GOP Presidential nominee Donald Trump. On Polymarket, the odds of a Republican sweep on November 5 – winning control of not just the White House, but also the House and Senate – rose to 48% (as of early Friday afternoon), up from 28% a week earlier.

As Fundstrat Washington Policy Strategist Tom Block notes, the ability of non-Americans to participate in betting markets and the fact that bettors as a whole tend to be predominantly male mean that betting-market odds might not represent true election signal. For investors, however, arguably the more meaningful use for betting-market odds is to examine how they affect the stock market. As Fundstrat Head of Research Tom Lee put it, “Regardless of their ability to predict the election outcome, it probably makes sense for investors to pay attention to betting market movements, because they seem to be impacting equity markets.” Check out our Chart of the Week below for the Fundstrat Data Science team’s findings in this regard.

To be clear, the Fundstrat team does not have a preference in the election: Both Lee and Head of Technical Strategy Mark Newton maintain a constructive intermediate- and long-term view of equities regardless of the election’s outcome. Their nearer-term views are another matter. Of late, Lee has noted frequently that the eight weeks preceding a Presidential election can be tricky for investors, particularly when the race is tight, and he maintains this view, despite seeing the S&P 500 as resilient and the Federal Reserve as dovish.

Newton is slightly more sanguine about the final weeks leading up to the election. Due to election-year seasonality, he views it as possible that “we could chop around and actually rally into the end of October or beginning of November before the election.” Despite this, however, he, too, is cautious: “As I mentioned last week, there are reasons to suggest that markets can have a dip of between 5% and 7%, and I think that happens in the month of November.” Still, his view for the rest of the year remains bullish. “In my view, the stock market could have its best year of the century. It’s already up around 22% year to date, and I think that over the next six months, markets in general will be good – though I don’t think it’s going to be a nice straight line.”

Chart of the Week

Head of Research Tom Lee and Fundstrat’s Data Science team have found a correlation between Polymarket election betting-market probabilities and sector performance. Thus, as Lee put it, “Regardless of whether one believes the betting markets represent a true election signal, it seems like the betting market movements are impacting equity markets. So to me, it probably makes sense for investors to pay attention to them.” The sectors most strongly correlated to improving betting-market odds for each candidate can be seen in our Chart of the Week.

Recent ⚡ FlashInsights

[fsi-flash-insights]

FSI Video: Weekly Highlight

Key incoming data

10/23 10:00 AM ET: Sep Existing Home SalesTame10/23 2:00 PM ET: Oct Fed Releases Beige BookDovish10/24 8:30 AM ET: Sep Chicago Fed Nat Activity IndexTame10/24 9:45 AM ET: Oct P S&P Global Manufacturing PMITame10/24 9:45 AM ET: Oct P S&P Global Services PMITame10/24 10:00 AM ET: Sep New Home SalesTame10/25 10:00 AM ET: Oct F U. Mich. Sentiment and Inflation ExpectationTame10/25 10:00 AM ET: Aug F Durable Goods OrdersTame- 10/28 10:30 AM ET: Oct Dallas Fed Manuf. Activity Survey

- 10/29 9:00 AM ET: Aug S&P CoreLogic CS home price

- 10/29 10:00 AM ET: Oct Conference Board Consumer Confidence

- 10/29 10:00 AM ET: Sep JOLTS Job Openings

- 10/30 8:30 AM ET: 3Q A 2024 GDP

- 10/30 10:00 AM ET: 3Q24 Treasury Quarterly Refunding Press Conference

- 10/31 8:30 AM ET: Sep PCE Deflator

- 10/31 8:30 AM ET: 3Q Employment Cost Index

Stock List Performance

In the News

[fsi-in-the-news]