Last week, the S&P 500 notched its sixth consecutive up week to close on Friday at a new all-time high. For Fundstrat Head of Research Tom Lee, this was more evidence of the fortitude that the market has shown in recent months: stocks have risen on numerous occasions, even after investors were given reasons to sell off. They have advanced despite higher-than-expected inflation prints, weaker jobs numbers, geopolitical turmoil, and election-related uncertainty. “We also have challenging seasonality and an elevated VIX, while [the 10-year yield] is back to above 4%. Yet, the S&P 500 is rising,” he noted.

As Lee previously anticipated, the dovish Fed, a recent “bazooka” of Chinese stimulus, and the prospects of a no-landing economy have all arguably acted as tailwinds to bolster stocks. However, in his view, the main reason for the market’s resilience is cash on the sidelines. “I think the resilience hints at the fact that investors are under-allocated,” he explained, “and I think liquidity is becoming the driver as we head into year-end.” Though macro data remains important because the Fed is still watching it, “for the moment I think it’s become secondary.”

To be unambiguously clear, “This doesn’t mean I think stocks go up forever,” Lee warned.

That’s certainly a view he shares with Head of Technical Strategy Mark Newton. “I still see the broader U.S. stock market as being in good shape, with not many intermediate-term warnings,” he reassured us, but “in the nearer term, U.S equity trends have reached areas of resistance. Various breadth, sentiment, and cyclical-based indicators lead me to suspect that a near-term correction will happen starting at some point between now and the end of October that could result in a 5-7% correction in stock indices into mid-November before the next leg higher gets underway.”

In other words, while Newton would characterize current U.S. stocks as “over their skis,” and perhaps in need of consolidation, he views any such pullback as “a short-term correction only, not the start of a larger decline.” That will “likely make the road between now and mid-November a bit trickier,” he admitted, “but for those focused on an intermediate- or longer-term time horizon, any weakness heading into November should represent an attractive risk/reward opportunity for dip buying of U.S. stocks for a technical December rally into year-end.”

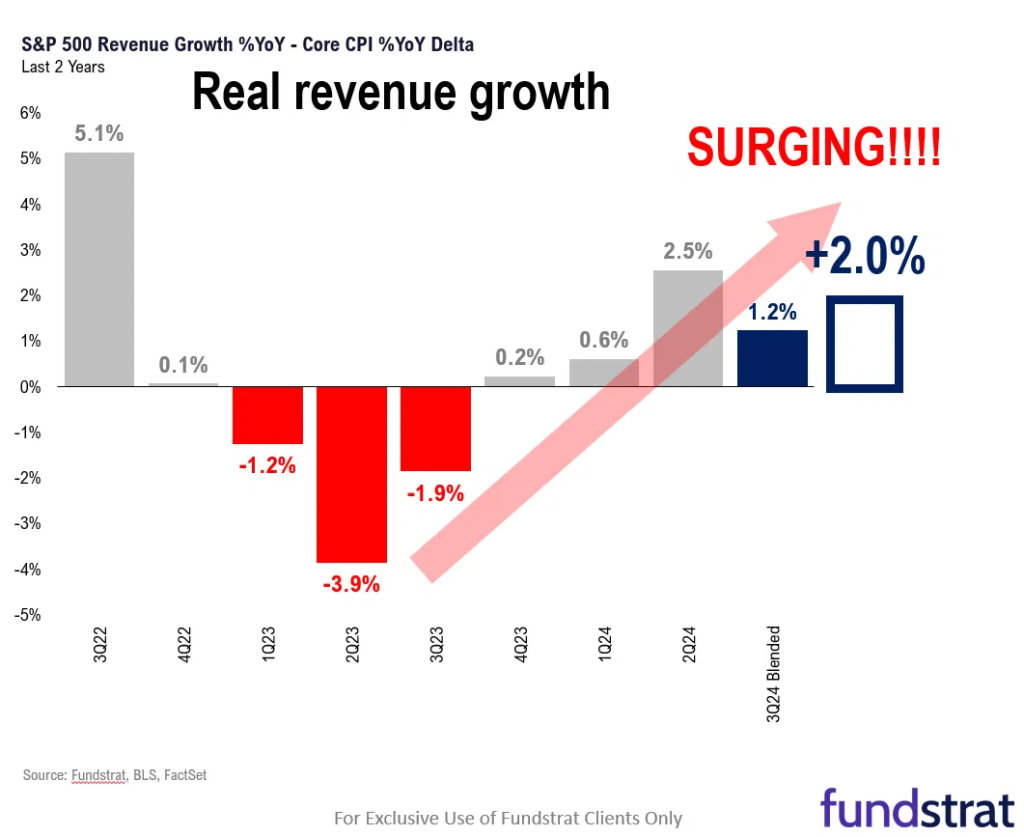

Chart of the Week

While stock skeptics view the stock indices’ year-to-date advances as evidence of overvaluation from a P/E standpoint, Fundstrat Head of Research Tom Lee disagrees. “Keep in mind that corporate revenue growth has remained steady at 4% to 5% even as inflation fell from 7% to about 3%. That is a huge swing,” he said, “and it implies that the quality of 3Q24 EPS growth is stronger than a year ago. I think that therefore, higher P/E’s are justified.” We see this illustrated in our Chart of the Week.

Recent ⚡ FlashInsights

[fsi-flash-insights]

FSI Video: Weekly Highlight

Key incoming data

10/15 8:30 AM ET: Oct Empire Manufacturing SurveyTame10/15 11:00 AM ET: Sep NY Fed 1yr Inf ExpTame10/17 8:30 AM ET: Sep Retail Sales DataTame10/17 8:30 AM ET: Oct Philly Fed Business OutlookTame10/17 9:00 AM ET: Sep M Manheim Used Vehicle IndexTame10/17 10:00 AM ET: Oct NAHB Housing Market IndexTame10/17 4:00 PM ET: Aug Net TIC FlowsTame- 10/23 10:00 AM ET: Sep Existing Home Sales

- 10/23 2:00 PM ET: Oct Fed Releases Beige Book

- 10/24 8:30 AM ET: Sep Chicago Fed Nat Activity Index

- 10/24 9:45 AM ET: Oct P S&P Global Manufacturing PMI

- 10/24 9:45 AM ET: Oct P S&P Global Services PMI

- 10/24 10:00 AM ET: Sep New Home Sales

- 10/25 10:00 AM ET: Oct F U. Mich. Sentiment and Inflation Expectation

- 10/25 10:00 AM ET: Aug F Durable Goods Orders

Stock List Performance

In the News

[fsi-in-the-news]